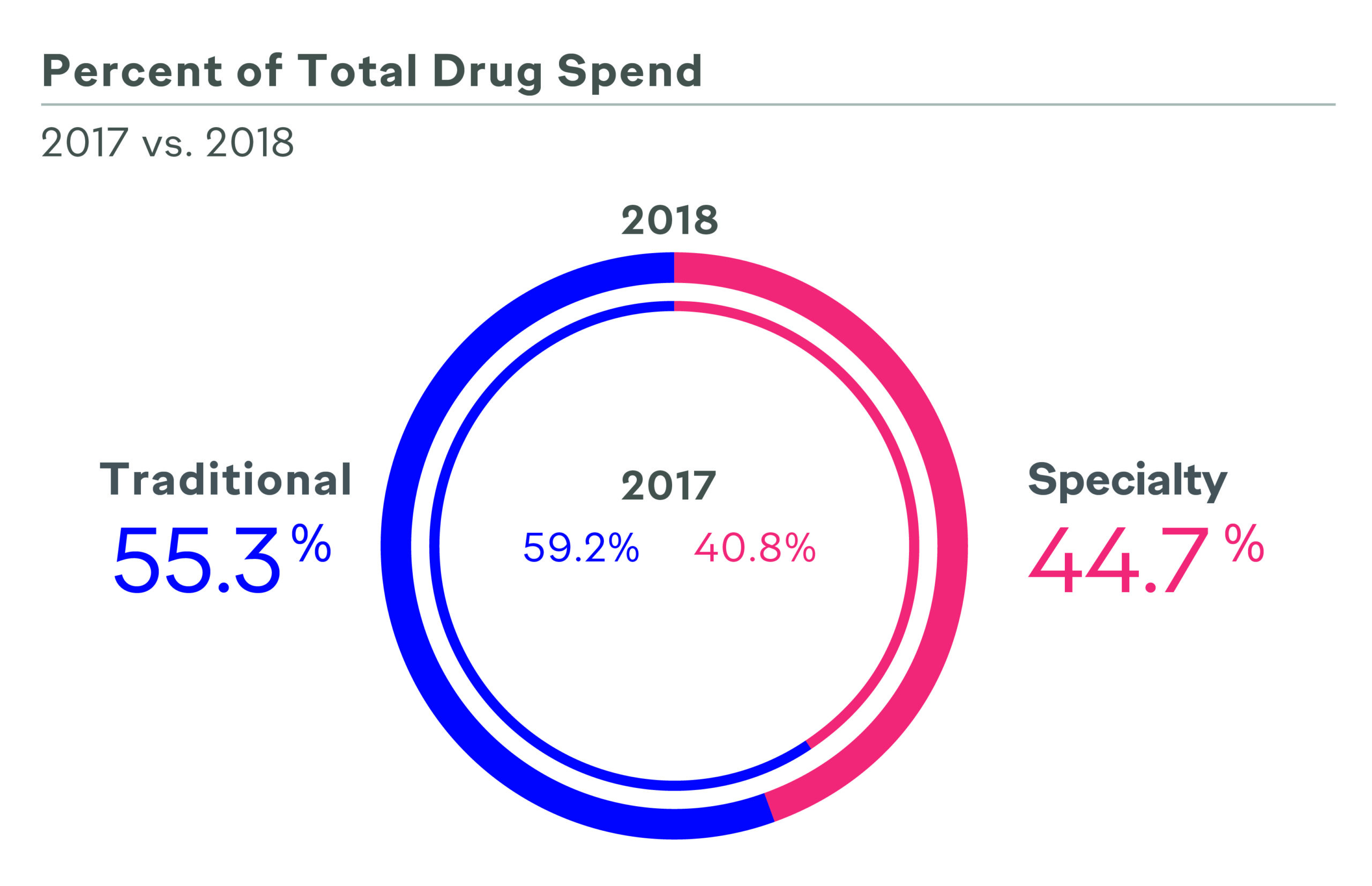

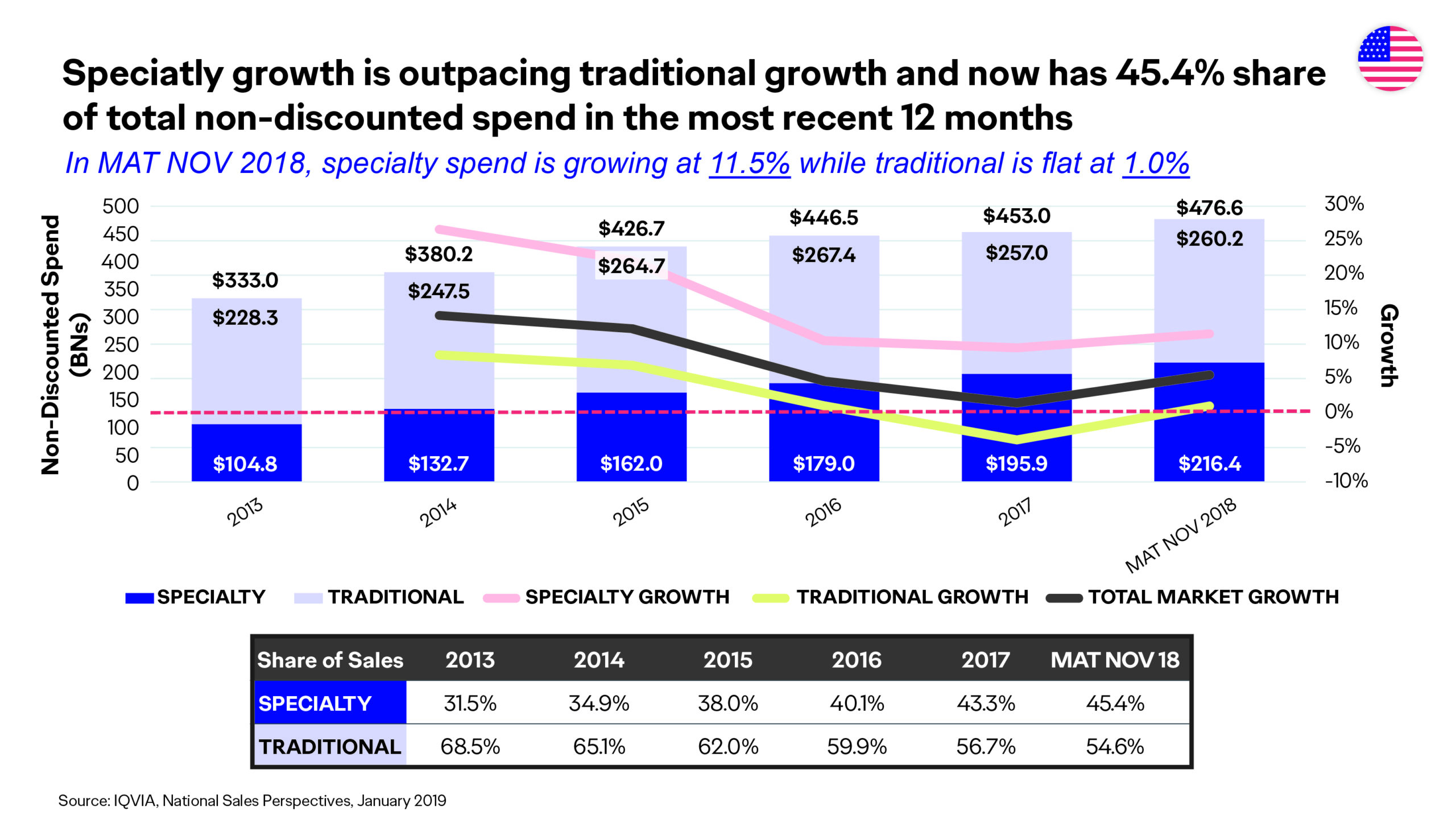

Value-based care, value-based contracting, outcomes-based contracting, risk-based contracting—the emergence of these strategies have left no doubt value in healthcare is high priority among payers, prescribers, patients, and federal and state governments and policy makers. In an era in which specialty pharmaceuticals make up 45% of the overall drug spend,1,2 payers are seeking innovative approaches to stay ahead of the trend and remain not only profitable, but viable. Manufacturers are putting more skin in the game to get—and keep—their products on formulary.

