Specialty drugs* have become the growth engine in the pharmaceutical industry worldwide. In the U.S. alone, spending on specialty medicines has nearly doubled in the past five years.1 Moreover, specialty drugs accounted for approximately half of the total new drugs and biologics approved by the FDA in 2015.2 This growth trend is likely to continue, driven by new medicines for autoimmune diseases, hepatitis C, oncology, and rare diseases.

Against this backdrop, many traditional big pharma companies are creating specialty divisions and a growing number of smaller companies are solely focused on specialty products. As interest in these products grows, it presents marketers with new opportunities. To help marketers take advantage of these opportunities, we take a closer look at the appeal of specialty drugs in today’s healthcare landscape as well as some mission critical marketing requirements for success under this model. We also present some key considerations for marketers who are thinking about making the switch from big pharma to specialty pharma.

What’s Behind the Rise in Specialty Pharma?

Laws and regulations that incentivize the production of specialty drugs have been in place for more than 30 years. However, only over the past decade or so have pharma companies really begun shifting away from developing blanket treatments for the largest patient populations. Today, pharma manufacturers—both large and small—are progressively tailoring their pipelines to specialty medicines targeted for niche markets with significant unmet needs. The sudden rise of specialty drugs can be partially attributed to several major shifts in the dynamics of the pharmaceutical industry.

Big pharma’s fascination with more traditional small molecule medicines, especially primary care drugs, continues to decline, due in large part to relentless commoditization. Patent cliffs and intense generic competition have resulted in significant erosion of market share for many name-brand products. Such commoditization has also given payers greater control over drug prices in primary care therapeutic classes where close substitutes and potential generics are available. Taken together, manufacturers operating in this space are no longer achieving the returns they once were.

In light of these changes, manufacturers are turning their attention to specialty drugs that offer greater potential for substantial financial return. By targeting niche disorders, manufacturers can often establish a foothold by being first to market, thereby avoiding access and pricing pressures associated with commoditization. Also, by focusing on targeted patient populations, companies can get their products to market much more quickly. Clinical studies can be smaller and more streamlined. In addition, niche products have the potential to receive orphan drug designation, which includes such benefits as a faster approval process and extended patent life.

Specialty drug development and commercialization is also being driven by the industry’s shift toward personalized medicine, combined with pressure to demonstrate better outcomes for targeted patient populations. Breakthroughs in genomics and improvements in genetic testing have created a deeper understanding of the underlying biology for complex, chronic, and/or rare conditions. These advancements together with technological innovation have enabled the development of more targeted medicines.

As specialty drugs gain more attention and focus, marketers looking to move to this sector need to understand how they can create success for these products.

Marketing Requirements for Specialty Pharma

Marketing challenges continue to grow across the entire pharmaceutical industry as manufacturers are increasingly asked to do more with less. Marketers are expected to accelerate sales in spite of shrinking exclusivity, and improve margins in the face of growing price sensitivity. In addition, they’re expected to grow market share with limited product differentiation and restricted physician access.

Given the limited target population for most specialty products as well as the high-cost structure often associated with their development, an even smaller margin for error exists for marketers in specialty pharma. To achieve marketing excellence in this space, marketers must take a sophisticated approach to targeting and segmentation as well as ensure development of a strong economic and clinical value message tailored to different stakeholders.

1. Effective Segmentation and Targeting

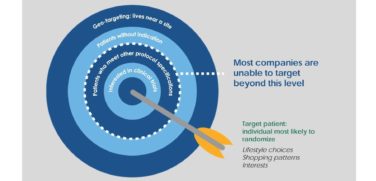

Driving product adoption in a fragmented environment with multiple interrelated stakeholders requires an effective segmentation strategy. Without the resources to go after the mass market, specialty pharmaceutical companies typically operate under a much leaner commercial model. For these organizations, directing resources to the right market segments in the marketplace is critical. In turn, questions of who to go after and the rationale for doing so become that much more important.

