Most European countries have experienced more than one wave of COVID-19 infections. Lockdown and social distancing measures implemented to control the infection rates have resulted in a significant contraction in European economies. It is expected that several months or even years will be required for economies to regain their pre-pandemic levels.

COVID-19 vaccines have emerged as a key tool against the pandemic with several candidates achieving emergency or conditional approval. The focus on quickly developing COVID-19 vaccines has meant that countries and supranational bodies have made substantial investments in funding manufacturers to develop candidates in an accelerated manner, as well as in striking advance purchase agreements and procuring supply when available. For example, in the UK alone, the cost of five such procurement deals, for up to 267 million doses, was expected to be £2.9bn.

When factoring in other costs such as sponsoring research and development, distribution, and administration, the total spend has been estimated at £11.7bn.1 Similarly, at the end of 2020, the EU approved a €6.2bn addition to the year’s budget, €1.1bn of which was earmarked for vaccines, in order to address the impact of the pandemic.2

Considering the UK spent £397m on vaccine procurement in 2018/2019, and that similar levels of COVID-related vaccine expenditure inflation are common across the globe, questions around the long-term impact on healthcare budgets are being raised.3 In January 2021, CRA conducted a survey with 20 payers from France, Germany, Italy, Spain, and the UK. In this article, we explore their expectations around the pandemic’s impact on healthcare budgets and measures likely to be taken to close the funding gap.

Impact of COVID-19 on Future Healthcare Funding

In the short term, most payers did not anticipate COVID-19 would have a significant negative impact on pharmaceutical and vaccine reimbursement, as healthcare budgets have been bolstered by additional funding from governments willing to grow deficits to address the crisis. However, as economies emerge from the pandemic and governments look to ensure the long-term health of public finances, payers expect substantial pressure to curb expenditure.

In parallel with the pandemic, we have seen several changes or announcements of planned changes to value assessments across Europe, with health technology assessment (HTA) methodologies evolving towards an ever-greater balance of assessing both the clinical and economic merits of an intervention. For example, March’s Accord Cadre publication in France saw pricing in the country move toward a more formulaic approach with a greater focus on budget impact and cost effectiveness. Similar changes have occurred or are expected across Europe. While these changes do not come as a surprise—debates over shifting HTA towards a more cost-focused methodology long pre-date the pandemic—the extent to which the pandemic likely has accelerated their adoption is notable.

Limitations in healthcare budgets following the pandemic are expected to be exacerbated as the costs of COVID-19 vaccines, currently predominantly covered by ringfenced emergency funds, roll into general vaccine or preventative budgets. Assuming COVID-19 becomes an endemic virus, payers expected that vaccine funding and procurement would slowly be decentralized and incorporated into general vaccine schedules alongside other routine immunizations such as influenza. While most payers were bullish over the prospect of vaccine/preventative budgets being increased in the short term to cover the inclusion of COVID-19 vaccines in routine schedules, they acknowledged this may not be sustainable in a post-pandemic environment. As such, payers expect to face large funding gaps, particularly at the sub-national level, as budgets are squeezed in order to pay down deficits, while expenditure is increased by their new responsibility for COVID-19 vaccine procurement.

Solutions to Address Budget Challenges of COVID-19

In order to address the funding gap left by COVID-19, payers expect to look for savings elsewhere. As seen long before the pandemic, limiting or reducing pharmaceutical expenditure is perceived as the obvious opportunity for savings, given the relative ease with which this can be achieved compared with adjusting other components of healthcare budgets.