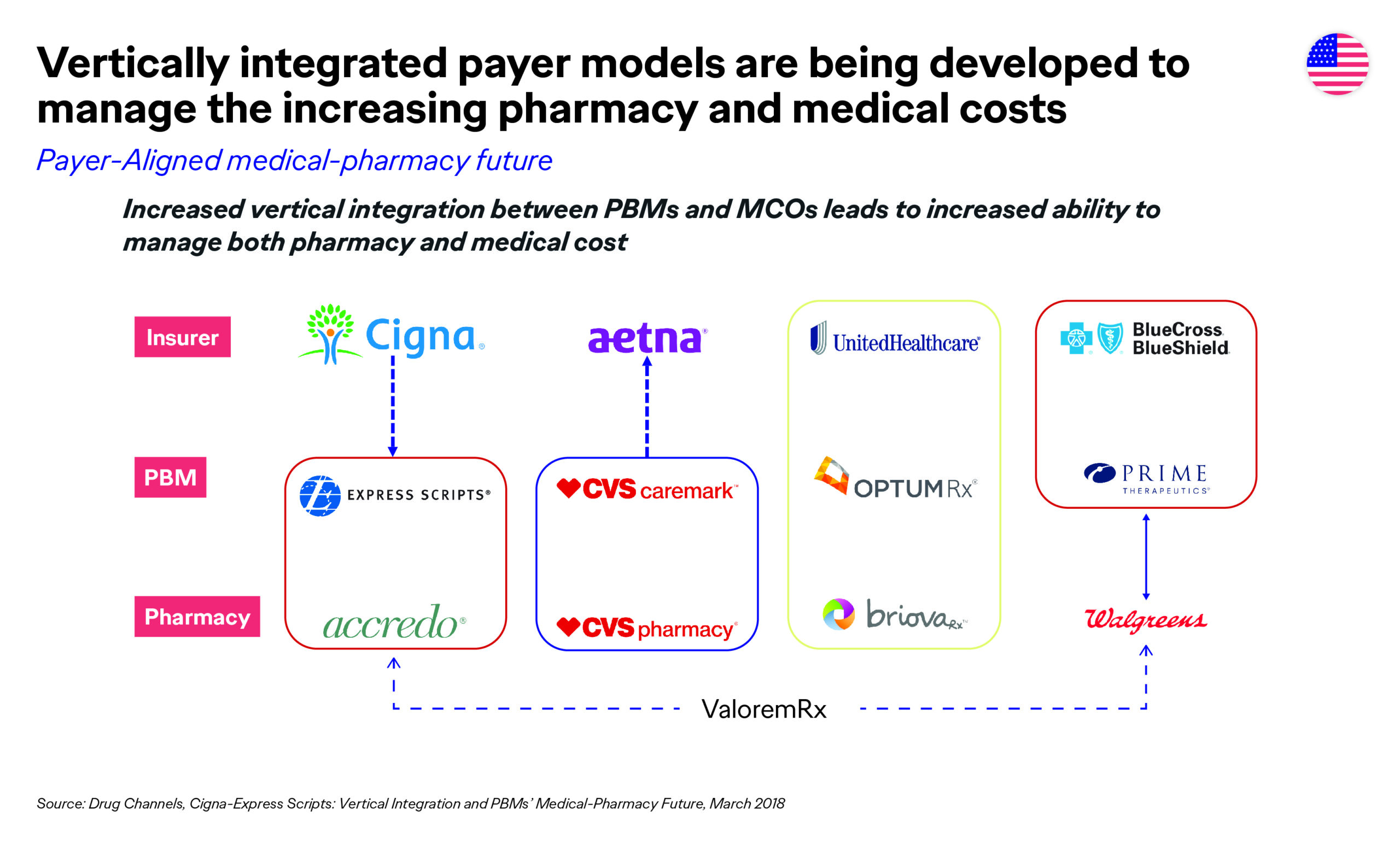

Payers are implementing many strategies to help achieve their business goals, such as vertical integration (CVS/Aetna; ESI/Cigna, etc.),3 consolidating formularies in the top spend-driving categories (inflammatory disease, oncology, and multiple sclerosis),4 proactively engaging in value- and outcomes-based contracts with pharmaceutical manufacturers (Harvard Pilgrim/Novartis; UPMC/Biogen, etc.),5 and leveraging big data to accomplish all of the above.

