This is the second article in a three-part series examining the commercial dynamics surrounding combination therapy in oncology across the U.S. and Europe. In this article, we investigate strategies that manufacturers could consider to optimize pricing and access opportunities for their combinations in today’s environment. (You can find part one here.)

Status Quo: The Core Issue

In oncology, it has been the “status quo” for combination therapies to face challenges with respect to pricing and access. Present approaches for value assessment and pricing are designed for monotherapy agents and lack the capacity to capture the value and facilitate sustainable pricing of combinations. In particular, challenges arise when healthcare systems are unwilling to pay for incremental value for a combination compared to existing (often monotherapy) treatments and when the price of combination components cannot be dissociated from that of other indications.

Given the complexity associated with pricing combination therapies, manufacturers should identify potential challenges and pricing implications early in development and factor these into key decisions throughout the development process. In this article, we briefly look at some of the critical factors influencing pricing flexibility throughout development and offer insights on how to optimize global pricing strategy in the short and long term.

Anticipating Challenges and Optimizing PMA Strategy in Today’s Environment

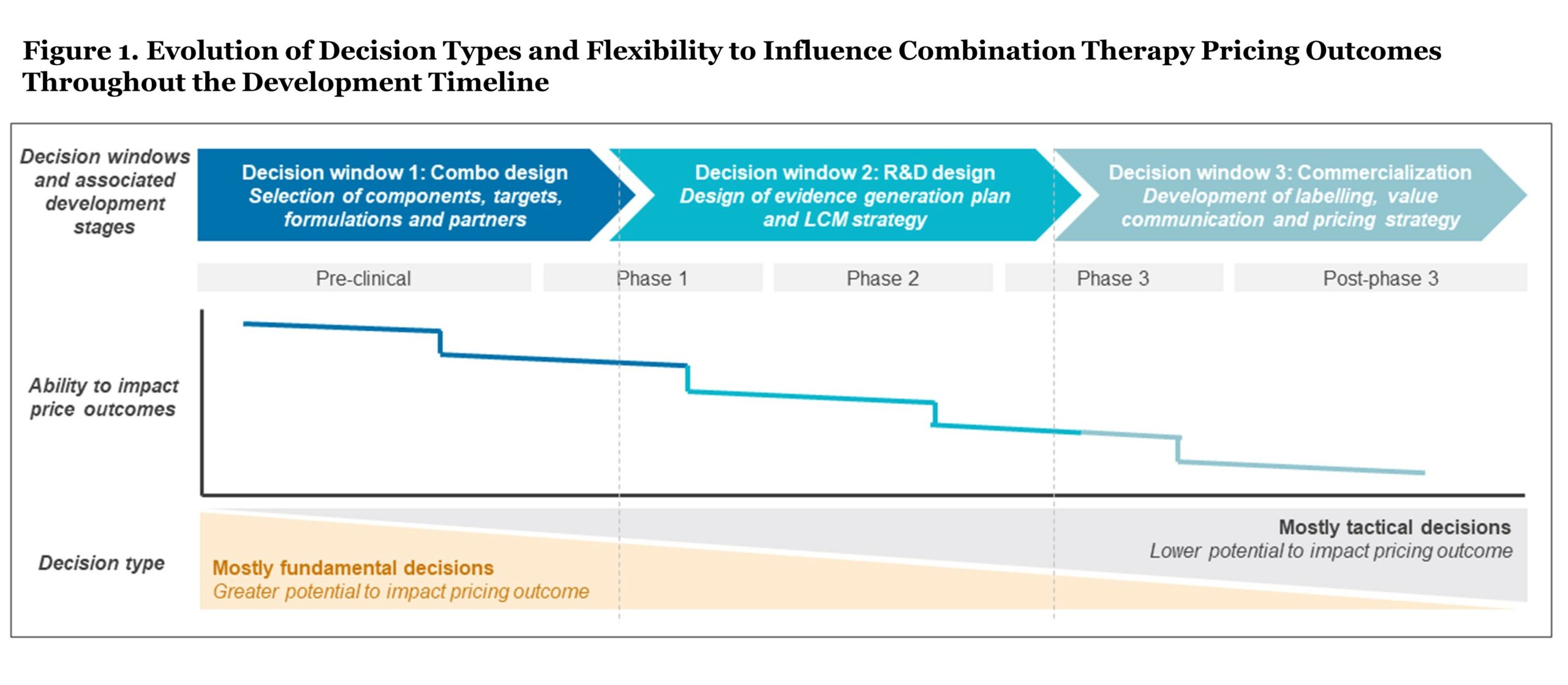

Throughout the drug development timeline, manufacturers face a series of pivotal decisions that shape pricing and access outcomes for a combination therapy in oncology. However, as decisions transition from fundamental (early commercial and development decisions) to tactical (later-stage commercialization and access decisions), the ability to influence pricing outcomes based on clinical value diminishes (see Figure 1). To drive success, it is essential for manufacturers to make the right decisions at the right time, particularly in early development where decisions can be highly impactful in terms of shaping clinical value and downstream price outcomes.

