As the pharmaceutical industry struggles to increase revenue in the face of sluggish drug pipelines, tightening regulations, and retiring blockbusters, mature brands offer a significant opportunity to improve the bottom line.

As brand marketers we face many challenges in our careers. During my 35-plus years of sales and marketing management, I have found that mature brands pose the greatest challenge and yet offer the most potential upside. While it’s true that mature brands are no longer breaking ground and lack the buzz that attracts prescribers’ attention, they do offer an opportunity to drop a greater percentage of sales revenue to the bottom line, as most, if not all their development costs have been covered.

The key to the profitability of mature products is deploying promotional efforts that are cost-effective, complementary, and above all else, used shrewdly. Smart tactics use the mature brand’s established presence and familiarity as the foundation upon which reminder-style promotional tactics can be laid.

Historically mature brands fell into three categories in terms of their portfolio viability:

• Continue to actively promote, co-promote or license

• Let the brand remain within the portfolio but just take whatever revenues come from prior promotional investment

• Sell or get rid of the brand

Today these are no longer our only options. Our tightening business environment has led us to recognize the profit opportunity that lies within mature brand promotion. Many companies are seeking appropriate promotion of these hidden treasures to drive revenues while they seek the next- generation standard bearers.

The availability of robust physician- preference databases culled from multiple communication platforms makes mature brand promotional outreach even more attractive and efficient. Now you can pinpoint only those targets that show promise with highly individualized outreach and obtain significant return in Rx levels.

As a result of this increased interest and data support, promotional methodologies to drive mature brand revenues have expanded, providing us with options unavailable a few years ago.

MATURE MARKET TEAMS

As the role of the sales representative shifts to tailor to specific market needs, less costly mature market teams have evolved as a new model. These teams can be:

• Established market representatives with pharmaceutical experience who are needed to reinforce the brand’s message

• Customer service representatives requiring no pharmaceutical experience who are used for sample or literature drop-off

• Virtual representatives via tele- detailing for reaching all target segments with updated information and addressing sample requests, again with little to no pharmaceutical experience required

These teams can be developed in-house or outsourced depending on portfolio needs within the company and access to the appropriate talent pool and infrastructure. They can be used solely or in tandem with other promotional tactics to support a brand. For example, hard-to-reach targets might be covered by virtual representation while high prescribing targets can be cost-effectively reached with a customer service or established market team.

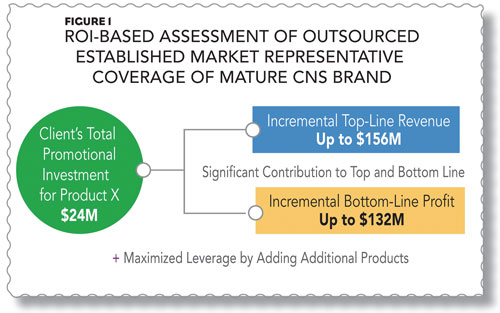

One major pharmaceutical company elected to deploy an outsourced established market team to promote a mature CNS brand. A reorganization of field staff within the company had left this brand with very spotty field coverage at best, but revenue and profit potential still existed for a number of years. They elected to field an out- sourced national established market team to cost-effectively enhance their efficiency, and added several other mature products to the rep’s bag to leverage their field investment. Based on the existence of a large available talent pool due to recent industry layoffs, the outsourced provider was able to build a strong team of experienced reps who hit the ground running and were able to sell successfully against generic competition. The client saw an incremental top-line revenue increase of $156 within the first 15 months of coverage. Market share rose, as did ROI (Figure 1). The outsourced team brought in an incremental profit of $132 million over those first 15 months, which is a 34% higher profit per dollar invested than that generated by the legacy team.

IN-MARKET TEAMS

This outsourced field sales model is best used when a brand offers some revenue potential through personal contact, but does not warrant a dedicated established market team. It allows the pharmaceutical company to agree to have an already in-market team represent their product(s) by sharing the cost of a representative over selected targets. This is different from buying into a traditional syndi- cated team characterized by its excess capacity where the team owner has exclusive control over targeting. On the contrary, in-market teams are expressly designed to carry multiple, non-competing brands for multiple clients at a lower cost/per call than fielding an internal team. And, unlike other syndicated models, 100% control over targeting is assured for every pharmaceutical client that signs on, maximizing promotional spend.

The in-market team model has been utilized successfully in many promotional efforts for mature brands. An example is the promotion of a gastrointestinal drug that had been in use for decades prior to FDA approval, but was now reentering the market as an FDA approved drug.

