By the end of this decade, nine out of the top 20 highest-grossing drugs will be losing exclusivity (LOE). As these blockbusters lose their patent, the industry faces significant headwinds in the form of national payer and pharmacy benefit manager (PBM) verticalization and unprecedented government involvement in pharmaceutical pricing. In this article, we evaluate some tactics manufacturers could consider for the U.S. market to maintain their market share and extend the erosion curve (Figure 1).

The continued vertical integration of PBMs with national plans, pharmacies, and providers (among others) has led to three large PBMs with disproportionate market power. Because of this increased power, PBMs can squeeze value through rebates and contracts from manufacturers. At the same time, a critical provision of the Inflation Reduction Act (IRA) allows the U.S. Department of Health and Human Services (HHS) to select a set number of high-spend, mature drugs each year and negotiate price reductions upward of 60%. Thus, while previously mature brands were primarily concerned with preparing for generics entering the market, manufacturers may begin to see revenue erosion even before LOE.

The continued vertical integration of PBMs with national plans, pharmacies, and providers (among others) has led to three large PBMs with disproportionate market power. Because of this increased power, PBMs can squeeze value through rebates and contracts from manufacturers. At the same time, a critical provision of the Inflation Reduction Act (IRA) allows the U.S. Department of Health and Human Services (HHS) to select a set number of high-spend, mature drugs each year and negotiate price reductions upward of 60%. Thus, while previously mature brands were primarily concerned with preparing for generics entering the market, manufacturers may begin to see revenue erosion even before LOE.

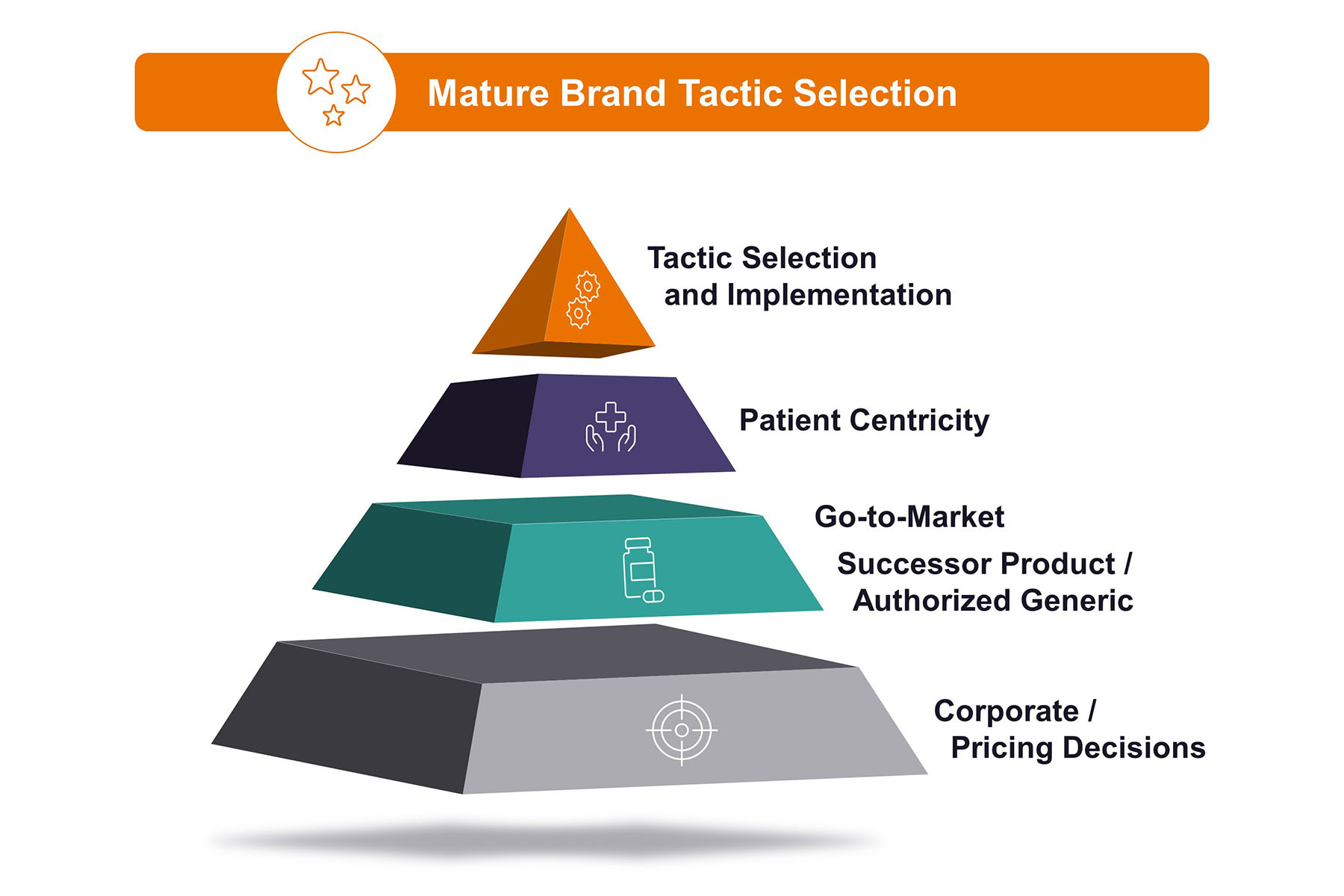

As we move into the new environment of increased PBM market power, the government’s direct price negotiation, and overall heightened price sensitivity, manufacturers must consider additional opportunities and avenues to prolong their erosion curve. The eventual tactics of choice must address the patient’s need while supporting corporate objectives. Based on the manufacturer’s objectives, these tactics could be categorized as focused on Volume or Price Preservation.