As part of an effective segmentation and targeting approach, marketers will first need to clearly define who the key customers are and determine the best method(s) to reach them. To segment specialty markets, marketers must consider more than just their customers’ behaviors, but also their unmet needs and the types of data that will influence them. They will also require a clear understanding of the patient and how they seek treatment. Since some specialty drugs address the needs of smaller populations, some physicians might see as few as one patient per year—or even less. In these cases, a traditional sales approach will not be effective. However, by understanding the patient pathway across the continuum, including clinician recognition and the diagnosis process, marketers will be able to determine the best approach for reaching them.

2. Compelling Economic and Clinical Value Story

Historically, manufacturers of specialty products have relied on their first-to-market status to justify premium pricing and unrestricted market access. However, specialty drugs are now outpacing traditional pharmaceuticals at an alarming rate and addressing larger patient populations. In response to the rising total costs and utilization of specialty drugs, these products have come under greater scrutiny from providers and payers, and market access and product adoption are no longer a guarantee.

In order to be successful, these manufacturers will need to be able to make specific economic and clinical value claims that resonate with different stakeholder groups. This will require that they develop the data to back those claims up. In parallel to targeting and segmentation, value propositions will need to be customer centric. This means that organizations will need to focus on specific outcomes that matter to key stakeholders across the continuum of care and provide the economic and clinical evidence to support them.

Specialty pharma represents an exciting alternative to the conventional pharmaceutical business model, and interest in this space shows no signs of slowing down. The inherent risks of operating in smaller markets makes commercial success—both at an organizational and individual level—that much more critical in specialty pharma. This creates significant opportunity for marketers looking to make the transition to specialty pharma from big pharma, particularly those who understand what it will take to succeed under this model and who can execute accordingly.

Footnotes:

*While the term “specialty drug” does not have a standard definition, for the purposes of this article we are referring to prescription drugs—often complex, large molecule biologics—that have limited distribution and target a narrow group of rare and/or chronic diseases.

1. IMS Health. “IMS Health Study: U.S. Drug Spending Growth Reaches 8.5 Percent in 2015.”

2. Diplomat Pharmacy, Inc. “Diplomat Publishes New Report on Specialty Drugs Approved in 2015 and Expected for 2016.” http://www.prnewswire.com/news-releases/diplomat-publishes-new-report-on-specialty-drugs-approved-in-2015-and-expected-for-2016-300200604.html.

Sidebar: Thinking of Switching to Specialty Pharma?

Specialty pharma presents enormous career opportunities for marketers. This includes individuals who are looking to move into a specialty division within a big company as well as those marketers looking to make the switch from big pharma to a much smaller company. However, marketers, particularly those in the latter case, must realize that this transition represents more than just a simple career change. Specialty pharma is often a different cultural environment—one that marketers must be prepared for. Those that understand the differences and can identify the opportunities that exist will be best positioned to not only adapt, but thrive.

1. Resource Limitations

The amount of resources afforded to you will likely be more limited than what you’re accustomed to. Due to smaller operating budgets, specialty companies or divisions have to allocate fewer resources with greater precision. In turn, you should expect greater cross-functional planning and might need to be creative with existing resources.

2. Expanded Scope of Responsibility

In big pharma, tasks can be delegated among many people and the job you were hired to do is likely clearly defined and very focused. However, in a smaller company or division, you’ll likely have to wear more hats and carry a wider range of responsibilities (e.g., engaging with a broader range of stakeholders). Those willing to accept and embrace greater responsibilities will be best positioned for a smooth transition.

3. Fewer Layers

Smaller specialty companies often don’t have the same level of infrastructure as larger pharma manufacturers. This can enable quicker decisions and provide marketers with ample opportunities to bring fresh ideas forward. However, this can also be a challenge for individuals who prefer more formalized structure and clearly defined roles. For big pharma companies with specialty divisions, this may or may not apply and will likely depend on the extent to which these specialty divisions are integrated across the rest of the organization.

4. Greater Scrutiny from Stakeholders

While some specialty products continue to fly under the radar, many others are drawing significant attention from key stakeholders due to their price and specific therapeutic area. Given the importance of every sale, marketers will need to anticipate and prepare for increased scrutiny and have a plan to address it.