Biopharma blockbusters in the last 10 years show a disturbing trend. On average, they returned 11% less global revenue than previous years’ launches. In oncology, it’s 47% less.1

As a top 10 biopharma company leader shared with us, “Real blockbusters are gone. We are dealing with small figures and often missed expectations. It takes a lot more work to create a blockbuster.”

Today’s market is different than when blockbusters seemed relatively easy to develop. From the 1990s to the early 2000s, the golden age of the blockbusters saw the rise of mass-market drugs such as Lipitor, Crestor, Plavix, and Zyprexa. This decade saw more than 150 blockbuster launches, mainly small molecule drugs for high prevalence and treatments for several chronic conditions.

Then between 2005-2015, there were 110 global blockbuster launches, with a high concentration in specialty care and biologics. With these launches came more complex science, which pushed biopharma’s evolution to integrate more medical engagement alongside the existing commercial focus for healthcare providers and payers. This change resulted in an era of growth, meeting needs in high white space areas such as oncology.

Challenges of the New World Order

We’re now moving into a new era of global launch—one where it is harder to achieve the heights of blockbusters that we saw in previous ages. This new world order is marked by smaller, fragmented opportunities, increasing headwinds in high investment therapeutic areas, more complex customer groups requiring nuanced engagement models, and more compressed resources and investment from global pharma.

All these challenges come at a time when the industry faces higher expectations from investors for innovation speed, scale, and growth in a post-COVID-19 environment.

In particular, this new world order is marked by three universal trends that were not headwinds in previous ages: innovation outpacing healthcare adaptation, increasing expectations for global access, and impending patent cliffs. Recognizing these three trends can bring new perspectives to your own portfolio planning.

1. Innovation Is Expanding, But Healthcare Systems Are Slow to Adapt

Science continues to evolve rapidly, most recently delivering more complex technologies with the advent of immunotherapies, cell and gene therapies, and more platform technologies (such as CRISPR) that target diseases with niche patient subgroups. Despite the rapid advances that have enabled these innovations, healthcare systems and commercial infrastructure aren’t keeping pace.

For example, cell and gene therapies have curative potential in high unmet diseases. These therapies garnered $23B in global investment in 2021, and the industry has more than 3,500 therapies in development. Despite the interest, developers of these therapies struggle against systems that are not designed to handle high-touch, integrated, one-time high-cost therapies.

To date, a small number of brands have managed to create blockbusters on a global scale, with some now approved in more than 30 countries. But multiple companies have withdrawn marketing authorization in ex-U.S. markets because of commercialization challenges. Regulatory, pricing, and reimbursement pathways will need to evolve to support these innovations in addition to eligibility alignment, referrals, and integration with local healthcare to facilitate access to the patients who can benefit from them.

For biopharma, success in this space will require integrated models that are significantly different than what has been used with historic medicines. Due to COVID-19, leaders also face the challenge of rethinking global and regional supply chain resilience to manufacture and supply these therapies to patients.

Driving scale in a slow-moving healthcare ecosystem is not just a challenge for cell and gene therapies. ZS’ 2022 State of AI in Life Sciences Survey shows that 47% of AI use cases are in drug discovery.2 The use of emerging technology here will lead to an even more diverse landscape of launches and approaches to commercialization.

2. Expectations Are Increasing for Global Access to Therapies

Everyone in healthcare agrees we need global, equitable access to care and medicines.

Countries are raising expectations for what global access means, starting with increasing speed and breadth of access. For example, the traditional launch sequence of the U.S. followed by Germany and then select European markets has led to significant gaps in access. To reduce inequity, the European Federation of Pharmaceutical Industries and Associations (EFPIA) pledges to ensure access to new medicines for all 27 EU member states no later than two years after receiving EU marketing authorization.3

Decision-makers face additional pricing pressures across the globe that add complexity to launch and scale plans. Pricing regulations have already been rolled out in Japan, and Europe plans to introduce a single health technology assessment (HTA) in 2025.

U.S. pricing pressures are constantly looming, but the last few years have seen more aggressive pricing reform legislation and policy regulations. Pricing regulations in China, a priority emerging market for most of large pharma, has significantly limited growth potential. In the 2021 update to China’s National Drug Reimbursement List (NRDL), only about 65% of negotiated products were successful and those saw an average price cut of approximately 61%. Orphan drugs fared worse, with some having prices cut by 95% to gain access to the market.4

Biopharma organizations are adjusting their approaches to development and commercialization. Pharma is also stepping up to the global call for health equity in development and delivery. With an average cost of $2B per drug that reaches the market, having clear paths to data requirements, pricing agreements, and access remains critical to scaling launches globally.

