Retail marketers have it easy. They have shopping and purchasing data easily at their disposal. All of the mainstream publishers, like Google and Facebook, are comfortable serving their ads. They don’t have to worry about making sure their ads are only in states where it is legal to sell their product. Meanwhile, marketers of the quickly growing cannabis and CBD industries don’t have those advantages, but Good Harvest Co. is working to level the playing field a bit. PM360 spoke with Founder and CEO Eric Meth about how his company is gathering and using cannabis and CBD shopper data to make it easier for marketers to find the right customers.

PM360: Why did you decide to start this company?

Eric Meth: About 20 months ago, I started looking for something new. I had a successful 25-year career working with big box retailers in which we used their data around the shopping behaviors of their consumers, both online and in-store, to build out a healthy marketplace of rich consumer insights. I saw an opportunity to apply that into the emerging cannabis and CBD space. At its core, Good Harvest Co. is a data platform focused on harnessing insights around those same types of shopping and purchase behaviors and utilizing those segments as a way for brands to leverage that rich data to more finely target their desired consumers.

In order to have success, you need data on the cannabis buyers. Where are you getting it?

In order to have success, you need data on the cannabis buyers. Where are you getting it?

More traditional marketers are coming into the cannabis space from industries like CPG or retail and quickly realize they don’t have the same tools at their disposal. They can’t just go to Google or Facebook—the two big arrows in their quiver that probably did 80% of the heavy lifting at their last job. So we started having conversations with these marketers about ways to leverage their data. And we are working with brands in this space that have their own promotional websites and getting permission to place a pixel on their site that captures the ways consumers shop and the URLs attached to each action. That way we don’t access any of the personally identifiable information (PII) of those consumers. We’re more focused on device-identifiable information (DII).

Are you then building audience personas or segments based on that data?

