It’s more challenging than ever to be a pharma marketer.

Rapid changes in the market resulting from COVID-19. The shift from private practice to health system-employed clinicians. Tighter budgets. Smaller field forces. These factors, and more, make it increasingly difficult to engage hard-to-reach audiences and drive strong brand performance.

Furthermore, demand for digital solutions has triggered a transition to omnichannel communications. Going beyond multichannel (i.e., many channels), an omnichannel strategy is a customer-centric, unified brand experience across all channels. This industry-wide transition to omnichannel has, in turn, led to a deluge of communication at every possible touch point.

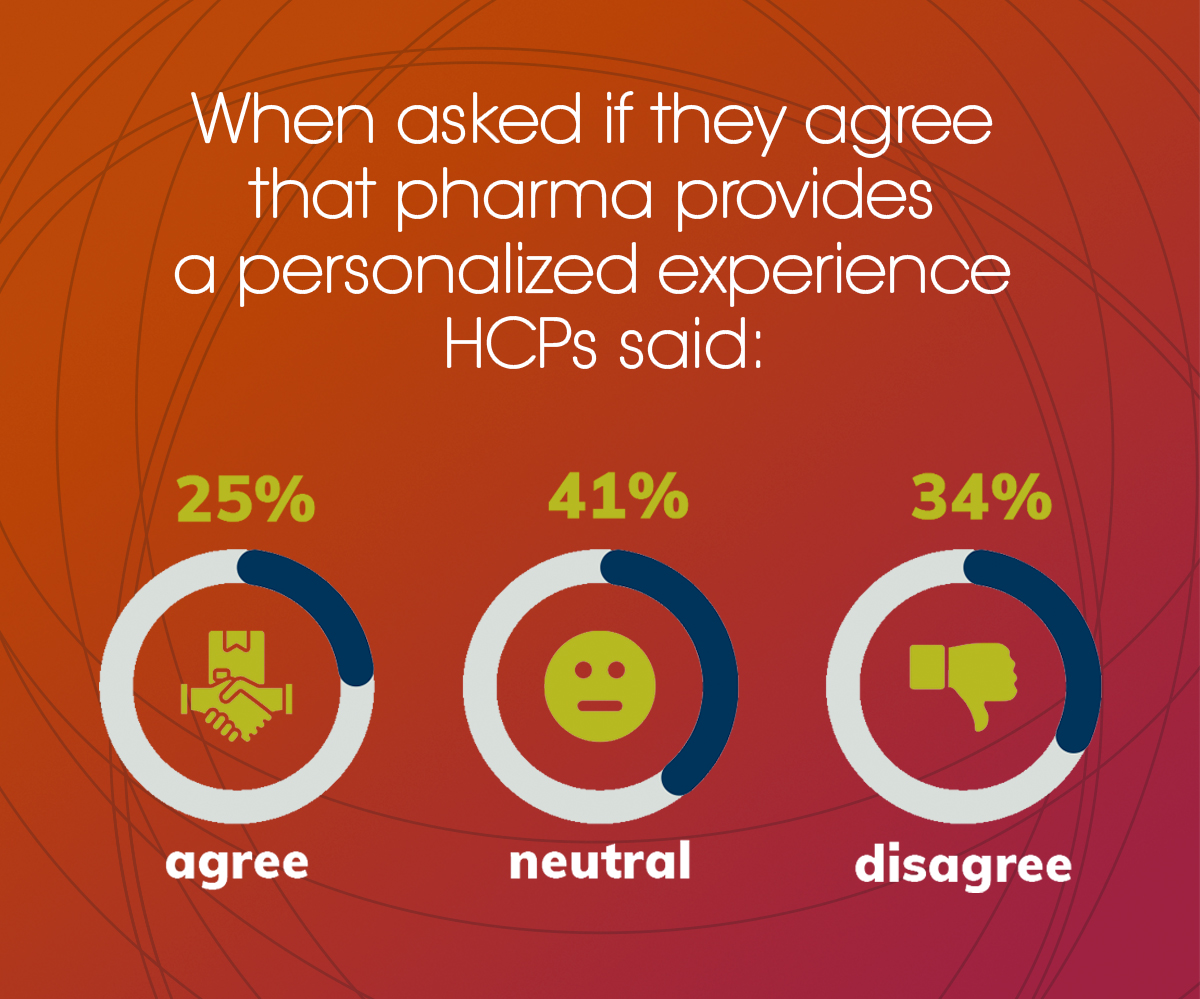

Unfortunately, the vast majority of this communication is just noise. In fact, only 25% of U.S. healthcare professionals (HCPs) agree that pharma marketing provides a personalized and relevant experience (Figure 1).1

The ideology that “healthcare is local” is becoming increasingly ubiquitous. While this view is valid, the industry has evolved even further. It’s become personal. Therefore, healthcare marketing needs to be as personalized as possible. Pharma marketers need to understand the individual HCP. The individual key opinion leader (KOL). The prevalence of a particular disease state in an individual market. And so on.

The ideology that “healthcare is local” is becoming increasingly ubiquitous. While this view is valid, the industry has evolved even further. It’s become personal. Therefore, healthcare marketing needs to be as personalized as possible. Pharma marketers need to understand the individual HCP. The individual key opinion leader (KOL). The prevalence of a particular disease state in an individual market. And so on.

Pharma marketers increasingly recognize and acknowledge this shift, but they’re not pivoting nearly as quickly as they should. It’s a big lift! The industry still relies heavily on TV-based national advertising campaigns to drive top-of-the-funnel awareness. In 2022, drugmakers’ $5.8 billion investment in TV significantly overshadowed the $1.2 billion it dedicated to digital.1

The conventional one-size-fits-all cookie-cutter approach doesn’t cut it anymore.

What Is Local Marketing?

It’s a methodology for creating and delivering personalized and relevant marketing, by encouraging brands to shift their focus. To view the healthcare market in a whole new light. Not as a whole, but rather in a uniquely granular manner. To build marketing plans from the bottom up, not the top down.

