The two largest pharmacy benefit managers (PBMs), CVS Health and Express Scripts, promote their formulary exclusions as innovative approaches to pharmacy management and a way to counter what they view as bad behavior in the pharmaceutical industry.

But a closer look reveals exclusion lists are an old pill in a new bottle. Many claims made by PBMs do not stand up to scrutiny, and PBM-driven discourse masks troubling trends in pharmacy management and the increased burden on those who need care most.

Are Exclusion Lists Innovative?

Payers and PBMs have two utilization management tools to discourage the use of non-preferred drugs. First, they can price these drugs higher than alternatives. Second, they can restrict when the drug will be authorized for reimbursement. These restrictions take many forms but can be grouped into two categories:

1. Step therapy: The patient must use one or more different drugs before the non-preferred drug is authorized.

2. Clinical criteria: The drug will be authorized for patients with a documented medical need—sometimes a narrower population than authorized by the FDA label.

Payers have grown increasingly aggressive with these techniques over the past decade. Step therapy protocols used to be uncommon and based on simple criteria—such as trying one generic before the authorization of a branded agent. Protocols now often require failure of multiple preferred therapies or even preferred mechanisms of action.

These restrictive protocols provide payers significant leverage over pharmaceutical manufacturers when negotiating rebates in competitive therapy areas. Manufacturer rebate spend as a percentage of gross sales has grown accordingly in a wide array of categories from mass markets, such as diabetes and asthma, to specialty markets, such as inflammation disorders and hepatitis C.

Against this backdrop, PBM exclusion lists are little more than a harsh version of restrictive protocols that other payers have used for years.

What PBMs Are Saying. And Not Saying.

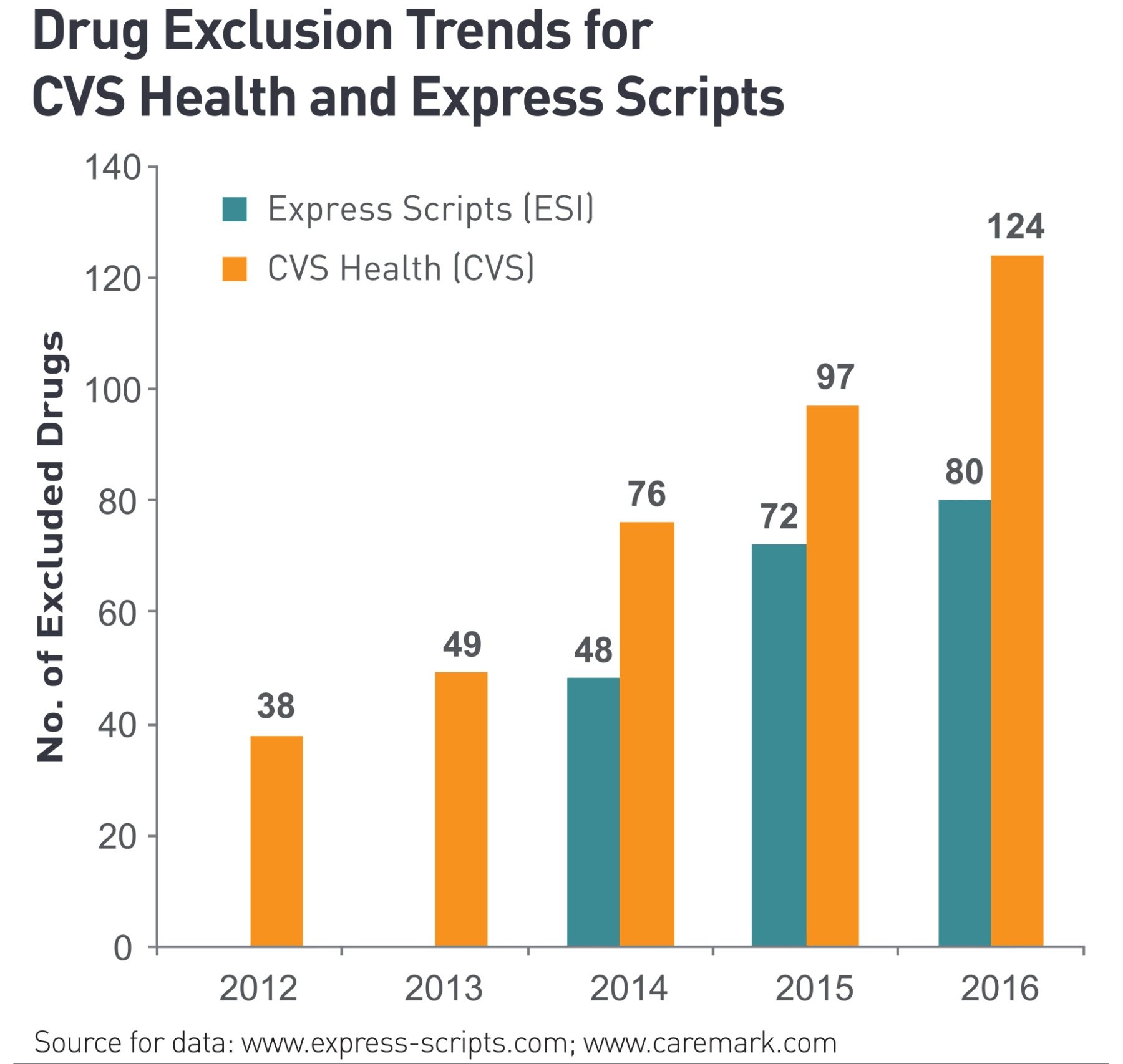

PBMs have said they moved to exclusion lists in response to pharmaceutical manufacturers’ coupon programs. In a recent interview, Steve Miller, Chief Medical Officer of Express Scripts, talked about coupon programs as a key offender that figured into the first exclusion list in 2013. CVS Health also cited these coupons when it introduced its exclusion list in 2011.

