CSOs can seamlessly integrate multi-channel efforts that will drive impactful results.

The pharma industry’s approach to promotion is changing. Much has been written about this, and there is much speculation as to where the industry is heading in terms of field headcounts and portfolio management. What is undeniable is the industry’s shift to greater reliance on promotional outsourcing to represent all brands. A recent report published by Visiongain forecasts that revenues in the Contract Sales Organization (CSO) industry will grow to $3.9 billion globally in 2013, with personal promotion still accounting for the largest portion of revenues over a 10-year forecast.1

Another dynamic of this increasing dependence on the CSO is the rise of non-personal promotion outsourcing services. According to the same Visiongain report, other promotional areas will grow even more rapidly than personal promotion in the next 10 years. eDetailing for example, is expected to reach $200 billion in revenues to CSOs by 2013. This trend is reinforced by healthcare practitioner (HCP) communication preference survey results indicating HCPs have moved from “one or two favorite ways of receiving communications to wanting as many as seven ways” in the last three years.2

As a result of this increasing demand for outsourced services, the CSO industry is also changing. To meet the performance requirements of many clients, today’s CSO is offering integrated personal and non-personal solutions that are both nimble and flexible. And because CSOs can leverage costs across multiple clients, they are able to cost-effectively build the necessary infrastructure to support these activities using varied, industry-wide experience to provide the most impactful solutions.

Building the New Contract Sales Teams

This new CSO model evolution began only a few short years ago with a shift in requested service contracts to cover promotional shortfalls resulting from industry downsizing. Before this shift, most requests for proposals (RFPs) to CSOs specified share of voice enhancement for mature brands in lower deciles or added a back-up team to the in-house group covering a major brand. Today, RFPs call for dedicated field teams with non-personal support to cover launch, growth and mature brands—additionally differentiated by the fact that the CSO rep is the only field rep specified for that brand.

The availability of highly experienced talent to fulfill CSO contracts has reinforced this CSO position as the go-to resource. As a result of industry downsizing, CSOs have been able to “up their game,” selecting only the very best talent to meet contractual commitments. CSOs can then retain these best-in-class reps, offering career opportunities that can span multiple contracts over time. And service organizations also have been quick to develop the necessary technology interfaces for these fielded teams, synching seamlessly with sales force automation (SFA) platforms using smartphones, iPads and other notebook technologies depending on the client.

That being said, the types of teams being fielded now, and those being requested for future services, are markedly different from the expansive primary care dedicated-team field models of the past. Established relationship (shared) and customer service teams are increasing in popularity, providing coverage to brands within the portfolio that are still promotion responsive but have been dropped by in-house coverage due to a shift in concentration to specialty brands. These brands could even be older chemical entities that are being delivered in a new delivery system or with a new dosing schedule, and will benefit significantly by personal promotion.

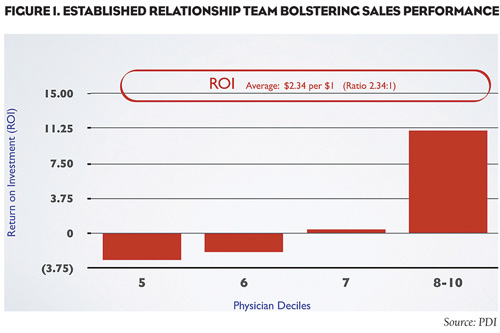

A case in point is an established representative team that supports promotion of a leading pharmaceutical company’s seasonal medication to those who would otherwise not receive a personal sales call (Figure 1). Despite a market leader position that is difficult to improve upon, a return on investment (ROI) of $2.34 for every dollar spent has been achieved. Based on a pay-per-call model, these established relationship teams have evolved as a significant, cost-effective industry resource due to their high engagement potential in specific zip codes and deciles, particularly with primary care, dermatology, pediatric and obstetric/gynecologic offices.

Customer service teams are also on the rise. These teams help the industry maintain a face and shelf presence for established brands no longer requiring a full-fledged detail. The customer service rep will keep the office current with samples, brochures and other pertinent patient information on the brand(s) they represent.

Customer service teams are also on the rise. These teams help the industry maintain a face and shelf presence for established brands no longer requiring a full-fledged detail. The customer service rep will keep the office current with samples, brochures and other pertinent patient information on the brand(s) they represent.

Dedicated specialty teams, Medical Science Liaisons (MSLs) and Key Opinion Leaders (KOLs) are more the norm for launch and growing brands, and these teams tend to be small in size, handling high-prescribing HCPs in key markets with personal coverage.

Increasing the Value Proposition

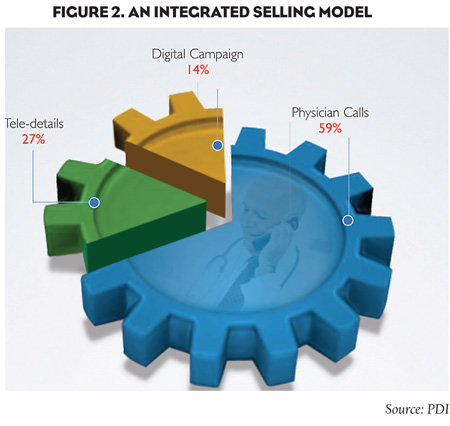

In addition to offering manpower relief to a downsizing industry, today’s CSO contract undeniably delivers more value to the industry as a fully integrated solution—one that delivers personal promotion empowered by technology along with non-personal outreach. By offering a flexible platform with an array of services—personal, teledetails, digital and print—the CSO is able to deliver promotional tactics that best suit clients’ target accessibility (Figure 2). For example, instead of offering 18 details against a target over a year, we might package 12 personal visits with follow-on support coming from teledetails and eDetails in an integrated selling model. This integration of services is a more efficient approach, using the more expensive rep time to address the HCP’s concerns on a personal level and then following up with non-personal promotion to support his or her efforts.

