I started my Insights career at a medical devices division of one of the world’s largest pharmaceutical companies. A significant shake-up at the company marked the start of my tenure: a newly appointed CEO with a consumer-packaged goods (CPG) background introduced a new Chief Marketing Officer (also from CPG) and an influx of global marketers from renowned companies such as P&G, Kraft, and Coca-Cola.

This ushered in a paradigm shift for our organization, namely, the creation of integrated product teams, consisting of a diverse mix of disciplines: marketing, insights, R&D, regulatory, clinical, manufacturing. It was here that the tightrope walk began—navigating the tension between the scientific disciplines and marketing. A newfound appreciation emerged for how healthy tension could better meet the needs of patients, caregivers, and healthcare professionals (HCPs) globally.

The Healthy Tension

Healthy tension is about pushing product development and claims to optimally meet market challenges and crafting messages that resonate with patients, caregivers, and HCPs, all while maintaining a steadfast commitment to sound measurement and scientific rigor.

In recent voice of the customer interviews conducted by KS&R, one pharmaceutical professional proactively said:

“I would love to see us [MR & Insights] come in a little earlier to say, ‘what’s the value prop? Is there a secondary endpoint that could really help us stand out?’ Then we should start that clinical trial earlier, rather than do it at the postmark. We aren’t part of those conversations…by the time it gets to us and they say go forth and launch, it’s a little tougher…we could probably make it a little better…to be able to say ‘now we have a really nice story because this is what the patients wanted.’”

Fostering Team Synergy

Despite the significant commonalities between insights and clinical teams—such as gathering consumer and customer insight through various data collection methods, designing studies, analyzing data, and interpreting findings—these teams frequently operate in silos. Bridging the gap between these silos can unlock enhanced collaborative potential and impact.

