Funding and access are not new topics of conversation in the rare disease space. Genzyme made headlines in the ’90s when it launched the enzyme replacement therapy Cerezyme for a then-unprecedented $300,000 per year. In 2007, Alexion set a new pricing milestone of $500,000 annually for Soliris, a treatment for an ultra-rare blood disorder. As prices continued to rise, industry analysts began to publish top 10 lists cataloging extremely expensive rare disease brands.

Cell and gene therapies (CGTs) marked a shift in the rare disease paradigm. While still expensive, they offer effective one-time treatments rather than exorbitant annual costs. The first wave of successful CGTs included high profile CAR T-cell therapies such as Kymriah and Yescarta, as well as vector-based gene therapies like Luxturna.

Today, the momentum of CGT access is growing among regulators and payers worldwide. We’re seeing a new wave of success stories, despite rising prices. bluebird bio’s Zynteglo for beta thalassemia has had recent success entering the U.S. market (despite challenges that led to withdrawal from European markets), as has Skysona for cerebral adrenoleukodystrophy (CALD). Orchard Therapeutic’s Libmeldy for metachromatic leukodystrophy (MLD) became the first one-time CGT priced at over $2M to be funded by NICE in the U.K., a market in which access is driven by rigorous cost effectiveness. Novartis’s Zolgensma for spinal muscular atrophy (SMA) is gaining access around the world with similarly high starting prices.

New Forms of Pricing and Payer Access Are on the Rise

In the early days of rare and orphan medicines, extremely high-priced treatments received less payer scrutiny than you’d see with more prevalent diseases. The overall budget impact was low, and there is a natural aversion to the negative optics of restricting access in diseases with significant unmet medical need.

More recently, payers require greater assurance they are paying for a meaningful clinical benefit. They have launched centers and teams devoted to monitoring and assessing therapies for rare and orphan diseases. Underperforming treatments are no longer overlooked in the shuffle of other high-spend categories. Commercial organizations have had to rethink how they collect and share evidence with the external world, and drug-makers have had to reassess how they capture value in their pricing.

