This is the first in a three-part series examining the commercial dynamics surrounding combination therapy in oncology across the U.S. and Europe. In this article, we discuss the challenges and opportunities within the current landscape and key issues impacting pricing and access for combination therapy.

Combination Therapy in Oncology

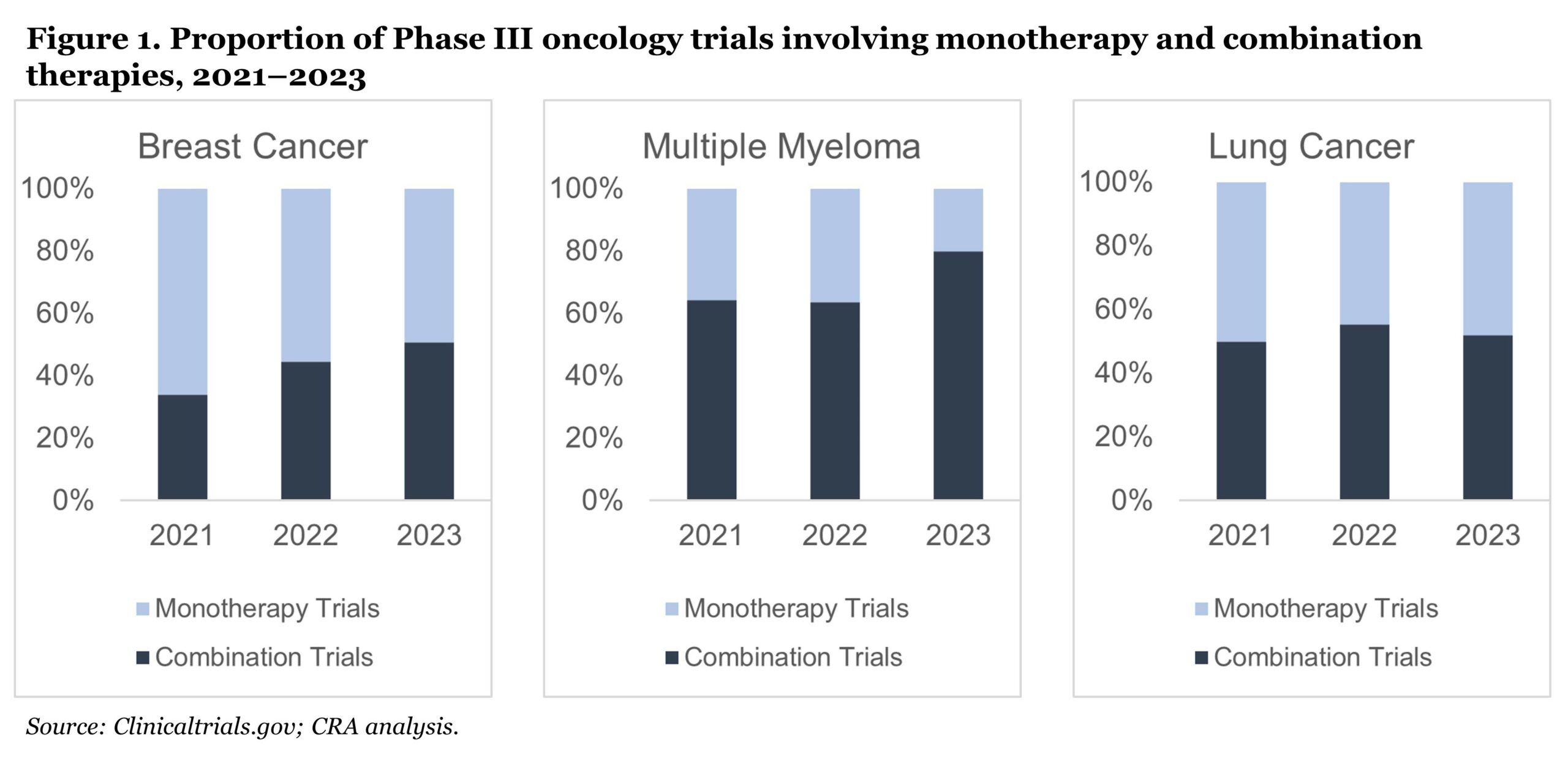

Combination therapies comprising two or more therapeutic agents have become a cornerstone of oncology management and are increasingly a development focus for the pharmaceutical industry. Between May 1, 2016, and May 31, 2021, 42% of all U.S. Food and Drug Administration (FDA) oncology approvals were for drugs used in combination.1 Between 2022 and 2023, 47% of Phase III oncology trials involved combination therapies, a number that continues to grow over time (see Figure 1).2

Combination therapies have provided incremental improvements in survival and the standard of care (SoC) continues to move toward combination—with even triple and quadruple combinations becoming more common. Combinations may present in a number of possible permutations, including purely novel components, components with established indications and prices, and generic/biosimilar components.

Combination therapies have provided incremental improvements in survival and the standard of care (SoC) continues to move toward combination—with even triple and quadruple combinations becoming more common. Combinations may present in a number of possible permutations, including purely novel components, components with established indications and prices, and generic/biosimilar components.

With a growing number of combination approvals, and the potential for higher cost and extended duration of treatment, payers (particularly ex-U.S.) are voicing concerns about lack of value for money and unsustainable increases in budget impact. In addition, many markets are increasingly incorporating elements of cost effectiveness into their health technology assessment (HTA) processes, which can be particularly challenging for combinations that offer minor incremental benefit over SoC monotherapies.

From the manufacturer perspective, payer policies and legislation on combination therapy pricing are impacting global development, pricing, access, and commercialization strategies. Critical questions on what to develop, where to launch, and how to price need to be reframed in the context of the evolving combination therapy landscape.