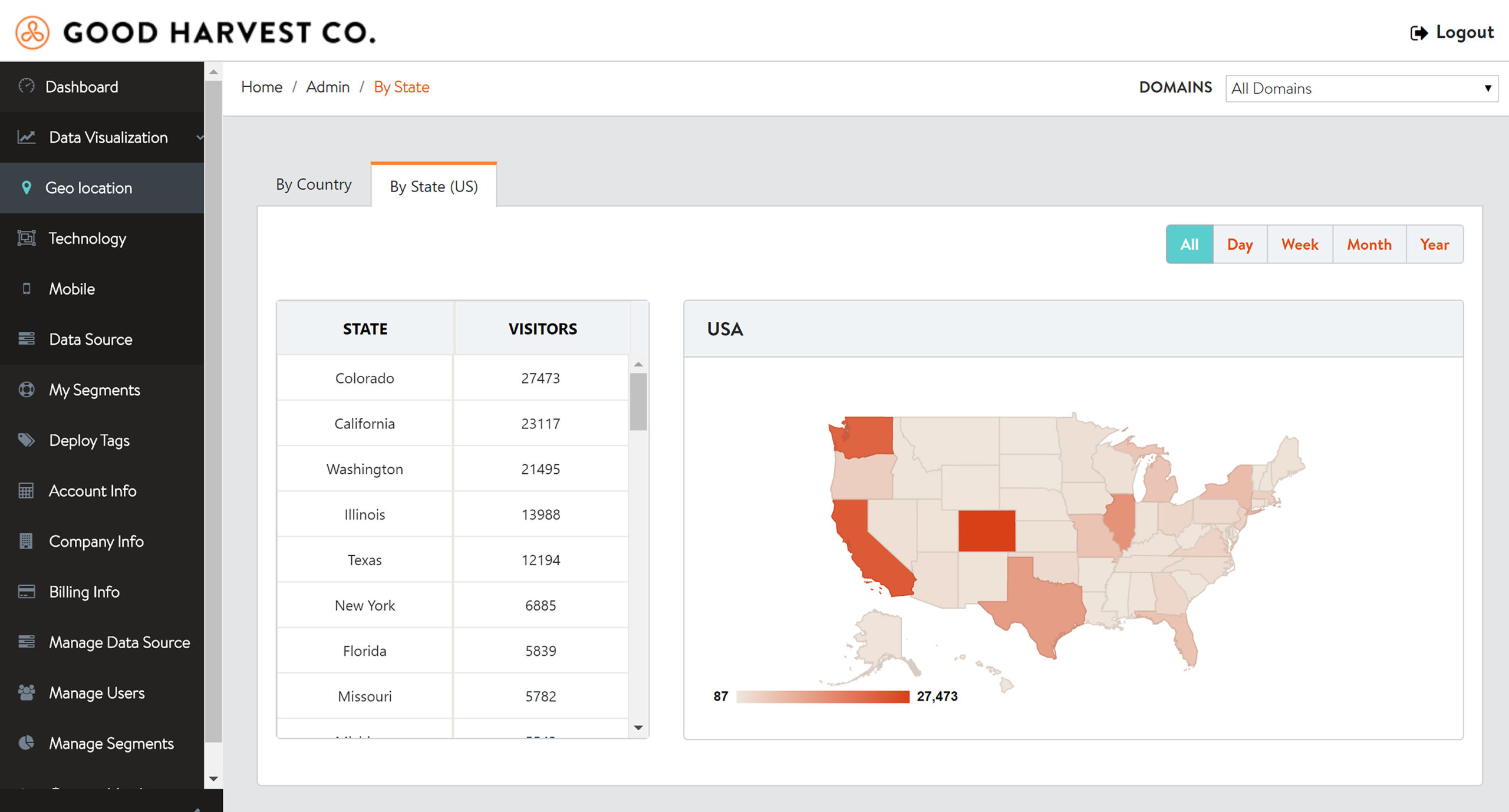

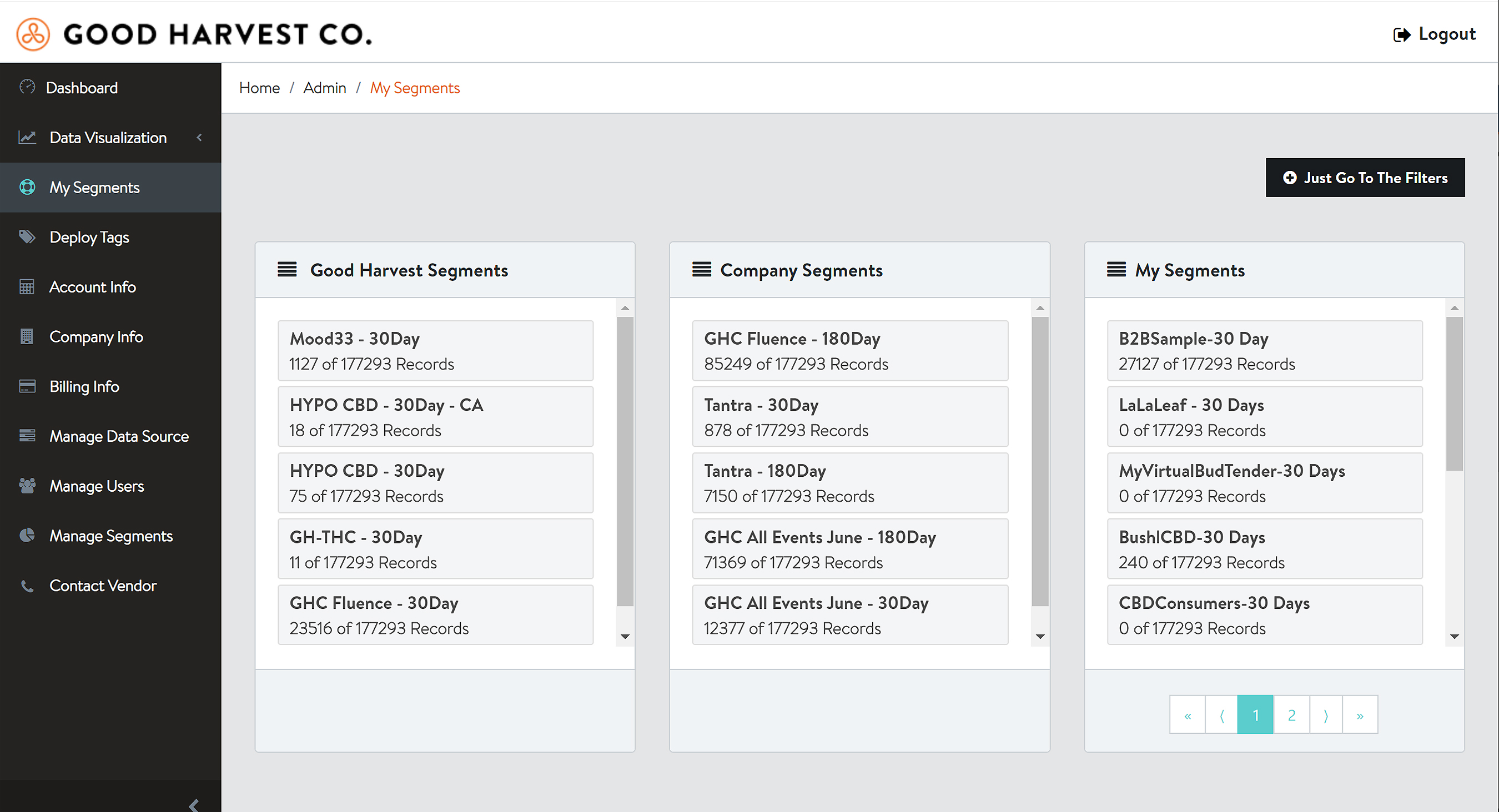

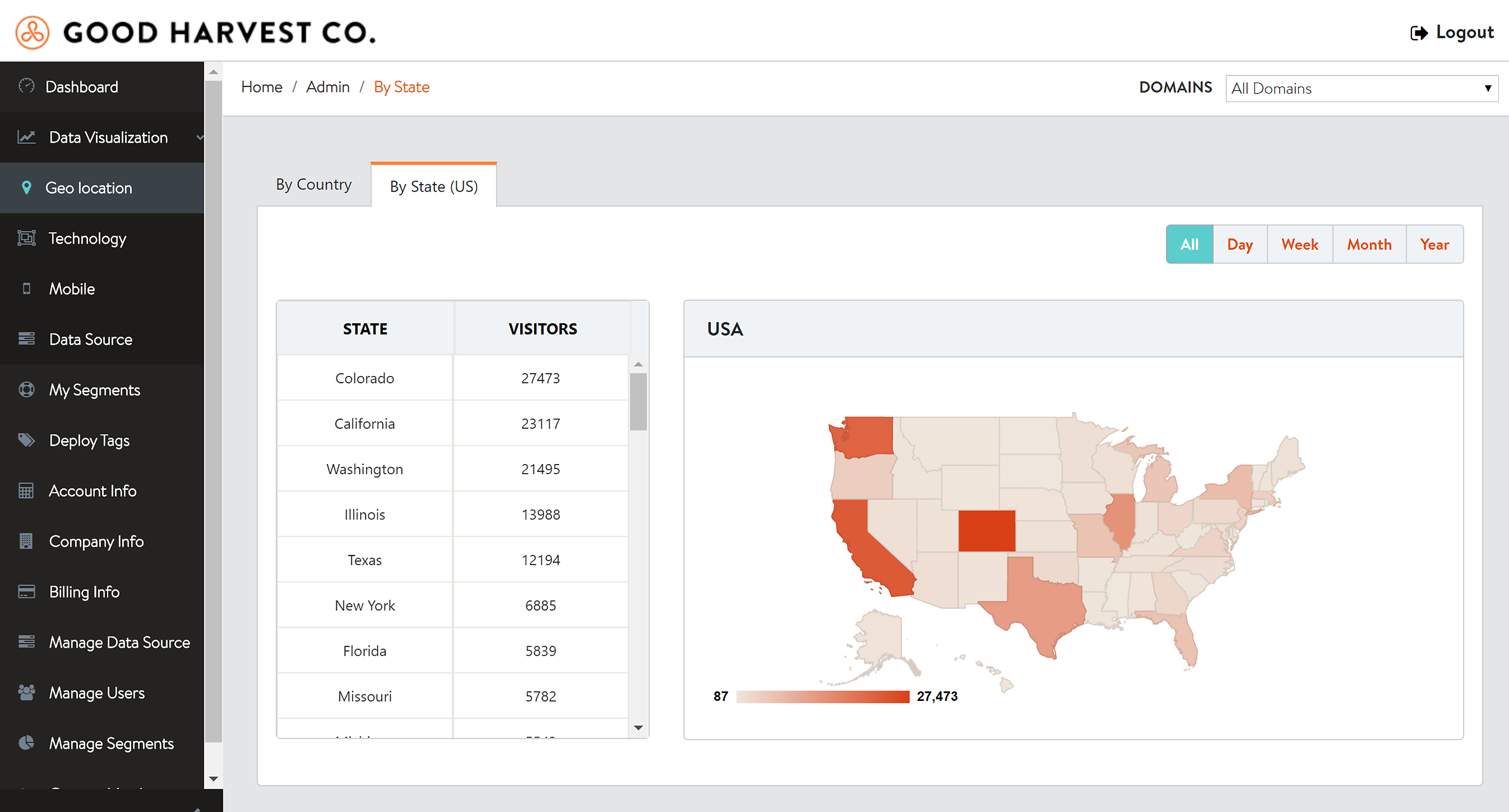

The way we’re currently gathering is more focused on categories of product. But once we start aggregating everything, we can break it down into meta categories such as the types of consumers. For instance, flower consumers who consume cannabis products in a traditional sense, concentrate consumers who prefer cartridges you can vaporize, edible consumers, topical consumers, etc. Then you have CBD, which is more of an overall general category.

Based on that data, we could help brands to target consumers in the state of California that show a level of intent for edible versus another type of product. It gets cool when you can start correlating, but our dataset isn’t big enough yet. However, once we gain more scale, that’s where you start seeing interesting correlations. You might find consumers who show an interest in edibles are also looking at concentrates, just not as predominantly. The real holy grail is linking the shopping behavior to the actual purchase behavior and understanding deficiencies between the two and the reasons why a consumer is shopping for certain products but they’re not consummating the purchase.