This proven, data-driven approach enables any brand to break through the clutter with strategy, content, and channels that flexibly adapt to the ever-increasing variability in the marketplace, where communications must be customized on every possible level. Region by region. Market by market. HCP by HCP. KOL by KOL. Patient by patient. Granular data drives this precision and personalization.

The more personally relevant the marketing is, the more engaging it will be.

Why Should You Consider It?

Applying local marketing in your omnichannel approach is a powerful complement to a company’s national brand strategy. It can and should be leveraged at every stage of the brand lifecycle, from pre-launch disease awareness through loss of exclusivity.

The convergence of dynamic marketplace factors should encourage you to rethink and retool your current marketing approach. Understanding all the factors that influence brand performance at a granular level is critical to your success.

Factors to consider:

- The continued rise of healthcare systems means redefining the priority and strategy of targeting HCPs one on one.

- Increased managed care controls impose strong restrictions on clinicians’ prescribing options, resulting in greater variation in brand performance.

- Rapidly changing characteristics of the U.S. population will result in substantial pockets of differences in prescription drug sales potential due to age, income, ethnicity, and the ability to pay within smaller and smaller geographies.

- Increased access to information by the patient in a self-directed manner will render some marketing efforts more effective and others less efficient.

- Time constraints, HCP preference, and limitations imposed by their organizations will continue to decrease sales representatives’ access to important HCPs, empowering HCPs to be more in control of how (and who) they interact with.

With so many variables affecting healthcare marketing, brands must look deeper into the data to thrive in today’s environment. Data makes all the difference. It enables you to pinpoint and prioritize the highest-opportunity markets, targets, influencers, channels, and patients. Data makes all the difference, because it helps you see and react to previously unseen differences. And the more granular the data, the better.

With so many variables affecting healthcare marketing, brands must look deeper into the data to thrive in today’s environment. Data makes all the difference. It enables you to pinpoint and prioritize the highest-opportunity markets, targets, influencers, channels, and patients. Data makes all the difference, because it helps you see and react to previously unseen differences. And the more granular the data, the better.