Payers are implementing many strategies to help achieve their business goals, such as vertical integration (CVS/Aetna; ESI/Cigna, etc.),3 consolidating formularies in the top spend-driving categories (inflammatory disease, oncology, and multiple sclerosis),4 proactively engaging in value- and outcomes-based contracts with pharmaceutical manufacturers (Harvard Pilgrim/Novartis; UPMC/Biogen, etc.),5 and leveraging big data to accomplish all of the above.

As marketers, our value story to payers has had to evolve significantly. No longer does the clinical value alone get you on the list. Also, if you don’t have head-to-head (H2H) versus the gold standard of care, or tangible outcomes data that tie back to performance measures, your road to access will be a very challenging journey.

As marketers, our value story to payers has had to evolve significantly. No longer does the clinical value alone get you on the list. Also, if you don’t have head-to-head (H2H) versus the gold standard of care, or tangible outcomes data that tie back to performance measures, your road to access will be a very challenging journey.

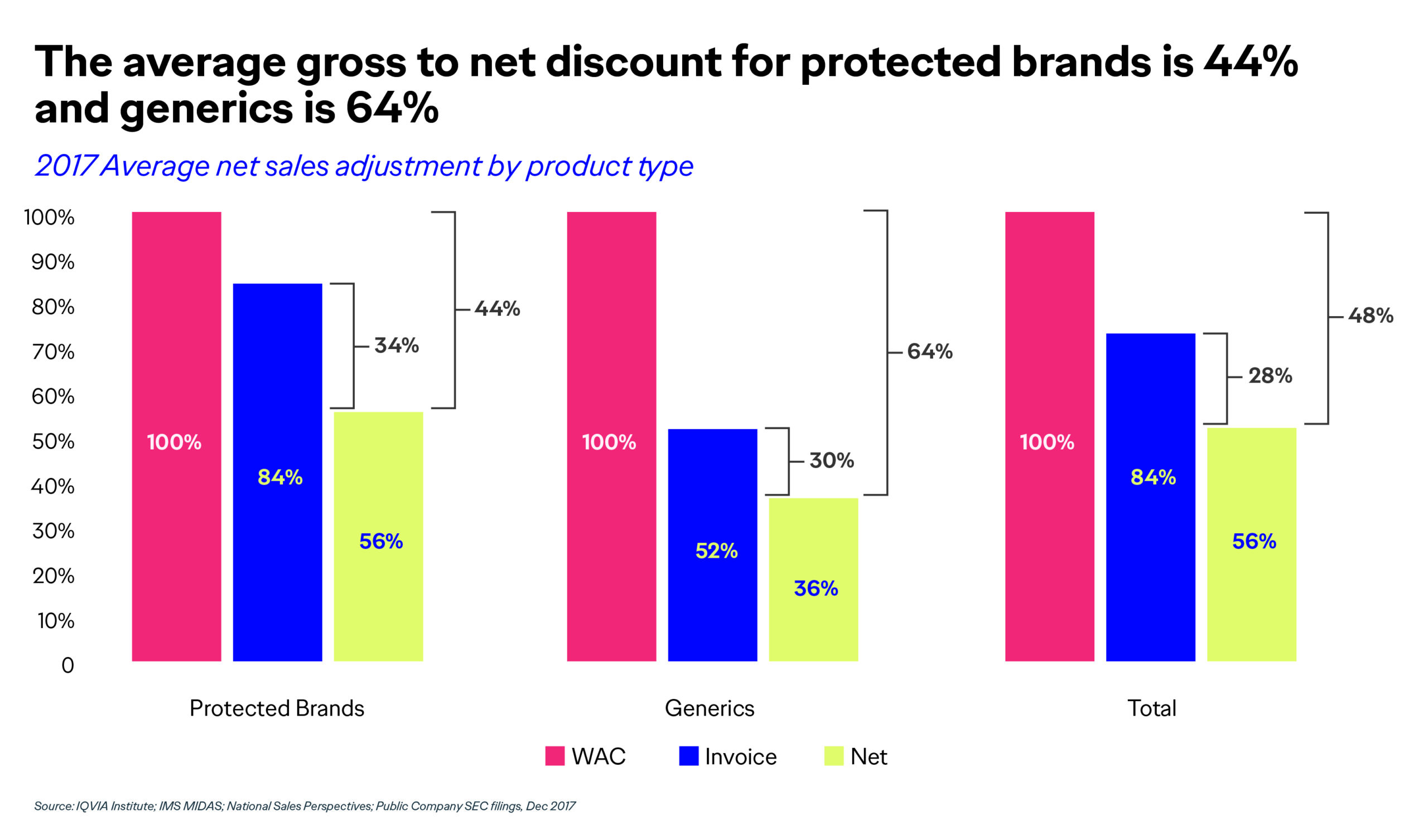

If, however, you can develop and implement a partnership that ties your product’s performance to favorable patient outcomes, and thus reduces costs through shared risk, payers are much more willing and able to give your product an opportunity to prove itself out in the real world. Otherwise, you may find yourself giving away much of your product and/or product portfolio for free, or at significant revenue discounts, which is where most manufacturers are at today, with an average gross-to-net discount of 44% to 64%.2

Developing a More Sustaninable Healthcare System

Developing a More Sustaninable Healthcare System

This article will shed some light on what and how manufacturers and payers are evolving their business relationships to find solutions to overcome the unsustainable trends and spend in healthcare, while still delivering the most cost-effective innovative treatment options to patients who need them.

