Imagine you are a primary care physician (PCP) in a mid-sized Midwestern city. Over half of your patients struggle with chronic diseases that are caused and/or exacerbated by patient behaviors, particularly diet, exercise, stress, smoking, and medication adherence. You do your best to counsel these patients on behavior changes that could mitigate disease progression and symptoms, but behavior change is hard, your time with each patient is limited, and pharmacotherapy only helps so much.

One day, a sales rep from a leading drug company enters your office with a gleam in her eye. “Doctor,” she says, “I have some very exciting news for your asthma patients. We just got FDA clearance for a new treatment for your asthma patients that can reduce ED visits and hospitalizations by over 50% versus standard of care, with effectively zero safety risk or side effects, and at a much lower price than branded drugs.”

“That’s fantastic.” you think. “I have a lot of patients who could benefit. What class of drug is this?”

“Actually, it’s not a drug. It’s a digital therapeutic.”

Uh oh. Things just got a lot more complicated.

Why It’s Harder to Prescribe DTx than a Drug

If this new treatment were a drug, you would know exactly what happens next. Upon FDA approval, the drug would get a unique identifier (an NDC code). Payers would review the drug’s evidence and make coverage and formulary determinations. From there, the drug would appear in Surescripts or other eRx workflow within the EMR, enabled at scale by the NDC code. You could prescribe the drug though this software and know that the script would go to a pharmacy, which will stock the drug, dispense it to a patient, collect a copay, and file a claim with the patient’s PBM, once again enabled at scale by the NDC code. Once you send that prescription, your job would be done until the patient’s next visit.

With a digital therapeutic (DTx), there is no such process or infrastructure, only questions.

- What is a DTx, anyway? And can software really treat a disease?

- How do I know when to prescribe a DTx and which ones to prescribe?

- What does it mean to “prescribe” a DTx? Am I sending a script to a pharmacy, sending my patient to the app store, or following some other process?

- How do I know if a DTx is covered by insurance and what my patient will have to pay?

- Is my office responsible for activating and training the patient? Do I have to monitor the patient between visits? How much time will that take, and is any of that time billable?

- Will patients flood my office with phone calls when they have technical problems with the DTx?

Unlocking the Potential of DTx

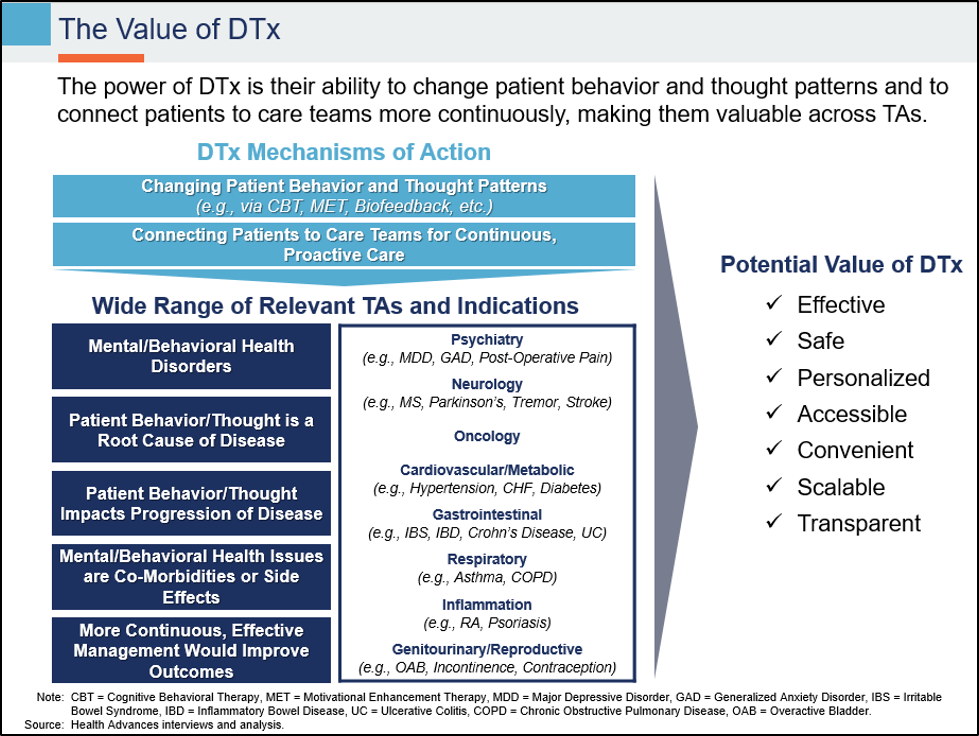

DTx have the potential to become an important and widely used treatment modality. These software-based interventions offer significant advantages over traditional drug and device-based therapies:

But to realize that promise, the DTx industry (including the many leading biopharma companies actively investing in DTx) will need to overcome numerous practical challenges illustrated by our thought experiment.

