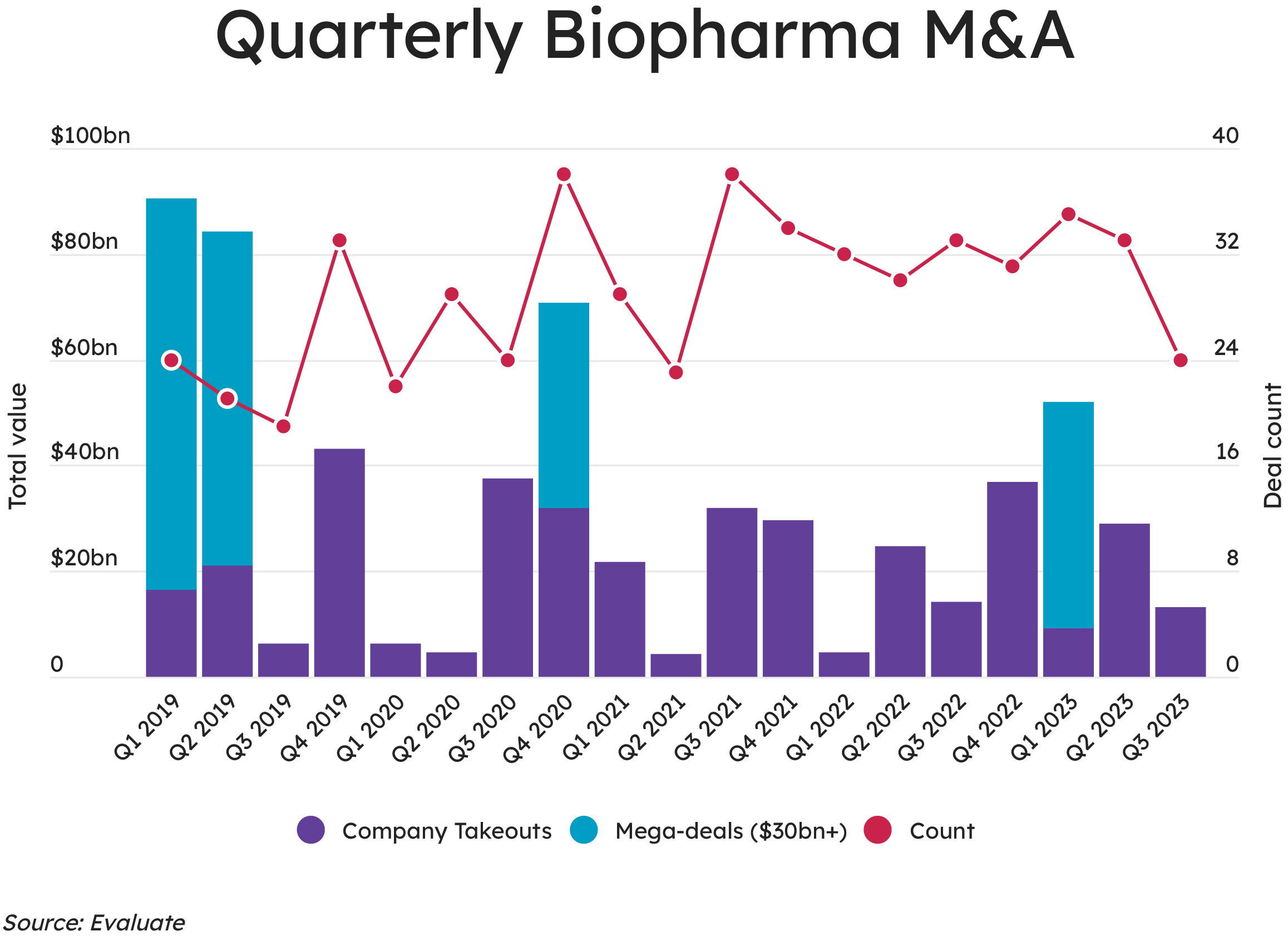

With 2024 on the horizon, many in the biopharma space are taking stock of 2023 and what the current environment means for their potential success next year. After a promising start to the year on the merger and acquisitions (M&A) front, the third quarter was a disappointment for those hoping that the challenging commercial situation was coming to an end.

Earlier this year, EY reported that a significant proportion of biotechs were set to run out of funds within two years and the current outlook makes that a real concern to many in the industry. Is this a natural rebound after the excesses of 2020/1 or a problematic overcorrection?

The likelihood is that it’s a bit of both, but dealmaking is the lifeblood of the pharmaceutical industry and with the first casualties of the patent cliff already being hit, big pharma companies have plenty of motivation to seek out deals with biotechs holding promising assets.

However, with many biotechs running out of road, the question is whether they can hang on for long enough for a deal to be done.

What Will Revive the Dealmaking Situation?

The longer that investment remains at suppressed levels, the more attritional the industry will be. This is not necessarily a bad thing—few drugs that enter clinical trials eventually gain approval—so concentration of investment around fewer companies, platforms, and assets that are more differentiated is better for long-term innovation. Nevertheless, picking the winners from the losers at early stages of R&D is as much luck as calculated risk.

