Direct-to-consumer (DTC) marketing strategies have evolved over the past decade due to the rise of new forms of communication, along with access to massive amounts of data and the ability to use it to maximize the efficiency of marketing investments. These changes have permeated the industry, with even the most traditional forms of media adapting to meet the needs and expectations of both marketers and consumers. TV is no exception.

While linear TV continues to dominate pharmaceutical media budgets (pharma spent more than $5 billion on national TV commercials in 20191), the overall advertising landscape has expanded to encompass new platforms, including addressable, over-the-top (OTT), and digital connected TV. It is no surprise that marketers are looking to invest in new media channels—it’s where their target audiences are migrating. In fact, it is predicted that more than 20% of all U.S. households will cut the cord by the end of 2021 in favor of subscription video-on-demand services, such as Netflix, Hulu, and Amazon Prime Video, which boast more than 110 million subscribers combined.2,3 There is potential to reach target audiences through these platforms, but they are still only 6% of marketing budgets, which is why efforts must continue to optimize linear TV.4

Although these platforms inherently have TV at their core, they serve media in a way that closely resembles digital media because they are highly personalized to the viewer and can serve ads programmatically. Pharma marketers can now reach specific target audiences, accurately measure their campaign performance, and quickly adjust their strategies compared to linear TV. Marketers have embraced these benefits of digital and video and have come to expect near-real-time analytics and the ability to quickly adjust their TV buys too.

These new platforms and new expectations have resulted in an increasingly complex industry, which requires new methods of planning and ensuring marketing investments are working optimally. Although some traditional approaches to TV buying (i.e., upfronts) aren’t disappearing, data is changing the way marketers strategize and plan media buys. This is why pharmaceutical marketers need to embrace this new media age and optimize all stages of the advertising process, from upfront planning, to in-market reporting, to post-campaign ROI measurement.

In-Flight Reporting

For example, I worked with one brand to optimize its linear TV campaign using in-flight performance metrics. With these insights, the brand was able to make changes and track granular performance by network.

Early on, the brand was able to see whether its commercial spots were reaching its target audience effectively. It discovered that a cultural network and a science network consistently reached more qualified audiences, validating its investment. In fact, the cultural network was effective at reaching an audience nearly 50% more qualified than the general U.S. adult population, while also reaching more than 160,000 households. The science network reached over 200,000 households and was 60% more targeted than a widespread national TV campaign. In contrast, two cable sports networks reached a significantly lower concentration of target patients, causing the brand to scale back investments in those networks.

While the general sports network reached 120,000 people, they were less likely to be diagnosed with the condition than the average U.S. adult population. Therefore, this data proved that investing in this network was not a good use of its media budget since other networks were much better at reaching the brand’s target audience. Having access to these performance metrics allowed the brand team to consider its investment strategy and reallocate its buy to networks that reached a higher percentage of its target audience. While these networks are relatively small scale compared to national TV campaigns that reach millions of households, the cumulation of the results of these changes can lead to significant increases in audience quality.

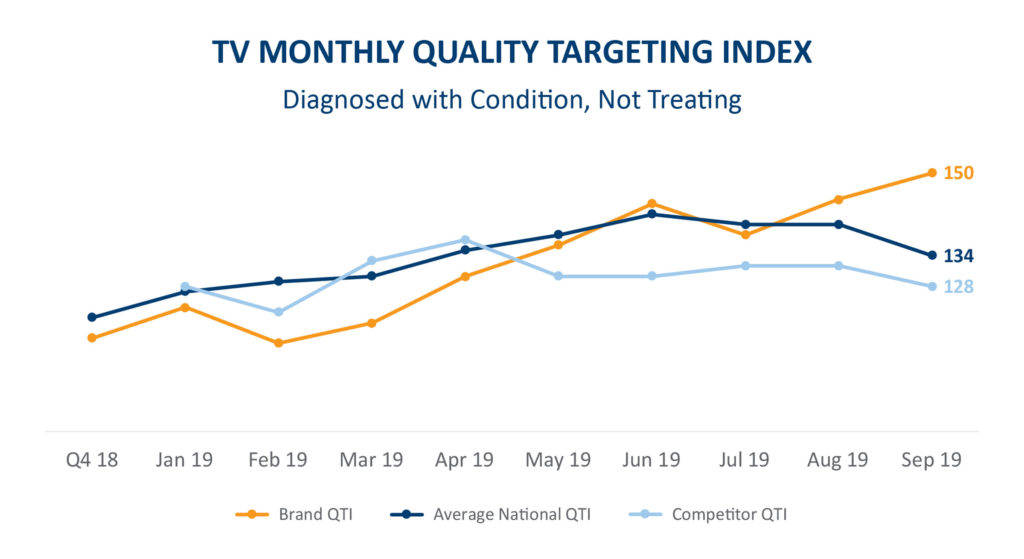

The brand was able to use these insights along with ongoing monthly reports that compared its TV performance to national TV viewership and its competitor’s TV buys to identify where there were opportunities to adjust TV spend and media weight. The brand shifted its spend toward top quality networks and saw an increase in quality of gross ratings points, more commonly known as GRPs, for the remainder of the campaign. These changes resulted in the brand reaching audiences 12% more targeted than the national average (see figure).

Timely access to campaign performance was a complete game changer for this launch brand. As a new-to-market therapy, it had one chance to make a lasting, positive first impression.

Timely access to campaign performance was a complete game changer for this launch brand. As a new-to-market therapy, it had one chance to make a lasting, positive first impression.

Post-Campaign Measurement

By implementing the recommendations gleaned from the in-flight analyses, the brand was successful in driving new conversions to brand. Over the course of the year, the campaign converted new patients at a rate 27% higher than the Crossix benchmarks for launch brands.

While TV continues to remain an integral part of pharmaceutical media plans, it doesn’t necessarily mean that it will continue to operate as it always has. In-flight, granular metrics—and the ability to quickly adjust media plans based on them—has become an expectation, and the time has come for a full measurement makeover.

With these unprecedented insights, both marketers and agencies can now have ongoing conversations around their media strategy to ensure that their investments are achieving the desired health outcomes at all points throughout their campaigns.

References:

1. https://www.statnews.com/2016/03/09/drug-industry-advertising/

4. https://www.broadcastingcable.com/news/non-linear-sales-a-growing-part-of-tv-revenues-magna