Decision Window 1: Combination Design

Decision Window 1: Combination Design

Primary decision type: Fundamental

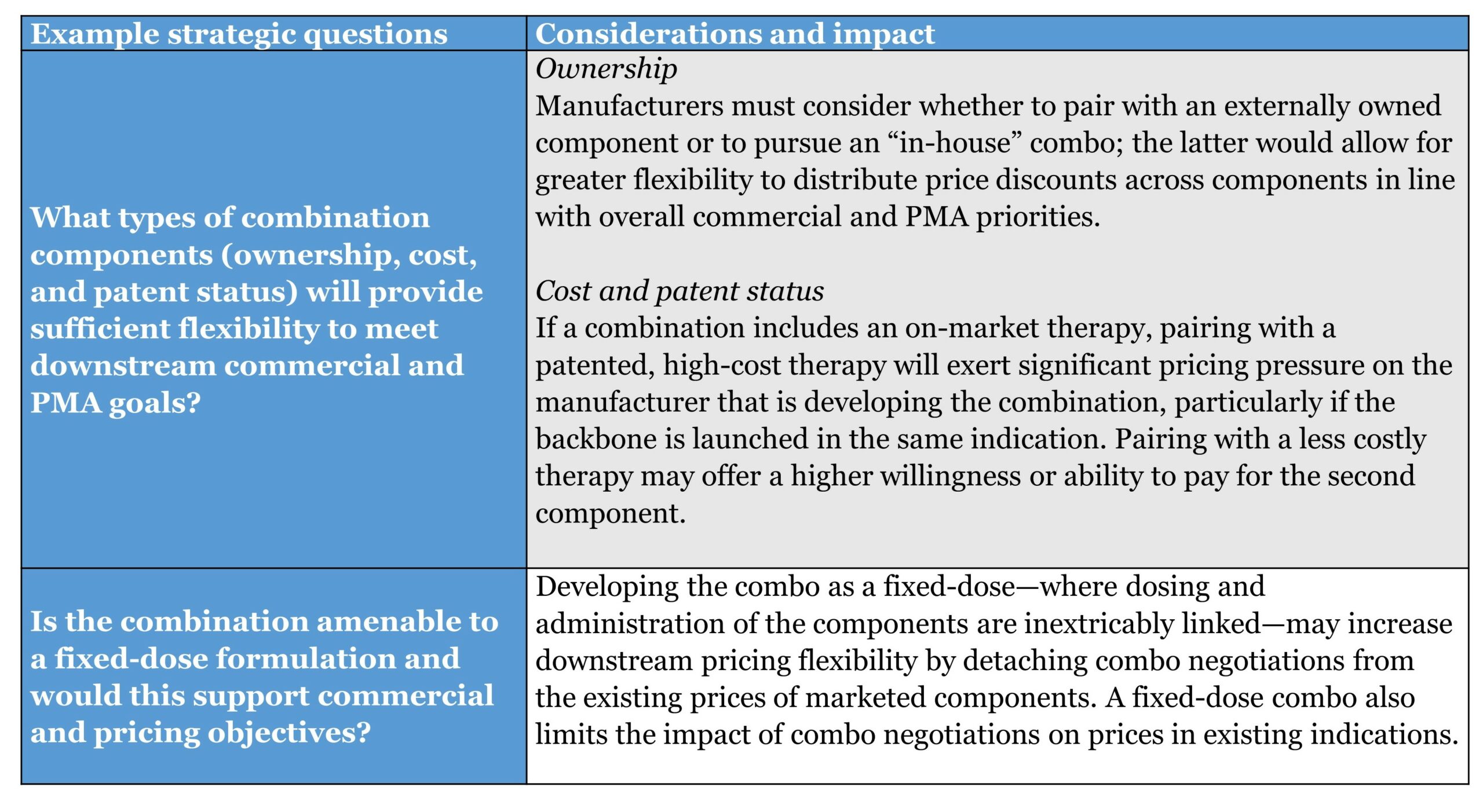

Early in development, manufacturers make fundamental decisions about the core characteristics and design of their combination asset. This stage presents a relatively “blank slate,” and the highest ability to impact the ultimate pricing potential of the combination. However, as these fundamental decisions take shape, they effectively lock certain aspects of the therapy, limiting the ability to impact pricing downstream.

In addition to the actions covered below, manufacturers must consider the clinical rationale for the proposed combination therapy and its intended therapeutic target, as well as the choice of development partners and associated agreement structures if not pursuing an “in-house” combination.

