As a mission-driven company and digital healthcare leader, GoodRx has helped patients obtain an estimated 80 million prescriptions they otherwise may not have been able to afford.1 We have been improving patient affordability for over a decade, across generic and brand medications, including specialty treatments—sometimes by more than 50%. GoodRx is the leading platform2 with the highest unaided awareness and trust across patients, physicians, and pharmacists3 that Americans—regardless of insurance status—use across many phases of their healthcare journey. Our solutions enable pharma manufacturers to engage with providers and patients so they can start and stay on the right medication and improve their health outcomes.

A key goal is to minimize worries about out-of-pocket (OOP) costs and affordability in the decision-making process so a provider can prescribe the most appropriate medication for their patient, and the patient is not forced to choose between groceries or medicine. However, as the use of specialty medicines continues to increase, we believe it’s time to take a fresh look at how our industry helps patients with access and affordability.

The Uses—and Costs—of Specialty Treatments Keep Rising

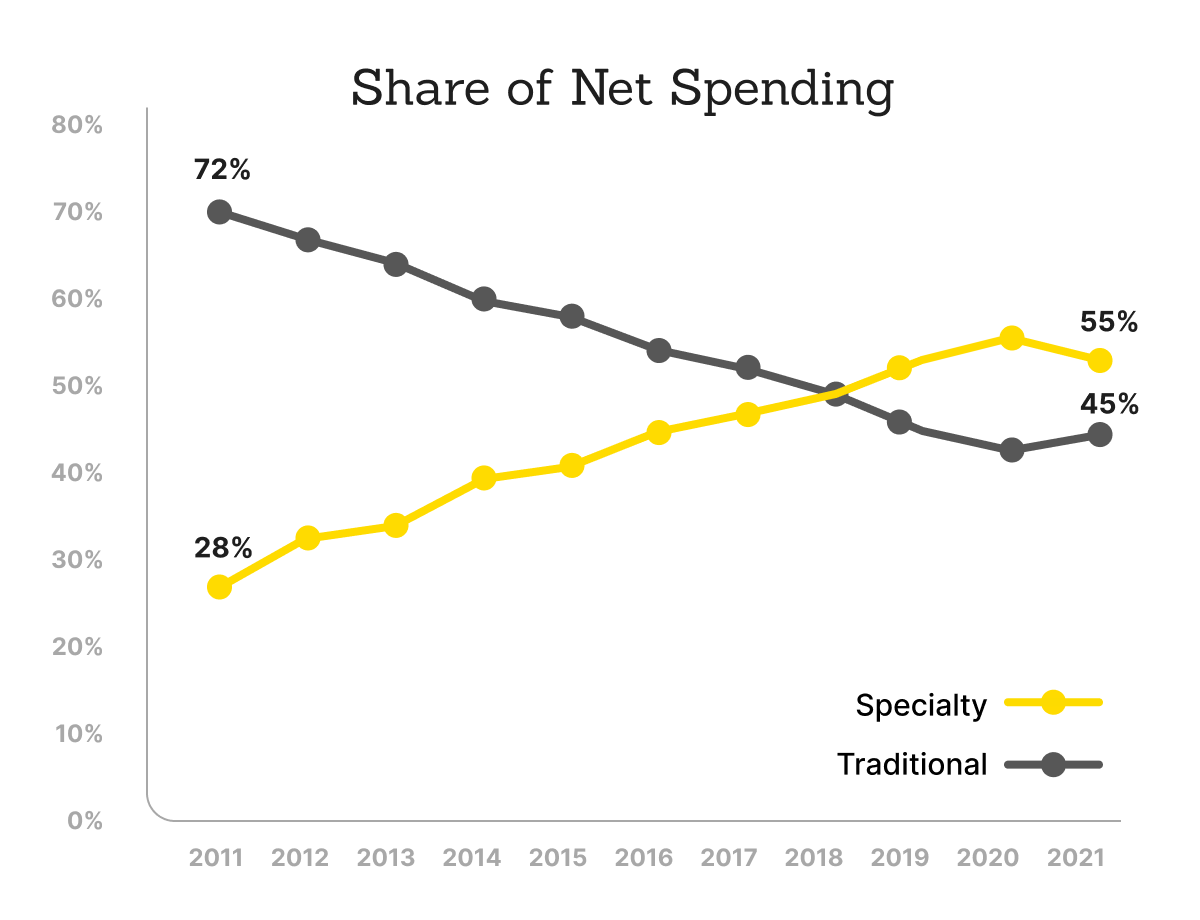

