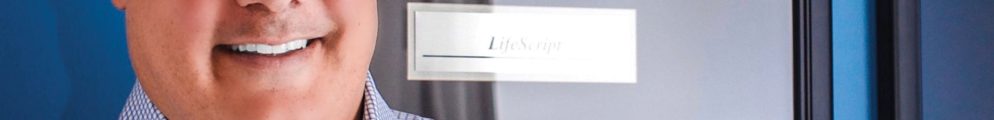

As a pharmaceutical marketer, you know the chance of your drug being on a formulary exclusion list has increased dramatically in recent years. Why? Employers are demanding a way to manage growth in their pharmaceutical spend, and the two largest pharmaceutical benefit managers (PBMs), CVS Health and Express Scripts, have responded by increasing the number of drugs excluded from coverage (Figure 1). As a result, patients are required to pay the full cost of their medication. That’s a real problem for a marketer. If your drug lands on a formulary exclusion list, you need to know how to respond most effectively; it’s why I’ve written this article.

Two Critical Questions Your Plan Should Address

Two Critical Questions Your Plan Should Address

CVS Health and Express Scripts typically announce their formulary exclusion lists for the upcoming year the first week in August. If your drug is on the list, you immediately bear an immense responsibility. Your next steps have major implications for the health of your brand and your career. You recognize that the exclusion carries tremendous potential to negatively impact brand finances and that senior management needs answers that will enable a positive and confident response to questions by the board, shareholders, and the financial community. To meet senior management’s needs, your plan should address at least these questions:

- What is the sales impact of the exclusion?

- How will you manage the loss caused by the exclusion?

What is the sales impact?

Sales impact can be ascertained through two estimates: The direct impact of the formulary exclusion on patients and healthcare professionals (HCPs) and the indirect impact on prescribing by HCPs.

Direct impact on patients

Your contracting team will provide an estimate of the direct impact on net sales; it is drawn from the analysis the team completes when determining the rebate to offer. Remember that not all PBM clients adopt the exclusion list, but the number that do has grown each year. Adjust your estimate accordingly.