Decision Window 2: Clinical Program Design

Decision Window 2: Clinical Program Design

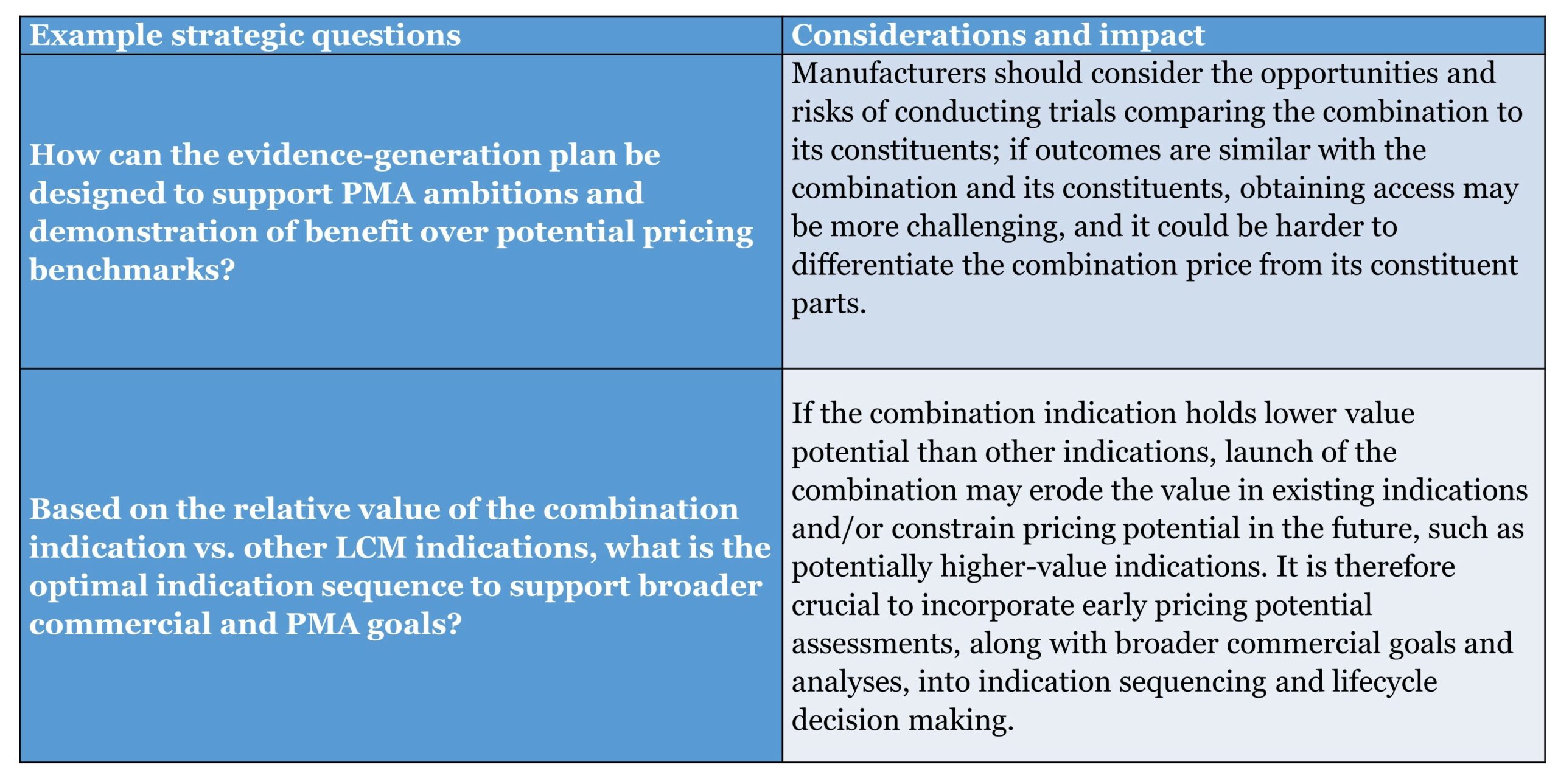

Primary decision type: Mix of fundamental and tactical

As drug development progresses, key decisions must be made regarding the design of the combination clinical program, the target population, and evidence generation plan. These include both fundamental and tactical decisions that will have considerable impact on the ultimate pricing outcome, but the degree of flexibility is already constrained by earlier fundamental decisions.