Based on that data, we could help brands to target consumers in the state of California that show a level of intent for edible versus another type of product. It gets cool when you can start correlating, but our dataset isn’t big enough yet. However, once we gain more scale, that’s where you start seeing interesting correlations. You might find consumers who show an interest in edibles are also looking at concentrates, just not as predominantly. The real holy grail is linking the shopping behavior to the actual purchase behavior and understanding deficiencies between the two and the reasons why a consumer is shopping for certain products but they’re not consummating the purchase.

How are you utilizing your data in the programmatic buying space?

From the start, we had no desire to build another bidder for advertising inventory. The market already has plenty of demand side platforms (DSPs) and supply side platforms (SSPs). We are focused on partnering with DSPs and already have one with the cannabis-friendly Safe Reach, specifically as a channel partner to execute our current brand campaigns. We also have other soft partnerships we are pursuing to create match tables.

We look at the device data that we have through our pilot program and our match rate against a platform’s inventory that reaches the same devices that we’re reaching. Obviously the higher the match rate, the better we could push an ad effectively on a targeted level to those devices. That’s how we’re focused on gaining distribution and that’s our revenue model. The base CPM for cannabis inventory is typically in the $6.00 range. We generate revenue from the CPM premium on top of that $6.00 base that our shopping behavior data provides.

We look at the device data that we have through our pilot program and our match rate against a platform’s inventory that reaches the same devices that we’re reaching. Obviously the higher the match rate, the better we could push an ad effectively on a targeted level to those devices. That’s how we’re focused on gaining distribution and that’s our revenue model. The base CPM for cannabis inventory is typically in the $6.00 range. We generate revenue from the CPM premium on top of that $6.00 base that our shopping behavior data provides.

Looking down the road, what else would you like to do in the long term?

While we want to stay focused on helping marketers to better influence purchase around known consumers, we would also like for them to be able to use the data for more audience discovery. The big upside isn’t so much around the existing base—the 35% of the population active in this space—it’s in the 30% to 40% from consumers who aren’t yet active. That includes consumers in states where CBD is legal to purchase but they’re unsure about where to go, what to buy, what product is good for them. I categorize them as the unknown known consumer. You’re taking attributes from known consumers and then projecting that against consumers that you don’t know but look a lot like the ones you do. That’s a big part of what we’re focused on.