In value-based healthcare, health plans/PBMs, employers, and government-sponsored healthcare programs focus on optimizing patient outcomes through the use of procedures and medications with established evidence while providing the highest value. Payers implement prior authorization (PA) as a tool to ensure that medical and pharmacy care are administered as indicated and that plan members receive safe and effective treatment for their condition.1 Plus, of course, there are financial reasons as well for executing PA criteria:

- Mitigate/manage risk associated with unnecessary costs.

- Control budget exposure of newly approved treatment without documented real-world evidence.

- Drive savings for stakeholders.

Landscape Overview

Prior authorization as a utilization management tool is here to stay. The launch of expensive specialty medications (e.g., hepatitis C, PCSK9Is, immune-oncology) in the last several years is one reason for PA restrictions. In a May 21, 2015, Managed Healthcare Executive article, Patrick Dunham, Chief Executive Officer for Curant Health, said he “would guess prior authorizations are more common practice because of the increase in specialty medications in the market. Twenty years ago, specialty drug spend accounted for about 10% of total drug spend. I believe it now accounts for approximately 70% of total drug spend.”

Dunham added, “Today, the newest specialty medications, although relatively safe, are very expensive. PBMs and payers have added [prior authorizations] to confirm that proper step therapy or clinical requirements have been met before they agree to pay for the therapy. I would expect [prior authorizations] to become even more commonplace as we see even more specialty expensive drugs flood the market.” He concluded, “I think everyone understands that [prior authorizations] are here to stay and we will continue to see an increase in their use.”2