4 Volume Preservation Tactics for Mature Brands

Multiple tactics can involve a volume preservation focus, but implementing the more successful ones is often coupled with either a price reduction or a high discount. With the IRA drug pricing provisions, the government has unwittingly created an environment where an entrenched brand with either a voluntary or negotiated lower price could crowd out generics and biosimilars and maintain a sizable market share by successfully implementing tactics prioritizing patient accessibility. Here is a breakdown of some of the different tactics involving volume preservation.

1. Direct-to-patient Distribution

Direct-to-patient distribution is a tactic that some manufacturers have successfully deployed for their mature brands. For example, the Janssen Select Program allows patients with either commercial or Part D coverage who meet specific criteria to pay a relatively low cost for a 30-day supply of Xarelto. It will be worth watching if Janssen decides to expand the program further if Xarelto is compelled to reduce its Part D pricing post-IRA negotiations. Some other brands with high Part D exposure are already exploring this avenue as an alternative to rebating in case they have to reduce their price.

2. Pharmacy Disruptors

Brands that have reduced their price and lack the appetite for additional rebates to PBMs could also look to engage pharmacy disruptors (e.g., online pharmacies and discount card vendors) as a potential avenue for maintaining market share. An example of this approach is Sanofi’s latest partnership with GoodRx, whereby patients with a valid prescription, regardless of their insurance status, could purchase a 30-day supply of Lantus using a GoodRx coupon at their retail pharmacy. Another similar disruptor is Mark Cuban’s Cost Plus Pharmacy, which different mature brands are exploring as a potential option.

3. Telehealth

Telehealth is another channel that has gained popularity in the post-COVID environment and provides a novel channel for mature brands. Multiple disruptors, such as BlinkRx and GoodRx, offer telehealth and pharmacy services to patients and cover a wide range of disease areas. However, it is worth noting that although these services do not extend to specialty medications/disease areas, manufacturers should monitor the evolution of this channel to find opportunities to expand the market presence of their brands where feasible.

4. Authorized Generic

Introducing an authorized generic can help patients transition to the generic product, allowing them to benefit from reduced out-of-pocket (OOP) costs while preserving the overall patient volume. However, this tactic would be applicable for the six months of the Hatch-Waxman exclusivity period and would be less relevant once lower-priced, multi-source generics enter the market. Additionally, once the IRA goes into full effect, authorized generics would be treated like the brands, thereby blunting their impact as a potential tactic.

4 List Price Preservation Tactics for Mature Brands

Meanwhile, mature brands that want to focus on list price preservation should consider a different set of tactics.

1. Long-term Contracts

One list price preservation tactic is engaging in Long-term Contracts, even though this entails rebating and thus has gross-to-net implications. A tried and tested tactic, typically, manufacturers enter long-term contracts with payers in the immediate pre-LOE period. Although the success of this tactic may be limited after the launch of low-cost, multi-sourced generics in the small-molecule space, this tactic has been particularly successful for biologics. Humira has maintained its share in the immediate term, even after multiple biosimilar launches at various price points. Remicade held its market share for multiple years by deploying this tactic, even after the entry of numerous infliximab biosimilars.

2. Successor Asset

Another tactic that some manufacturers have successfully implemented, which also preserves the brand’s list price, is launching a new version of the product nearing LOE as a successor asset. Since this newer asset typically has better efficacy and a longer lifecycle, manufacturers will encourage patients to switch to their new product (e.g., following the launch of Skyrizi in 2019, AbbVie encouraged existing Humira patients to adopt Skyrizi for the relevant indications). The success of this approach is predicated on launching the successor asset well ahead of the brand LOE, and manufacturers should consider contingent plans in case the development of the successor asset is delayed for any reasons beyond their control.

3. Dispense as Written Campaign

Although infrequently deployed, manufacturers have previously implemented additional tactics that have served their brands well. One of these tactics is a Dispense as Written (DAW) campaign, which has fallen out of favor as they have come under Congressional scrutiny for being anti-competitive. Additionally, plans have implemented hurdles that discourage the dispensation of brands when low-priced generics are available. Nonetheless, one could see a situation where generics may be in short supply, in which manufacturers successfully implement a DAW campaign to ensure patients get access to their medications.

4. Legal Agreements with Generics/Biosimilar Manufacturers

Finally, for the sake of completeness, we mention the implementation of legal agreements with generics/biosimilar manufacturers for a limited volume of generic entries in the peri-LOE period. This arrangement intends to build a ramp for generic entry while prolonging the erosion curve. However, this tactic is onerous to implement, as it entails continuous monitoring of market shares to ensure that all parties adhere to the agreement and also attracts heightened payer scrutiny. Additionally, despite the agreement, the brand would not be able to control the velocity of generic adoption at some of the more extensive plans.

In conclusion, a manufacturer can help prolong the erosion curve of their mature brand in a number of ways. The choice of tactics should be patient centric and ensure that barriers to patient accessibility are reduced. However, additional factors such as commercial objectives and government action concerning brand pricing would also guide the tactic selection.