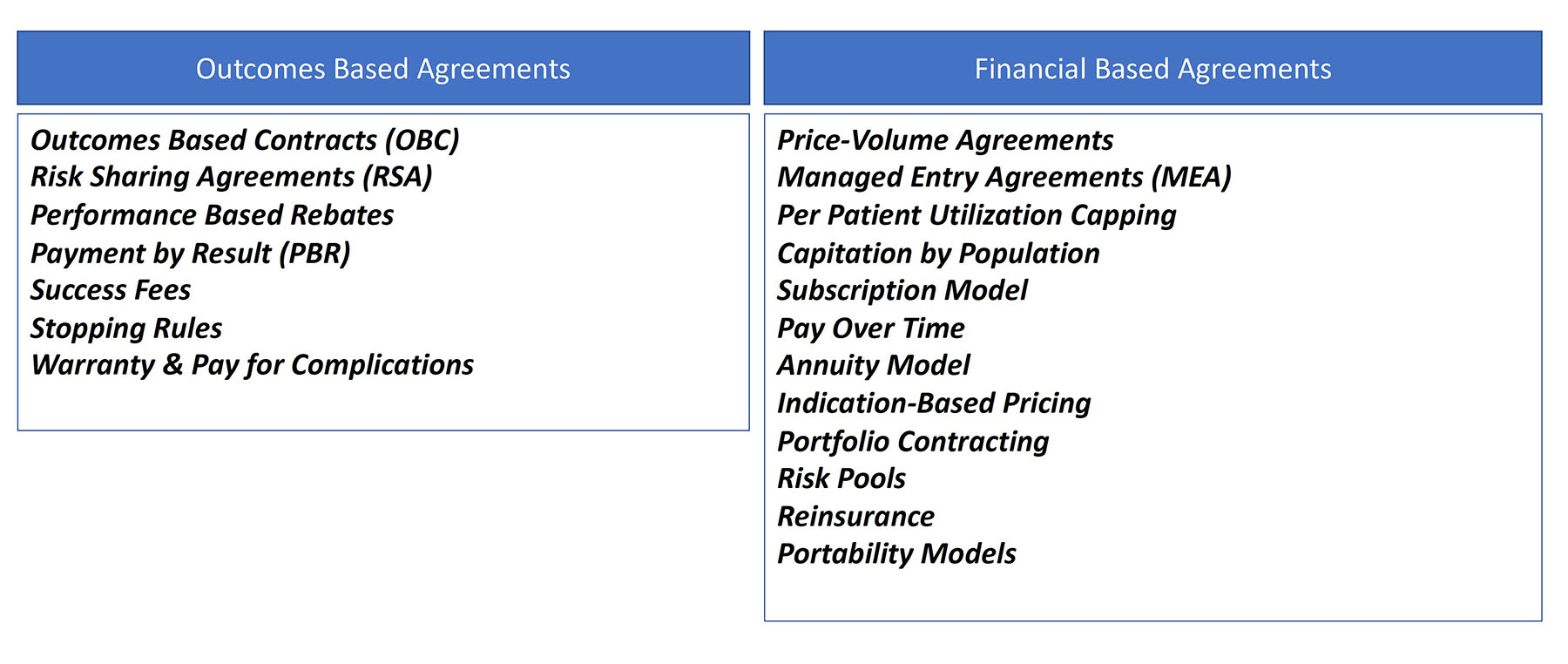

In the face of high community demand, rising prices, and more stringent payer requirements, new and innovative methods for creating market access have become necessary. Rare and orphan disease therapies are often approved with small, short duration trials with surrogate endpoints. For this reason, they are ripe for innovative payment models, value-based agreements (VBA), and outcomes-based agreements (OBAs). Innovative agreements can take various forms, ranging in the types and sources of clinical outcomes and forms of financial risk sharing (i.e., rebates, paybacks, or earned payments) (Figure 1).1,2

There are now so many different types of alternative access arrangements that in early 2022, the Academy of Managed Care Pharmacy (AMCP) convened an Advisory Group comprised of experts from health insurance plans, pharmacy benefit managers (PBMs), integrated delivery networks (IDNs), biopharma manufacturers, and consultants in order to segment the types of agreements and create a common lexicon.3 Lori Wood, Senior Principal at Valuate Health Consultancy and facilitator of the working group noted that “as a manufacturer, you can’t ask the payer what they recommend. The orphan drug-maker has to come to the table early with multiple ideas. There is no one size fits all.”

There are now so many different types of alternative access arrangements that in early 2022, the Academy of Managed Care Pharmacy (AMCP) convened an Advisory Group comprised of experts from health insurance plans, pharmacy benefit managers (PBMs), integrated delivery networks (IDNs), biopharma manufacturers, and consultants in order to segment the types of agreements and create a common lexicon.3 Lori Wood, Senior Principal at Valuate Health Consultancy and facilitator of the working group noted that “as a manufacturer, you can’t ask the payer what they recommend. The orphan drug-maker has to come to the table early with multiple ideas. There is no one size fits all.”

Outside the U.S., the global model for high-cost rare disease therapies already mandates that manufacturers offer a mix of innovative pricing and access arrangements. Francis Pang, Global Head of Market Access at Orchard Therapeutics noted that “payers globally want a menu of innovative pricing mechanisms: guaranteed outcomes, pay for performance, long duration of risk sharing, tiered pricing, and caps on the number of patients and doses.”

Curative CGT Is Driving a New Level of Funding and Pricing

By 2015, it was clear the era of one-time CGTs had arrived. Frameworks for how to value and price curative, one-time CGTs began emerging everywhere, through consortia of experts, think tanks, and CGT company executives.4

The early CGT entrants tested these theories. bluebird bio CEO Nick Leschly and team evangelized a suite of innovative CGT pricing approaches to use with payers around the world, including pay-over-time (or annuity) and outcomes-based risk shares. Spark Therapeutics launched Luxturna with flexible pricing options that included an OBA over three years, which promised rebates to payers in the event that participants did not meet the clinical milestones promised from trials. In Europe, Novartis’ Zolgensma payer reimbursement agreements include government registries to track health outcomes over five years, with rebates for clinical milestones that are not achieved or maintained. European payers have said the registry-based OBA will become the standard for all expensive one-time CGTs moving forward.