3. A Patent Cliff Is Looming, Increasing Expectations on the Next Wave of Launches to Fill the Gap

ZS analysis shows the top pharma companies have more than $230B in worldwide revenues at risk from 2022 to 2030; the top 10 pharma companies combined have more than 45% of their revenues at risk. During this time, 69 blockbusters will lose patents. While pipelines are active, the opportunities for each launch are smaller, and the replacement power of current pipelines is not big enough.5 Each launch needs to maximize its revenue potential to bridge the gap.

The industry has the dry powder to lean into acquisition and alliances to help. The top 12 biopharma companies have an estimated $170B to use. Industry watchers can expect bolt-on deals and some spinoffs and divestitures toward desired areas of focus. As we saw in previous ages, these deals are important to expand and fill the pipeline, but they can also create more work and potentially detract leaders from launches when success is vital.

To navigate this new world order, many organizations are undergoing transformations to gain efficiencies through more streamlined global commercial models in core revenue-generating markets. Organizations are becoming more focused on their resources, effectively working to realize the full potential of their upcoming launches with less.

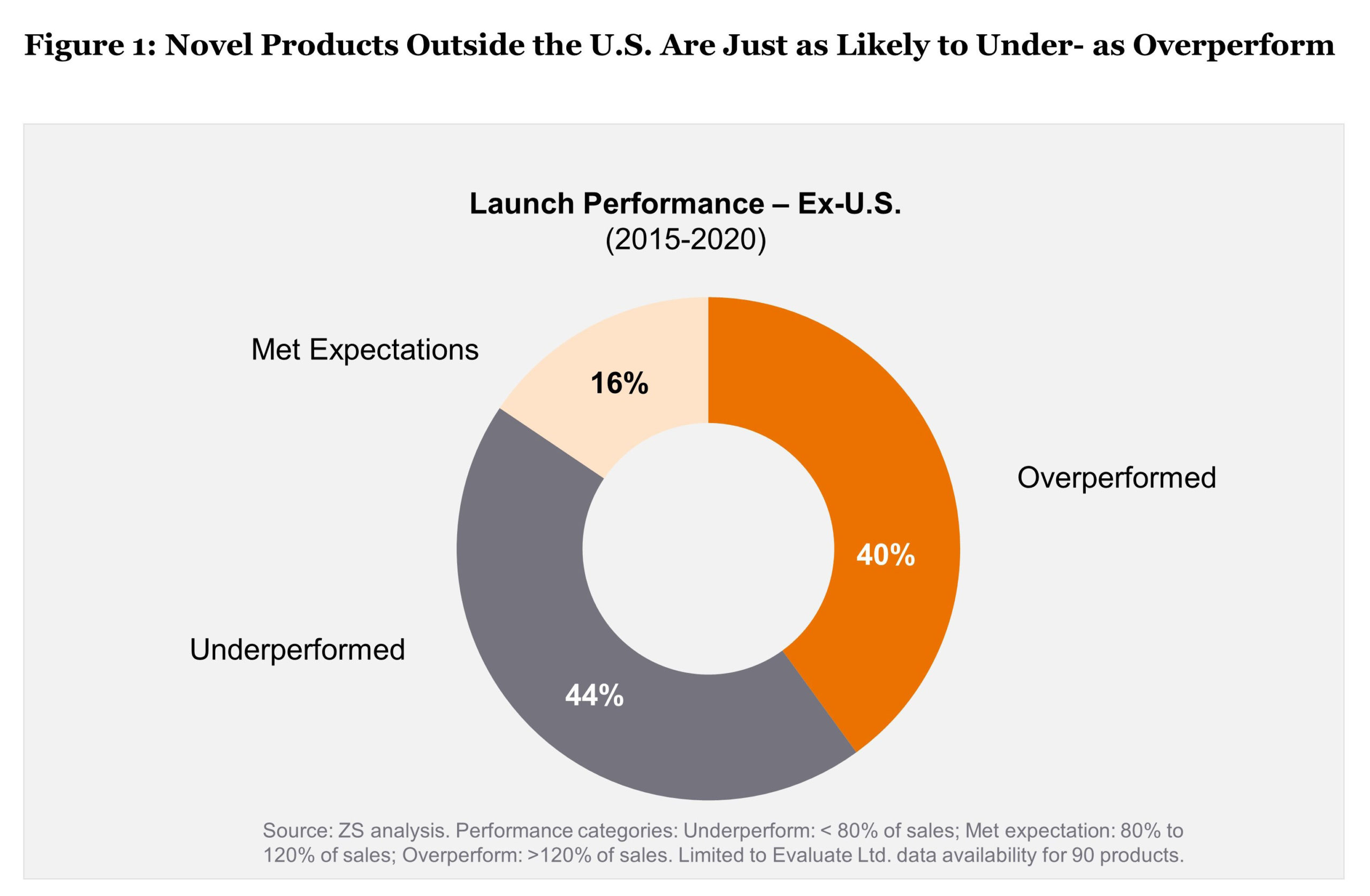

Under these conditions, a lot of ex-U.S. launches are still failing to meet expectations. ZS’ research tracking launches from 2015-2020 shows that novel product launches are just as likely to underperform as overperform (see Figure 1).