A U.S. aging population, a rise in the net per capita spending on specialty drugs, an increased life expectancy (apart from the impact of COVID), and the increasing prevalence of chronic diseases are expected to boost the specialty pharmaceuticals market to $352 billion by 2027.4 Specialty drugs now account for 55% of category spending,5 primarily driven by costs and growth in immunology and oncology therapies (Figure 1).

Since GoodRx’s founding in 2011, we’ve seen firsthand that specialty brand drugs continue to have additional, more complex access and affordability barriers. Insurance approval and distribution for specialty drugs can cause significant treatment delays up to three to four weeks for many patients.6 This has major implications due to the severity of the conditions that specialty drugs treat and the potential for untreated diseases worsening and progressing. Our aim at GoodRx is to reduce friction and increase transparency to enable patients to more quickly start and stay on specialty therapies as prescribed by their HCPs.

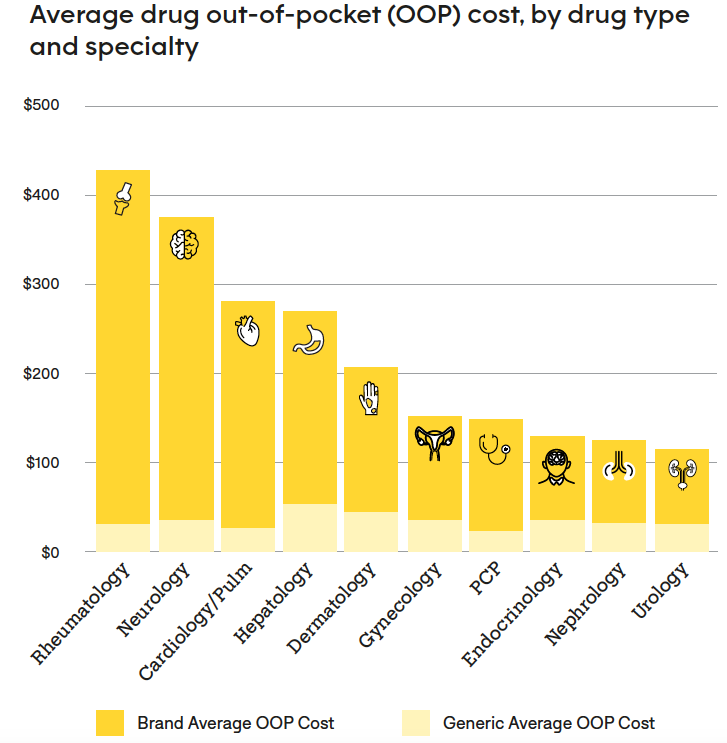

A recent GoodRx analysis across 10 specialties (Figure 2) demonstrated that the larger the OOP cost gap between generic and branded drugs, the less likely patients were to fill their prescription—and the greater the opportunity to reduce abandonment rates by lowering costs for patients. These valuable insights can help pharmaceutical companies improve the design, distribution, and management of their copay assistance programs to align more closely with average patient OOP costs and the brand-generic gap in the therapy areas in which they market Rx medications.

