As many in the industry now know, the Inflation Reduction Act (IRA) is the most significant reform of Medicare prescription drug coverage since the creation of Part D and has wide-ranging implications for the healthcare industry. The recent announcement of the first 10 drugs selected for price negotiations is a significant first step in Medicare’s effort to directly set drug prices for seniors. However, the impact of the new law will reverberate in the industry for years to come. This article covers some of the reasons these drugs were chosen, how the process for price negotiation will occur, and the impact for the industry and for patients. With this understanding, marketers can plan their strategies amidst the pressures of price negotiations.

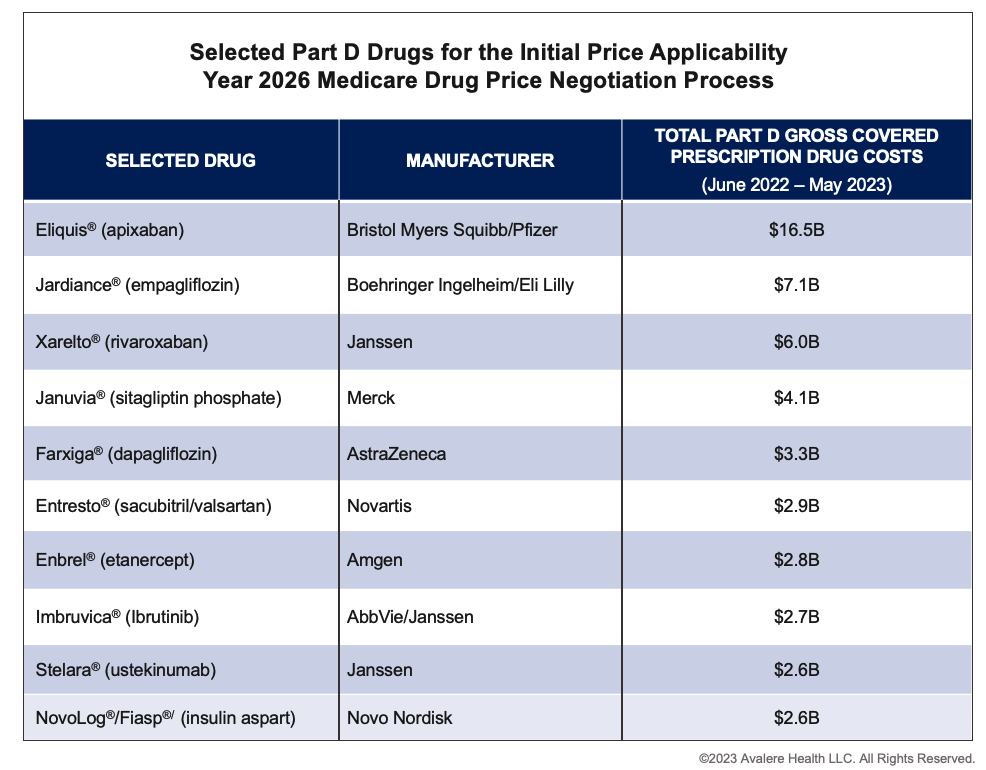

The Centers for Medicare and Medicaid Services (CMS) selected the first round of therapies for negotiations based on the following criteria:

- They have been approved for at least seven years for small molecule drugs and 11 years for biologics.

- They do not have biosimilar or generic competition available in the market.

- They do not qualify for any exemption (e.g., for orphan products or plasma therapies).

- They represent the top 10 eligible products based on highest gross Medicare spending between June 2022 and May 2023.

The drugs selected include anticoagulants, antidiabetic agents, heart failure drugs, and autoimmune and cancer therapies.

Over the next few weeks, manufacturers will submit a range of clinical, marketing, sales, pricing, and patient data, and then meet with CMS to discuss submissions later this fall. CMS will present an initial offer for each drug’s maximum fair price (MFP) by February 1, 2024. Companies will then have 30 days to either accept or submit a counteroffer and have the option to participate in up to three negotiation meetings prior to the negotiation period closing on August 1, 2024. The MFPs will be announced publicly in September 2024 and go into effect on January 1, 2026.

Over the next few weeks, manufacturers will submit a range of clinical, marketing, sales, pricing, and patient data, and then meet with CMS to discuss submissions later this fall. CMS will present an initial offer for each drug’s maximum fair price (MFP) by February 1, 2024. Companies will then have 30 days to either accept or submit a counteroffer and have the option to participate in up to three negotiation meetings prior to the negotiation period closing on August 1, 2024. The MFPs will be announced publicly in September 2024 and go into effect on January 1, 2026.