Decision Window 3: Access and Commercialization

Decision Window 3: Access and Commercialization

Primary decision type: Tactical

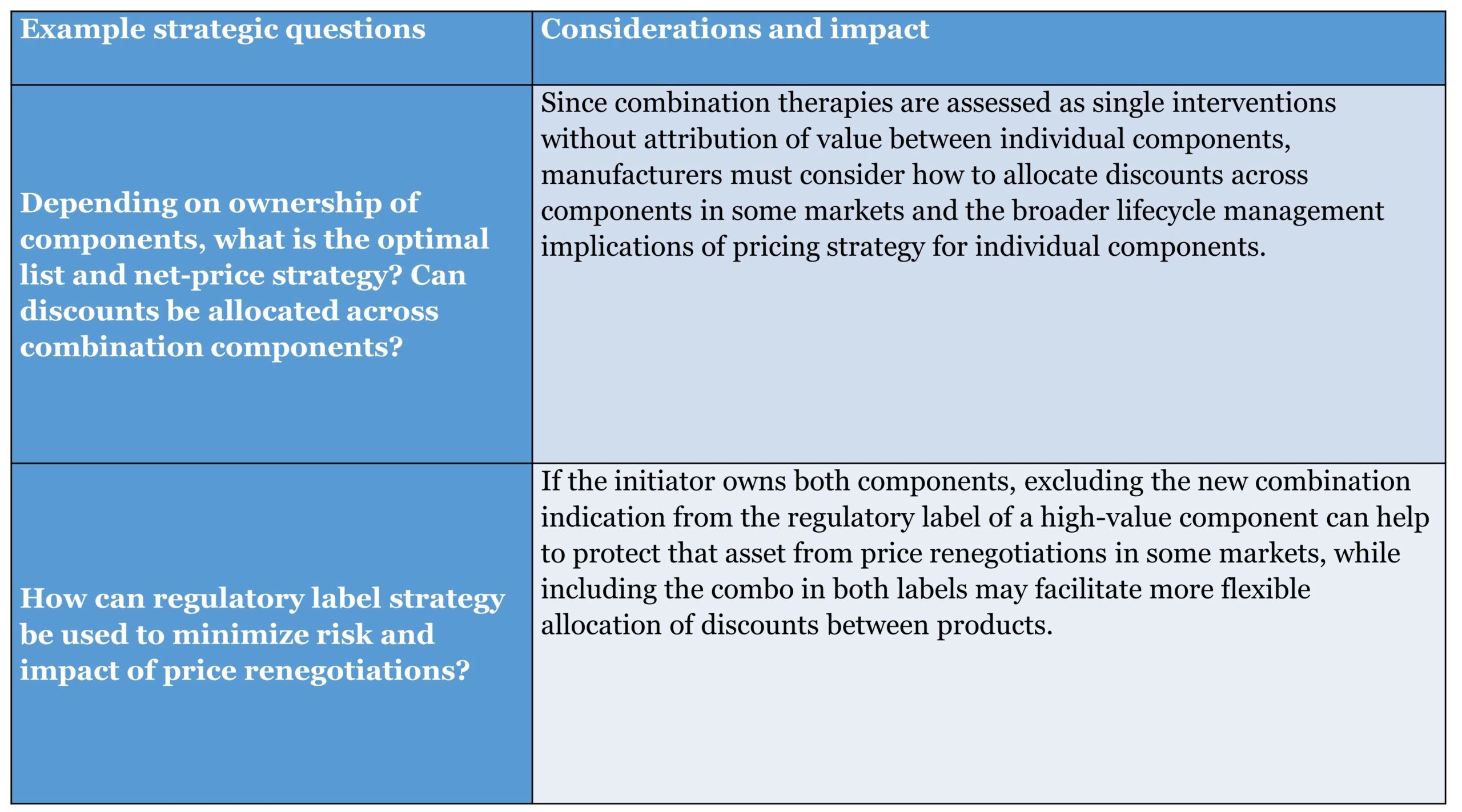

Once the pivotal trial design has been finalized and a manufacturer approaches market access and commercial launch, most remaining decisions are “tactical.” While decisions at this stage are crucial in fine-tuning pricing strategies and achieving optimal access, their ability to influence price potential is limited by decisions around core therapy characteristics, target population, and clinical evidence that have already occurred in earlier time windows.

Commercial Decision Making with Pricing and Access in Mind

Commercial Decision Making with Pricing and Access in Mind

Decision making across time windows is dependent on several factors, including market-specific dynamics, the evolving competitive landscape, and broader business priorities. The interplay of these factors, combined with the timing of the decision, can be challenging for manufacturers—and the impact on pricing and access outcomes is not always considered proactively.

For example, a manufacturer may decide to initiate development of a combination therapy on the basis of the U.S. market potential due to current competitive and premarket approval (PMA) dynamics. However, by the time of launch, the organization may also seek to commercialize the combination outside of the U.S. and could be faced with significant pricing and access challenges that were not considered during the initial investment decision.

Ultimately, some core principles can guide decision making to optimize pricing and access outcomes for combinations at later stages in the development timeline, including:

- Cross-functional alignment: The voice of pricing and access functions in strategic planning must increase, both for fundamental early-stage investment decisions and throughout the development process, as combination-specific decisions can be complex and affect multiple dimensions of a company’s portfolio/franchise.