When 1+1 ≠ 2

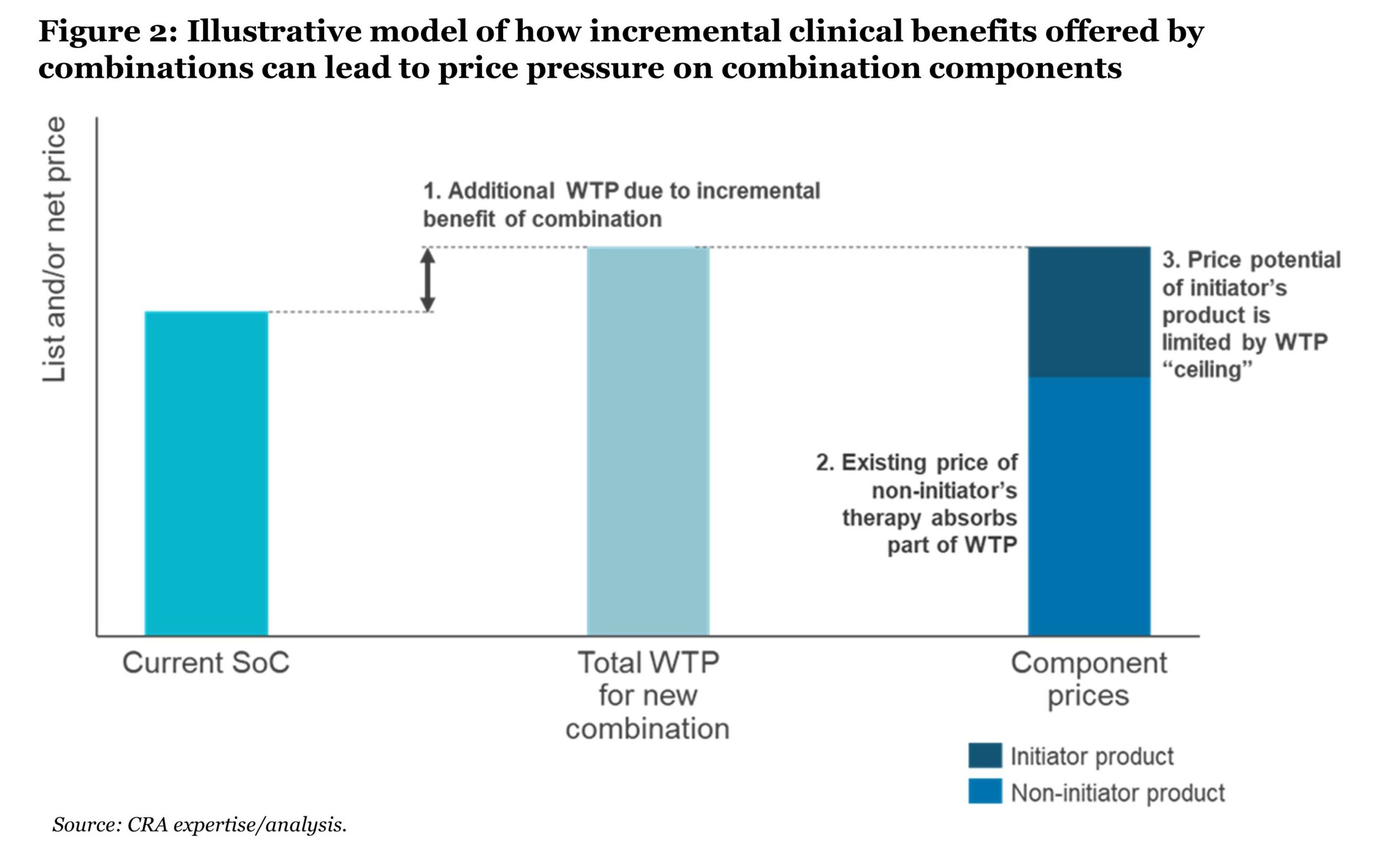

In theory, combining two or more branded agents can lead to a price that exceeds SoC monotherapy. Current value assessment and pricing methodologies do not include an inherently higher willingness to pay (WTP) for a combination versus a monotherapy, which results in challenges for manufacturers—particularly if they are the initiator of the combination (see Figure 2).

In the absence of indication-based pricing—which could allow for the preservation of monotherapy value when negotiating a follow-on combination indication—one or more components of a combination must usually be discounted to reach a combined price that matches payer WTP. However, where there are other existing or planned indications, the practice of discounting has broader revenue implications for the brand. As a result, manufacturers are increasingly opting to not launch their combination indications in certain markets.

In the absence of indication-based pricing—which could allow for the preservation of monotherapy value when negotiating a follow-on combination indication—one or more components of a combination must usually be discounted to reach a combined price that matches payer WTP. However, where there are other existing or planned indications, the practice of discounting has broader revenue implications for the brand. As a result, manufacturers are increasingly opting to not launch their combination indications in certain markets.

