Over the past 20 years, well over half (58%) of the New Active Substances (NASs) that have successfully been introduced within the U.S. pharmaceutical market have been specialist driven. And particularly since 2010, these products have delivered strong growth. Yet, their success has had some unintended and potentially long-lasting consequences for the economics of our health system.

QuintilesIMS has analyzed the impact that specialty products have had on payers’ practices and patient behavior as well as on pharmaceutical manufacturers’ sales. The findings, presented here, raise two very serious questions for the industry: 1) will specialty brands be able to retain their value in the marketplace and 2) will innovation continue to be rewarded to the extent necessary to perpetuate it?

Larger Benefit for Smaller Numbers

Between 2010 and 2016, an astounding 35 brands delivered more than $300 million in sales in their first year on the market. Their success stems from the fact that they are innovative and are meeting a market need, especially in oncology, autoimmune diseases, and central nervous system disorders. Nearly a quarter (24%) of launches in 2013 could be characterized as innovative (up from 15% in 2007), and fully half of all brands launched between 2011 and 2016 entered markets with high need (compared to 27% in 2007).1

But, a larger economic story can be missed in light of this success: The patient population benefiting from launch brands is shrinking. In 2007, on average, approximately 180,000 patients were exposed to a launch brand, a number that had fallen to 40,000 by 2015. This has created the perfect health-economic storm for payers who are now paying four times the cost for products that benefit one quarter of the patients. They’re left with less in their budgets to cover the lion’s share of their insured population.

