Networking has become the career buzz-term of the decade. It is everywhere; and Lord knows we business faculty pound it into the heads of our students on a daily basis. We tell them to use LinkedIn, make calls, rehearse elevator speeches, collect cards, do informational meetings, send out hand written cards, never eat alone, consider it a full-time job, and never ever stop doing it. But the truth of the matter is that most of us do not do it very well. If we can get off the dime at all, it is usually when we are losing our job. Then we say, “Uh oh, I better start networking!” Sales people are good at it, and consultants better be good at it, or the distinction between consultant and unemployment quickly evaporates.

And even when we do network, it may have a directionless, organic feel to it. We call someone we know, meet with them and see what happens. If we do enough of this we believe that the numbers alone will drive some good things to us, but we probably wasted a lot of time doing it. This lack of planning is a little like having a new product to sell and wandering around the street trying to figure out who might like to buy it. What company or brand manager would ever launch a product that way? And here we are launching the most important product of our lives that way. It’s amazing.

So beyond just brow beating us all about networking: What else can be done? First, we can start thinking of ourselves as brands that we are launching or relaunching. After we have defined our brand (a subject for another column) we need to do two things: 1) Decide what segment of the market we are aiming at, and 2) build a strategy to penetrate it. The first of these is probably the simplest, but it is also passed over by many of us.

This brings us to penetration strategy—really the point of this column. Most of us understand that we need to think of networking as information and contact gathering, and not job requests. We understand that all networking conversations should end with the name of the next person to call. But what we may not understand is that we should be thinking of each contact from a target marketing point of view. The value and opportunity that each network contact presents varies widely. The challenges and goals of a conversation with a friend of a friend needs to be thought of very differently from a conversation with a senior vice president that we have never met before. And the payout from these different “markets” is also very different.