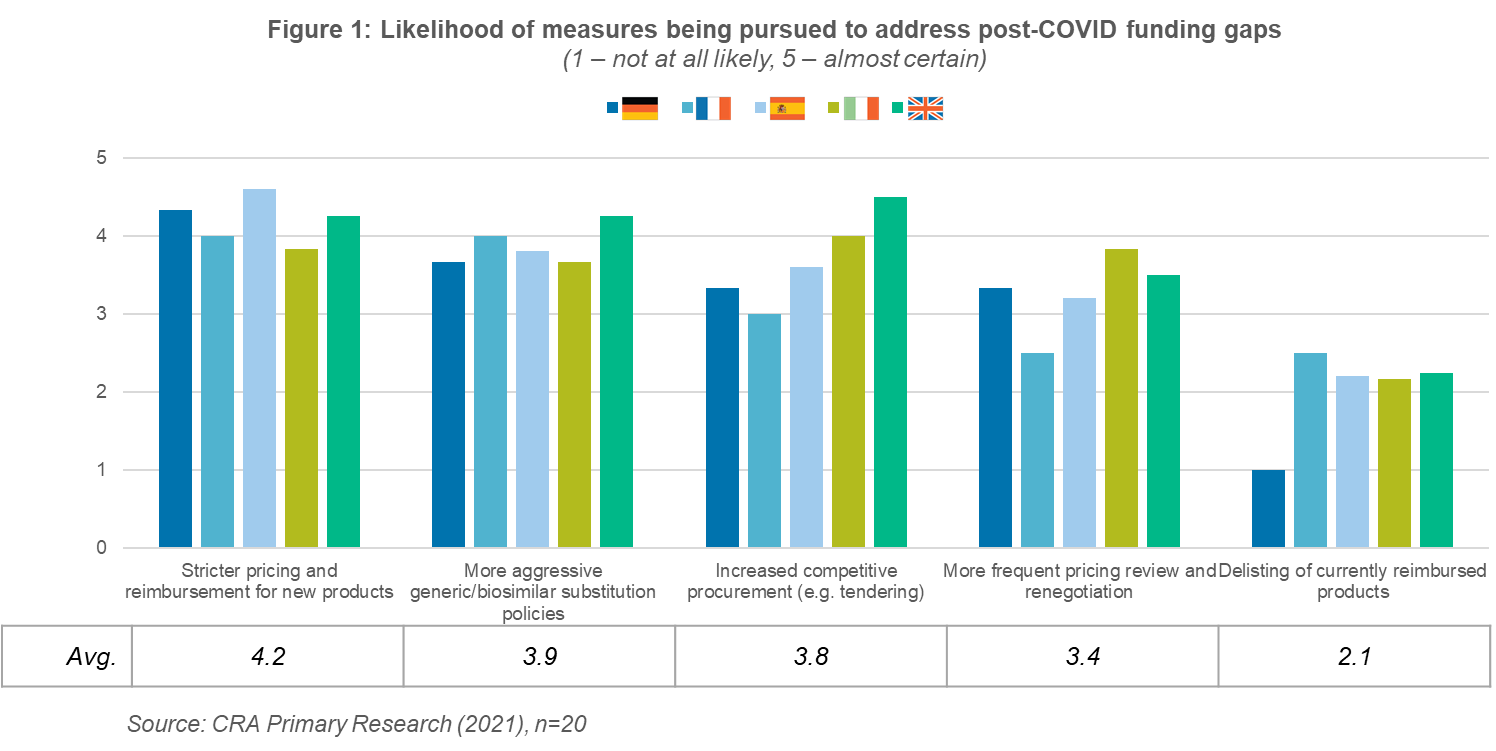

Post-pandemic budget pressure is expected to fall disproportionately on new launches, with payers across almost all markets seeing stricter pricing and reimbursement for new products as the most likely measure taken to limit expenditure (Figure 1). However, existing products are also expected to be squeezed with payers anticipating they will more aggressively promote generic/biosimilar substitution, as well as attempting to stimulate additional price competition via procurement.

While these measures will almost certainly place pressures on industry, they do not sharply deviate from ongoing pre-COVID-19 trends. More extreme options, such as delisting reimbursed products, are seen as relatively unlikely. As such, payers generally believe that they will return to “business as usual”—albeit with somewhat more aggressive cost controls—once we exit the pandemic. However, it remains to be seen how payers will react if faced with unprecedented budgetary pressure, perhaps options currently seen as extreme may begin to look more attractive.

While these measures will almost certainly place pressures on industry, they do not sharply deviate from ongoing pre-COVID-19 trends. More extreme options, such as delisting reimbursed products, are seen as relatively unlikely. As such, payers generally believe that they will return to “business as usual”—albeit with somewhat more aggressive cost controls—once we exit the pandemic. However, it remains to be seen how payers will react if faced with unprecedented budgetary pressure, perhaps options currently seen as extreme may begin to look more attractive.

Role of Managed Entry Agreements

In the post-pandemic and expenditure-restricted world, payers and industry will need to collaborate on managed entry agreements to ensure patients continue to receive the care they need, while also protecting healthcare budgets and business models.