- Calibrate expectations: Net-price and access expectations should be aligned in the context of a dynamic global pricing ecosystem and in relation to the value of the innovation offered, as incremental clinical innovations for combination therapy are not fully recognized in terms of pricing opportunity.

- Invest in true innovation: Making the right choice at the right time, for the right product is key; with a longer-term view, manufacturers should either focus more on investing in “game-changing” combinations or manage stakeholder expectations by adequately assessing risk and developing mitigation strategies.

The constraints present in today’s “status quo” environment create a disconnect between medical practice in the U.S. and other markets where combinations are treated with greater scrutiny. The result is fewer choices for patients and less incremental innovation available within the oncology treatment paradigm outside the U.S. Irrespective of geography, however, access decisions by payers need to consider the incremental benefit that combination therapy may offer or reserve funding for more significant innovation.

By understanding the drivers of this conundrum, manufacturers can better navigate their decision-making processes for combination therapy to facilitate pricing outcomes that create a best-case scenario for patient access across markets. However, when the “status quo” is the key constraint, and limited options are available to operate within it, manufacturers also may need to challenge payer systems to shift their approach to combination therapy value assessment, pricing, and access.

Stay tuned for the third article in this three-part series, which investigates options for manufacturers to shape the future opportunity for combination therapies in oncology.

Acknowledgements: The authors wish to acknowledge the contributions of Becky Martin and Srishti Sunil to this article. The views expressed herein are the authors’ and not those of Charles River Associates (CRA) or any of the organizations with which the authors are affiliated.