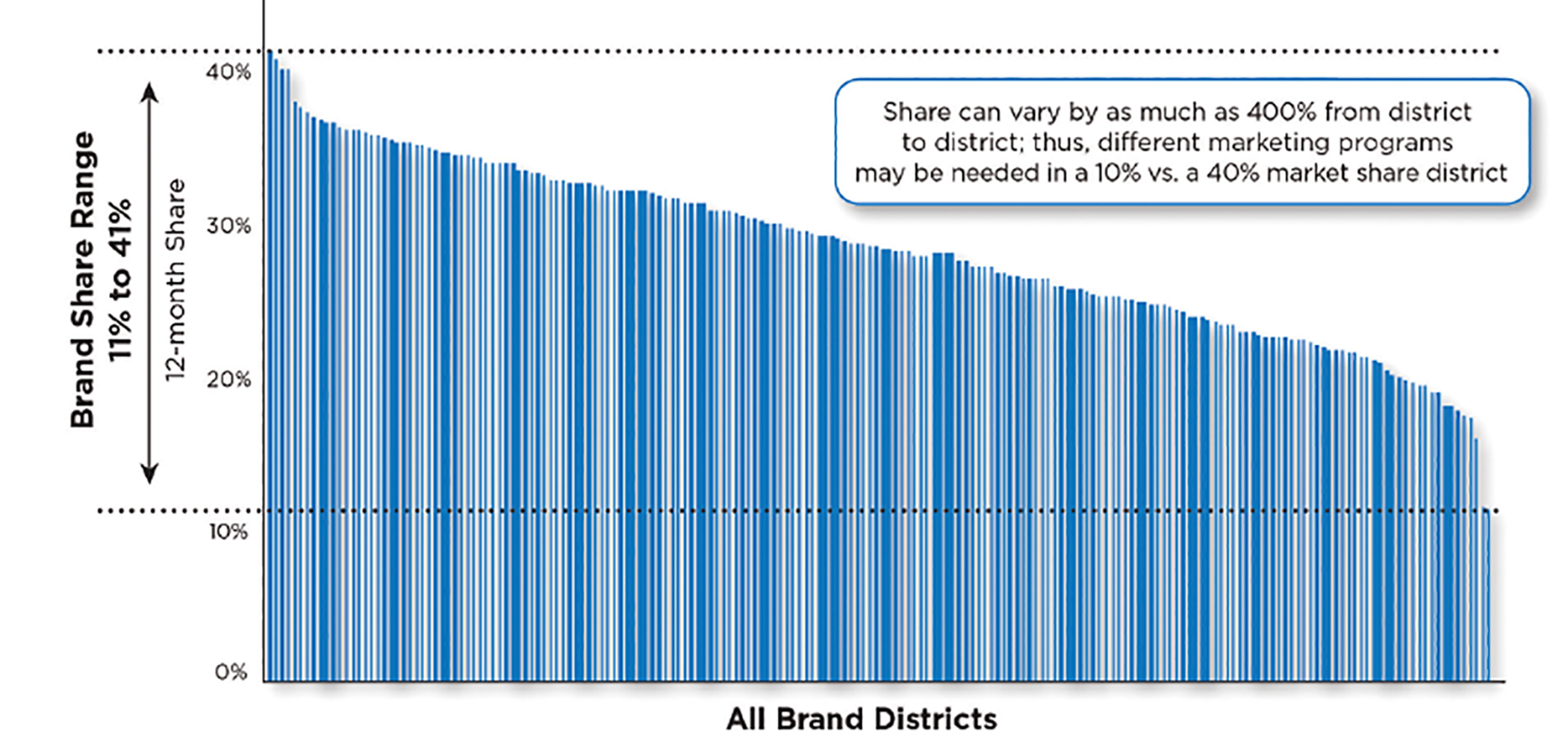

One way of focusing your local marketing efforts is on a geographic basis. For instance, market share for most brands can vary by as much as 400% from district to district across the U.S. (Figure 2). Logically, the districts with lower share have different challenges, barriers, and headwinds. Understanding those allows strategies and tactics to be customized. Treating every district, in the same way, would result in lower performance, underutilized resources, and missed opportunities.