To demonstrate how this integrated approach can deliver effective results, consider, as an example, a CSO contract with a specialty pharma company launching a new treatment medication to diabetes experts, endocrinologists and primary care HCPs. In this case, the CSO, client-managed specialty team is the only team deployed in the field. They have been tasked with a national launch to top markets in the United States, with white space covered by teledetails.

To demonstrate how this integrated approach can deliver effective results, consider, as an example, a CSO contract with a specialty pharma company launching a new treatment medication to diabetes experts, endocrinologists and primary care HCPs. In this case, the CSO, client-managed specialty team is the only team deployed in the field. They have been tasked with a national launch to top markets in the United States, with white space covered by teledetails.

In preparation for the launch, the CSO’s call center contacted primary targets in order to determine their receptivity to the treatment modality being launched, their policies in seeing field reps and, where possible, set appointments for rep visits. The info recorded by the call center was then loaded into the field reps’ SFA platforms, giving them background info on each target within their territory. This delivered a far more effective first wave of coverage for the product launch.

In addition, a risk evaluation and mitigation strategies (REMS) web training portal was developed. Multi-channel recruitment for the REMS training included rep, voice, direct mail and digital solicitation. HCP participation was then tracked and integrated in the rep’s SFA platform for FDA-compliant reports.

Taking it to the Next Level

As seen in Figure 1, CSOs seamlessly integrating these multi-channel efforts will drive impactful results. Synching of response data from non-personal promotions and making it accessible to the field representative is key to this integration. HCPs have certainly shown their acceptance of technology, with more and more viewing information on the go via smartphone or iPad. Giving the field representative access to this level of HCP engagement is the first step in achieving better personal promotion in today’s selling environment.

To this end, several pharma companies deploying CSO teams are now using a multi-channel tracking calendar developed to enhance management of HCP relationships. Accessible through the SFA platform, this calendar gives the rep visibility into the various non-personal promotional efforts being conducted with their HCP targets. This info proves invaluable to the rep in “getting in the door” or keeping an HCP engaged. In addition, it gives the field force the ability to recruit customers to various HCP portals, keeping track of registrations and portal activity.

By allowing reps to have a proactive digital interface with their HCP targets, we are in essence putting them in the driver’s seat. Who better to drive the HCP engagement than the person who knows the HCP personally, and from that knowledge assess what is the most appropriate outreach to satisfy the HCP’s needs?

This rep-triggered activity is the necessary second step in the CSO rep evolution that will dramatically improve all promotional efforts. Already there are apps in use as part of a digital tools suite where reps can display fully compliant, client-approved digital content during a call, collect HCP insights, and then extend their call with additional compliant, approved information sent post-detail via email. Based on a management platform that integrates personal and non-personal promotion data with HCP data and then pushes it out to the SFA platform, these tools are truly driving a flexible, nimble CSO delivery model.

Optimizing the partnership

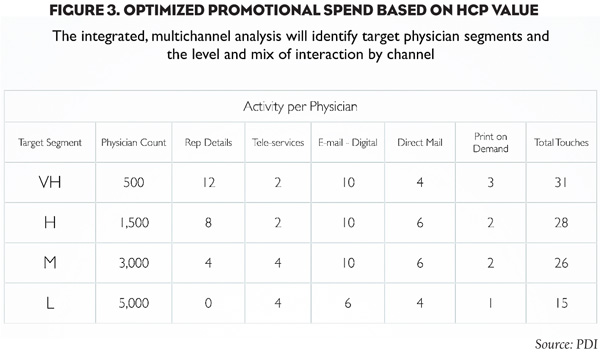

Whether the partnership arrangement is fee-for-service or involves shared risk, there is much to be gained in working with a CSO in 2013 and the years ahead. The flexibility of evolving multi-channel platforms offers a cost-effective, optimized promotional spend as shown in Figure 3 that is difficult, if not impossible, to create within the existing pharmaceutical industry infrastructure.

This integration optimizes live interaction, which is still very much a necessity, and does so by allowing the rep to function as a true resource to the HCP. Rather than delivering rote details, reps are able to offer engaging interactive experiences that provide true value to HCP targets. By drawing upon the rep to drive follow-on, multi-channel outreach as needed, CSOs are truly creating a superior customer experience.

This integration optimizes live interaction, which is still very much a necessity, and does so by allowing the rep to function as a true resource to the HCP. Rather than delivering rote details, reps are able to offer engaging interactive experiences that provide true value to HCP targets. By drawing upon the rep to drive follow-on, multi-channel outreach as needed, CSOs are truly creating a superior customer experience.

There are still obstacles to overcome for sure. For instance, sales and marketing departments are seeking ways to integrate their efforts to optimize outcomes. However, the impetus is here, and the CSO industry is delivering the tools needed to deliver impactful promotion across all channels.

References:

1. “Pharmaceutical contract sales market will reach $3,912m in 2013’ predicts new Visiongain report,” http://www.visiongain.com/Press_Release/297.

2. “Email or snail mail from pharma? Docs like both, study finds.” Fierce Pharma, 11/15/12.