The penalty for not participating in the process or agreeing to a price is significant. Manufacturers who do not wish to accept a price must either remove all products from Medicare and Medicaid coverage or face a 95% excise tax.

The Ripple Effects of CMS’ Price Decisions

Drugs selected for negotiation represent therapeutic areas and diseases that are critical to Medicare patients, including cardiovascular disease, diabetes, and chronic kidney disease. Additionally, highly competitive classes, such as rapid-acting insulin and immunologics are included on the selected drug list. Many of the products on the list already offer significant price concessions and rebates to Part D plans in securing formulary access. CMS negotiation may lead to additional savings for beneficiaries and for the Medicare program. However, it will also create market disruption for the 10 products directly impacted, as well as prescription drugs in the affected therapeutic areas, which could impact patient access.

CMS’ price decisions for these products will certainly have ripple effects across these therapeutic classes. Manufacturers of non-selected products in these classes should consider the implications for future formulary coverage in Part D, evidence generation in light of changes in perception of value, and their own products’ future negotiation processes. Manufacturers will want to understand the changing plan economics under Part D redesign in addition to the coming effects from drug negotiation as they embark on contract negotiations for the 2025 plan year and beyond. Manufacturers that expect portfolio assets to be selected in upcoming price applicability years should prepare by assessing the strength and rigor of differential clinical data to inform an evidence-generation strategy to optimize their value dossier.

Furthermore, many of the selected products are direct competitors or products that CMS will look at when determining comparative effectiveness between each selected product and its therapeutic alternative. Manufacturers will have to consider how to balance competitive interests while making the best possible case for the innovative value of the therapeutic class.

Considerations for Generic/Biosimilar Entry

Many of the drugs selected for negotiation are nearing the end of their respective lifecycle and could see generic or biosimilar competition before the new price takes effect. Manufacturers of drugs negotiated for Initial Price Applicability Year 2026 and future years should assess when generics and biosimilars are likely to enter the market. Even if a drug is selected for price negotiation, the timeline of generic or biosimilar entry may make a selected product no longer eligible for negotiation or shorten the effective period of its MFP.

Ultimately, CMS’ determination of the MFP could also present challenges to biosimilar or generic entry. Stakeholders interested in commercialization of biosimilars and generics must also reassess commercial planning to account for how the MFP determination could devalue a therapeutic market.

The IRA’s Impacts Beyond Medicare

The prices set under the program will be public, and private insurers may seek to leverage these prices as a benchmark in negotiations with manufacturers for selected drugs and competitor products. Pricing and contracting strategies are expected to shift, and manufacturers may consider changes to their launch price strategy for new market entrants.

For the first two years of the program, all selected products will be self-administered medicines covered under Part D. After this period, CMS will begin to include physician-administered drugs covered under Part B in the program. The IRA sets physician reimbursement of these products at the CMS-established MFP plus 6% versus current average sales price. This will effectively reduce physician reimbursements for selected drugs and could also have downstream application to the commercial market.

Some stakeholders have expressed concern that negotiation could lead to a reduction in drug innovation. The Congressional Budget Office predicts that reduced pricing could lead to manufacturers developing fewer small molecule drugs because the law gives these drugs a shorter, nine-year, post-approval window before “fair prices” are implemented. According to PhRMA, two-thirds of manufacturer companies have already stated they’ll need to revisit their pipeline strategies to evaluate small molecule drugs across a sequence of planned indications in clinical development program(s).

