The healthcare industry is rife with hidden revenue streams, specifically within the patient affordability (PA) solution realm, that divert funds away from their intended purpose, which is to benefit the patient. The complexities within the pharmaceutical supply chain make it particularly easy for these pockets of money to go unchecked and unnoticed. One example of this is voucher and bridge programs. These programs are designed to help patients cover out-of-pocket costs and are funded by drug manufacturers. PA vendors manage these programs, as well as oversee claims processing and related payments.

Most of these PA vendors have been candid when discussing how other players in the healthcare ecosystem, namely pharmacy benefit managers (PBMs), have profited by obscuring their revenue sources. However, it is not a surprise that many of these vendors are involved in a similar practice—usually hidden from the view of patients and their drug manufacturer clients—called pricing spreads or spread margin. Read on to learn how these work and how to avoid them.

Evaluating Price and Dispensing Fees

Average wholesale price (AWP) or wholesale acquisition cost (WAC) is the commonly accepted standard price for drug payers. Pharmacies then contract with a claims processor at a specific negotiated rate, which is characterized by a percentage plus or minus of the AWP/WAC. For example, a bigger pharmacy chain may receive more reimbursement funds, while a smaller, independent pharmacy might receive less.

All pharmacies, both retail and specialty, charge dispensing fees that can vary from one another. These pharmacies and their chains can negotiate better dispensing rates based on various factors, such as their geologic location, the types of drugs they dispense, and number of patients.