Three drivers need to be activated in order to revive dealmaking:

1. De-risking catalysts for clinical-stage biotechs to drive valuation and M&A interest: Acquisitions over the past couple of years have largely focused on late- or commercial-stage biotechs with complementary product portfolios that can be easily bolted onto the large pharma buyer. Companies with first-in-class drugs for new oncology and immunology targets, as well as rare diseases, have been in particular demand. We are beginning to see companies enter or strengthen their position in the obesity race through M&A too.

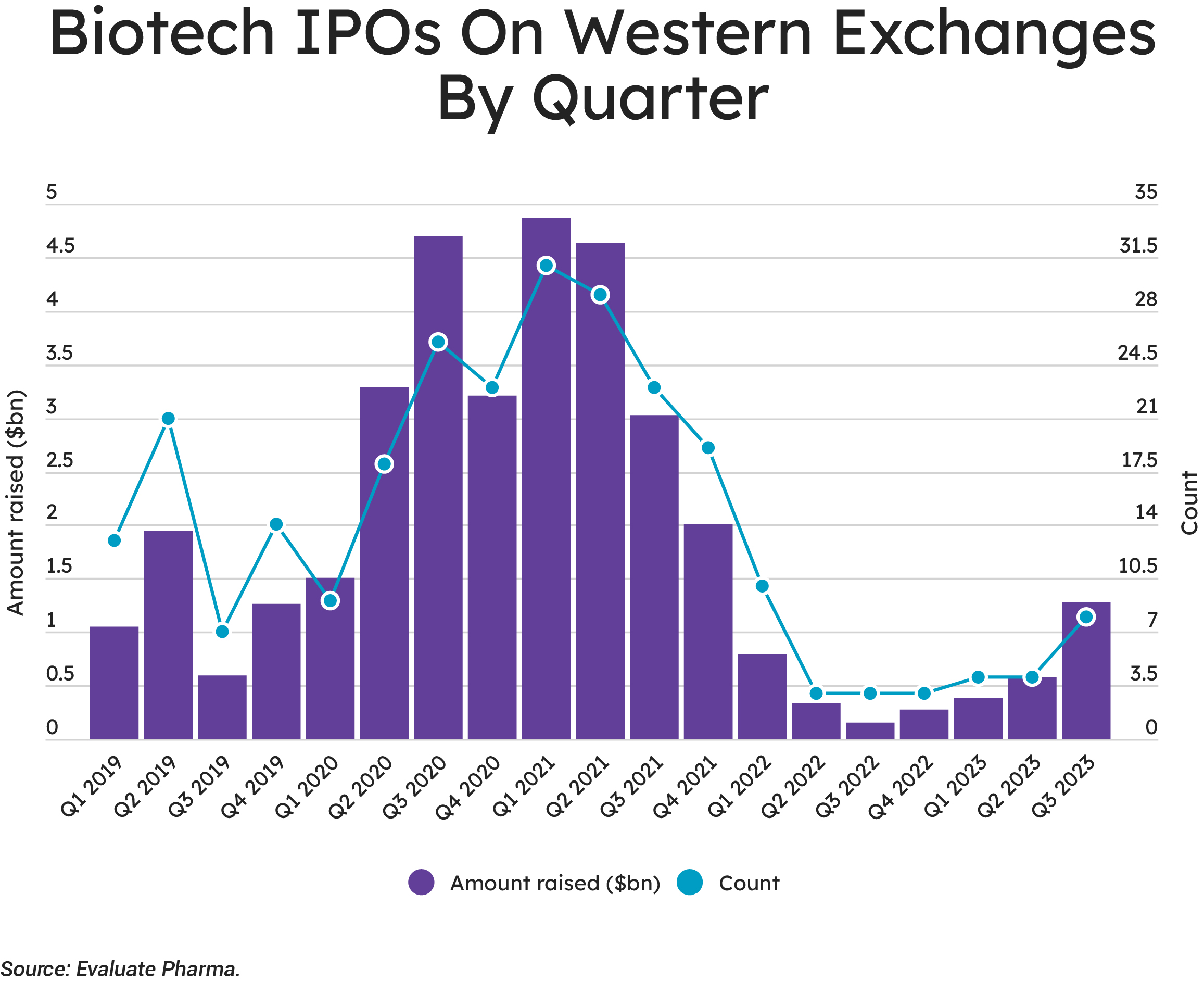

2. Share price performance and investor sentiment will reopen the initial public offering (IPO) window: Uncertainty is at the root of much of the poor share price performance. Global geopolitical uncertainty provides a challenging backdrop but the pharma industry itself has many questions that are holding back the market performance of small and mid-sized biopharma companies. The Inflation Reduction Act (IRA) continues to make investors nervous and, while it was ultimately unsuccessful, the FTC’s intervention in the merger of Amgen and Horizon will have done little to settle investors’ nerves.