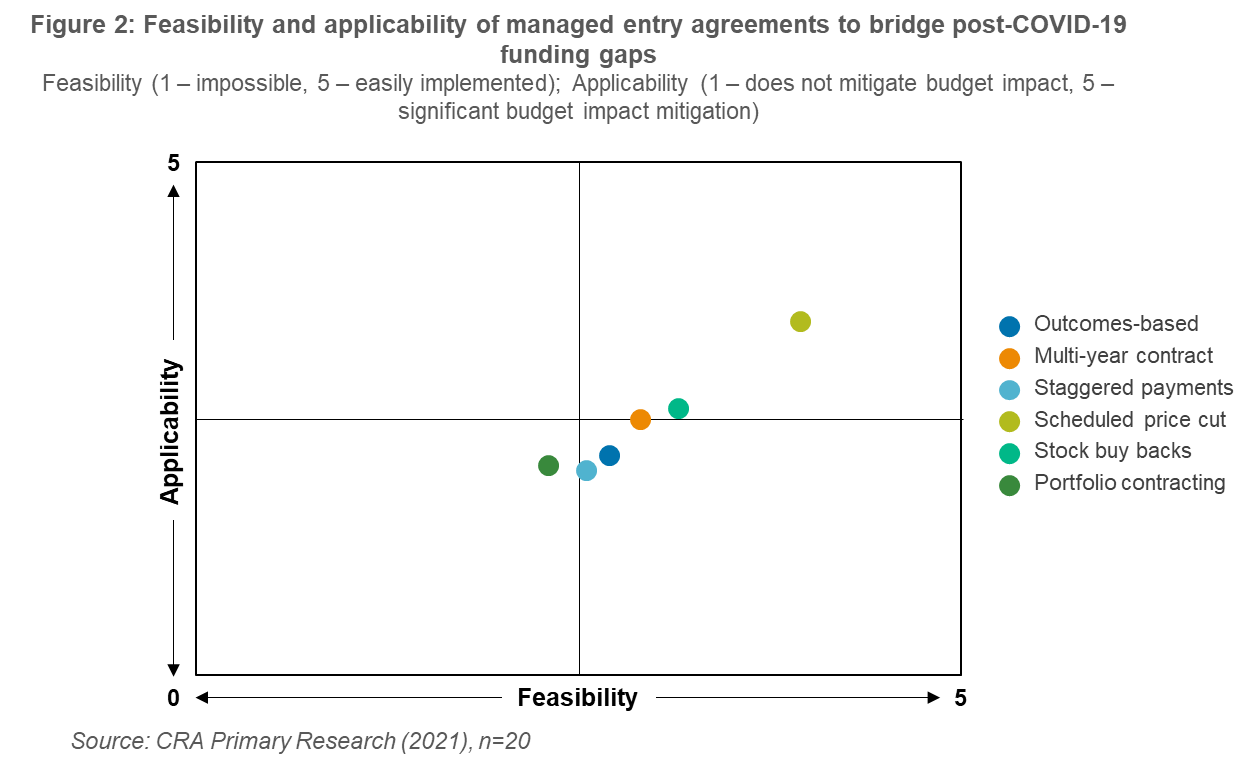

Most of the managed entry agreements tested with payers were seen as modest solutions which were neither clearly achievable nor effective. The most promising solution, as identified by payers, were scheduled price cuts in which healthcare systems can reliably expect to bridge some of the post-COVID funding gaps (Figure 2).

Overall, outside of Italy—an innovator in terms of managed entry agreements—payers were generally pessimistic over the feasibility and applicability of alternative solutions to mitigating the budget impact of COVID-19 vaccines. Most favored relying on simple net discount focused approaches to reducing expenditure, meaning manufacturers will need to assemble compelling cases on why collaborating on alternative solutions can create value for all involved. This has traditionally been a difficult case to sell to payers; however, the widespread disruption COVID-19 has brought, and will continue to bring, to healthcare systems may also foster a necessity for innovation in procurement and funding.

Overall, outside of Italy—an innovator in terms of managed entry agreements—payers were generally pessimistic over the feasibility and applicability of alternative solutions to mitigating the budget impact of COVID-19 vaccines. Most favored relying on simple net discount focused approaches to reducing expenditure, meaning manufacturers will need to assemble compelling cases on why collaborating on alternative solutions can create value for all involved. This has traditionally been a difficult case to sell to payers; however, the widespread disruption COVID-19 has brought, and will continue to bring, to healthcare systems may also foster a necessity for innovation in procurement and funding.

Conclusions

Overall EU4 and UK payers expect pharmaceutical budgets to come under increasing pressure due to the COVID-19 pandemic. Macro-level contraction of economies, coupled with slowly transitioning COVID-19 vaccination into routine funding, will likely mean that payers will need to find savings. In the short term, payers are likely to increase the scrutiny of pricing and reimbursement for new launches. Additionally, they will look to make savings by increasing the use of generics and biosimilars, as well as using competitive procurement approaches. In terms of managed entry agreements, payers are likely to prefer simple financial agreements such as scheduled price cuts versus more innovative outcomes-based approaches.

In recent years, we have seen countries begin to develop more innovative payment models in response to the challenges posed by gene therapies. These payment models, implemented even in historically conservative healthcare systems, were driven by necessity to fund these expensive new therapies. Despite payers’ stated reluctance to pursue more than simple discounts for COVID-19 vaccines, the scale of the challenge may well create the motivation required to develop new models of reimbursement.

The views expressed herein are the authors’ and not those of Charles River Associates (CRA) or any of the organizations with which the authors are affiliated.

References:

1. https://www.nao.org.uk/press-release/investigation-into-preparations-for-potential-covid-19-vaccines.