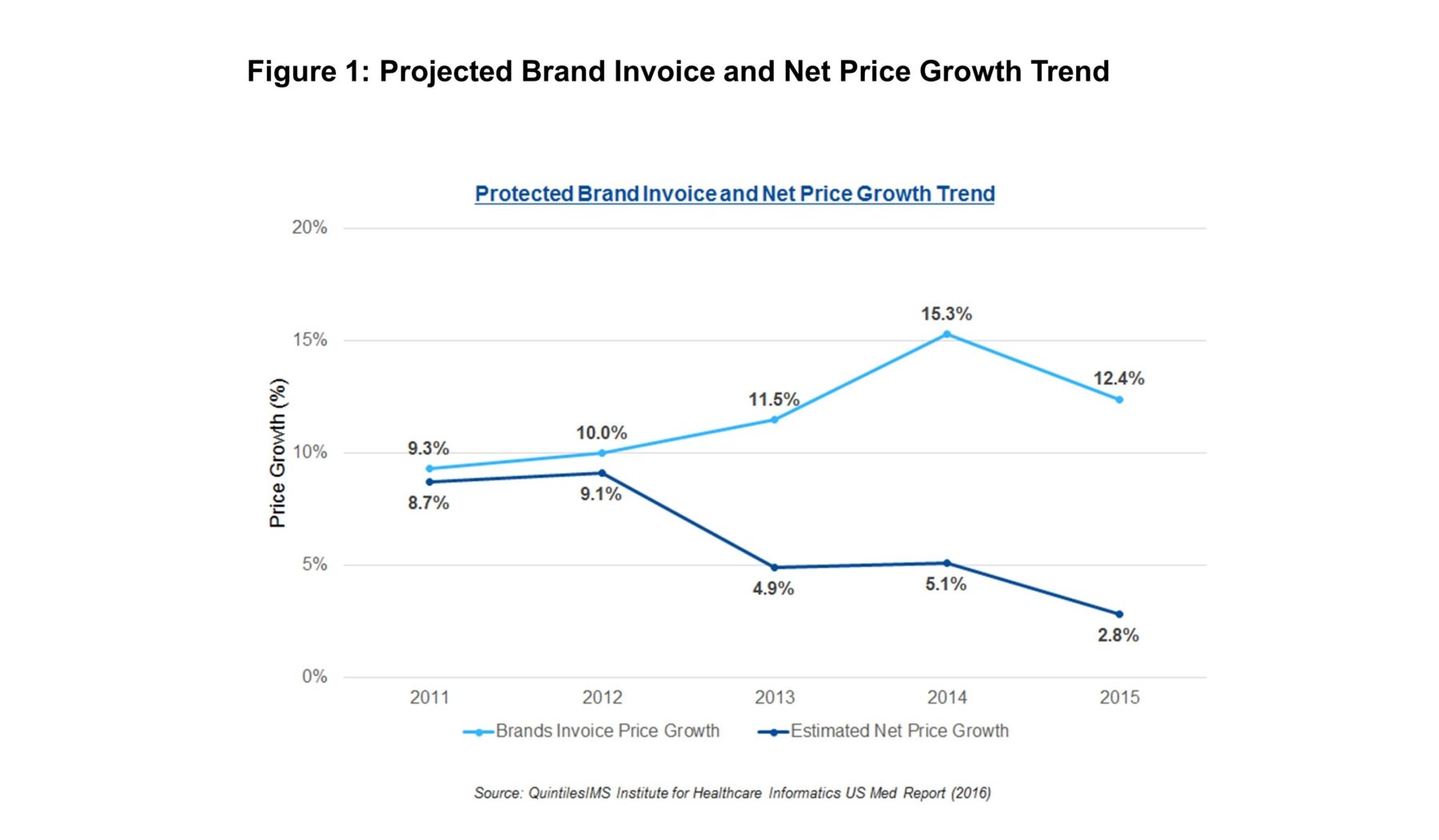

Payers can address this financial challenge either by negotiating deeper rebates with pharmaceutical companies, or by aggressively managing patient access to launch brands. Figure 1 shows that in recent years, payers have been successful in extracting steeper price concessions from manufacturers. Consequently, the industry’s net price growth slowed sharply in just three years—from 9.1% in 2012 to 2.8% in 2015.

Payers can limit patient access to expensive launch brands either by decreasing formulary coverage and/or by increasing the patient’s co-pay. To measure the impact of decreasing formulary coverage, we tracked the percentage of prescriptions presented to pharmacists that insurers reject due to lack of coverage. Within commercial plans, pharmacy rejection rates have soared from 12% in 2010 to 33% in 2015.

Payers can limit patient access to expensive launch brands either by decreasing formulary coverage and/or by increasing the patient’s co-pay. To measure the impact of decreasing formulary coverage, we tracked the percentage of prescriptions presented to pharmacists that insurers reject due to lack of coverage. Within commercial plans, pharmacy rejection rates have soared from 12% in 2010 to 33% in 2015.

Similarly, we should be able to quantify the impact of co-pay increases by examining prescription abandonment at the pharmacy. Although abandonment rates have remained fairly stable from 2010 to 2015, we believe that this is simply because the impact of co-pay increases is being offset by a growing use of co-pay assistance programs.

Thus, launch teams are absorbing a one-two punch—they are simultaneously granting deeper rebates to payers and providing more patient support.

Unintended Consequences

In this environment, prescription fill rates (total prescriptions presented at the pharmacy, minus those rejected and abandoned) for innovative brands is quite low. In 2014 and 2015, the fill rate during the first six months of launch was 39% for innovative brands and 57% for non-innovative brands, suggesting that payers are much more aggressive in limiting access to innovative brands.

So, given payers’ pushback, the question becomes: Is the industry’s innovation still being rewarded? The answer is a cautious, “yes, but less than in the past.” And the change is taking place rapidly. From 2010 to 2013, innovative brands generated sales approximately three times the size of sales for non-innovative brands. In 2014 and 2015, that ratio had shrunk to about two times the size. So, the differential is diminishing at an alarming rate.