Where Pricing Spreads Are Likely

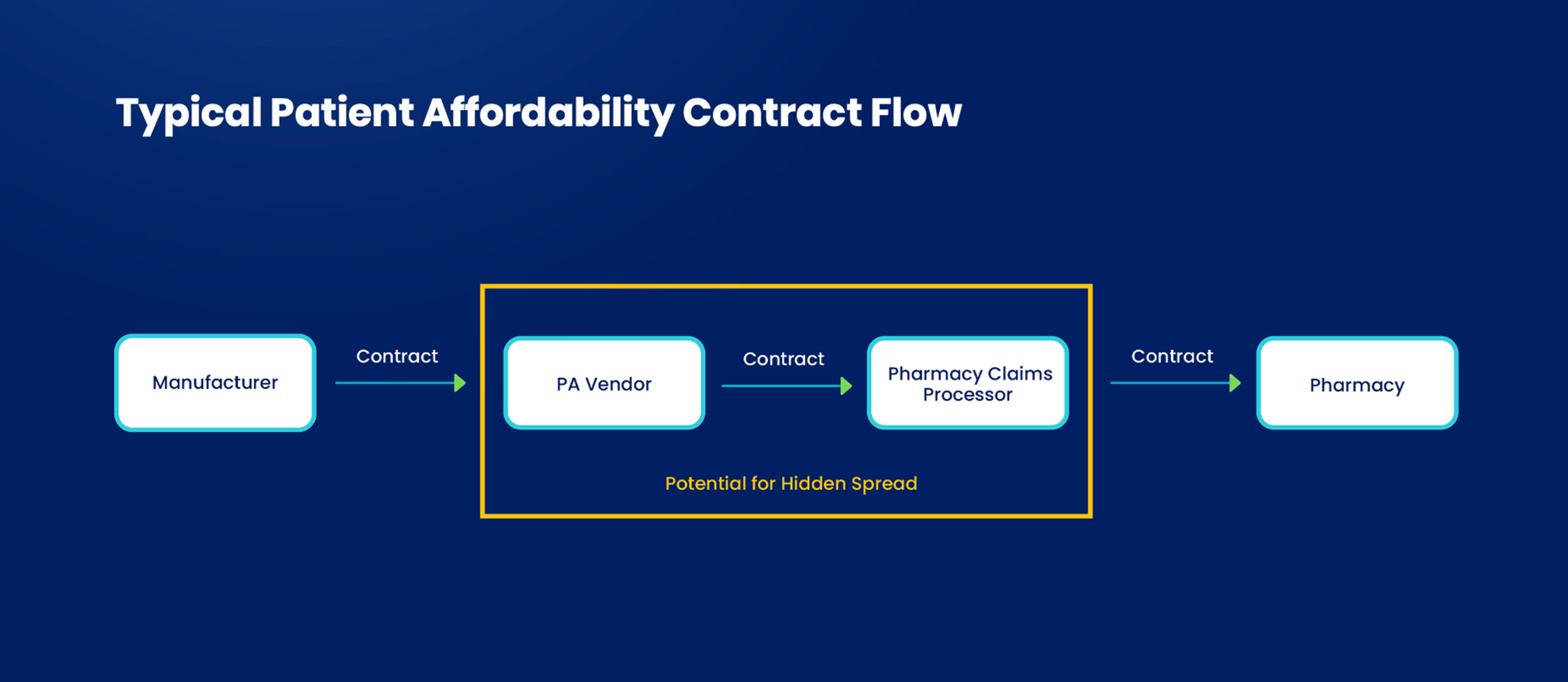

Four key players are typically contracted in a patient affordability program: the drug manufacturer, PA vendor, pharmacy claims processor, and pharmacy (see figure). The rate of reimbursement for dispensing a drug is contracted between the claims processor and the pharmacy and is influenced by the number of patients, or their “reach.” The larger the reach, the better rates they can negotiate.

The PA vendor, normally, doesn’t influence contracted rates with pharmacies; however, they are the only ones in this flow that can see what the pharmacy was paid and what the manufacturer has contracted to pay. This is where there is potential for a pricing spread, in which the PA vendor is charging significantly more for each claim than they are paying.

The PA vendor, normally, doesn’t influence contracted rates with pharmacies; however, they are the only ones in this flow that can see what the pharmacy was paid and what the manufacturer has contracted to pay. This is where there is potential for a pricing spread, in which the PA vendor is charging significantly more for each claim than they are paying.

Modeling Spreads on Voucher Claims

To give an idea of a normal spread on a voucher claim, let’s explore a scenario where a PA vendor bills a drug manufacturer at AWP -9%, but the pharmacy contracts at AWP -12%. In this case, the vendor has pocketed 3% of the AWP of the drug in that transaction. If it was a specialty drug with an AWP of $15,000, in-office dispensing (IOD), and the contracted rate of AWP -17.5%, then the vendor would have pocketed $1,275 on one fill of this drug. So, you can understand how much money can be made by a PA vendor who is implementing spread pricing on a single voucher claim.

What happens when we extend this example over the course of a year? Well, the numbers become shocking as PA vendors ensure they will make a hefty profit—which on average, can be over $700 on each voucher claim—regardless of the pharmacy distribution network.

In another example, we will use a mid-sized brand with a limited distribution network of three to four pharmacies, not including “wholly owned” chains, and IOD pharmacies to round out the coverage. Suppose they process a monthly average of 2,500 claims and the PA vendor charges AWP -11% on a $19,500 drug as the negotiated rate for the voucher program. Considering the pharmacy network makeup, an average pharmacy’s contracted rate would be AWP -15%. The PA vendor in this equation would receive an additional payout of $23.4 million over a year’s time as a result of the pricing spread.

While we have only mentioned voucher programs, pricing spread exists on bridge claims since the PA vendor’s processor is setting the rate the pharmacy will be paid.

Is There a Solution?

Here are helpful tools that manufacturers can use to determine and manage the total cost of running copay, voucher, and bridge programs over time.

- Look beyond per-claim fees of a few dollars when negotiating contracts—it is a good place to start but not the PA vendor’s biggest concern.

- Analyze listed fees in conjunction with hidden cost areas, such as voucher and bridge spread—compare these to vendors with a transparent pricing model.

- Dictate in contracts that pharmacies must receive the total amount of any passthrough costs attributed to areas for potential spread—voucher claims, dispensing fees, and any other probable areas.

- Validate all current programs—communicate with a partner pharmacy to see what was actually paid.

Spreads directly impact drug manufacturers’ bottom line. Indirectly, this unjustified cost impacts the healthcare ecosystem as a whole. Holding vendors accountable and eliminating costs that are the result of unfair pricing will help foster honest and transparent practices in the patient affordability industry and beyond.