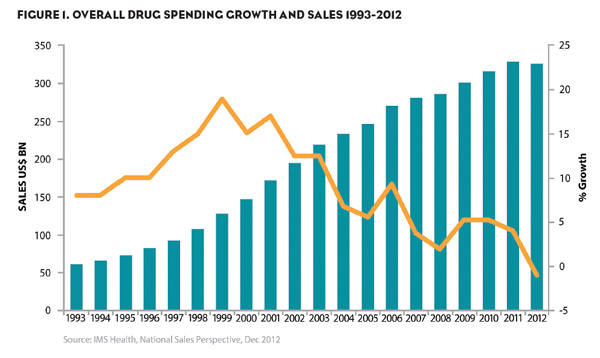

The IMS Institute for Healthcare Informatics released important findings recently in their report Declining Medicine Use and Costs: For Better or Worse? The report demonstrated for the first time in measured history how year over year drug spending in the United States declined by 1% from ~$329B to ~$326B. On a real per capita basis the decline was steeper coming in at a 3.5% drop. This decline represents the smallest progression the market has seen between 2007 and 2008. Figure 1 shows the overall trends according to the report since 1993.

It is well known that the industry has run into a significant string of branded medication loss of exclusivity (LOEs), which has been a driver of this trend. In 2012, heavily used former so-called “blockbuster” drugs such as Lipitor, Plavix and Singulair all had their generic alternatives available at a lower price point. A review of the patent expiry for many top selling branded medications shows significant exposure through the year 2016.

According to IMS’s National Prescription Audit (NPA), in 2012 the LOEs, combined with the access controls put in place by payers, drove the proportion of generics-to-brands dispensed in 2012 to an all-time high of 84%. Looking back 10 years, this proportion still favored generic dispensing—but only marginally—with 51% of all prescriptions dispensed being generic. While LOE-related prescribing is a significant driver of the trend noted, it would be too simple to suggest that LOE’s are the only market forces acting on the trend.

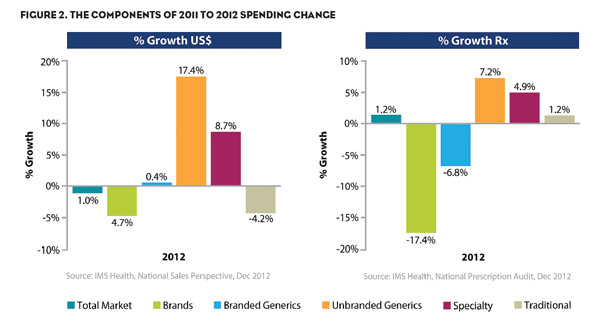

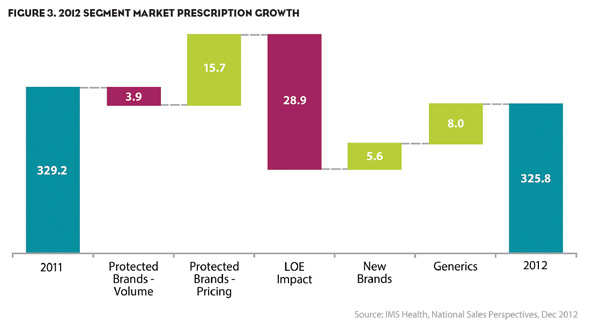

Looking at Figure 2, the components of the drivers of spending change can be measured using five different puts and takes. To get to the drop, we can see that while the principal driver of change was a $28.9B impact seen from LOE, there was also a $3.9B drop in spending due to a drop in the volume of all protected brands. This represents a total drop in spending of $32.8B.

Countering these drops are three market forces: a $15.7B gain driven from pricing increases from existing protected brands, $5.6B spends attributed to new drugs launched in 2012, and $8B attributed to the sales of the new marketplace generics. These gains accounted for $29.3B in spending.

However, not all of the branded markets demonstrated consistent behavior. Specialty drugs still are performing well given their ability to deliver better patient outcomes in previously unsatisfied markets. Figure 3 shows that prescriptions for specialty medications in 2012 grew 4.9% with spending increasing 8.7%.

In terms of health, the growth of prescribing in unsatisfied areas marks a positive signal for patient outcomes. Increased demand and access for generics improve the responsible use of those medications as their lower cost increases patient adherence—which of course ties closely with better treatment outcomes. In the meantime, newer and more innovative medications have been made available to patients who previously had limited options for treatment (RA, MS, oncology, etc.). This has improved their quality and length of life—and again improves the patient outcomes.

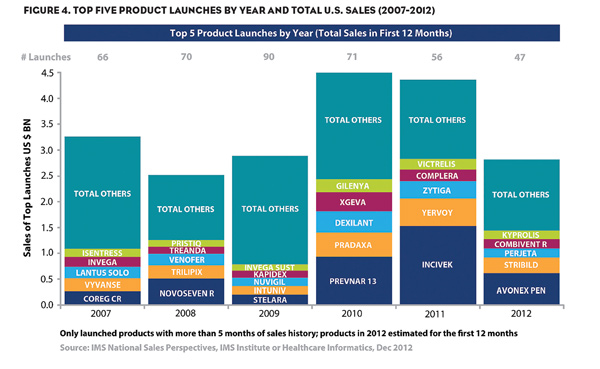

The specialty sector is where pharmaceutical companies see promise in upcoming years. A positive sign is the increased trend in new drug approvals, which is a marker of the level of innovation demonstrated by the industry. Figure 4 shows the launch and sales profile for top medications from 2007 through 2012.

In the last 3 years, 2010-2012, a total of 174 product launches occurred. The characteristics of the top drugs launched in these years include a significant number of specialty medications. Between 2011 and 2012, among the top five drugs in sales, six were launched into specialty markets. Overall, this period represents a profligate period of innovation for the pharmaceutical industry, rivaling the number of drugs launched in the so-called “golden era” of pharmaceuticals in the 1990’s.

The principal difference from the prior era is the quantity of launches remains in the therapeutic areas that are targeted. The medications that are being launched target smaller, but in many cases, unsatisfied conditions for which sufferers had limited or no treatment options previously. Where the traditional definition for “blockbusters” in the past was first 12 month of sales over $1B, the industry now is looking at a new definition of “blockbusters” in which creating improved outcomes in unsatisfied markets is the new form of the modern blockbuster.

While the decline in spending from 2011 to 2012 is a first for the pharmaceutical industry, it essentially marks the beginning of the end of the cycle in which many blockbuster drugs have seen and will see loss of exclusivity. The profile of today’s biopharmaceutical company appears focused on creating a new normal that pays particular attention to producing drugs in unsatisfied markets to improve the potential for positive patient outcomes. With market pressures from the government and payers similarly aligned, increased focus will need to be paid in upcoming years to performance of these innovative medications against the demand for positive patient outcomes.