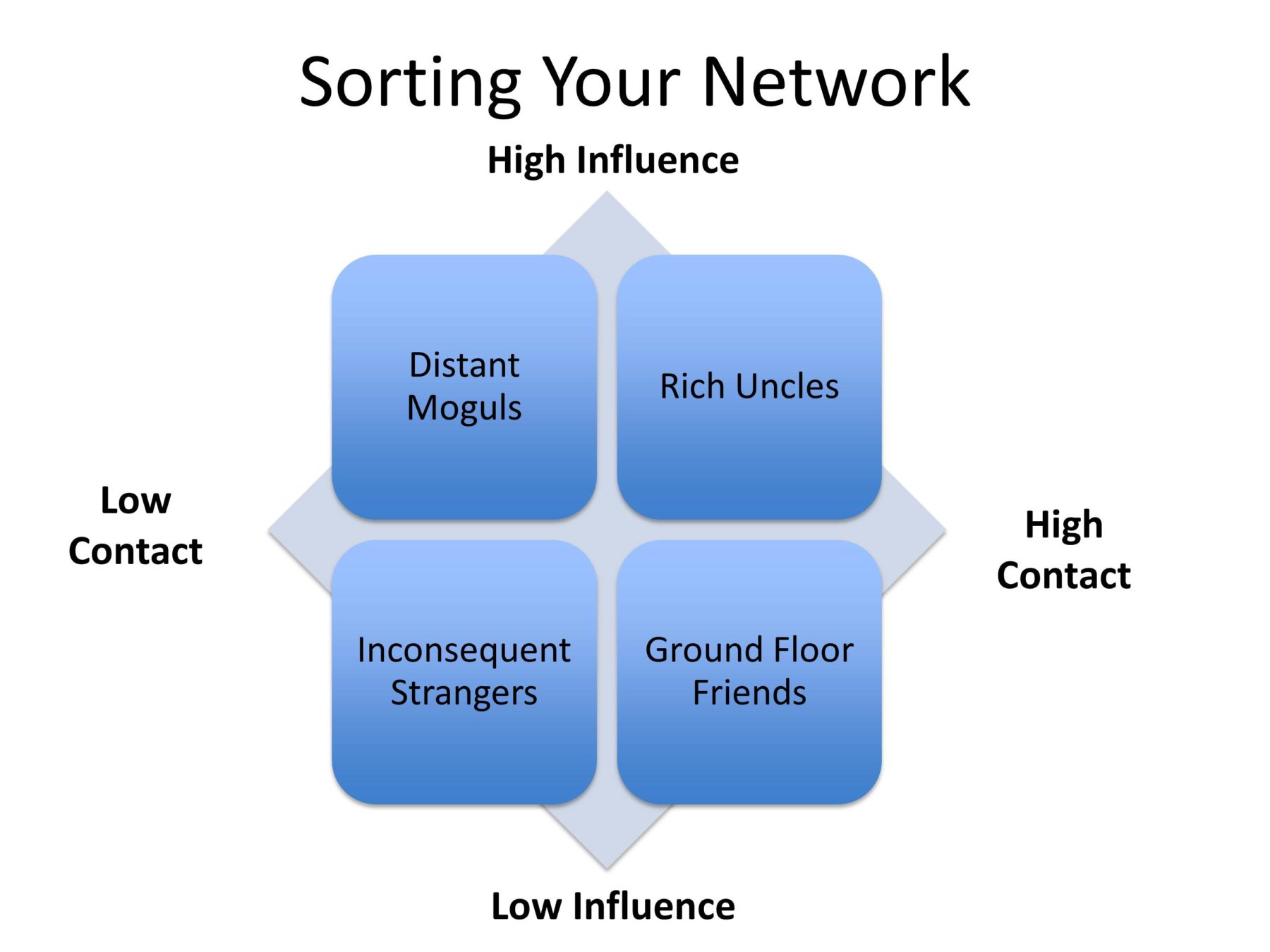

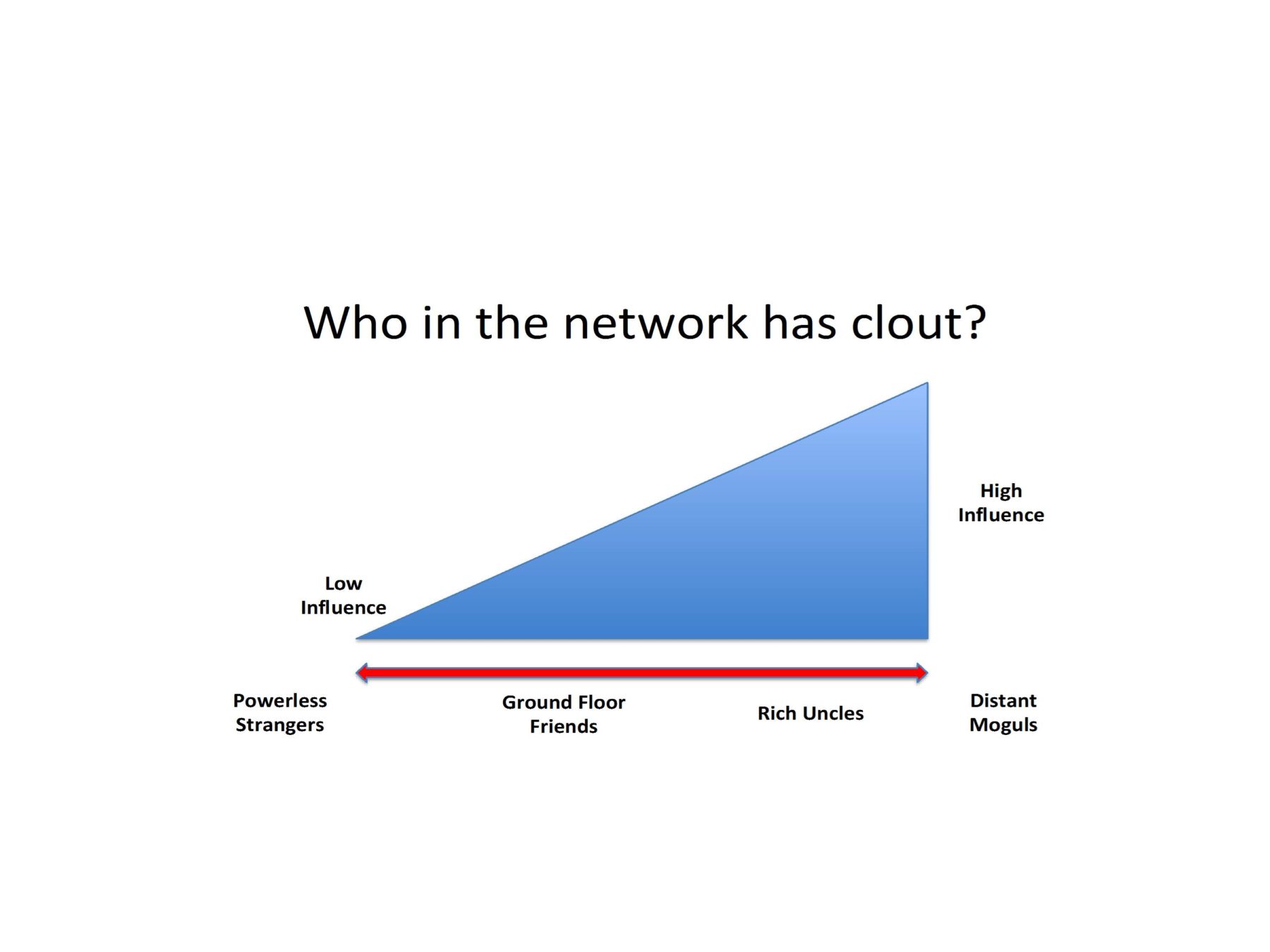

The table below provides an interesting way to understand network target markets. It does this by using two contact variables (level of influence and level of contact). Each of these cells represents a different micro market with different advantages. The goal for each is to go after what they have to offer with a clear strategy.

Cells 2 and 3 are the ones that we are likely to have the clearest opinion of. Cell 2 is made up of influential people whom we know and who know us. They are our “rich uncles” because they are the ones who are the most likely to have the ability and interest in finding us jobs. But the truth of the matter is that most of us do not have a network heavily stocked with rich uncles. If you have rich uncles, they should be carefully maintained, because clearly they are the most likely to help you find the best opportunity.

Cell 3 is the other obvious cell because we are most likely to view it as valueless—so we ignore it. But these people are not valueless. They are the thin edge of the wedge of your network. They have the least influence, but they are the people who can introduce us to one of the most valuable groups—their ground floor friends. You never know who they know.

Cell 3, the “ground floor friends,” may be the most important group. They can do several things for you; most importantly they can tell you about their company. This information includes where the opportunities are, who the decision makers are, what the culture is like, and how the hiring process works. In essence, they can be your internal information network (spies)—and there is no other cell that will provide this for you. They are also relatively easy to reach. So the thinnest edge of the wedge can quickly get you to this most important cell.

Cell 3, the “ground floor friends,” may be the most important group. They can do several things for you; most importantly they can tell you about their company. This information includes where the opportunities are, who the decision makers are, what the culture is like, and how the hiring process works. In essence, they can be your internal information network (spies)—and there is no other cell that will provide this for you. They are also relatively easy to reach. So the thinnest edge of the wedge can quickly get you to this most important cell.

The challenge with Cell 1 (Distant Moguls) is that you don’t know them, and they do not know you. Getting to see them will require a bridge from another network member—most likely a rich uncle. These people owe you nothing and they are doing someone else a favor just to see you. Once you get in front of them your job is to quickly find a way to make some sort of personal connection and then make a clear and brief presentation of your brand. You will need to leave them with a memory, so that they will be able to say: “Oh I remember Mueller, he was the guy who…”

So building and using a robust network means doing several things:

- Focus on the segment of the market that you want to work in;

- If you have a rich uncle, cultivate the relationship further;

- Work from the thin side of the wedge by cultivating your internal informers; and if you get to a mogul,

- Be prepared with a clear brand description and a memorable personal connection.

This micro analysis will take the randomness out of your network building and lead you more quickly to your next career opportunity.