Indirect impact on prescribing

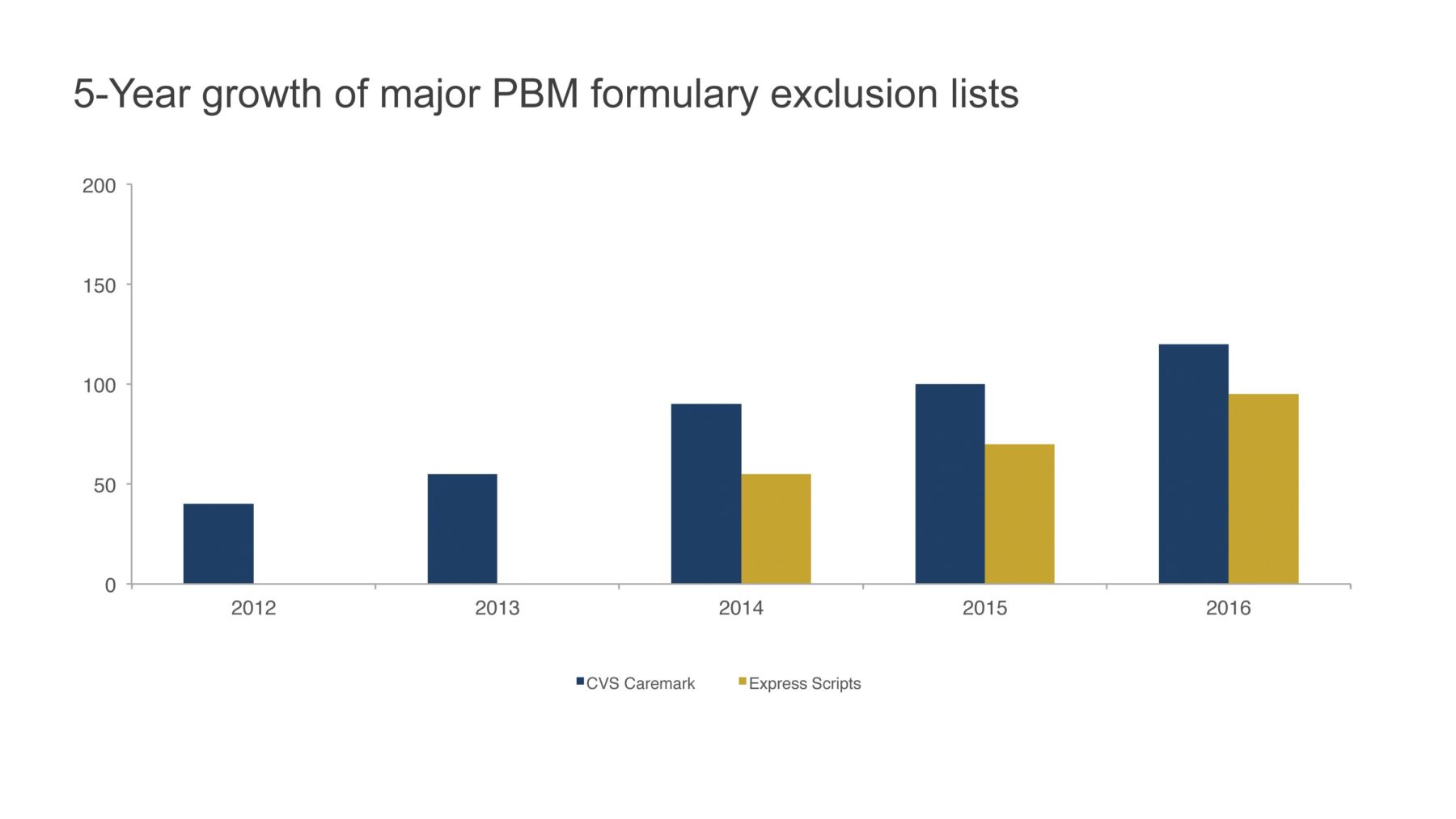

Known in the industry as spillover, healthcare providers often form exaggerated perceptions of restricted access. In turn, they prescribe less of an excluded drug—even to patients whose access has not been restricted. Because there is a natural tendency to overestimate the frequency that negative events occur, spillover is essentially the HCP response to increased patient complaints about full-price co-pays, calls from local pharmacies due to a National Drug Code (NDC) block, or new prior authorizations.

Does negative spillover really exist? The answer is a resounding, “Yes!” I can state this with confidence because my team has observed it in primary research and measured it with secondary data.

The backstory: When I had contracting responsibilities within the industry, I too doubted spillover’s existence. Yet spillover was often the rationale for offering more aggressive rebates than our contract model justified. I became determined to measure it. As leader of an independent consulting practice, I could dedicate the time and resources to understand spillover’s effect—and to develop and refine a methodology to measure it (Figure 2).

To accurately measure spillover, you must marry prescription and formulary data, two data sets that do not easily align. We developed a payer hierarchy that achieves this. Today, it is in use at 13 different pharmaceutical companies for a multitude of market access applications, including the measurement of the direct and spillover impact of changes in access, such as brand placement on a formulary exclusion list.

To accurately measure spillover, you must marry prescription and formulary data, two data sets that do not easily align. We developed a payer hierarchy that achieves this. Today, it is in use at 13 different pharmaceutical companies for a multitude of market access applications, including the measurement of the direct and spillover impact of changes in access, such as brand placement on a formulary exclusion list.

How will you manage the loss?

Once you have an estimate of both the direct and spillover impact of a formulary exclusion, you can develop a plan to manage each.

