When it comes to conducting benefits investigations, initiating prior authorizations, and accomplishing other patient services tasks, much of the work falls to medical office staff whose job is to help patients get on and stay on therapy. This article reports on recent specialty-specific research designed to explore staff goals, challenges, pain points, and most valued hub services. The results may be surprising!

We know time-pressed doctors are growing increasingly frustrated with non-clinical activities that crowd their schedules and steal attention from patients. Medical Economics, in its latest annual survey of top challenges, reported that the No. 1 issue “ruining medicine for physicians” is paperwork and administrative burdens.1 These non-clinical tasks have grown to the point that some are calling for medical practices to hire specialists solely dedicated to managing insurance processes and updates in laws and regulations.2 This notion appears to be taking hold. A 2019 AMA survey reported that 36% of respondents had at least one staff member “whose sole purpose was to work on prior authorizations.3”

The medical office staffers who manage these administrative challenges to help patients get and stay on therapy are, in many ways, the superstars of access and adherence. It is their tireless effort that opens the door to cost-effective and continued therapy. Yet as important as these professionals are, little is known about how they interact with patient support programs, including hub services.

In an effort to gain a fresh understanding of staff-to-hub interaction, ConnectiveRx recently conducted an online self-administered survey of 284 medical office staff members who use or may need to use hub services (e.g., medical practice managers, billing managers, medical assistants, etc.). Respondents represented practices from a variety of clinical specialties that tend to use complex patient- or physician-administered specialty products: Endocrinology (30%), Orthopedics (31%), Rheumatology (30%), Neurology (30%), Ophthalmology (25%), Dermatology (33%), Urology (30)%, Gastroenterology/Hepatology (35%), and Oncology/Hematology Oncology (40%). The objective was to better understand these individuals’ goals, challenges, pain points, and most valued hub services.

Summary of Overall Findings

Importantly, only about half of the respondents report that their practice uses hubs. Hub use ranged from 77% in Neurology practices to 33% in Urology. Of hub users, nearly 75% report engaging with an average of at least two hubs per month, and 65% of practices currently using hubs report multiple users within the practice. Only about one-third of hub users report their practice has guidelines regarding hub use. The majority of respondents indicate that they individually make the decisions regarding whether to use hubs and which ones to use.

Current hub users report high overall satisfaction with the hub used most often (7.4 of 10), and a majority are happy for the hub’s support and agree with its role in helping patients get on therapy. Ease of use and convenience is important to users so that the services adapt easily to office workflow. Users perceive hubs as much more valuable than do non-users, suggesting that brands looking to launch or expand adoption of their hubs need to educate office practices about the benefits of using hubs.