Local vs. National Marketing

Local vs. National Marketing

While data analysis and segmentation practices are prevalent when preparing national marketing plans, they are seldom performed at the local level. National averages often mask the true variation that exists on a more granular level, and the causes go undetected.

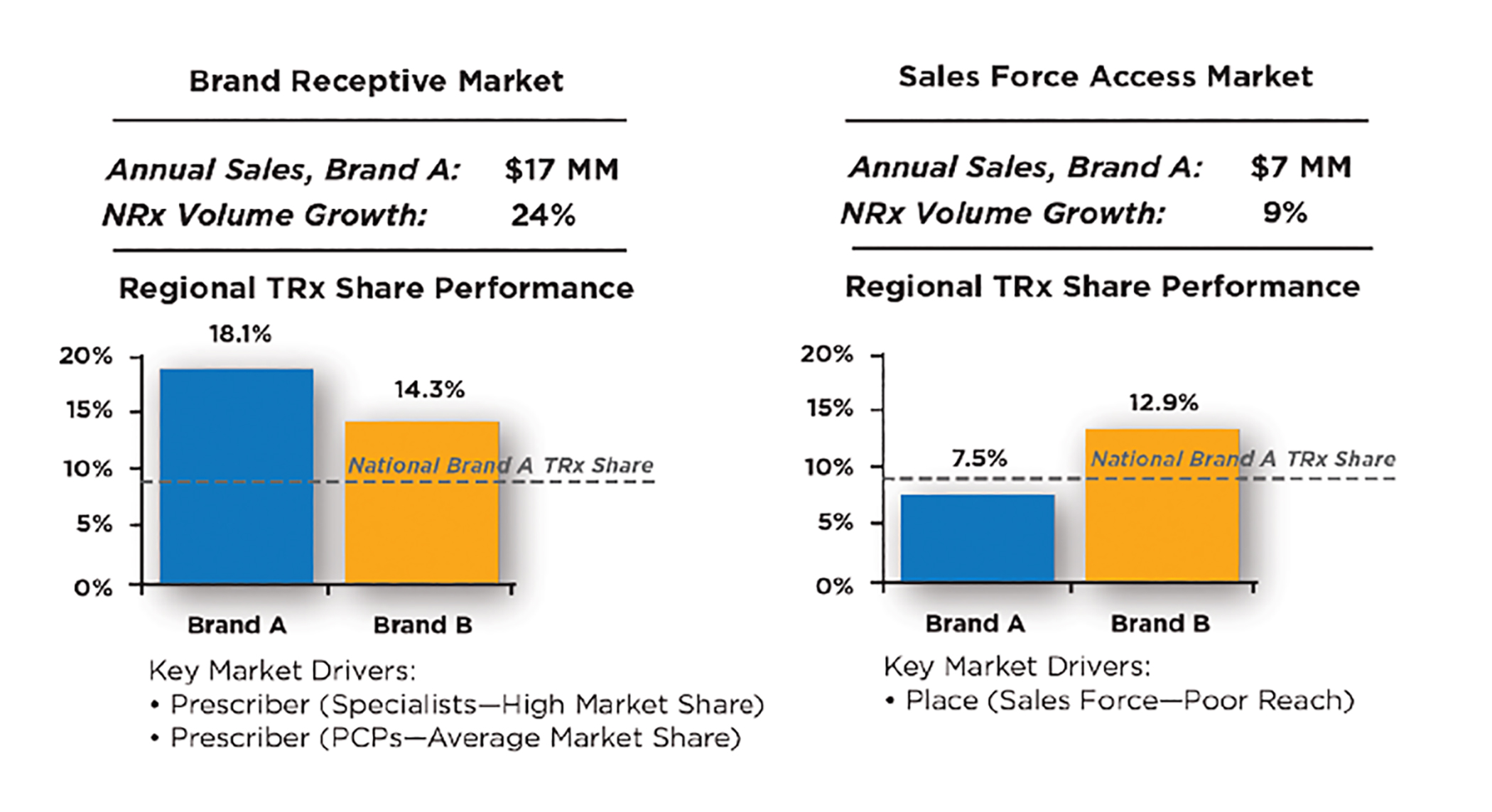

For illustrative purposes, two markets were examined for the same pain drug. The markets are similar in size, market opportunity, and formulary status. But the data show polar-opposite results, driven by differences in granular market drivers (Figure 3).

When conducting an analysis at the granular level, one is able to determine that the first market is a “brand receptive” competitive market, meaning high use and reimbursement for leading branding products. The other is a “sales force access” competitive market, meaning limited rep access to HCPs. This results in poor call-plan performance.

When conducting an analysis at the granular level, one is able to determine that the first market is a “brand receptive” competitive market, meaning high use and reimbursement for leading branding products. The other is a “sales force access” competitive market, meaning limited rep access to HCPs. This results in poor call-plan performance.

On the surface, one might conclude that the representative in the “brand receptive” market is simply better at her/his job than the representative in the other market. Traditionally, that has been a common way to look at it. However, a deeper analysis of these markets uncovers numerous drivers—beyond representative effectiveness—that account for the variation in TRx share performance.

Once the drivers of performance variation are understood on a granular level, it becomes apparent that each market requires different strategies and tactics. In the “brand receptive” market, Brand A is the market leader, so it has significant opportunity to broaden its base of prescribers and thus drive product performance by educating HCPs with local specialists. Conversely, in the “sales force access” market, Brand A faces significant competition from other brands. Therefore, it needs to grab market share. This may require field force access and nonpersonal promotion initiatives that improve reach with target HCPs.