Managing the direct effect

Your plan to manage the direct loss from a formulary exclusion should include tactics designed to retain existing patients and procure future ones. There are a number of patient assistance program types to consider, many of which offer real benefits. When designed well, these programs can be worth the investment. Choosing or designing one of these programs is outside the scope of this article, but one caveat when designing a patient assistance program is to be diligent in estimating its cost.

Managing the spillover effect

The objective for managing negative spillover on HCP prescribing is straightforward: Use pull-through messaging that will align HCP perceptions of access with the reality of access for their practice. Unfortunately, traditional pull-through messaging practiced across the industry falls short of this objective. To learn why, one pharmaceutical company surveyed HCPs who received traditional pull-through messages about their perceptions of a brand’s access. When an HCP’s perceptions were compared with the brand’s actual access for that HCP, the survey found that many HCPs perceived the brand’s access as far worse than it actually was. The result: The brand’s market share was lower than HCPs whose perceptions were consistent with reality.

Which raises the question: Why doesn’t traditional pull-through improve access perceptions?

When surveyed, HCPs stated they prefer pull-through information that is an accurate representation of their expected access experience based on the patients they treat. Instead, they said they typically receive messaging concerning a percentage of lives for an unrelated population (e.g., state- or nationwide), or a cherry-picked list of payer formularies that cover a brand but not their patients, or tier information without the actual out-of-pocket amounts their patients pay. Traditional pull-through messaging does not meet these needs—and its effect on their prescribing reflects this.

In response to HCP preferences, a new HCP-specific approach to pull-through messaging has recently been developed. It differs from traditional pull-through by presenting information about the current brand access experience for an individual HCP’s patients. This messaging includes an access percentage derived using information about the HCP’s practice, a list of payer formularies for whom the HCP prescribes, and local co-pay amounts for the payer formularies listed.

Traditional Messaging vs. Dynamic Messaging: Is There a Difference?