What the Future Will Hold

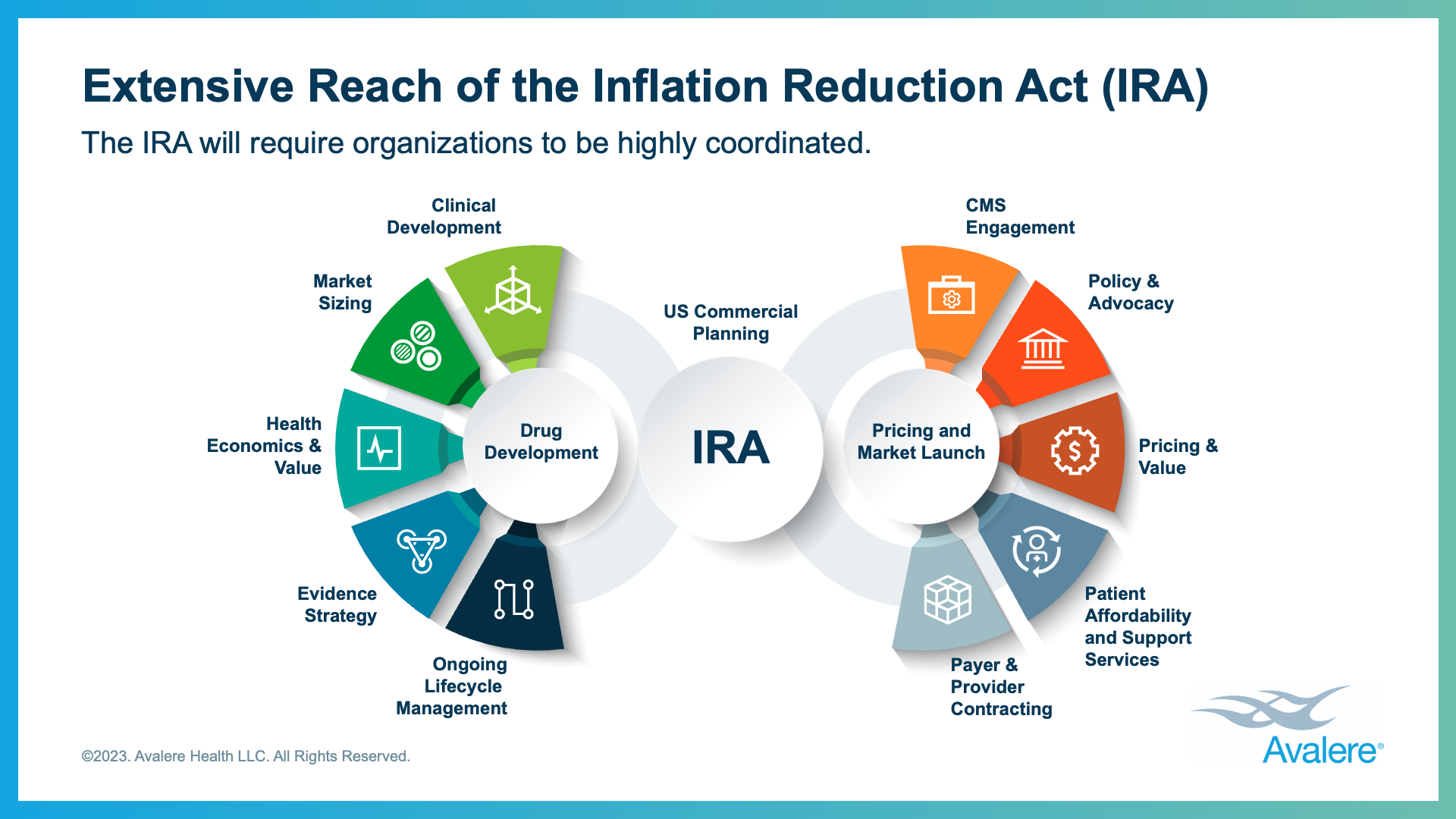

CMS negotiations will expand to include 15 additional Part D drugs for 2027 and another 15 under Part B and D for 2028. Life sciences companies must now reconsider every stage of a product’s lifecycle, from investment to development phase, all the way through to inline assets. They will need to create a new framework that accounts for the changes that the IRA has introduced to a product’s journey to market.

The list of products chosen for negotiation in the first year will impact the potential timing of selection for other high-spending drugs, so manufacturers should continue to analyze qualitative and quantitative factors that could impact the negotiation potential in their portfolio and pipeline. Additionally, manufacturers that expect their portfolio assets to be selected should assess their evidence-generation strategy to optimize their value dossier for future negotiation.

The list of products chosen for negotiation in the first year will impact the potential timing of selection for other high-spending drugs, so manufacturers should continue to analyze qualitative and quantitative factors that could impact the negotiation potential in their portfolio and pipeline. Additionally, manufacturers that expect their portfolio assets to be selected should assess their evidence-generation strategy to optimize their value dossier for future negotiation.

A lot is still unknown regarding how the IRA will impact products entering the market. This is the first and most significant change seen to drug pricing in decades, but companies that plan ahead will be well prepared for potential changes.