Start by taking a hard look at the value your product brings to patients and the healthcare system overall. Not only from a clinical efficacy and safety perspective, but also from an outcomes and economic impact perspective. One of the most challenging things pharmaceutical marketers must overcome and compensate for is clinical trial design. Often, trials are not designed with U.S. payer customers in mind, and yet payers are one of the most important customers to convince, as they are the gatekeepers to patient access and affordability.

For example, metrics such as ability to offset cost of treatment or downstream complications or comorbidities are not accounted for in the Phase III study design. Nor are most measurable outcomes metrics, such as ability to reduce emergency department visits, hospitalizations, and rehospitalizations. If you can capture these data upfront in the study design, ideally as a primary and/or secondary end point, your chances of getting on formulary are much greater versus if you just have the standard efficacy/safety data.

Likewise, what product you study against is also critical. Payers want to see H2H data versus the standard of care, not versus placebo, and not versus lower-bar products or older technology. Having these data—particularly superiority data—will help your product to achieve early access and preserve access when new entrants come to market.

Demonstrating Value for Your Product

But, additionally, your product needs to be able to demonstrate value in treating a healthplan’s member population. Not just by addressing an unmet need in an under-treated or underserved patient population, but by providing real, tangible value. You can achieve value in several ways, including but not limited to:

1. Demonstrate value by virtue of demonstrating the ability to improve patient outcomes that impact performance measures and thus the total cost of care. Many brands fall miserably short of this evidence, given their non-payer-centric clinical trial designs. Some can overcome it by conducting Health Economic and Outcomes Research studies and publishing the results. But this effort can take years to achieve.