Affordability Can Improve Adherence Across Specialties

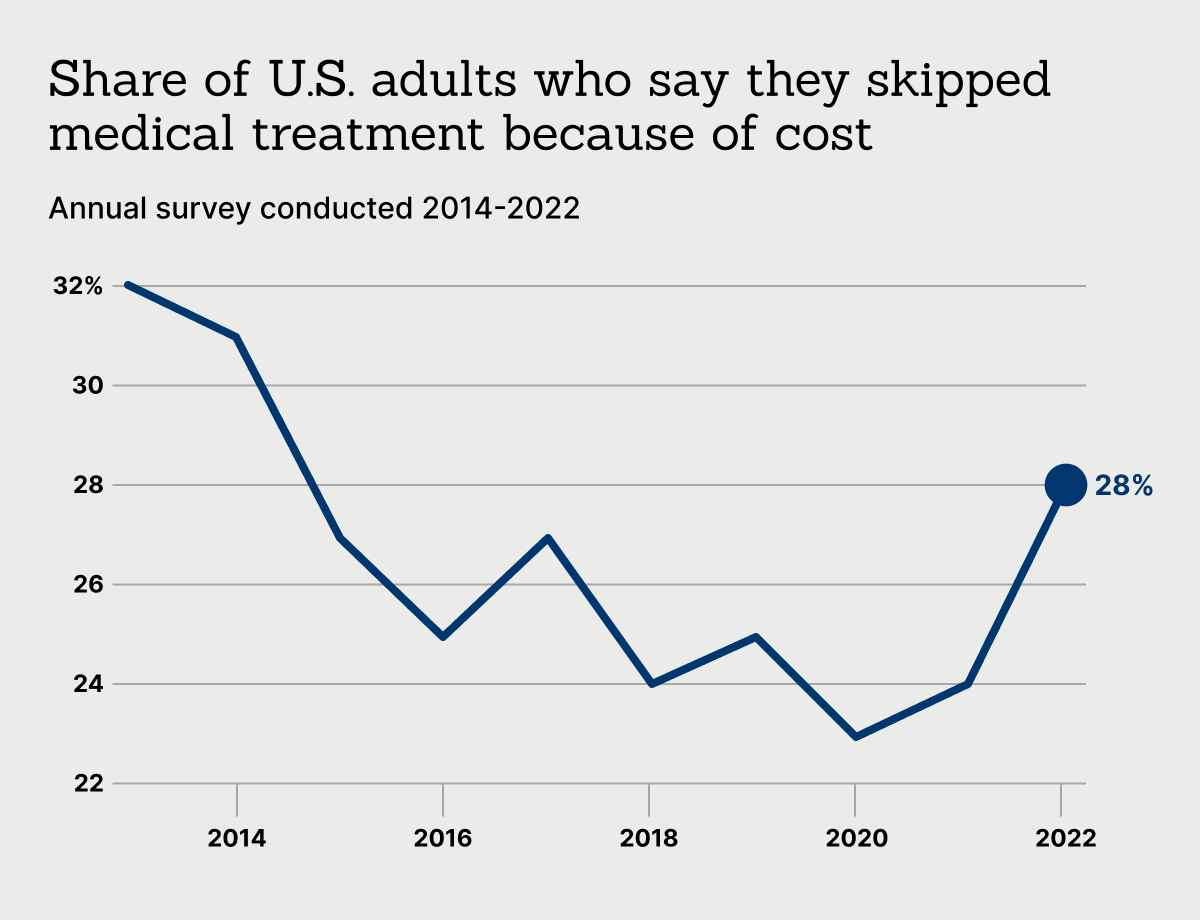

Improving medication affordability is the right thing to do, and it’s also the smart thing to do because of its impact on Rx abandonment, adherence, and health outcomes. The share of Americans who skipped medical treatment last year because of costs rose substantially, according to a new Federal Reserve survey published in May, “Economic Well-Being of U.S. Households in 2022” (Figure 3). The study found that “28% of adults went without some form of medical care in 2022 because they could not afford it, up from 24% in 2021.”7

When you consider the negative consequences of discontinued treatment, the ripple effects of unaffordable care and medications are significant. According to a recent GoodRx study, “While most aspects of day-to-day life have returned to a new ‘normal’ following the 3+ year COVID-19 pandemic, debt due to medication and healthcare costs remains a real concern…. Nearly 36% of Americans report that paying for prescription medications over the last year has been very difficult or somewhat difficult.”8

Consumerism Increases Focus on Value of Specialty Meds

Consumers’ perception of the value of healthcare products and services—including specialty treatments—has become more sophisticated and grounded in their day-to-day reality. The pandemic and other recent disruptions highlighted that patient affordability can be complex, and takes unique combinations of people, organizations, technologies, and resources to address.

Not all causes of non-adherence can be easily overcome, but patient OOP cost is one for which effective solutions—like GoodRx—exist today. However, because the affordability crisis looms so large in the U.S. a number of other solutions providers have recently entered the market.