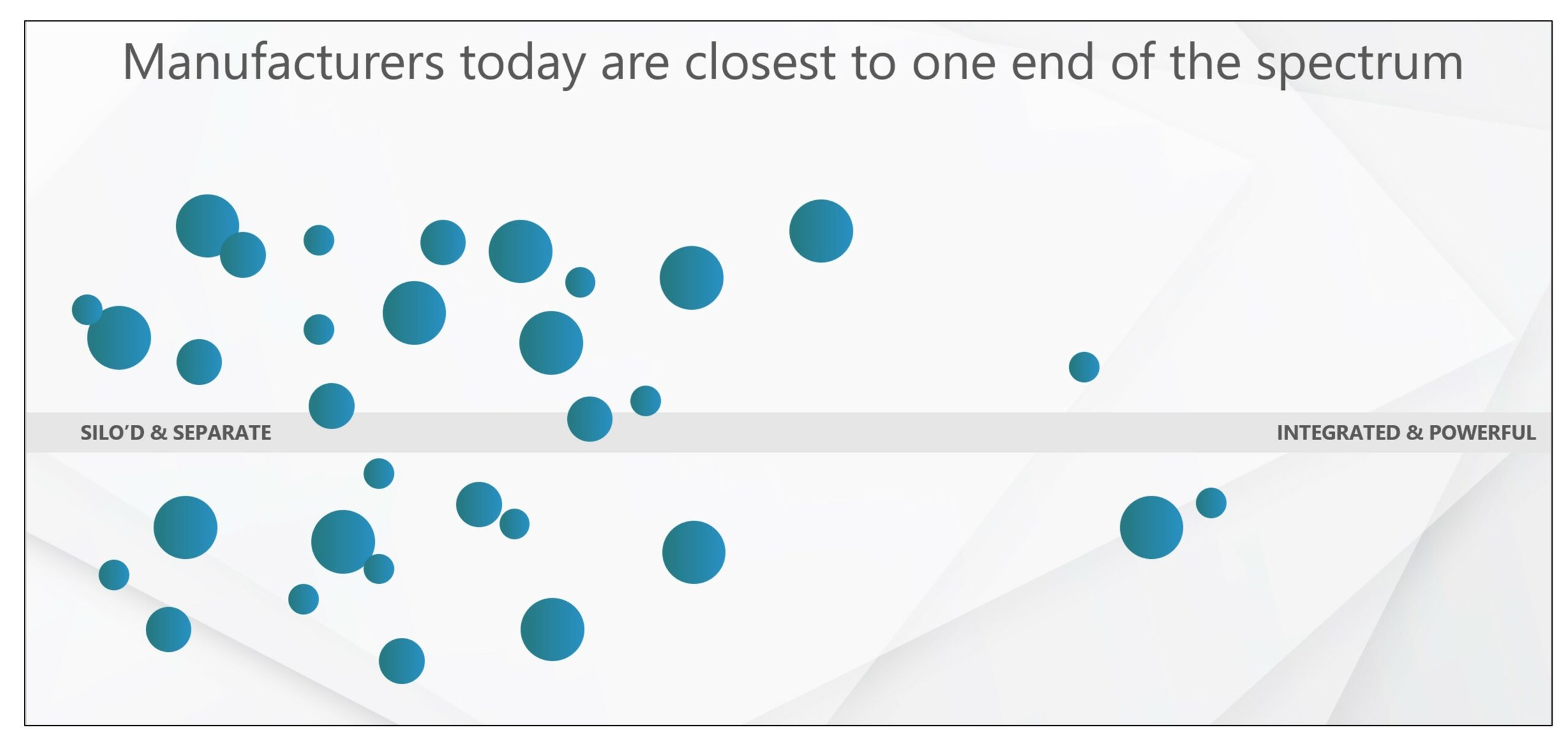

How insights and clinical work together falls on a continuum. Many manufacturers today really are closest to the “silo’d and separate” end. But some organizations are pushing toward the other end of the spectrum, seeking a sweet spot where integration makes the teams more powerful and their impacts on the population even greater.

Initiating Collaboration

Initiating Collaboration

Whether you are a marketer, insights professional, or on a clinical team, you can start pursuing deeper collaboration today:

- Facilitate Dialogue: Engage insights and clinical together in open discussions about each other’s annual learning plans. Raising awareness and finding common ground are possible here.

- Share Best Practices: Exchange knowledge on best practices, data collection methods, and analysis platforms between the departments. In my own experience, when market research went online in the early 2000s, my insights team helped our clinical team begin the move to online data collection versus paper, which significantly increased accuracy and speed to analysis.

It should go without saying that adding risk to drug approval and regulatory requirements is not the focus here. Billions of dollars are spent annually for additional trials. The focus is on bringing the most value to these additional investments by bringing clinical and insights together.

Case Study: Pushing the Insights Toolbox to Clinical

Traditionally, when a clinical study is designed, the clinical team determines the desired duration, endpoints, comparators, patient population to recruit, and so on. In a notable case, a client came to us when marketing brought up a question that sales reps were regularly getting from HCPs about an inferred benefit based on the currently published data for their indication. Neurologists and cardiologists wanted to increase their use of our client’s product and were inclined to believe the product could meet a secondary need, but they were not confident about how effective it would be.

When designing trials to capture specific endpoints, adjacencies always could be explored, but we often aren’t sure which should be prioritized. The R&D and clinical teams pushed for design of another randomized controlled trial (RCT) to capture this additional endpoint, but marketing wasn’t convinced that level of investment was required.

To determine the value of a future trial, a conjoint study was conducted to measure the impact new data would have on prescribing habits. Sales, marketing, clinical, and R&D poured over what was possible to support the desired claims. A mix of clinical data sources could be available—not just a potential RCT, but also retrospective analysis and meta-analysis in its place. The impact of statistical significance, comparators, secondary endpoints, and study duration were included. We also tested a nuance in the primary endpoint of interest since we were not completely sure what a new trial or analysis would show. This way, the research could inform what risk the team had if the primary result was not as strong as expected.

To gather the insights, we recruited HCP specialists who treat the patient indication, and they completed the conjoint exercise. The exercise was modeled to tee up eight to 10 scenarios as potential abstracts in a medical journal. Each screen was an abstract for Product X, and each abstract was unique in its combined presentation of a study design, endpoints, and statistical significance.

After evaluating the clinical design and results for a scenario, the specialists allocated their next 100 treatments across products. If you ask directly, a specialist might say “Yes, I need an RCT to prove it” but we learned otherwise by modeling what share looked like with and without that RCT. It turns out the payback wasn’t there for the RCT investment. The client could expect a meaningful lift in Rx volume by publishing a meta-analysis that showed a positive trend.

Going back to the original hypotheses, physicians already believed the product would probably be able to deliver, and the meta-analysis data simply made them more confident to write for a product they already saw value in.

Healthy Tension Led to Meaningful Impact

Ultimately, the company saved millions of dollars by deselecting an RCT and were able to get to market with results from the meta-analysis at least 24 months faster.

This is just one example of how leveraging the insights toolbox can strengthen clinical design and strategy. Clinical evangelized the work by directly guiding their strategy which increased confidence in moving forward with the meta-analysis. Together, the insights and clinical teams:

- Equipped reps with new materials

- Allocated financial resources to make larger impacts elsewhere

- Impacted more patient lives with their product

- Strengthened relationships between marketing, insights, clinical, and regulatory

The healthy tension between insights and clinical, when channeled effectively, can steer meaningful changes that positively impact patients’ lives, ultimately affirming why we each play our part in this ecosystem every day.