3. IPO window will allow venture capitalists (VCs) to seed new companies, rather than supporting existing portfolio with down rounds: The IPO market has been quiet for the past couple of years, but the third quarter of the year did show some signs of promise. It was the first $1bn quarter since 2021 which does suggest that biotech’s IPO window is opening once more. However, many of those that did hit the public markets saw their initial valuations fall in the subsequent weeks. It’s also worth noting that all those IPOs were in the U.S. markets with the European window remaining stubbornly closed.

The Spirit Is Willing…

The wider macro environment suggests that M&A levels should continue to pick up after the disappointing lack of activity in the third quarter. The larger companies facing those patent cliffs need fresh assets to boost their product portfolios, especially in light of the IRA. Furthermore, many companies are sitting on large cash reserves which can be deployed for tactical acquisitions, especially with biotech valuations remaining suppressed.

These tactical additions to the portfolio are certainly the trend at the moment. Notably, the data in the figure below shows only a handful of mega deals over the past few years, with bolt-on acquisitions offering the most attractive option. The more appealing targets have a narrow therapeutic focus and best-in-class or first-in-class assets. This allows for a complementary portfolio fit without the kind of competitive overlap that comes under regulatory scrutiny from the FTC.

Acquiring companies are often looking for near-term growth drivers, which means that late-stage pipeline drugs are in high demand. For earlier-stage drugs, the conversation is often one around licensing and partnering, which allows both sides to mitigate the risks associated with R&D.

Acquiring companies are often looking for near-term growth drivers, which means that late-stage pipeline drugs are in high demand. For earlier-stage drugs, the conversation is often one around licensing and partnering, which allows both sides to mitigate the risks associated with R&D.

Healthy levels of M&A are essential to support the progression and availability of new treatments. It takes considerable investment to fully develop a brand’s potential, especially considering that additional indications and long-term data may be required for broad access. This may best be achieved by large pharma companies, with their combined $200bn annual R&D budget, compared to smaller companies that are relying on external investment. For investors in smaller companies, M&A also provides an avenue to reinvest into emerging science and to ensure that the pipeline keeps flowing.

…But the Market Is Weak

The venture financing that fuels the early-stage players has seen a slowdown of late. Evaluate’s VC data show quarter-over-quarter drops in the number of biopharma companies raising private cash and in the amount of money raised.

Biopharma companies raised $3.95bn in venture capital globally during the third quarter of 2023, but firms raising small and large rounds brought in far less cash during the quarter compared to Q1 and Q2. Given the rough time endured by the few firms that did manage to go public in recent months, some small firms may be grateful that they’ve not had that option yet and that they remain in the relative safety of their VC firms—albeit for longer than either party may have chosen.

Many of those companies that were able to squeeze through the narrow IPO window have struggled. Eight companies floated in the third quarter of 2023, raising $1.3 billion—but that cohort lost 29% of their value, on average, by early Q4. For some of these companies, there may be an element of being careful what you wish for, but we should note that several of the companies have performed rather well. Floating is always a gamble, and investors are inclined to punish any perceived errors harshly, so any players targeting an early 2024 tilt at the markets will need to be confident.

Many of those companies that were able to squeeze through the narrow IPO window have struggled. Eight companies floated in the third quarter of 2023, raising $1.3 billion—but that cohort lost 29% of their value, on average, by early Q4. For some of these companies, there may be an element of being careful what you wish for, but we should note that several of the companies have performed rather well. Floating is always a gamble, and investors are inclined to punish any perceived errors harshly, so any players targeting an early 2024 tilt at the markets will need to be confident.

How Can Biotechs Position Themselves for Deals?

What does all this mean for the individual biotechs that need to find the wherewithal to continue with their mission?

Firstly, a clear vision is required on how to create value for the end customer, whether that is patients, potential partners, or investors. Pharma is unequivocal in looking for assets that are first-in-class or best-in-class, with a measurable patient impact, so adopting a development roadmap with this shared mindset is essential. In the absence of this, raising capital will be a challenge considering the huge number of other companies vying for investment.

Secondly, an open mind when it comes to the type of deal on the table. Many of the more recent deals that have taken place have been a mix of upfront costs and milestone payments as the larger partners look to spread the risk of their investment. With fewer late-stage assets available, and a need for larger partners to look for early-stage, higher-risk opportunities, it is likely that this trend will continue. Biotechs should do their research to understand comparable deals and to define what a good outcome for their business would be.

Finally, of course, biotechs need to combine a focus on ensuring every penny is well-spent with working to prove the commercial potential of their lead assets. Biotech and smaller pharma companies are less equipped to navigate the commercial elements of getting their therapies to market. Having a clear view of patient population, payer perspectives, and manufacturing challenges may seem like a secondary consideration in the face of the clinical coalface, but when tempting investment, it’s not something that can be ignored.

In today’s tough market conditions, these approaches must all be informed by a data-driven value proposition. Prospective investors and partners are not just looking for a compelling growth narrative, but also robust business fundamentals. Demonstrate both and the path forwards becomes much clearer.