Pharmaceutical companies spend approximately $10 billion globally in media expenditures each year to engage with physicians and consumers, and yet the experience that they are driving customers to is wholly unfulfilling. While the pharma industry is making strides in mobile strategy, most of that strategy is geared towards internal productivity. It is time for pharma to take significant action, and to approach their customer base from a “mobile-first” perspective. Too often pharma marketers think of physicians and patients as professions and conditions, instead of people. If you want to understand how physicians and patients engage with media, look at your own behavior when you want to find out more information. The first thing you do is pull out your phone, and the truth is, physicians and patients are no different.

During Mobile World Congress 2017, IPG’s mobile excellence company, Ansible, unveiled the MDEX, an index of mobile-ready brands across 22 countries. Created in partnership with YouGov and powered by Google Tools, the MDEX analyzes more than 3,500 mobile assets against 60 different criteria, then assigns each one an overall score out of 140. The 60-data-point assessment of what constitutes a dynamic mobile experience includes numerous objective measures, such as page load speed and easy to access site or app search features, along with measures like consumer ratings and navigation.

The purpose of the MDEX is not to show winners and losers, or to focus on absolute rankings. It is designed to show areas of strength and potential improvement, enabling companies to measure their brand’s performance within its industry category and beyond.

At a global brand level, the only two pharmaceutical companies to even make the list were Bayer Pharmaceuticals, which ranked higher than both Audi and BMW for German consumers, and Johnson & Johnson’s Acuvue, which ranked at 10 within the United States. Later this month in concert with Ansible, Healix, the healthcare-focused agency from IPG Mediabrands, plans to release a Pharma MDEX in order to gain perspective around how mobile-ready specific pharmaceutical brands are.

The reality is, being mobile-ready is critical.

- Of the 773 billion active internet users, 91% of them are active mobile internet users.

- Today there are 917 billion unique mobile users, which accounts for 66% of the world’s population.

- According to a Research2Guidance report, 80% of physicians use smartphones and medical apps.

- 72% of physicians access drug information from smartphones.

- 63% of physicians access medical research from tablets.

- 44% of physicians communicate with nurses and other staff from smartphones.

- According to a 2015 HIMSS Mobile Technology Survey of healthcare professionals, nearly 90% of respondents are utilizing mobile devices within their organizations to engage patients in their healthcare.

- 52% of smartphone users gather health-related information on their phones.

- Consumer mobile usage outpaces mobile advertising spend by 3 times.

- 46% of U.S. mobile phone users expect their page load times to be almost as fast or equal to their desktop.

- 87% of shoppers look for product information before visiting the store, 79% while in the store, and 35% after they leave the store.

As brands develop their mobile strategy, it’s important to consider the platform and its benefits to users. An app can provide a mobile-centric experience for existing and loyal customers, and utilize native device functionality including push notifications and GPS. Mobile web is a more affordable option with numerous benefits. It is easier to maintain, faster to deploy, and takes advantage of SEO and brand/site discoverability. In general, mobile website visits almost always exceed unique visitors to its native applications.

The five key criteria that brands need to evaluate as it relates to their mobile readiness include:

- Discoverability: The capacity of a brand’s mobile website or application to be discovered when a user needs it.

- Mobile Optimization: A technical assessment of a brand’s website optimization for mobile (mobile web only).

- Navigation and Content: The chosen structure of a brand’s mobile website, utilizing easy-to-use menus and prioritized content.

- Utility and Usability: An assessment of UX in terms of intuitive design and value proposition and consumer experience.

- Driving Desired Actions: The features and functionality that drive users seamlessly through to desired actions or content (streamlined forms, auto fill, hover states).

