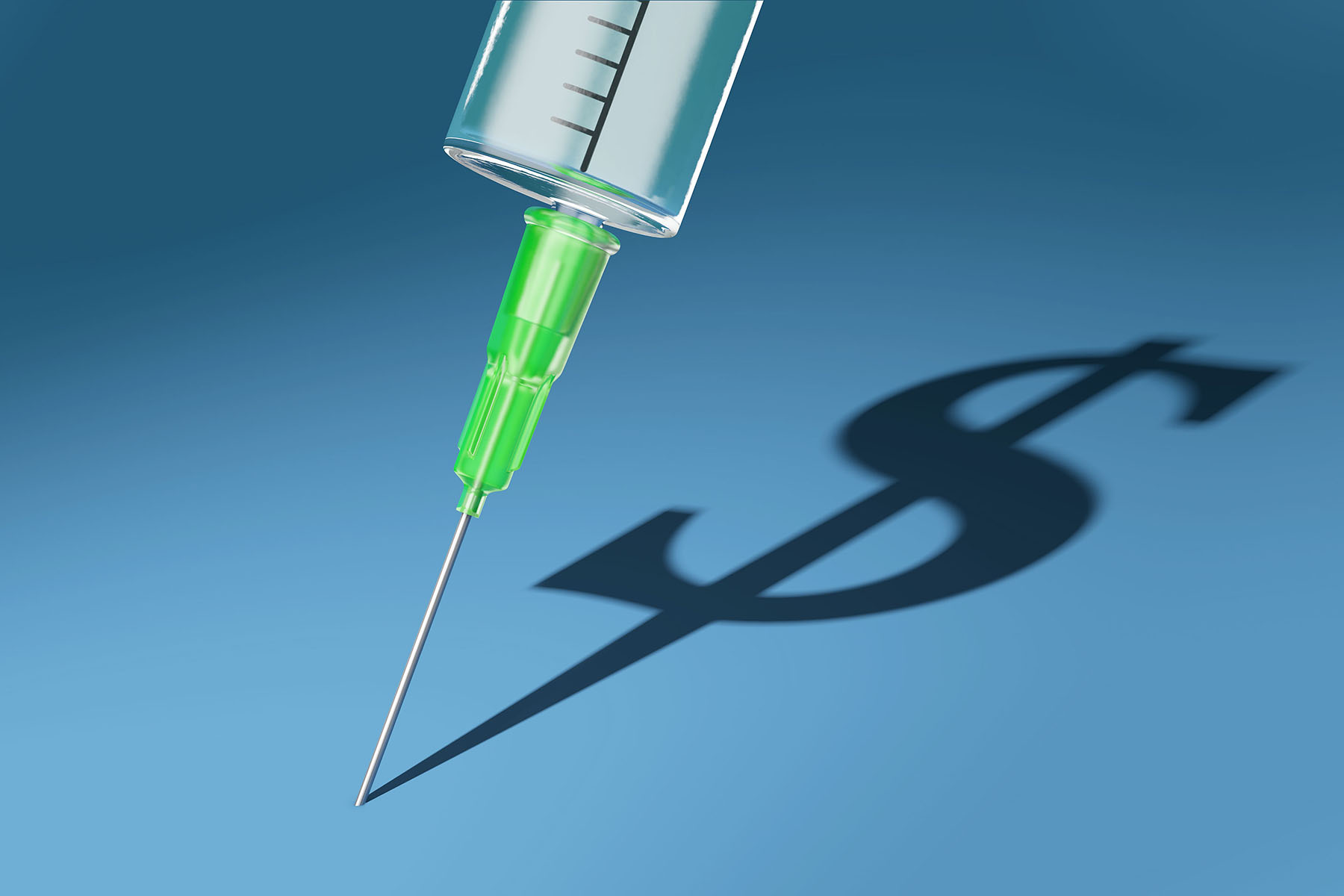

The pharmaceutical supply chain is so complex that it provides the perfect camouflage for unscrupulous companies to prioritize profits over patients. We talked about how easy it is for hidden revenue streams to go unnoticed in our last article, “The Hidden Facts About Voucher and Bridge Pricing.”1 It comes as no surprise that the Kaiser Family Foundation’s latest public opinion poll found 29% of U.S. adults surveyed reported not taking their medication as prescribed due to cost.2 In keeping with our mission to drive honesty and transparency in healthcare pricing practices, our goal is to uncover—and mitigate—tactics that impact the pharmaceutical ecosystem. This time, we’d like to delve into the impact copay accumulators and maximizers have at the program level.