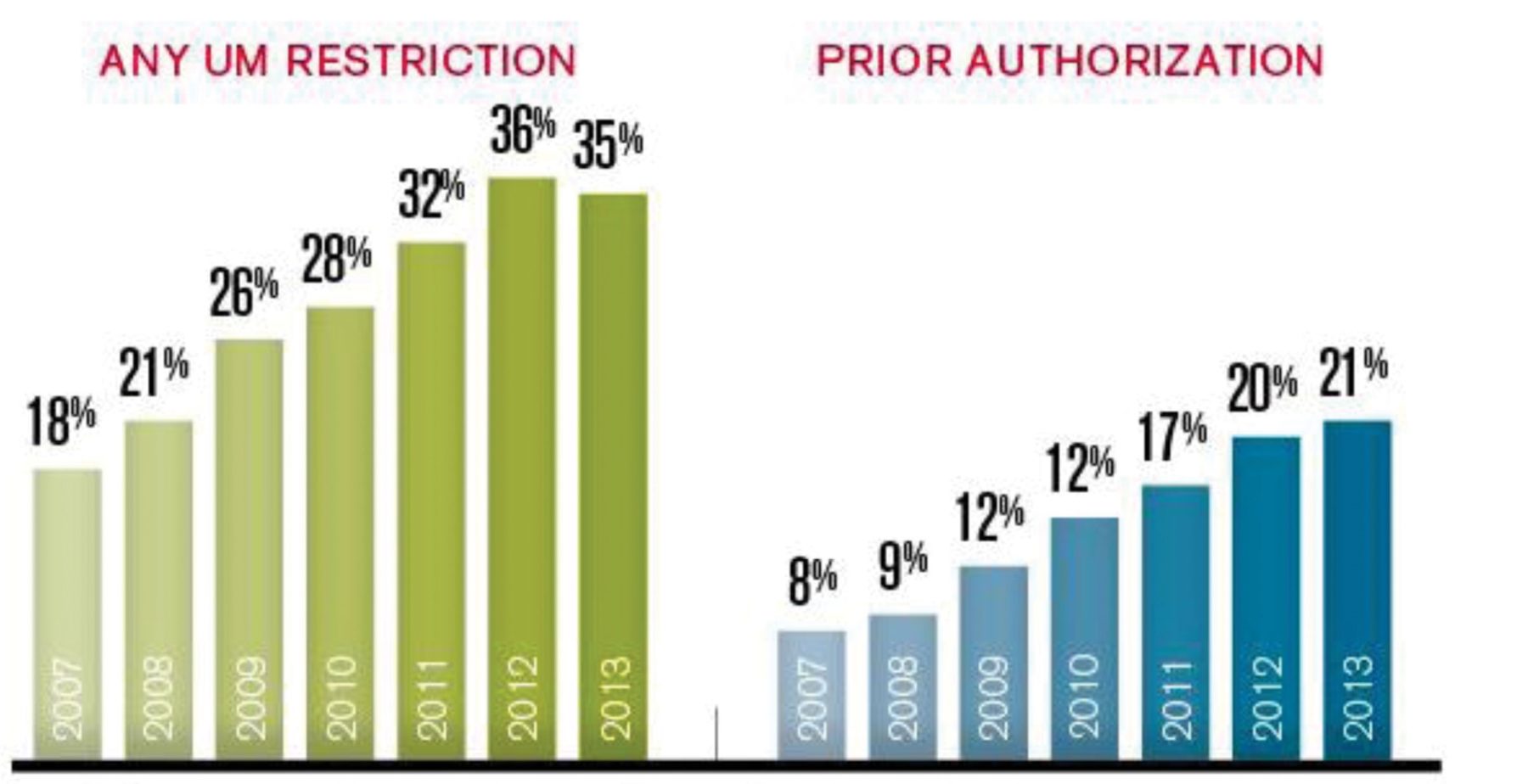

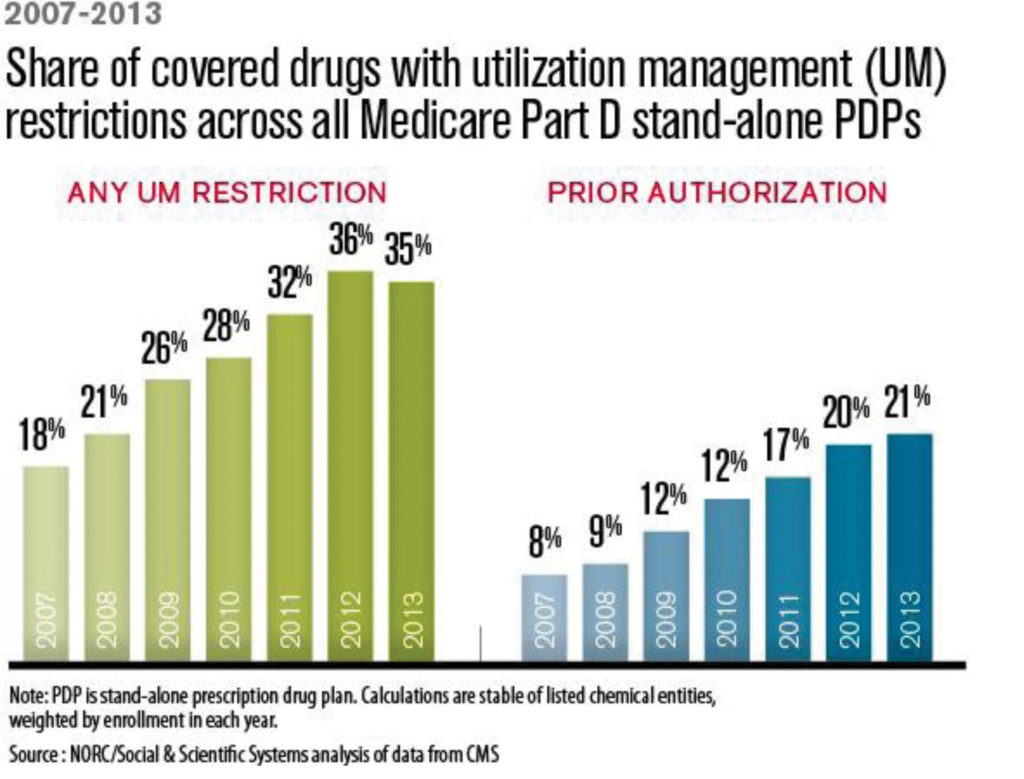

Evidence of increased use of PA or any utilization management restriction can also be found in Medicare Part D (Figure 1).3

However, CMS references “industry standards” and appropriate guidelines as benchmarks when reviewing PA policies from Part D plans. CMS compares formularies to identify outliers and requires these Part D plans to provide reasonable justification.6 PA policies on the rise in Medicare Part D follows the trend of increase in specialty medications.

However, CMS references “industry standards” and appropriate guidelines as benchmarks when reviewing PA policies from Part D plans. CMS compares formularies to identify outliers and requires these Part D plans to provide reasonable justification.6 PA policies on the rise in Medicare Part D follows the trend of increase in specialty medications.