The (Missed) Mobile Opportunity

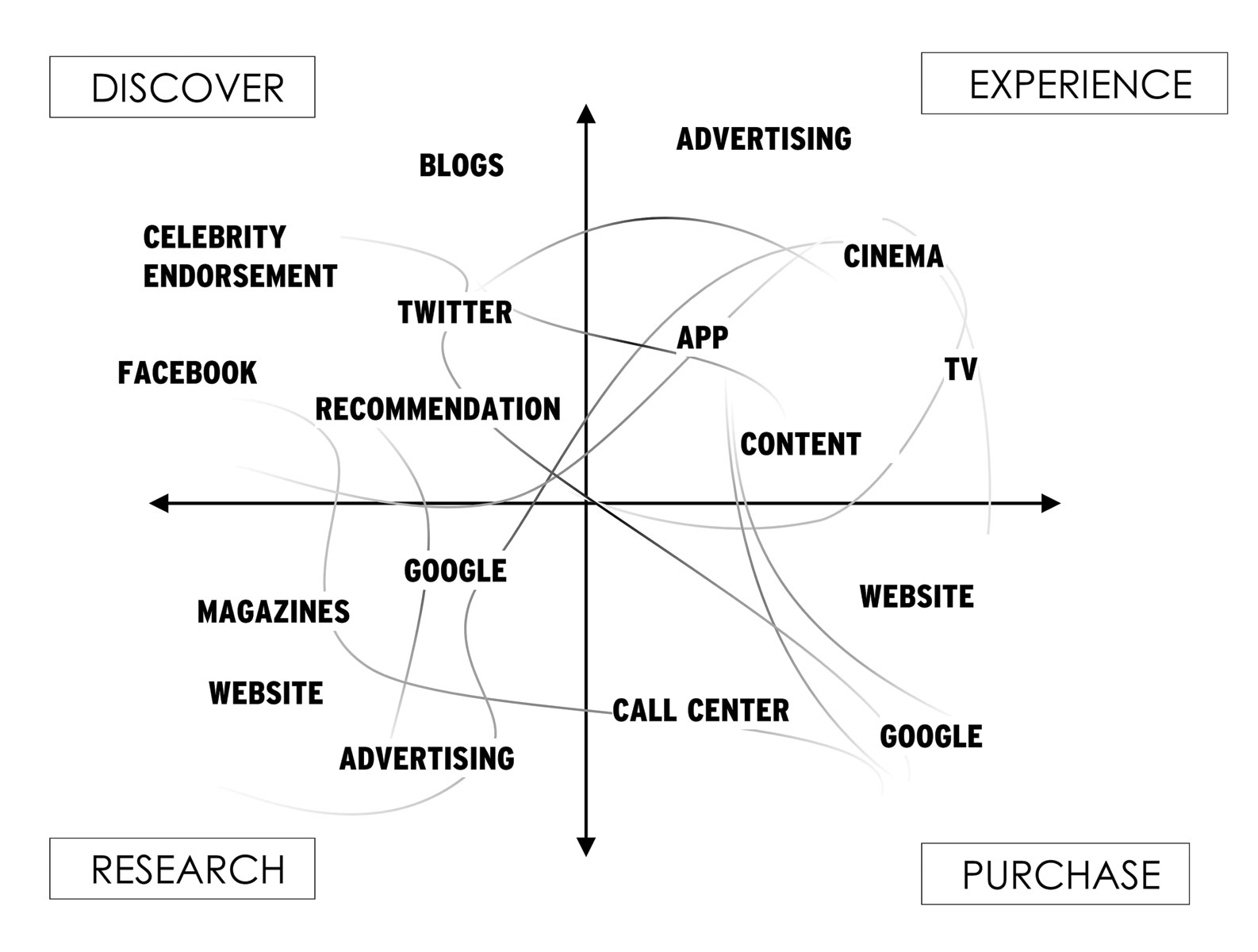

Mobile has a role at every stage of the conversion process as it relates to both physicians and consumers. Physicians and consumers are all looking for answers, and regardless of where they originally are introduced to a brand or a therapeutic condition, they all turn to their phones to research more. By not meeting the demands of physicians and consumers through easy-to-use and frictionless mobile experiences, pharma companies are experiencing lost opportunity as users are driven to competitors who do. And most brands (See Figure 1) don’t have it right.

- 51% of smartphone users have discovered a new company or product when conducting a search on their smartphones.

- 61% of mobile users are unlikely to return to a site they had trouble accessing.

- 1 in 3 smartphone users have purchased from a company or brand other than the one they were seeking because of information provided in the moment they needed it.

- 33% of consumers start mobile research with a branded website.

- 40% of consumers will visit a competitor site after having a poor mobile user experience.