How Copay Accumulators Can Hurt

As of 2022, nearly 90% of payers included copay accumulators or maximizers in their plan designs,3 the most widespread use recorded yet. Although they are marketed as a cost-saving tool to plan sponsors, they can have a negative effect on patients and adherence. Copay accumulators are a mechanism by which insurers can disallow copay assistance funds from counting toward a patient’s deductible or out-of-pocket (OOP) limit, meaning they still need to pay down that amount in a benefit period before their plan kicks in for any type of claim.

Worst of all, accumulators have this impact more often on patients with chronic illnesses or rare diseases, and the pharmaceutical companies who supply the treatments they urgently need. Patients can experience impacts such as reduced adherence, potentially resulting in negative health outcomes. However, what we’d like to spotlight is the financial impact on pharmaceutical copay assistance programs and how accumulators are adding unnecessary cost burdens that are a factor in rising prescription prices and adverse gross-to-net impact.

An Example of Accumulator Impact

In an effort to help patients adhere to their prescribed therapies, drug manufacturers offer eligible patients a copay assistance program, a prescription benefit at the pharmacy which covers some or all of a patient’s OOP expense. Once the OOP limit for the patient is met, usually after one or two fills of a specialty drug, the patient has no additional cost for their medication since the health plan pays the full prescription benefit.

Copay assistance program providers usually do not detect when a health plan is using a copay accumulator until after several fills. By then, the program cost per impacted patient is at least double what it should be, which is a gross misuse of these funds. In essence, copay accumulators are a method of misdirecting manufacturers’ copay assistance funds to instead fatten the bottom lines of accumulator vendors and payers such as pharmacy benefit managers (PBMs).4

In this hypothetical scenario, let’s examine the overall financial impact of copay accumulators to a high-cost, low-volume specialty program. If we assume an average wholesale price (AWP) of $17,000 and 3,000 patients per year, this makes each claim extremely valuable. Most specialty clients in this category will have a $25k annual program maximum, leaving the brand open to excessive financial risks.

Given the average impact per patient, per program, we can roughly assume that 20% of their patients will be impacted by accumulator type programs. This exposure will leave the brand paying more than $10.8M over the cost of non-impacted commercial patients. If this were a real-life program analysis, the cost may be higher when you consider up to 40% of patients can be impacted.

The Game Changer

The overall impact of accumulators on the U.S. pharmaceutical industry is sobering when you consider the $10.8M impact we calculated above is just from one small hypothetical drug brand. If copay assistance programs could identify an accumulator-impacted patient on the first fill, just imagine how many millions could be saved each year. But how can sneaky accumulators be identified from the start? To ensure your programs save money, ask copay assistance vendors:

- For help determining your copay accumulator exposure by requesting an analysis of your existing programs.

- For copay programs intelligently designed to identify patients impacted by an accumulator at the very first fill, preventing the diversion of funds away from the program.

- If your vendor provides an accumulator solution. If so, is it only a split-adjudication model?

- Whether your vendor’s accumulator solution is centered around a seamless patient journey designed to reduce friction and ensure adherence.

- If they have innovative technologies that can adapt quickly to changes in the healthcare landscape.

- For seamless and reliable copay and benefit processing through API-based platforms with a foundation in fintech.

The ultimate goal is to create programs that both help patients gain access to prescribed therapies while also reducing the financial strain on the greater pharmaceutical ecosystem. Be sure you are asking the right questions so your programs can deliver on that promise.

References:

1. Turner, Matt. “The Hidden Facts about Voucher and Bridge Pricing.” PM360, 15 Sep. 2022, https://www.pm360online.com/the-hidden-facts-about-voucher-and-bridge-pricing.

2. Hamel, Liz; Lopes, Lunna; Kirzinger, Ashley; Sparks, Grace; Kearney, Audrey; Stokes, Mellisha; and Brodie, Mollyann. “Public Opinion on Prescription Drugs and Their Prices.” Kaiser Family Foundation, Oct 20, 2022, https://www.kff.org/health-costs/poll-finding/public-opinion-on-prescription-drugs-and-their-prices.

3. Fein, Adam J. “Copay Accumulator and Maximizer Update: Adoption Plateaus as Insurers Battle Patients over Copay Support.” Drug Channels, 22 Feb. 2023, https://www.drugchannels.net/2023/02/copay-accumulator-and-maximizer-update.html#more.

4. “The False Promise of Current Drug Pricing Reforms.” Paysign, Inc., 24 May 2022, https://paysign.com/the-false-promise-of-current-drug-pricing-reforms.