Specialty Brands Also Benefit from the ‘GoodRx Effect’

As a digital health pioneer, GoodRx has systematically cultivated extremely loyal and engaged provider and patient audiences over the past decade. We often say that our platform enables pharma brands across all specialties to “reach the audience they want at the scale they need,” across the entire health journey. This commitment to objectivity, close attention to health literacy and user experience, and breadth of topics and services across the healthcare journey is part of what has led our users to name GoodRx as their number one trusted digital health savings platform.9

We continue to learn about the specialty needs of our audiences. For example, our user research uncovers the key pain points for patients and providers across top conditions on GoodRx like immunology, oncology, multiple sclerosis (MS), and women’s health, specifically fertility and osteoporosis. These users visit the 500+ drug pages on the GoodRx platform for products that are specially distributed or administered.10 Further, 2.9 million consumers have visited specialty drug pages on GoodRx, and patients taking a specialty treatment have almost double the number of medications in their basket than non-specialty users.11

We continue to learn about the specialty needs of our audiences. For example, our user research uncovers the key pain points for patients and providers across top conditions on GoodRx like immunology, oncology, multiple sclerosis (MS), and women’s health, specifically fertility and osteoporosis. These users visit the 500+ drug pages on the GoodRx platform for products that are specially distributed or administered.10 Further, 2.9 million consumers have visited specialty drug pages on GoodRx, and patients taking a specialty treatment have almost double the number of medications in their basket than non-specialty users.11

GoodRx’s Increased Specialty Focus Supports Brands of Any Size

Over the past 11 years GoodRx has gained unique insights about a range of specialties, including their similarities and differences when it comes to HCP behaviors and patient affordability. GoodRx solutions support a broad variety of specialty therapies, including vaccines, biologics and other targeted therapies, and medical diagnostics and devices.

GoodRx solutions can extend the reach of patient support and copay programs for pharma manufacturers that have existing specialty infrastructure, as well as deliver supplementary solutions—from awareness to access to adherence—for companies and brands that may not have a complete patient support ecosystem in place. Here are a few examples:

- GoodRx Health – Content hub that helps patients find answers with thousands of credible articles and videos, including co-branded content that can help patients better understand and take action throughout the complex specialty journey

- GoodRx for Providers – Healthcare providers consult GoodRx at the point of prescribing to help patients with access and affordability, and leverage tools like specialty hub enrollment forms

- Patient Navigator – Custom patient segmentation tool to drive users to the right solution or enroll in a hub

- GoodRx Assist – Point-of-sale (POS) rebate program that attracts cash-paying patients who require additional financial assistance to start and stay on medication.

It’s clear that specialty-focused therapies will continue to grow, and GoodRx can be a valuable partner to pharma manufacturers in this space. Click here to learn more about how our insights and solutions for specialty can help your brand.

References:

1. GoodRx Q3 2021 Letter to Shareholders, November 10, 2021, https://investors.goodrx.com/static-files/10cb1adf-5ada-4dff-b394-eb200c774c5a.

2. Qualtrics Brand Tracker Survey of GoodRx users, June 2021 – July 2022.

3. GoodRx Q1 2023 Earnings Presentation, May 10, 2023.

4. “United States Specialty Pharmaceuticals Market & Forecast 2020-2026,” BusinessWire, December 8, 2020. https://www.businesswire.com/news/home/20201208005835/en/United-States-Specialty-Pharmaceuticals-Market-Forecast-2020-2026-Focus-on-Oncology-Autoimmune-Immunology-HIV-Multiple-Sclerosis-Hematology-AMD-HGH-.

5. IQVIA Institute, March 2022. https://www.iqvia.com/.

6. “Specialty medication experience: Obstacles and opportunities,” Surescripts, September 2022. https://surescripts.com/lp/specialty-medications-data-brief-2022.

7. U.S. Federal Reserve, “Economic Well-Being of U.S. Households in 2022,” May 2023.

8. Sasha Guttentag, “Survey: More Than a Third of Americans Still Struggle to Afford Their Prescription Medications,” GoodRx.com, July 13, 2023. https://www.goodrx.com/healthcare-access/research/medication-debt-survey-2023.

9. Based on Qualtrics Brand Tracker Survey comparing GoodRx to 10 other digital healthcare savings brands, June 2021 – July 2022.

10. GoodRx internal data.

11. Ibid.