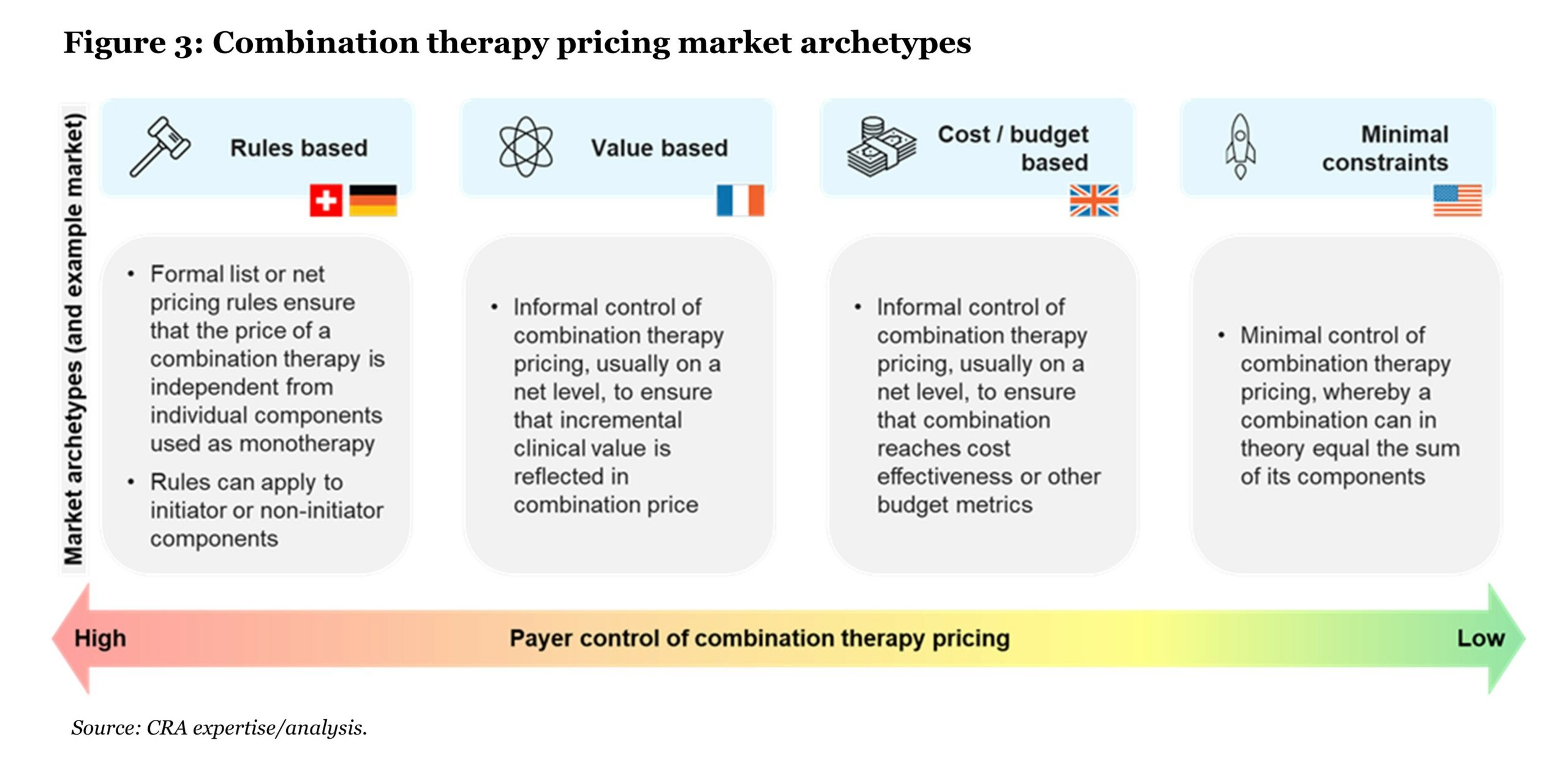

To simplify and structure the question of how combination pricing potential varies across markets, CRA considers an archetype-based model to classify markets according to the degree of payer control on combination therapy pricing (see Figure 3).

In markets like the U.S., which fall into the “minimal constraints” archetype, combination therapies can, in fact, be priced at “1+1=2,” that is, equaling the sum of the constituent parts as monotherapy. In all other market archetypes, achieving a “1+1=2” price is unlikely unless clinical benefit is at least double that of the existing SoC.

In markets like the U.S., which fall into the “minimal constraints” archetype, combination therapies can, in fact, be priced at “1+1=2,” that is, equaling the sum of the constituent parts as monotherapy. In all other market archetypes, achieving a “1+1=2” price is unlikely unless clinical benefit is at least double that of the existing SoC.

Additional nuances should be considered when the combination represents an indication expansion, both within and between these archetypes. Some markets consider a formally or informally weighted average value across indications (formally in Germany, informally in other comparative effectiveness markets such as the U.K.), while others require the price to be set at a level where all indications—including combinations—meet fixed thresholds of cost effectiveness or budget impact.

