Let’s start by stepping back to the beginning of this decade. In 2010, we started to see some big changes in the pharmaceutical and related industries. The blockbuster model seemed broken, sales forces were being reduced, and rep access to healthcare professionals was declining. The overall DTC budget was below $4B and very little was being allocated to digital channels. At the same time, a big digital revolution started to emerge as Facebook and Twitter, in particular, were growing fast. In mid-2010, Facebook had soared to more than 500 million users and the traffic volume on Twitter was dizzying.

Some industries had already capitalized on this new ecosystem. Starbucks and Coca Cola both had attracted huge Facebook fan bases of more than 20 million followers each. However, pharma was virtually non-existent in the digital ecosystem except for carefully curated corporate and brand websites. We are a highly regulated and naturally conservative industry. Social media was moving way too fast to keep up. The perceived regulatory risks and reporting burdens were considered too high and the FDA had not given any guidance.

Fast forward a few years and Facebook has now grown to more than 1.4B people worldwide. Twitter’s growth was proportionately similar, at least until recently. Other incumbents like Google+ came and went, and some exploded, such as Snapchat and Instagram. These social networks and messenger apps like WhatsApp and Messenger have enabled the new normal way of digital communication—online on our smartphones. In the U.S., every second person is active on at least one of these networks or apps. The Internet and all its digital channels are readily available in our hands at all times.

Healthcare Consumers’ Online Activity

The social networks and the rapid growth of the Internet of Things have transformed the access to information and the ability to connect with other people online. Before all of this happened consumers (patients, caregivers, etc.), had fewer online resources available (e.g., disease forums), however these were—and often still are—poor user experiences with only small numbers of users.

In 2014, Google reported that there were 27 billion health-related searches in the U.S. That’s 198 million searches daily. Wow. Health is the No. 1 topic searched on Google. Today, the twin engines of discovery, Search and Social, which both converge and overlap significantly, are our chief source of enquiry, discovery, and discourse.

A random search for “asthma attack” on Google, Facebook, and Twitter at the time of writing this article yielded the following metrics:

Google: 3,330,000 results

Facebook: 87,230 people talking about this

Twitter: Mentioned, on average, every 6 minutes

Consumers are faced with vast amounts of information across a myriad of destinations. Moreover, they have the ability to interact with each other on many of these destinations. Connections can be made in moments, discussions and comments strings begin, and suddenly new relationships and bonds are formed around common themes.

To the extent that these destinations and discussions are public, a tremendous amount of intelligence can be derived from the social and search activities of consumers. The challenge our industry faces when contemplating getting involved in digital is understanding who these consumers are, where are they going, what are they encountering, and what their interactions can tell us. Our objectives are clear: Intercept the right people with credible and authentic information that supports their personal needs. This is a major departure from traditional thinking and customary DTC tactics which have largely been one-way traffic to the consumers of our corporate or branded messaging. Consumers have tuned out and actively ignore this.

What Consumers Want Online

Consumers are looking for information about their disease or that which afflicts their loved ones and people they know. In today’s digital environment, the corporate or branded destinations are often seen as untrustworthy, too biased, and scary with all those warnings and precautions. Rather, consumers will aggregate quickly around educational information that addresses their needs versus branded information. Across all diseases we have scanned at my company, less than 2% of all online discussions mention a brand. When a discussion does involve a brand we eagerly track these threads but they still represent such a low frequency. Conversely, the other 98% of online dialogue address the diagnoses, symptoms, procedures, severities, and the emotions and needs of the disease journey.

In this new digital era, consumers more readily make health decisions based on shared, or perceived shared experiences they discover from others just like them.

However, consumers face the dilemma of which information to use. Of course, almost everyone turns to some of the same big publishers, but these provide only the surface level of information. You can learn what the telltale signs and symptoms may be. You can even find common treatments, etc. But these destinations don’t share the more intimate experiences that consumers have as they move through their disease journey with their loved ones. The opportunity for misinformation, misdiagnosis, and misguided advice is very real. The online ecosystem of information is very fragmented with generally small groupings with little critical mass or direction.

What Pharma Should Be Doing Online

Herein lies a great opportunity for pharma to step in and provide useful thought leadership that consumers will respect, trust, and follow. Providing consumers with disease and awareness hubs from which they can step to brands is a safe and proven opportunity for the industry.

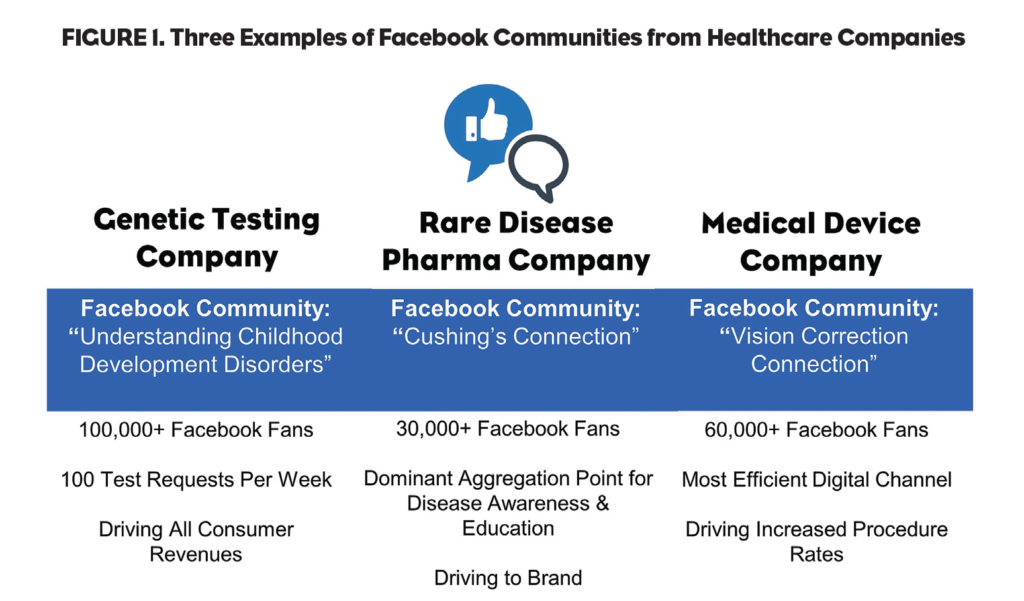

This may seem daunting or out of reach due to Medical, Legal, and Regulatory concerns, but there are now well-established playbooks that allow for safe and compliant digital campaigns. Figure 1 shows three examples of companies which feature a central, unbranded disease awareness and education community. In each of these examples a multichannel, unbranded advertising campaign is used to drive the community and their connections toward actions meaningful to the brands.

The digital landscape has evolved rapidly in the past few years. Consumers have new ways to find and share information. As the space continues to evolve, the burden is on the industry to catch up with the consumer, because they’ve been there a lot longer than us.