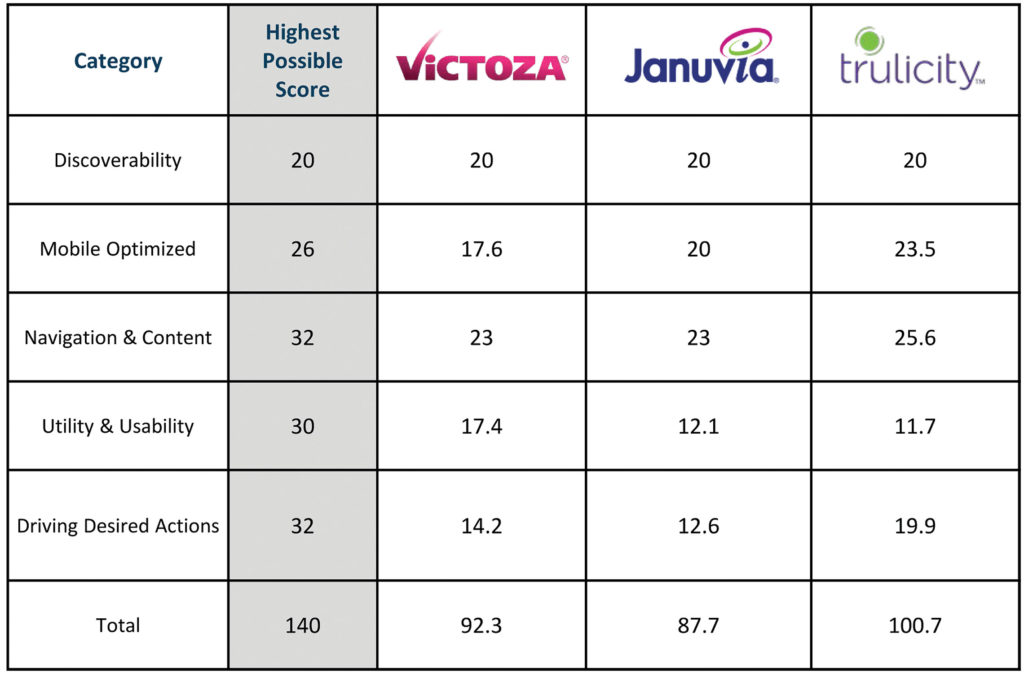

Previewing some results from the upcoming Pharma MDEX, we find that some pharmaceutical companies excel in certain categories such as discoverability, and have fairly high rankings in mobile optimization. However, the key metrics that generate customer engagement, such as utility, usability, and driving desired actions, bring their overall rankings down dramatically. Figure 2 shows competitors Victoza, Januvia, and Trulicity are all evaluated alongside each other. While Trulicity lags behind the others as it relates to utility and usability, its higher scores in “Navigation & Content” and “Driving Desired Actions” cause it to rank significantly higher than the competition.

Previewing some results from the upcoming Pharma MDEX, we find that some pharmaceutical companies excel in certain categories such as discoverability, and have fairly high rankings in mobile optimization. However, the key metrics that generate customer engagement, such as utility, usability, and driving desired actions, bring their overall rankings down dramatically. Figure 2 shows competitors Victoza, Januvia, and Trulicity are all evaluated alongside each other. While Trulicity lags behind the others as it relates to utility and usability, its higher scores in “Navigation & Content” and “Driving Desired Actions” cause it to rank significantly higher than the competition.

When we look at the original MDEX report released earlier this year, pharma companies as part of the healthcare category, ranks 15th out of 18 other industries such as Automotive and Financial Services. There is significant room for improvement to be made, particularly with user expectations being set by the likes of Amazon, Expedia, and Domino’s. As technology evolves and user expectations continue to rise, the brands (regardless of industry) that embrace and lead with mobile will see greater engagement.

When we look at the original MDEX report released earlier this year, pharma companies as part of the healthcare category, ranks 15th out of 18 other industries such as Automotive and Financial Services. There is significant room for improvement to be made, particularly with user expectations being set by the likes of Amazon, Expedia, and Domino’s. As technology evolves and user expectations continue to rise, the brands (regardless of industry) that embrace and lead with mobile will see greater engagement.

At a time when most people turn to their mobile devices as the very first step in an engagement process with any brand, it cannot be stressed enough how important it is to understand the mobile readiness of your brand—and recognize that the mobile experience has become more important than the experience customers have on their desktop. You need to ensure that the money you’re expending in media to connect with your customers brings them to a place that they are likely to want to engage with you on a consistent basis. Keep your eyes open for the upcoming Pharma MDEX to understand how best to take action. In the meantime, to download the Ansible MDEX Global Report across all industries, visit: www.themdex.com.