These data-driven insights demonstrate the undeniable value of looking locally versus nationally. And remember, market-specific dynamics are only one piece of the puzzle. It’s important to develop a host of data-driven insights, such as variations in prescribing habits, media consumption, KOL influence, and patient behavior.

How Can Local Marketing Scale Nationally?

To make granular insights such as these worth the brand’s time and resources, the strategies and tactics applied to these two markets need to be scalable on a national level. Therefore, identifying other markets with similar drivers is critically important. A granular marketing approach identifies specific opportunities for scalable brand growth that national marketing plans may not fully recognize or prioritize, particularly if the plans are developed by solely relying on national averages.

To scale a granular marketing plan, pharma marketers must first understand brand performance variations—market to market, HCP to HCP, KOL to KOL, patient to patient—and the key drivers behind them. Even though formulary continues to be a key predictor of market share, other drivers can have a significant impact on brand performance on a granular level. Market opportunity can be determined by disease state prevalence, HCP prescribing rates, access, KOL influence, risk, and the treatment perspectives relationship (and the list goes on).

It bears repeating: data makes all the difference. It enables you to pinpoint and prioritize the highest-opportunity markets, targets, influencers, and channels. Data insights—combined with machine learning and AI—enable you to replicate this personalized and relevant omnichannel approach across the country.

In summary, highly segmented, personalized, and locally, yet scalable initiatives are becoming critical to your brand’s success. New strategies and tactics are emerging rapidly that will enable you to capitalize on a local versus national view of the marketplace.

The conventional one-size-fits-all approach doesn’t cut it anymore.

This is why you must infuse local marketing into your omnichannel plans. It’s a proven way to break through the clutter with strategy, content, and channels that flexibly adapt to the ever-increasing variability in the marketplace, where communications must be personalized and relevant on every possible level. View the healthcare market in a new light, not as a whole, but in a uniquely granular manner.

You will undoubtedly find value in looking locally versus nationally.

References:

1. Relevate study

2. Nielsen Ad Intel