The year 2014 marked the best year ever for drugs approved for rare diseases. This is so important that we believe it could be a strong indicator of a market shifting focus away from established therapeutic franchises toward development of specialized drugs for niche indications that maximize pricing power and return on investment. Two orphan drugs that have substantial commercial promise include BMS’ Opdivo (nivolumab), and Merck’s Keytruda (pembrolizumab). Both are approved for treating advanced melanoma—the fifth most common type of cancer in the U.S.—which represents a significant unmet medical need. In fact, Opdivo is the seventh and latest melanoma drug approved by the FDA since 2011 due to pioneering scientific research into how PD-1 inhibitors are increasing our understanding of tumor cell immunology.

A disease is defined as rare if it affects fewer than 200,000 Americans, according to the National Organization for Rare Disorders (NORD). So far, approximately 6,800 rare diseases have been defined, which affect nearly 30 million people in the U.S. alone. In the past, Big Pharma ignored this segment of the market, and instead focused on large patient populations in established therapeutic areas such as cardiovascular diseases and diabetes. But now, developing orphan drugs to treat rare diseases is an industry priority.

Orphan Drugs Become The Priority

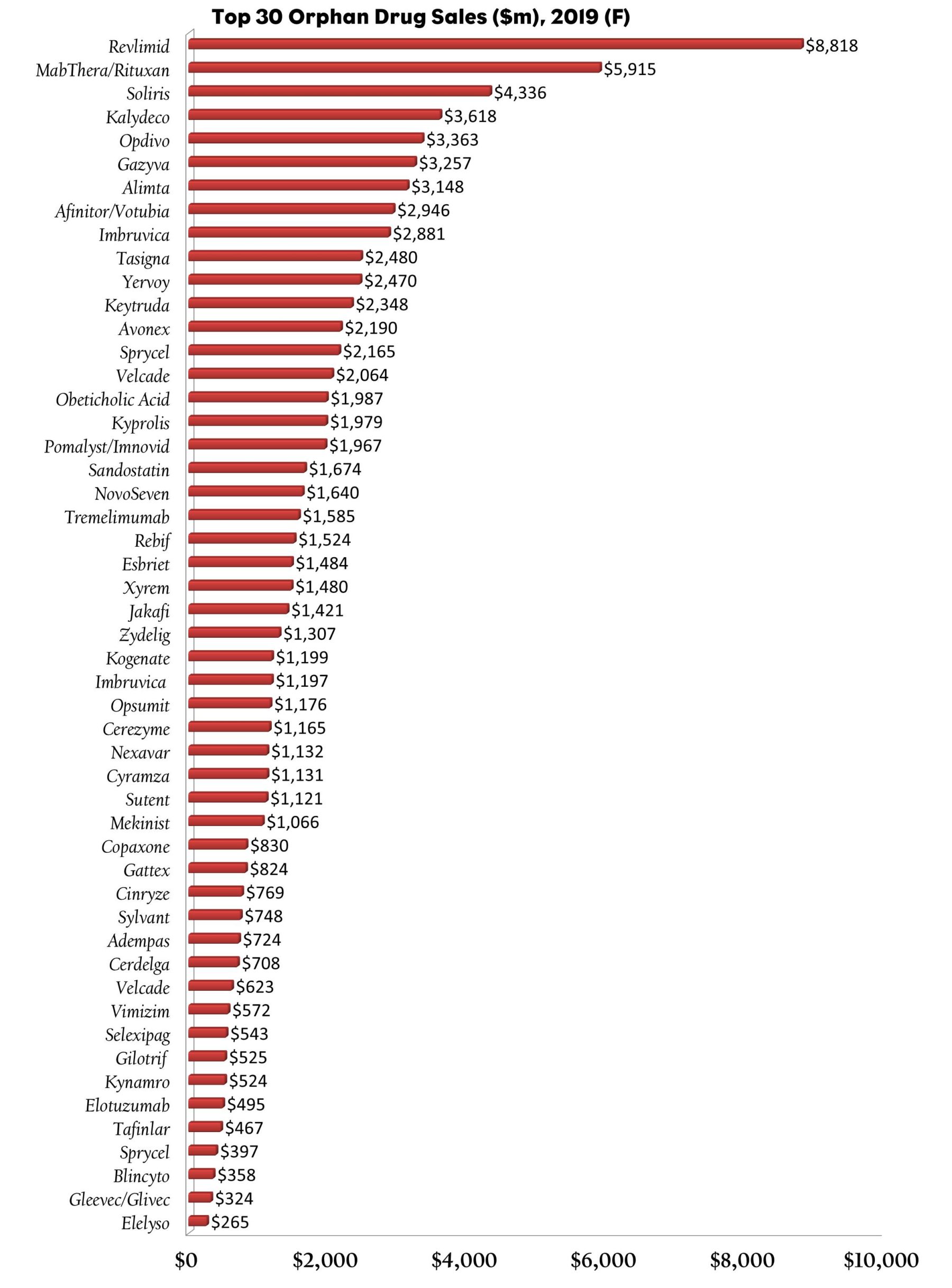

Seventeen of the 41 NMEs approved by the FDA in 2014 were orphan drugs—and Big Pharma is now responsible for over half of the top 50 orphan drugs currently on the market. Some drug makers such as Novartis and Celgene have well-established portfolios and can develop orphan drugs internally. Others, like Shire, choose to secure orphan drug assets through acquisition. Shire’s $4.2 billion acquisition of ViroPharma and its hereditary angioedema therapy Cinryze (C1 esterase inhibitor), and its recent $5.2 billion purchase of NPS Pharmaceuticals, which gave the company the rights to orphan drugs Gattex (teduglutide), which was approved for short bowel syndrome, and Natpara (recombinant parathyroid hormone), which was approved by the FDA in January to control hypocalcemia (low blood calcium levels) in patients with hypoparathyroidism, exemplifies this.

The need for product pipeline replenishment, quicker access to commercialization revenues, and attractive selling prices may partly explain this new-found infatuation with orphan drugs. Developers of orphan drugs generally see significant return on investment due to lower clinical trial costs, particularly in Phase III, where patient recruitment is much smaller, and approval times are usually faster because orphans tend to receive Priority Review from the FDA. This, combined with a minimum of seven years of marketing exclusivity in the U.S. (10 years in the EU) from date of approval, tax credits and grants for conducting clinical trials, and a waiver of user fees, developing orphan drugs not only makes strategic sense, but also financial sense.

Payers Face Sticker Shock

However appealing and lucrative the rare disease sector may now appear to be, it is certainly not without its own set of complications. One of the concerns is the industry’s pricing structure for orphan drugs. Some orphan drug prices have recently reached new unprecedented levels and orphan drug affordability has become a significant issue for payers, particularly as governments around the world see their healthcare costs explode.

Amgen came under fire when it announced in December 2014 that its new acute lymphoblastic leukemia (ALL) drug, Blincyto (blinatumomab) will cost $178,000 per year, the top price for a cancer treatment, surpassing Merck’s Keytruda (another immunotherapy), which is priced at $150,000 per year. However, unlike Keytruda and Opdivo, Blincyto is directed at a disease that affects only a small number of patients, half of them being children. Nearly 6,000 people in the U.S. will be diagnosed with ALL in 2015, and as a second-line treatment, Amgen’s drug will be indicated for only about 1,000 them. This situation is now starting to raise some very tough questions about whether orphan drug prices are justifiable or even sustainable over the long term.