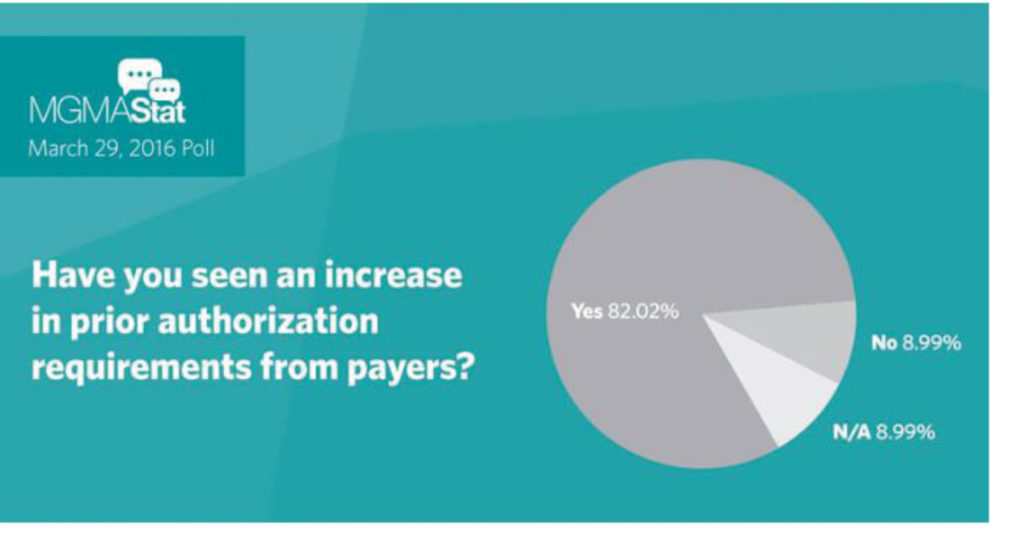

Indeed, according to a Medical Group Management Association (MGMA) Stat poll, more than 80% of physicians have seen an increase in PA requirements from payers (Figure 2).3 Not only is PA here to stay, but policies and requirements may become more stringent and restrictive. As payers attempt to identify risk and account for uncertainty, their most utilized and tested tool is PA.

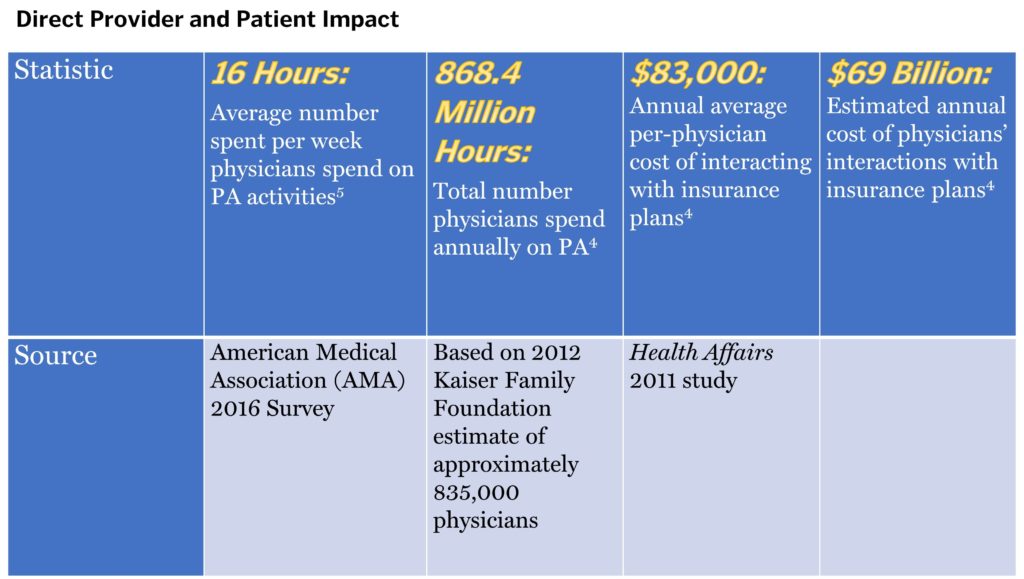

As Figure 3 shows, PA is a time-consuming and costly burden on healthcare providers. The excessive amount of energy and resources physicians and other clinical staff spend on addressing payer PA requests takes time away from patient care. In the AMA 2016 survey, 90% of respondents reported care delays due to PA requirements.5

As Figure 3 shows, PA is a time-consuming and costly burden on healthcare providers. The excessive amount of energy and resources physicians and other clinical staff spend on addressing payer PA requests takes time away from patient care. In the AMA 2016 survey, 90% of respondents reported care delays due to PA requirements.5

Stakeholders Leading the Way to Improve Prior Authorization

Stakeholders Leading the Way to Improve Prior Authorization

The AMA is determined to streamline the PA process and alleviate the administrative burden of PA requests. The group has broadened its campaign to include other provider groups as well as payers. In late January 2018, the American Hospital Association, America’s Health Insurance Plans, the AMA, the American Pharmacists Association, the Blue Cross/Blue Shield Association, and the Medical Group Management Association released a consensus statement identifying 16 “opportunities for improvement in prior authorization programs.” These concepts fit into 5 categories: 1) selective application of PA; 2) PA program review and volume adjustment; 3) transparency and communication; 4) continuity of patient care; and 5) automation to improve transparency and efficiency. The principles are a first step toward PA program reform that lessens provider burden while upholding quality patient care.6

What Can You Do?