Innovative approaches are not easily applied in all markets. More centralized single-payer markets have different needs than fragmented markets like the U.S. Disease registries often cannot collect the ideal outcomes data relevant for product evaluation, and in the U.S. the solution is to lean on insurance claims and integrated health datasets for measuring outcomes guarantees.

As one-time CGTs take center stage in finding innovative approaches to payer access, it will be interesting to see how the makers of novel chronic rare therapies align. In many cases, the biotech companies leading the commercialization in the U.S. are very small organizations, which may impact their ability to invest in highly innovative pricing programs. Larger pharmaceutical companies are more equipped and have existing payer relationships and infrastructure to implement such agreements.

In the U.S., the Institute for Clinical and Economic Review (ICER) is playing a lead role in the initiative to get the value equation right for emerging rare disease products. Pang notes that in the U.S., “one way of avoiding having to hire a large field and payer engagement force is to simply leverage an ICER opinion. It takes some proactivity, but there is no reason you can’t talk with ICER pre-launch.” We are seeing ICER become more proactive in their assessments, and rare diseases are often selected given the high need and high-impact potential.

As more CGTs are approved by regulators, it will be increasingly important to consider the scalability of these innovative pricing and access models.

As Payment Structures Change, Patient Access Must Evolve

Rare diseases take the U.S. model of patient support and reimbursement hubs to new levels of white glove support. The arduous task of getting payers to agree to reimburse—even with some restrictions and red tape—can easily consume an entire launch phase if not managed carefully. Helping patients and families pull through the intent of their specialist to prescribe is an equally important access challenge. Patients need support to find centers where payer-approved specialists are contracted and able to give the treatments, and support for the submission of medical prior authorizations. In some markets, including the U.S., cost sharing and coinsurance constraints may need to be overcome.

Global patient access extends that white glove support worldwide. Patients in one country may need to seek centers and funding in entirely different countries. Any support center today, no matter its scope or size, must be equipped to help patients and families find treatment anywhere in a drug’s lifecycle, from pivotal clinical trials, to early access outside of trial, to market authorization pre- and post-country reimbursement.

In the words of Matt Trudeau, formerly of bluebird bio, “innovative pricing and access creates massive operational complexity to manage, so we have to do our homework well in advance.” Managing the complexity of commercializing rare and orphan therapies requires specialized Marketing, Medical Affairs, and Market Access teams that are up to the task.

References:

1. AMCP Value-Based Contracting Advisory Group. “In the World of Value-Based Care, Words Matter: A Lexicon for Value-Based Purchasing.” Academy of Managed Care Pharmacy; 2022:1-11. Available at: https://www.amcp.org/sites/default/files/2022-08/VBCLexicon_0726.pdf. Accessed May 22, 2023.

2. Neumann PJ, et al. “The History and Future of the ‘ISPOR Value Flower’: Addressing Limitations of Conventional Cost-Effectiveness Analysis.” Value Health. 2022 Apr;25(4):558-565.

3. Gonçalves E. “Value-based Pricing for Advanced Therapy Medicinal Products: Emerging Affordability Solutions.” Eur J Health Econ. 2022 Mar;23(2):155-163.

4. Facey KM, et al. “Implementing Outcomes-Based Managed Entry Agreements for Rare Disease Treatments: Nusinersen and Tisagenlecleucel.” Pharmacoeconomics. 2021 Sep;39(9):1021-1044.

Acknowledgements: Special thanks to Sonalee Agarwal, VP, Alnylam Pharmaceuticals, and Crystal Watson, Head of HEOR, Atara Bio for their contributions to this article.