2. Drive volume (healthcare provider [HCP] demand) to generate rebates, which are a revenue stream for payers to help offset their costs in providing care and premiums for their member populations. However, when a product comes to market, it’s impossible for it to generate enough HCP demand to offset the rebates the payers are already getting from the market leader(s), so payers are reticent to allow formulary access right out of the gate (hence NDC blocks, step edits, etc.), and sometimes through at least year one. So, you have to work your way up from the bottom…fourth, third, second line, etc., stepping through the market leader(s) and generics, even if your product is more innovative than legacy treatment options. Without preferable access—which translates to patient affordability—HCPs are sometimes reluctant to prescribe the newer products (given the hassle factor), so it becomes quite a challenging situation, unless you are willing to give significant (>50%) rebates on the cost of your product. Even then, that may not garner your product the access and affordability patients deserve.

3. Engage in a value-based arrangement where both parties (the payer and the pharmaceutical manufacturer) agree to a mutually beneficial contract, whether it be value-, outcomes-, or risk-based. Put some skin in the game. Take on some risk. If your product is as good as your clinical trials demonstrated it to be, commit to it. Commit to it in a way that is relevant to payers’ business needs (i.e., what is the most optimal treatment option payers can provide to patients, while minimizing financial risk?).

Innovative Contracting Options

Developing and implementing a value-, an outcomes-, or a risk-based contract is no easy task. While a multitude of challenges must be overcome (legal, operationalization, and measurement), the benefit in the long run is your product may be added to formulary much sooner than it would have been otherwise. Also, the restrictions may be minimal/less onerous, and patients may be able to access and afford the more innovative treatment options they need and deserve.

Examples of innovative approaches to demonstrating value include:

- Biogen’s contract with UPMC, whereby reimbursement from Biogen to UPMC Health Plan will be linked to multiple sclerosis patient-reported measures of disability progression in a real-world population: https://www.upmchealthplan.com/pdf/ReleasePdf/2019_11_14.html

- Novartis’ contracts with Aetna, Cigna, and Harvard Pilgrim to reduce hospitalizations: https://www.cardiovascularbusiness.com/topics/healthcare-economics/give-take-pharma-payers-forge-risk-sharing-deals-new-heart-drugs

- AstraZeneca’s contracts with Harvard Pilgrim, in which AstraZeneca will be paid less for its products if it fails to meet agreed upon outcomes in real patients: https://healthpayerintelligence.com/news/harvard-pilgrim-enters-outcomes-based-pharmaceutical-contracts