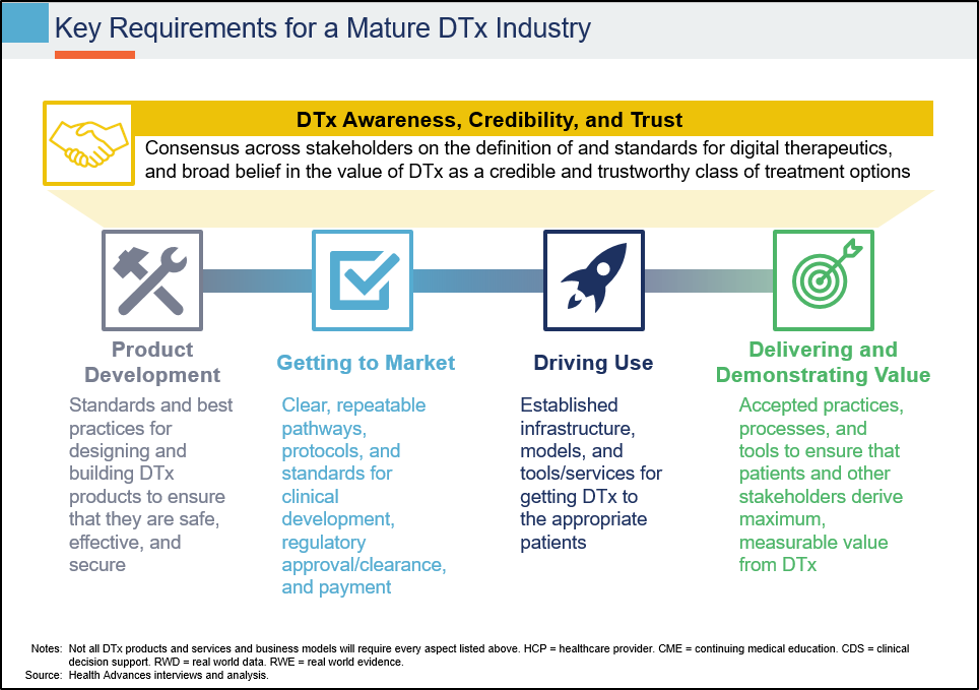

Working closely with the Digital Therapeutics Alliance (DTA), Health Advances recently engaged senior leaders from leading DTx and biopharma companies for perspective on the challenges that the DTx industry must overcome to mature. Based on those discussions and Health Advances’ extensive experience with commercial strategy in DTx, the team created a picture summarizing these challenges:

Today, in the absence of established, repeatable, and scalable paths to commercialization, each DTx company is effectively on its own. These companies already have their hands full with product design and validation, evidence generation, and regulatory clearance/approval. It is unsustainable for each company to also bear the burden of educating payers, health systems, healthcare providers, and patients on what a DTx is, how they should evaluate a DTx, how to integrate DTx into patient care and clinical workflow, and how to pay for a DTx.

Today, in the absence of established, repeatable, and scalable paths to commercialization, each DTx company is effectively on its own. These companies already have their hands full with product design and validation, evidence generation, and regulatory clearance/approval. It is unsustainable for each company to also bear the burden of educating payers, health systems, healthcare providers, and patients on what a DTx is, how they should evaluate a DTx, how to integrate DTx into patient care and clinical workflow, and how to pay for a DTx.

Drug and medical device companies don’t face such challenges. The pathways, business models, and infrastructure are all in place. The process isn’t always easy, but it is well-established and reasonably transparent. If you innovate, there is a clear path to market and to a return on your investment.

Where Do DTx Go From Here?

This is the future that the DTx industry needs to strive for. Fortunately, the industry fully understands the urgency of these challenges and is actively working to address them.

Policy advocacy is a big part of this effort. The DTA, the leading DTx trade organization, is intently focused on helping pave the way for DTx commercialization at scale, with particular emphasis on market access and reimbursement models. Leading DTx companies are involved with the DTA’s effort, and many are also coordinating with AdvaMed, a leading global medtech trade association, to lobby the U.S. government to create Medicare reimbursement mechanisms for DTx that achieve FDA breakthrough designation, as Dthera Sciences and Cognoa have.

These activities complement years of work by individual DTx companies to engage with commercial payers, efforts which have begun to pay off. In 2019, two of the nation’s leading PBMs, ExpressScripts and CVS Caremark, each announced the creation of digital formularies, making it easier for commercial health plan sponsors to include DTx products in their benefit plans.

The emergence of DTx-specific infrastructure is another key development. Two of the leading prescription DTx companies, Pear Therapeutics and Akili Interactive Labs, have both committed to building internal capabilities for detailing DTx to HCPs, helping to activate and train patients, and providing ongoing technical support—all of which are critical steps for relieving the burden that DTx products could place on prescribers and their office staff. At the same time, a new crop of companies aims to provide software and services to solve some of these problems and to make it easy and seamless for HCPs to prescribe DTx just as they would prescribe a drug. Examples include Xealth, Optum’s EnvoyHealth, and Flex’s BrightInsight.

These promising developments, combined with the accelerating pace of evidence generation and a wave of expected FDA clearances, will launch the DTx industry into a new phase.

Over the next two years, we will see the first few prescription digital therapeutics achieve broad market access and create mechanisms for distribution and payment. These trailblazers and the precedents they set will go a long way towards cementing the credibility of DTx as a treatment option and as a viable industry, and will pave the way for what could be a flood of DTx products that follow in their wake.

Ultimately, this will be great news for the industry and, more importantly, for the patients who stand to benefit from these exciting new treatment options.