As an industry, we continue to talk about “digital” as a unique channel as we staff centers of excellence focused on digital or multi-channel (with a focus on emerging channels). Similar to most industries outside of pharma, the pharma sales and marketing model is quickly moving to a world of digital first. That does not mean the demise of traditional sales and marketing models, it simply means that as media consumption and clinical learning by physicians becomes digital first—business models and strategy must follow or brands risk becoming obsolete from the customer’s point of view.

What if your bank assumed your primary interaction is via offline channels or they assumed you continue to prefer offline interaction over online? Most of us can’t imagine doing the majority of our banking through a branch office. We have migrated to digital—even mobile-first and the banks have kept resources allocated accordingly—with the physical locations playing a very different relationship role in the overall strategy than they had historically.

Okay, you argue pharma is different—physicians are different. While the healthcare and pharmaceuticals markets are certainly unique, physicians continue to migrate to digital first. Physicians are not strangers to technology. They use it on a daily basis for finance, travel, news and communicating with colleagues. The following sections highlight some of the recent market trends and what they mean to pharma in a “digital first” physician environment (all of the data is based on recent research from Digital Insights Group).

Multi-screen is the Norm

The average primary care physician (PCP) today has multiple digital devices (just like most affluent Americans). In fact, the “average” physician now has three (or more) devices—a mix of a desktop, laptop, smartphone and tablet. What is the most popular device overall? The smartphone. Furthermore, when PCPs are asked to pick their “primary” device for clinical information and decision-making (such as which Rx to choose for their patient), they pick their smartphone over any other digital device today.

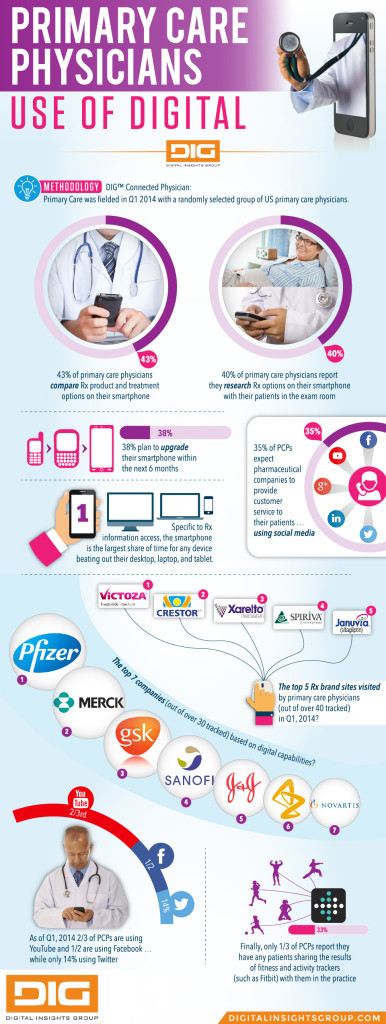

However, knowing which smartphone they currently use is only an indicator of their preference today; it doesn’t tell you which smartphone they will be using in the near future. And, from our most recent research, as of April 2014, fully 38% plan to upgrade their current smartphone within the next six months. So, the take-away here is that while it is important to understand that smartphones are the physicians “go to” device, it is equally important to recognize that the phone they are using today very well may not be the phone (or device) of the future.

Pharmaceutical Connectivity

The insight that digital is core to information access, and that a smartphone is a PCP’s primary device, is only the first step in understanding the impact of digital on the relationship between the physician, the pharmaceutical company and the rep. We found that 43% of PCPs compare pharmaceutical products and treatment options on their phone. Not only is the smartphone a reference, it’s a decision support tool—at the point of care.

Although visits to brand sites are not the primary route to pharmaceutical information for PCPs, they do provide a valuable resource to physicians and the latest traffic data reveals which brands/sites are currently in demand. The top sites visited by PCPs in Q1 2014 were Victoza.com, Crestor.com, Xarelto.com, Spiriva.com and Januvia.com.

Beyond branded product information, PCPs are also demanding digital capabilities and customer service online from the companies they deal with on a regular basis—online and offline. According to the latest data, the top companies in terms of digital capabilities (as ranked by PCPs) are Pfizer, Merck, GlaxoSmithKline, Sanofi, Johnson & Johnson, AstraZeneca and Novartis. What separates the top three from the rest? In addition to physician customer service platforms that are typically accessible through all branded and corporate sites (and consistent and in the proper form for all channels), the top companies also provide physicians an option to pull product and related information on demand.

Our research also revealed that physicians participating in an Accountable Care Organization (ACO) are less likely than their colleagues not participating in an ACO to visit with pharmaceutical reps in their office. However, they are more likely than their non-ACO colleagues to report that they are interested in virtually meeting with a pharmaceutical rep online. In other words, they are not against receiving and incorporating pharmaceutical information in their practice. To the contrary, they are much more likely than the average physician to be using a smartphone or tablet to access pharmaceutical information on a regular basis. They just prefer information access and updates on their terms, which are increasingly digital.

How about the role of pharma in the EMR? A recent deal between Merck and Practice Fusion to launch a portal called Population Health Management begins to shed light on the possible opportunities. Brand teams that are focused on whether or not they can have banner ads at the top of the EMR screen need to step back and think about the market trends over time—and move beyond the idea that simple advertising is how pharma will play in the EMR platforms of the future. As is the case in other industries, innovative methods of advertising and branding through a holistic integrated approach will be necessary to capture and maintain the attention of the physician.

Social Media

Although social media has revolutionized the consumer experience online, and created household names such as Facebook and Twitter, the reliance on social media by PCPs as a clinical resource is a mixed picture. Although physicians are using social media platforms like the rest of us (two-thirds use YouTube for any reason, half use Facebook for any reason and 14% use Twitter for any reason)—only 14% report social media is important to them as a clinical resource today.

That is not to say social does not have any relevance to physicians. Perhaps a better statement is that the models in use today may not be providing the link or integration into workflow as envisioned by busy PCPs. However, when asked their opinions about the role for pharma in social media, 35% expect pharmaceutical companies to offer customer service to their patients in social media. In other words, they see a greater opportunity for pharma to engage with their patients than they do for pharma to engage with them using social media.

Patient Connectivity

There remains a significant opportunity in the “last mile” of using technology to bring the patient and the physician closer together for ongoing communication and care management—in between visits. Also, technology at the point of care provides an opportunity for physicians to incorporate real-time information and updates when mapping out a treatment plan—or discussing treatment options. Fully 40% of PCPs have researched pharmaceutical options on their smartphone with their patients in the room with them.

Another area of interest (to the media at least) is the future of wearables and activity trackers. In Q1 2014, one-third of PCPs reported that they have patients sharing the results of fitness or activity trackers with them in the practice. Will the launch of HealthKit by Apple this month drive more adoption on the fitness, activity and “health” tracking over the next 12 to 16 months? That remains to be seen, but when activity and health/wellness data is tracked in a seamless fashion (or already included in our mobile device) the opportunity to capture, track and use data generated by the patient between office visits becomes a reality.

So when does the “digital physician” become just the…physician? For some brands and organizations the shift has already occurred. They have been undergoing a slow shift for the past decade and continue to move as fast as their customers. For others, the concept of “digital” remains something to be studied, tested, debated and then relegated to a defined part of the brand plan. It goes without saying that eventually all brands and organizations get to the point in time where digital is the norm. The critical question is: Are you a leader, fast follower, slow to adopt or the laggard?