A ZS analysis, however, showed no direct correlation between the existence or details of a brand’s coupon program and the likelihood of that brand to land on an exclusion list. If coupons served as the driving force behind exclusion lists, surely brands without coupons would remain available. Yet CVS Health excludes brands such as Eli Lilly’s Humalog in favor of Novo Nordisk’s competing NovoLog—even though Humalog lacks a coupon program while NovoLog has one. The message to manufacturers is clear: Coupon programs have no bearing on exclusion decisions.

PBMs also suggest exclusion lists target interchangeable therapies where patients can access an equivalent treatment. As Miller wrote in the Express Scripts 2016 exclusion list announcement, “We will only exclude medications from our formulary when clinically equivalent alternatives are already covered on our formulary.”

Not only do PBMs describe preferred and excluded drugs as “clinically equivalent,” but they also say the excluded therapies will hardly affect patients. Miller wrote, “In 2016, fewer than 0.5% of our members will be asked to use a different medication that achieves the same health outcome.”

There are several problems with this.

First, the definition of “equivalent” has quite a bit of wiggle room. PBMs have, in some cases, excluded category-leading drugs. Clinicians recognize the benefits of these drugs over competitors—whether through stronger clinical efficacy data, greater patient tolerability or more patient-friendly modes of delivery that enable improved adherence to therapy.

Second, this one-size-fits-all approach to pharmacy management fails to acknowledge patients respond differently to drugs that may have similar, average effects. This problem is especially acute when PBMs “ask” patients who may be doing well with their current treatments to switch to drugs that remain untested on them.

Finally, the Express Scripts National Preferred Formulary has more than 25 million members. This means 0.5% of these individuals corresponds to more than 100,000 people—hardly a negligible count. Many are patients with debilitating or life-threatening illnesses who need access to treatments that work for them without battling bureaucratic red tape to obtain a medical exception.

The Path Forward

Before the patent cliff, PBMs competed on their abilities to increase generic utilization. With generic dispensing rates above 85% today, PBMs can no longer differentiate on this dimension. Forced to find a new story and business model, they adopted exclusion lists.

This model creates a more confrontational relationship with the pharmaceutical industry. Unfortunately, patients do not earn much consideration in the process. Innovative therapies, such as the latest treatments for hepatitis C or PCSK9 inhibitors, are described primarily as cost problems to manage rather than groundbreaking opportunities to improve and extend lives. In February 2015, CVS Health detailed the cost threat of the new PCSK9 category to treat high cholesterol and described its benefits as “problems”:

“The PCSK9 inhibitors pose a similar [to hepatitis C treatments], but in many ways more compelling and complex, set of problems. Their target, hyperlipidemia, is one of the most prevalent conditions in the developed world. And the PCSK9 inhibitors do not provide a cure; they will be prescribed for ongoing maintenance therapy—decades for patients who survive that long. Moreover, they in some ways represent a silver bullet—injected once a month with few side effects, and they reduce LDL cholesterol dramatically.”

When a “silver bullet” is portrayed in a negative light, it’s time to change the dialogue. We have three recommendations to do so:

1. Increase transparency around PBM strategy: Major PBMs adopted a high control model to position manufacturers against each other for cost reductions. This is a reasonable enough strategy, but that’s all it is. Let’s set aside misplaced threats on coupon programs and others for an honest discussion on what PBMs are doing and why.

2. Adopt a patient health-centered dialogue: Innovations in specialty therapeutics cure diseases, extend lives and improve patient quality of life—outcomes worth celebrating. Yes, we must have cost discussions, and the pharmaceutical industry must improve its explanations of the value its products provide in the context of those costs. Manufacturers will benefit in these discussions if they focus on the bigger picture of patient health. Where the PBM business model embraces a short-term view and focuses narrowly on pharmacy costs, a patient health-centered dialogue will highlight longer-term outcomes and economic benefits of a healthier population.

3. Promote benefit designs that enable patients to receive the care they need at affordable costs: Today’s pharmacy benefit design increasingly places the financial burden on patients. The explosion in co-insurance cost tiers for specialty drugs threatens patients who suffer from diseases such as cancer or Crohn’s disease. Shouldn’t all of us who buy a particular policy benefit from the same affordable drug co-pays—regardless of whether we are diagnosed with hypertension or multiple sclerosis?

PBMs wield significant influence through their scale and presence in healthcare discourse and must keep patient health at the forefront of their decision-making. These organizations can lead the way in working with insurers and pharmaceutical manufacturers to host discussions and make decisions that best support the patients we all strive to serve.