Outcomes are also influenced by price metrics used across markets—particularly use of cost per duration of treatment versus cost per month. For example, where a combination results in the increased duration of treatment (e.g., by increasing progression-free survival (PFS) or overall survival (OS)) relative to the existing SoC backbone therapy, the total cost of the combination therapy is higher assuming that the cost of the backbone does not change. In cost-effectiveness markets such as the U.K., the increased quality-adjusted life year gain from the longer PFS or OS often supports only a modest additional cost on top of the backbone therapy. In extreme cases, this leaves combinations above acceptable incremental cost-effectiveness ratio thresholds even if the add-on therapy is provided for free.

Combination Pricing Risks

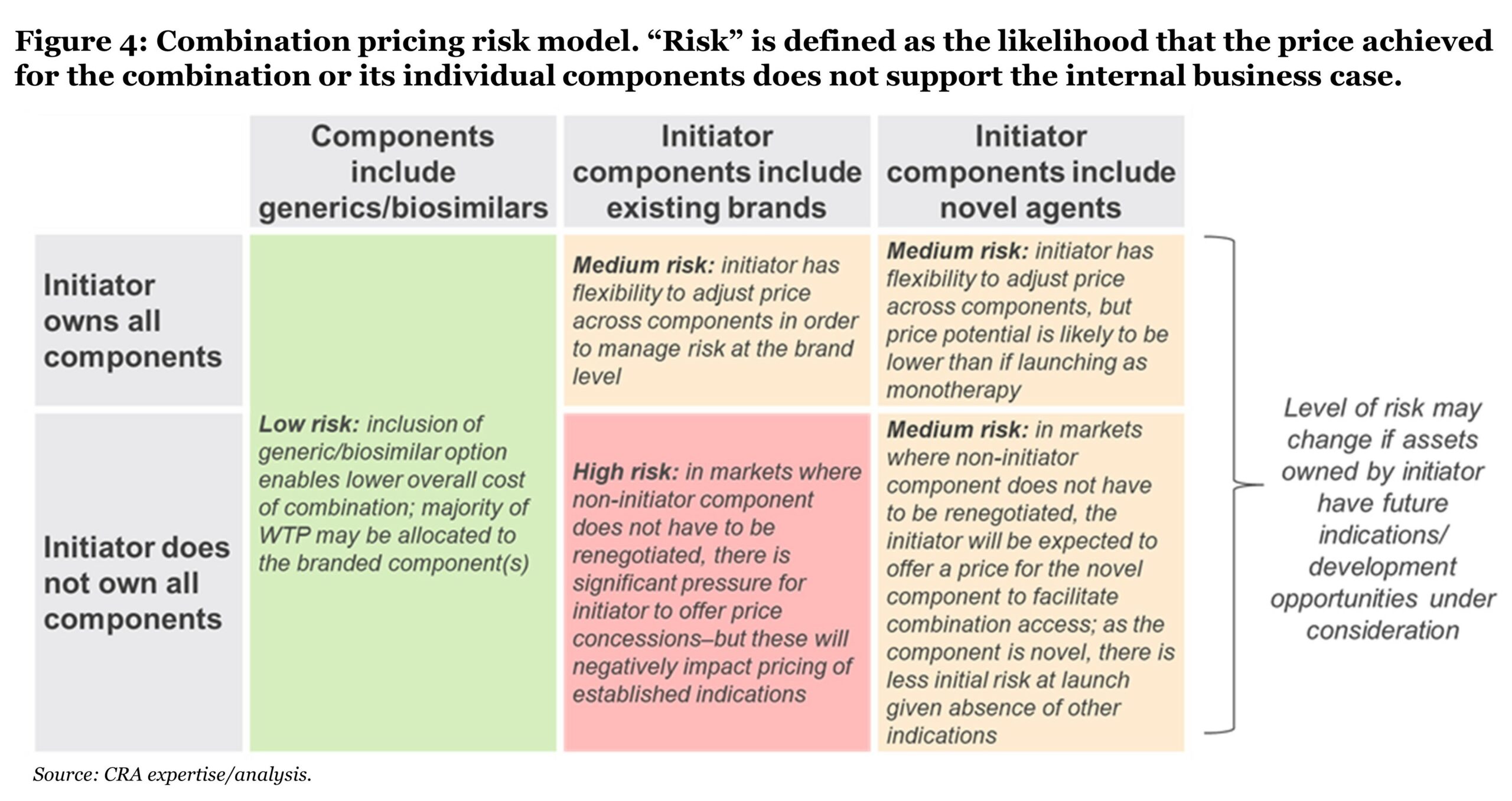

Manufacturers, or “initiators,” of combinations face significant pricing risks, namely that the price achieved for the combination or its individual components will not support the internal business case. Risk varies across markets, as discussed, but also across combinations, depending on the characteristics of the combination therapy. While many factors affect pricing risk, the most fundamental ones relate to the ownership and nature of the combination’s components.

Ownership of combination components

Ownership of the combination components impacts the initiator’s ability to control the outcomes of pricing negotiations. While owning multiple components does not solve the problem of “1+1<2,” it can increase the manufacturer’s ability to manage the lifecycle and net revenue of the products involved.

In most market archetypes, initiator-owned combination components typically include the combination use in their label and are subject to price (re)negotiation, whereas any changes to the label or price of non-initiator components are typically not mandatory. Therefore, when the initiator owns all components of the combination, greater flexibility is possible as negotiations can occur simultaneously across components and can influence the distribution of discounts across products. When the initiator does not own all components, the risk falls disproportionately on the initiator component(s) to offer a price that makes the overall combination cost acceptable to payers.

Nature of combination components

Pricing risk for a combination also depends heavily on the nature of its components. If components are novel, their initial price is determined in the context of the combination and the manufacturer may have more flexibility within price negotiations, although the price potential is likely to be lower than if launching as a monotherapy. If components include an existing brand, there is a significant risk that any price adjustments made to the brand will affect its existing indications, eroding value for the brand overall. If the components include a generic or biosimilar, the patent-protected component in the combination faces typically less price pressure due to lower cumulative cost.