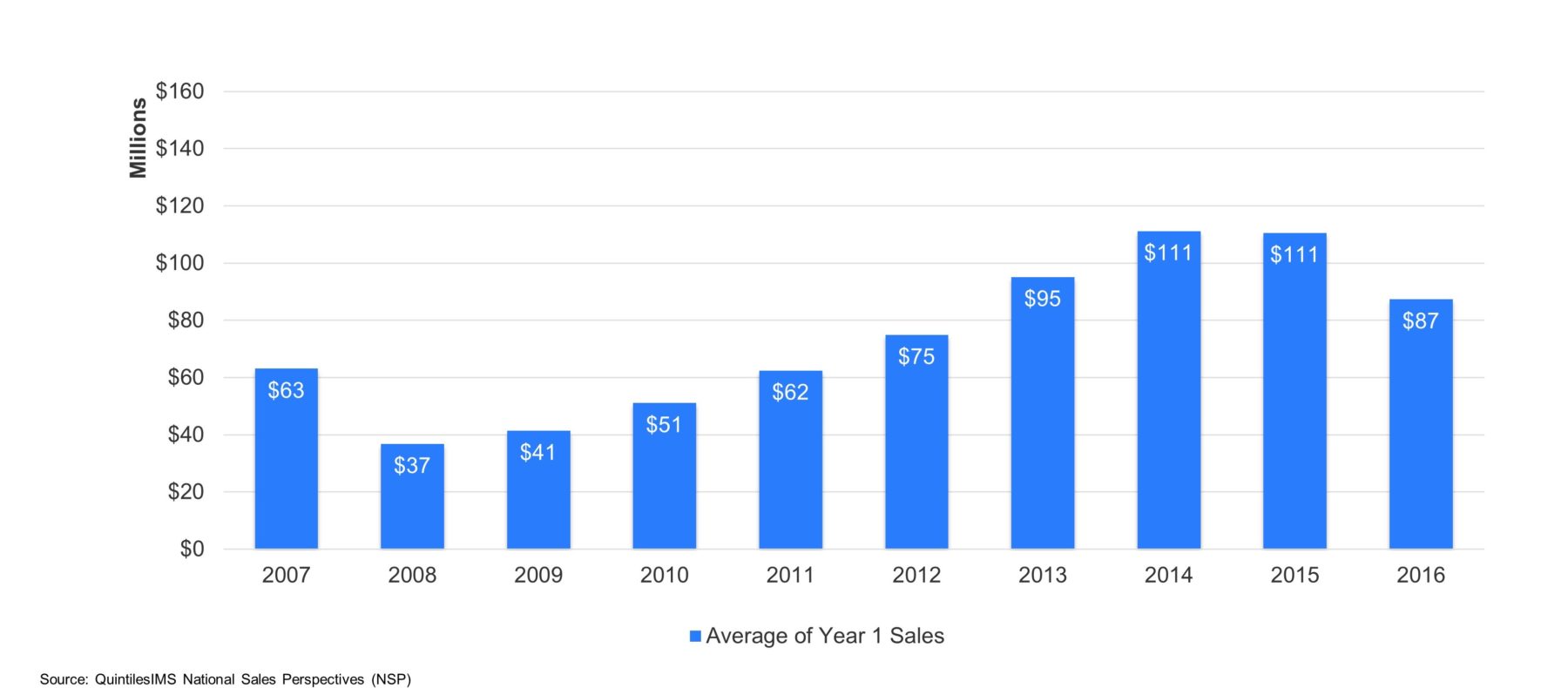

The outlook for the future is worrisome as payers’ budgets are finite, and something must give. Although in 2016, 25% of launches were categorized as innovative and 50% were launching into a market of high need, these brands are projected to have the lowest average first-year sales since 2013. (See Figure 2.)

What Can Innovators Do?

What Can Innovators Do?

Manufacturers must modify their best-demonstrated practices to account for the deepening influence of payers, taking steps to:

- Adopt more robust demand modeling to improve their forecasting capabilities. By more accurately sizing their asset, brand managers can better manage expectations of senior management, shareholders, and industry analysts.

- Carefully plan how to optimize their use of rebates and patient assistance programs to avoid over compensating.

- Employ a multichannel marketing model with a fully integrated and enabled customer team.

- Allocate their promotional resources across their marketing channels to reflect the regional nature of payers’ influence.

- Cultivate an intense patient focus. Specialty treatments are mostly geared to relatively small segments of patients with complex, difficult-to-manage disease. Identifying these patients and supporting their treatment for optimal outcomes will be key to excellent launches.

- Ensure, in the long run, that the cost of innovation is borne appropriately by all who benefit, not simply by today’s payers and patients. This will require creativity in addressing the macroeconomics of medicine.

The R&D industry’s contributions to patient health and to advancing medical science are universally applauded. Yet, innovation—more precisely its price tag—is forcing payers to aggressively manage their budgets in ways that are dampening revenues for specialty brand manufacturers. Yes, the rewards for innovation are still there, but for how long? The trend is not encouraging and may foretell a new era of limitation within the industry.

Footnotes:

1. Based on an objective scoring model developed by QuintilesIMS to assess innovation and market need.