You may be asking: What opportunities exist for payer marketers to address the PA requirements of payers while ensuring access of products and procedures to providers and patients? Without infringing on the payer’s justification for PA, payer marketers can provide payers with information and data to evaluate rationale for PA:

- Proper patient identification to ease risk concern and budget impact: Provide payers with prevalence and incidence of the treated condition along with key data elements such as ICD-10 codes to identify patients electronically.

- Cost consequence/economic models: Demonstrate value of the treatment to payers by illustrating cost avoidance if appropriate patients are treated in an apt manner or impact of not treating appropriate patients.

- Real-world evidence (RWE) generation: Supports that provider’s use aligns with FDA-approved indication. Given that payers would rather rely on their own data rather than RWE brought to them by manufacturers, consider forming a partnership with innovative and tech-savvy payers.7

- Value-based or outcomes-based contracts/risk-sharing arrangements: Incentivize payers to relax PA criteria while the manufacturer is at risk for outcomes.

Payers monitor the impact of the PA and determine ROI to continue the PA year over year. If unwarranted medical and pharmacy costs are avoided and trend/spend are under control without sacrificing operational efficiencies, payers chalk it up to a successful PA program. Therefore, it behooves payer marketers to present data, evidence, and information to support relaxing PA criteria or removal of PA.

What about providers and patients? Offer HUB services for providers and patients to increase access to products and procedures. Manufacturers can obtain copies of payer PA criteria and forms and help providers identify requirements. Ensure the providers are aware of medical necessity and what is needed to expedite the treatment request. Reduction of administrative burden eases a provider’s reluctance to prescribe and thereby avoid the hassle of PA. Educate patients on their benefits and help them navigate the complex healthcare system, but be careful not to offer them access to samples or coupons/copay assistance programs as these may negatively impact access.

Payers that implement PA or a step requirement do not credit use of samples as a qualifier to establish history. Copay accumulators are a new benefit design that targets specialty drugs with copayment assistance. Copay assistance programs no longer count toward a patient’s deductible or out-of-pocket maximum.8 Therefore, HUB services for patients should offer benefit design research and help patients understand the level of PA requirements.

What Does the Future Hold?

Gone are the days of the mega blockbuster as payers continue to wield their power to control volume, if not both volume and price. This is especially true with the vertical integration of mergers such as CVS-Aetna and Cigna-ESI. Yet, the PA process may be improved and streamlined with the coordination of medical and pharmacy benefits. The merger of a health plan with a PBM could provide and deliver better care with lower costs. Accumulation of data offers a holistic view of patient care. The provider may not need to address a medical policy for a procedure separately from a policy for a drug.

Integration could close loopholes in the PA process when one drug is covered under the medical benefit and another drug is covered under the pharmacy benefit, leading to coordination of treatments, especially in oncology. It is important for payer marketers to understand this new type of payer and the magnitude of its influence and incentives/drivers. Consider partnerships or pilots with these newly integrated entities and their access to both medical and pharmacy data; relevant RWE, data, and models become more important.

The hope, ultimately, is coordinated and streamlined care. With vast amounts of data readily available, providers may not have to review pages and pages of PA requirements and provide a thesis on medical necessity. The payer can collect data electronically in a matter of an internet second and determine if a patient qualifies for treatment. Thus, the patient receives timely and appropriate care.

If only there were a crystal ball to predict how these vertical integrations impact PA. Still, there is hope that this new type of healthcare firm can impact the industry positively.

References

- http://www.amcp.org/prior_authorization.

- http://managedhealthcareexecutive.modernmedicine.com/managed-healthcare-executive/news/prior-auths-are-here-stay?cid=TMD_MHEROS.

- https://www.aafp.org/news/practice-professional-issues/20170609priorauth.html.

- http://medicaleconomics.modernmedicine.com/medical-economics/content/tags/insurance-companies/prior-authorization-predicament?page=full.

- https://www.ama-assn.org/sites/default/files/media-browser/public/government/advocacy/2016-pa-survey-results.pdf.

- https://pink.pharmaintelligence.informa.com/PS122438/Providers-Payors-and-Prior-Authorization-A-Second-Front-In-Pricing-Fight.

- Reinke T: “Real-world Evidence Not Quite Believable Enough.” Managed Care. March 2018, pp34-35.

- http://www.drugchannels.net/2018/01/copay-accumulators-costly-consequences.html.