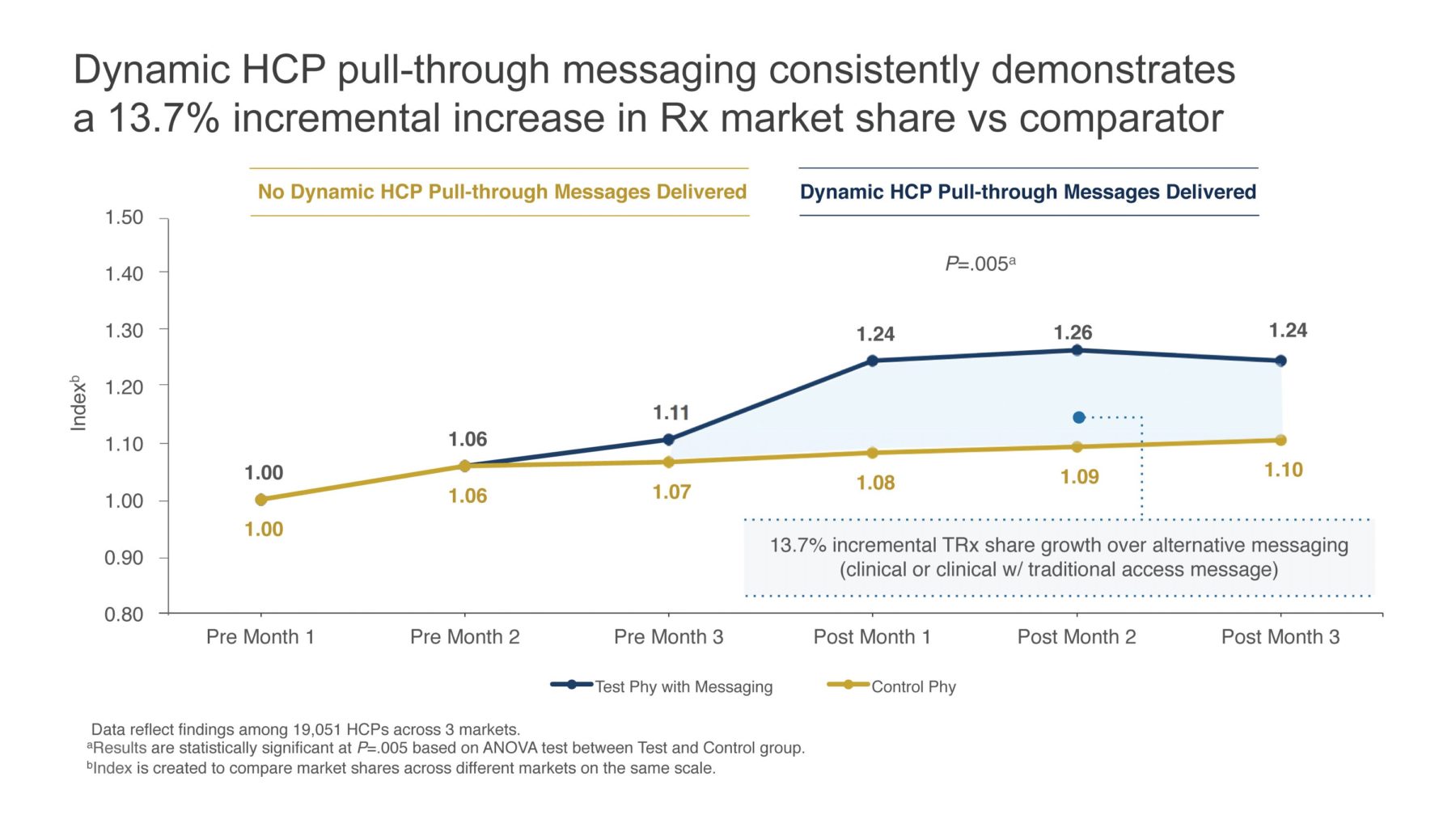

To determine if there is a difference in performance between the traditional and the new dynamic HCP-specific messaging approaches, Precision recently analyzed the impact of its Cost & Coverage pull-through messaging on HCP prescribing for three pharmaceutical companies. For all three companies, HCPs who received a clinical detail plus one of the new pull-through messages wrote significantly more prescriptions than those who received only a clinical detail or those who received a clinical detail and a traditional pull-through message. In fact, the overall impact for the three brands studied was an incremental TRx share growth of 13.7% versus the control group after just one dynamic pull-through message. A total of 19,051 HCPs were included in our analysis, which had a measured P value of .005, indicating that the difference observed was not by chance (Figure 3).

Furthermore, there were an average of 32 different HCP cohort groups and the incremental impact was observed across almost every group, including HCPs whose access was mostly restricted and mostly unrestricted. To estimate the potential impact for HCP-specific messages, one would simply multiply 13.7% by the brand’s annual U.S. sales by the percentage of revenue represented by the HCPs detailed with the message. A $500M brand x 25% (percentage of revenue represented by HCPs detailed with a targeted pull-through message) x 13.7% = $17.125M.

Furthermore, there were an average of 32 different HCP cohort groups and the incremental impact was observed across almost every group, including HCPs whose access was mostly restricted and mostly unrestricted. To estimate the potential impact for HCP-specific messages, one would simply multiply 13.7% by the brand’s annual U.S. sales by the percentage of revenue represented by the HCPs detailed with the message. A $500M brand x 25% (percentage of revenue represented by HCPs detailed with a targeted pull-through message) x 13.7% = $17.125M.

The Key Takeaway

If the brand you market is placed on a formulary exclusion list, your initial reaction needn’t be dismay. By understanding what HCPs want to hear about your brand’s access and responding with impactful information, you can not only mitigate the loss from negative spillover, but actually generate a new source of revenue by improving the perception of HCPs whose access is unaffected by the exclusion. Dynamic pull-through messaging can align your HCPs’ perceptions of access with the reality of access, resulting in benefits for patients and your brand’s market share.