Combination pricing risk model

By examining the ownership and nature of the combination components, we can characterize the overall pricing risk for a combination therapy using three levels: low, medium, or high (see Figure 4). Certain markets (e.g., Switzerland) may be an exception to this model, where the total WTP is divided across components regardless of ownership.

Call to Action

Call to Action

Pharmaceutical manufacturers continue to push forward with active combination therapy pipelines, seeking to offer improvements over SoC in oncology. It is their prerogative to support and commercialize new innovation, providing new therapeutic options to patients. This makes it vital to consider pricing strategy and the implications for lifecycle management early in the development process.

To date, manufacturers have worked within existing constraints for combination therapy reimbursement, often at the expense of commercial potential or patient access. Payers continue to actively limit the budget impact of combination therapies through price controls. Moving forward, manufacturers must consider their options and whether it is better to work within existing constraints or try to change them. With due consideration of these challenges, manufacturers can develop an approach that addresses business needs as well as payer requirements. This will involve a synergy across regulatory, clinical development, policy, and commercialization decision-making that is aligned with the needs of patients and the medical community.

Stay tuned for the second article in this three-part series where we discuss how pharmaceutical manufacturers can support combination therapy pricing and access within the current environment by optimizing clinical development decision-making, evidence generation, and value communication, balancing pricing trade-offs and preparing fit-for-purpose contracting solutions. In the third article, we consider market-shaping strategies that manufacturers can use to secure successful pricing and access outcomes for future combination therapies.

Acknowledgments: The authors wish to acknowledge the contributions of Becky Martin, Srishti Sunil, and Owen Male to this article. The views expressed herein are the authors’ and not those of Charles River Associates (CRA) or any of the organizations with which the authors are affiliated.

References:

1. David J. Benjamin, Alexander Xu, Mark P. Lythgoe, and Vinay Prasad. “Cancer Drug Approvals That Displaced Existing Standard-of-Care Therapies, 2016–2021.” JAMA Network Open 5, no. 3 (2022): e222265. doi:10.1001/jamanetworkopen.2022.2265.

2. Clinicaltrials.gov; CRA analysis.