The pandemic added to launch complexity, and in the 2019 to 2021 time frame, ZS analysis shows that 53% of the 149 U.S. launches underperformed analyst expectations across organizations, therapeutic categories, and asset types.

The pandemic added to launch complexity, and in the 2019 to 2021 time frame, ZS analysis shows that 53% of the 149 U.S. launches underperformed analyst expectations across organizations, therapeutic categories, and asset types.

What You Can Do for More Successful Global Launches

Start by taking more varied approaches to launches, as success lies in building a portfolio that enables you to succeed in your chosen markets driven by a customer-led strategy and delivered with targeted approaches by asset. Four recommendations to drive success in scaling a global launch are:

Define priorities and outcomes with geographic specificity. It may sound simple, but the objectives of a given launch can and should range in different areas, yet the global growth objective often overshadows the need for local priorities. Tailor your approach along these three principles:

- Prioritize commercial impact markets and resource them well. Focus the most resources and attention on the main markets that will drive approximately 75% of the business (for example, North America, Europe, or Japan). Ensure you have a deep understanding of the local market context and customers, including how to tailor your value proposition and customer engagement model to realize value.

- Emerging markets have experienced the fastest growth over the past decade, but opportunities range significantly across them. Scaling globally means balancing the global, regional, and local model to maximize reach and profit. To find this balance, consider your organization’s longer-term vision and strategic priorities along with existing infrastructure as you determine where to scale.

- Expand global access with creative partnerships to maximize reach in lower- and middle-income countries. For example, Pfizer recently announced a plan to provide all current and future patent-protected medicines and vaccines available in the U.S. or EU on a not-for-profit basis to 45 lower-income countries.6

Focus on fewer markets to increase value. Focusing on fewer markets can result in both higher assertion of value toward outcomes of a health category as well as cost synergies per dollar earned. In a 2021 ZS analysis, companies with average or better focus—meaning more than 66% of their revenues were in three therapeutic categories—saw a significant payoff relative to peers. Over 10 years, they grew at 7% versus 0.2% annualized rate and added about 50% more to their market cap.

Build a solid foundation with localized insights to guide global decisions. One of the main drivers of failing to scale a global launch is a lack of market understanding to define the realistic opportunity and cross-functional strategy. This begins with clinical data and outcomes needs, extends to your health economics and outcomes research and real-world evidence strategies, and of course, includes your commercial approach.

An often-cited example of a failure to understand the market is bluebird bio, Inc.’s recent launch of Zynteglio, which ended in the company’s withdrawal from Europe after failing to reach a price agreement with the German authorities.7 While bluebird bio cited challenges in getting the European healthcare system to recognize the value of its innovative therapies, the success of Novartis launching Zolgensma in Europe shows success is possible. However, in Novartis’ case the company benefited from more political energy towards finding solutions in pediatric categories with strong patient advocacy.

To prepare for your own launch, invest early in analytics and do not compromise on building a strong foundation of customer insight to define your opportunity. Build advanced analytic capabilities to support the insights you’ll need to address issues that arise so you can maneuver quickly when needed. Post-COVID-19, agility has been particularly important across specialties as we continue to see variation in access and experience. Many companies are finding that the time to peak is shorter, and every moment counts.

Use archetypes to launch and scale. Launch archetypes are tools you use to communicate in advance what your strategic priorities are, how those priorities translate to what you are trying to achieve in each market, and what levers you expect the company to lean on to achieve your goals. Using this type of tool can help you assess your organization’s abilities based on geographic expertise and resources you’ll need to define the optimal go-to-market model.

As you plan launches, especially those that challenge biopharma’s legacy approach, be honest with yourself about what it takes to be successful. Too often, the default is to build every solution in-house, but the expectation for partnership and coordination in areas along the patient journey is higher than ever. Ask: Is this component truly a competitive advantage? Am I making the customer’s life easier?

The Payoff Is Real

When it comes to scaling biopharma launches, the world feels bigger—and smaller—with global ambitions that need localized approaches. Success is increasingly about building the right global strategy with precision insight, execution, and flexibility locally. It is recognizing one-size-does-not-fit-all, especially as smaller products enter your portfolio. And while more than half of recent launches have underperformed between 2019 and 2021, the flip side is about 40% of launches exceeded analyst expectations. The possibility of success still exists and is in reach if you rethink your launch approach.

References:

1. ZS analysis for blockbuster products for last 10 years, May 2022.

2. https://www.zs.com/insights/state-of-healthcare-ai-survey-2022.

3. https://pharmaphorum.com/news/drugmakers-pledge-shorter-launch-times-for-drugs-in-eu.