The brand was in a state of rapid decline in a field with many competitors. The pharmaceutical company had not invested any internal resources to boost sales after it received FDA approval, but elected to pilot receptivity to promotion by contracting an outsourced in-market team to detail primary care physicians in a P1 position. After only eight weeks in the field, brand sales stopped declining and by the end of the pilot year, had begun to rise. As a result, the contract was extended for an additional six months.

NON-PERSONAL PROMOTION

Non-personal promotion can be used for all target physician segments, but it is especially useful for reaching low to moderate prescribers, no-see or uncovered targets where an aggressive personal promotion spend is not appropriate. The per/effort costs for such activities are considerably lower than in-person details making the potential payoff upside in maintained or increased Rx activity very attractive.

Certainly the ability to tailor messaging content to the individual based on the data accumulated through digital collection methods makes e-detailing and other non- personal tactics highly effective in promoting these brands. In addition, physicians are increasingly embracing digital technology and have shown a willingness to participate outside of normal business hours or in locations inaccessible to reps, such as their homes.

Although the cost for non-personal promotion, such as e-detailing, is significantly less than a live sales call, the technology infrastructure and database costs can be prohibitive if used to support a single brand. Nonetheless, some companies are willing to take the risk to invest in the technology to support digital outreach in-house, leveraging it against their entire portfolio, while others are turning to specialized outsourced providers such as digital agencies in test pilots or actual campaigns for individual brands. In either case, the industry is quickly moving to establish non-personal promotional tactics as a major component of mature brand promotion. In fact, a February 2012 survey conducted by Booz & Co. found that of the 69% of pharmaceutical executives surveyed who said the current promotional model is broken, 52% plan on increasing their use of e-detailing, while more than half were planning budget increases to support social media (58%), mobile tech (55%) and physician media channels (51%) promotiona1.

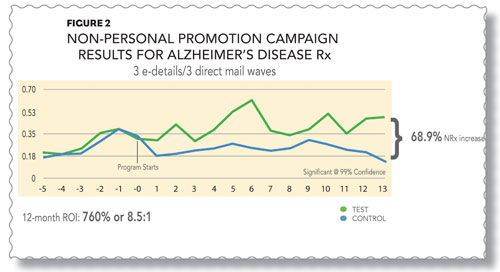

A typical example of a non-personal campaign integrating email and direct mail tactics is a 12-month program executed for a mature brand used in the treatment of Alzheimer’s disease (Figure 2). In this program, three direct mail pack- ages and three e-details were sent to the targets. Due to initial positive results, the number of physicians targeted was increased from 17,500 with 2,500 e-detail completions to 25,000 with an additional 5,000 e-detail completions. Not only was the ROI for the campaign a staggering 760% (8.5:1) over the first 12 months but there was a 68.9% uptick in NRx for the same period.

OUTSOURCED, COMPLETE COMMERCIALIZATION SERVICES

Unlike co-promotion or selling the product outright, outsourcing product commercialization efforts allows a pharmaceutical company to maintain control of their brand and benefit from its revenue stream when they no longer wish to provide all the necessary support to market and sell the brand. The outsourced partner assumes control of those aspects of commercialization no longer viewed as viable for doing in-house on a fee-for-service, risk-share or in-licensing basis. These can include: strategic planning, sales, marketing, logistics, legal, regulatory, distribution, managed markets, and medical and commercial operations.

Because all the commercialization capabilities are available via the outsourced partner, shifting over responsibility for the brand can be done quickly, often with minimal revenue stream disruption. A case in point is a European manufacturer of an injectable, who wished to re-launch their product to the U.S. market under their company name following the conclusion of a former co-promotional arrangement, and successfully did so within 60 days of signing the agreement.

LEVERAGING YOUR INVESTMENT

As marketers we know it is no longer business as usual. This is true throughout our portfolio. However, we no longer need to view our mature brands as lacking in potential. We now have viable, strategic options for handling mature brands and their unique set of challenges to optimize their impact on revenues and the bottom line.

Deciding which option(s) is/are most suitable for your brand—fielding a dedicated established market team, working with an in-market team, using non-personal promotional tactics or any targeted, coordinated combination of these, or completely outsourcing commercialization—will depend on the potential upside to your brand and the nature of the targets to be reached. Tapping the synergies that come from deploying multiple tactics can be quite compelling. In any event, leveraging your prior investment in these brands when done right, can offer a rich payoff.