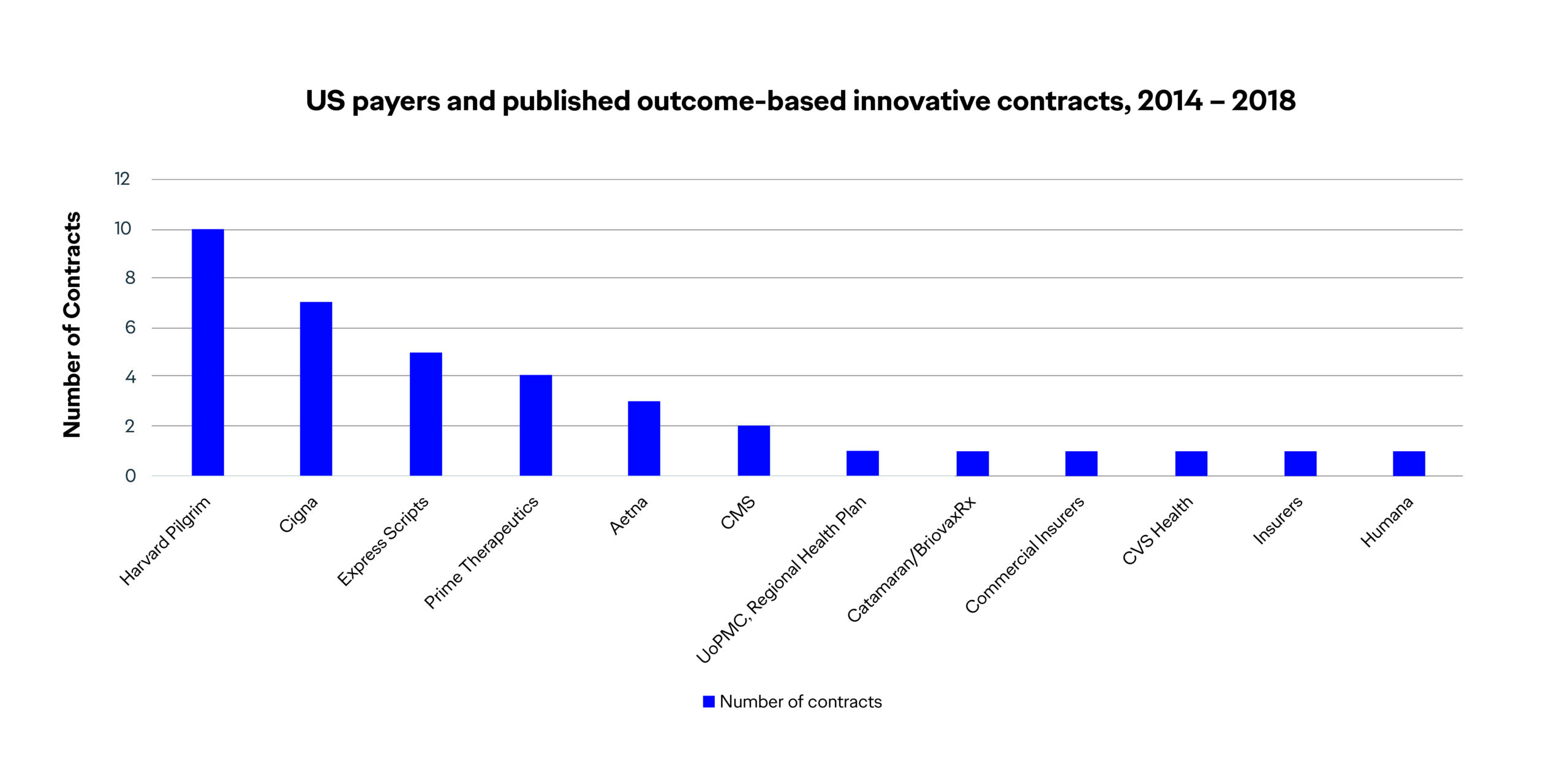

The number of value-based contracts is expanding over time, and Harvard Pilgrim has been leading the pack6,7:

While challenges remain, these industry pioneers (manufacturers and payers alike) have bravely charted a course—albeit an evolving one based on key learnings along the way—for the future of value-based healthcare. In the meantime, pharmaceutical marketers must pay closer attention to their clinical trials to ensure that they are designed to include endpoints and measurements/outcomes data that will address today’s payers’ needs. If they don’t have that data at launch, generating this data needs to be one of the top priorities post approval by the U.S. Food and Drug Administration.

While challenges remain, these industry pioneers (manufacturers and payers alike) have bravely charted a course—albeit an evolving one based on key learnings along the way—for the future of value-based healthcare. In the meantime, pharmaceutical marketers must pay closer attention to their clinical trials to ensure that they are designed to include endpoints and measurements/outcomes data that will address today’s payers’ needs. If they don’t have that data at launch, generating this data needs to be one of the top priorities post approval by the U.S. Food and Drug Administration.

To learn more about value-based healthcare, and value-based contracting, visit the Academy of Managed Care (AMCP.org) and its learning center: http://amcplearn.org/products/1532/value-based-contracting-e-learning-program.

References:

1. AMCP Specialty Pharmaceuticals in Development presentation; Tharaldson; Spring 2019. Page 27.

2. IQVIA Institute. IMS MIDAS; National Sales Perspectives; Public Company SEC filings; January 2019.

3. Cigna-Express Scripts. Vertical Integration and PBMs’ Medical-Pharmacy Future; March 2018.

4. Formulary Exclusion Lists published by CVS and ESI.

5. AMCP Headline Session: 2018-2019 Pharmaceutical Marketplace Trends; long.

6. Pharmaphorum website. https://pharmaphorum.com/wp-content/uploads/2018/10/Figure-1-LB.jpg)

7. Pharmaphorum website. https://pharmaphorum.com/views-and-analysis/payers-perspective-value-based-contracting-vbc/