Most Valuable Hub Services

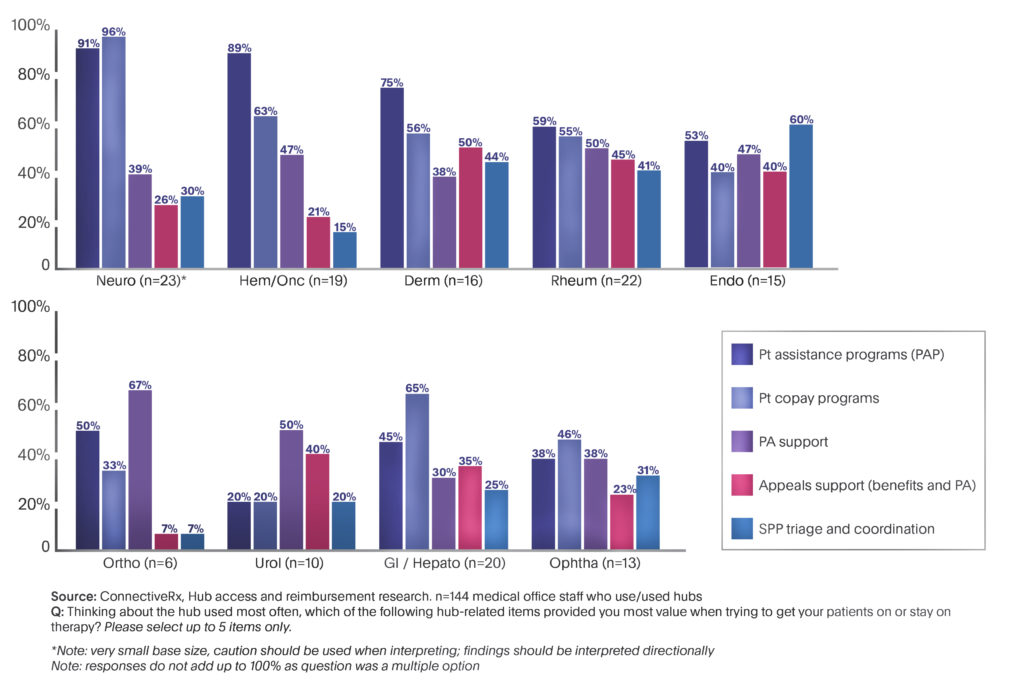

Almost all respondents think about hubs in terms of how well they help patients. The services reported as most valuable are patient assistance programs (PAPs), copay programs, and prior authorization (PA) support (Figure 1). When asked what hub services would lead to increased use of hubs, the most frequent responses were electronic PA processes, accurate and timely benefits information, and easy access to hub representatives. And here’s a shock: Users dislike long response times or hubs that are too complicated or tedious to use.

For non-users, four “wants” top the priority list: PA support, electronic PA, copay programs, and PAPs—all of which are usually part of hub services. Again, lack of awareness may be one obstacle to greater adoption of hubs.

For non-users, four “wants” top the priority list: PA support, electronic PA, copay programs, and PAPs—all of which are usually part of hub services. Again, lack of awareness may be one obstacle to greater adoption of hubs.

Taken together, these data suggest that brands should not expect practices to beat a path to their door. Indeed, brand teams need to re-examine both their patient services strategy and how to raise awareness of patient services with practices.

Specialty-specific Findings

A deeper dive reveals interesting distinctions between specialties. For instance, respondents from certain specialties—specifically Neurology and Rheumatology—have widespread familiarity and experience with hubs. Other respondents, such as those from Urology and Orthopedics, have had much less exposure. In fact, nearly 40% of Urology and Orthopedics respondents have never even heard of hubs.

Moreover, respondents from each specialty place high value on their own unique cluster of hub features. For instance, in Neurology practices, copay programs and PAPs have dramatically outsized importance. Conversely, in Endocrinology, the top-rated hub service is special pharmacy triage and coordination.

Bottom Line

- Even in specialty practices, where hub use might have been expected to be nearly universal, only about half of the respondents report that their practice uses hubs.

- Services reported as most valuable in getting patients on or to stay on therapy are PAPs, copay programs, and PA support.

- Respondents from each specialty place high value on their own unique cluster of hub features—so knowing those in advance can help brands design their communication program to engage practices.

As you might expect, this review just touches the surface of the survey results. For more detail on your specialty of interest, please contact me.

References:

1. Medical Economics Staff. “What’s Ruining Medicine for Physicians: Paperwork and Administrative Burden.” Medical Economics. https://www.medicaleconomics.com/business/whats-ruining-medicine-physicians-paperwork-and-administrative-burdens. Accessed June 21, 2019.

2. Dougherty, P. “Six Ways to Effectively Manage Prior Authorization at Medical Practice.” M-Scribe Medical Billing. https://www.m-scribe.com/blog/six-ways-to-effectively-manage-pre-authorizations-at-medical-practice. Accessed June 21, 2019.

3. Healio Primary Care. “AMA: Prior Authorization Hurdles Cause Negative Health Outcomes.” Healio. https://www.healio.com/family-medicine/practice-management/news/online/%7B6862c87d-122d-488d-abf6-d2188b0bd974%7D/ama-prior-authorization-hurdles-cause-negative-health-outcomes. Accessed June 21, 2019.