A new product launch, perhaps the single-most important initiative for a company, is the culmination of years of research and planning. Although the product launch is only a relatively brief moment in a brand’s lifecycle, its impact in terms of the level of investment, the fate of the product and the success of the company can never be overstated. The window of opportunity for launch is short and unforgiving and the success depends on flawless execution of launch activity across countries and functions. A recent study found that outstanding launch performance is rare, and consistently high performance across markets is even rarer, suggesting gaps in launch strategy that companies cannot afford to ignore. However, identifying those gaps and bridging them can be tricky. Without a solid, empirical understanding of the key determinants of success, companies are likely to approach this crucial phase rather haphazardly, thus wasting resources and missing opportunities.

Given that companies spend an average of $800 million to develop and launch a new product, it’s not surprising that pharmaceutical companies’ success rests not only on the quality of R&D pipelines, but also on the rapid uptake of their brands. Still, predictors of successful launches have, until now, been illusory. There have been anecdotes, but no evidence-based approaches to launch excellence. Therefore, it is, suffice to say, crucial to start the commercialization process early in the development cycle.

Challenges in Early Commercialization

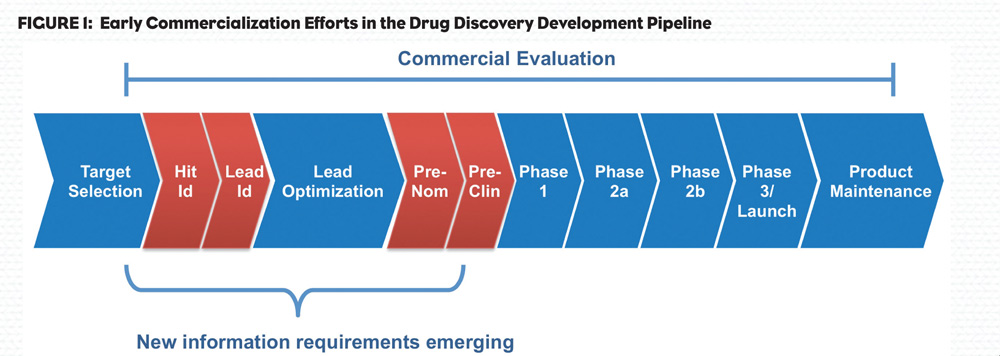

Early commercialization efforts are now seen to be more important than ever in the industry’s effort to pick their “winners.” Recent analyses suggest that R&D efforts are incorporating more commercialization inputs even earlier than the Pre-clinical Stage, in fact as early as the “Target Validation” and “Target Selection” milestones.

There are many reasons that are driving decisions earlier; however, escalation in investment cost, particularly in discovery (Figure 1), and cost of failure is motivating the industry to reconsider R&D business models, evaluation criteria and “go/no go” decision points.

To adapt to the new approaches and to enhance speed and reliability of decision making in pharma R&D, additional key sources of data, intelligence and insights that augment and inform their efforts will be needed.

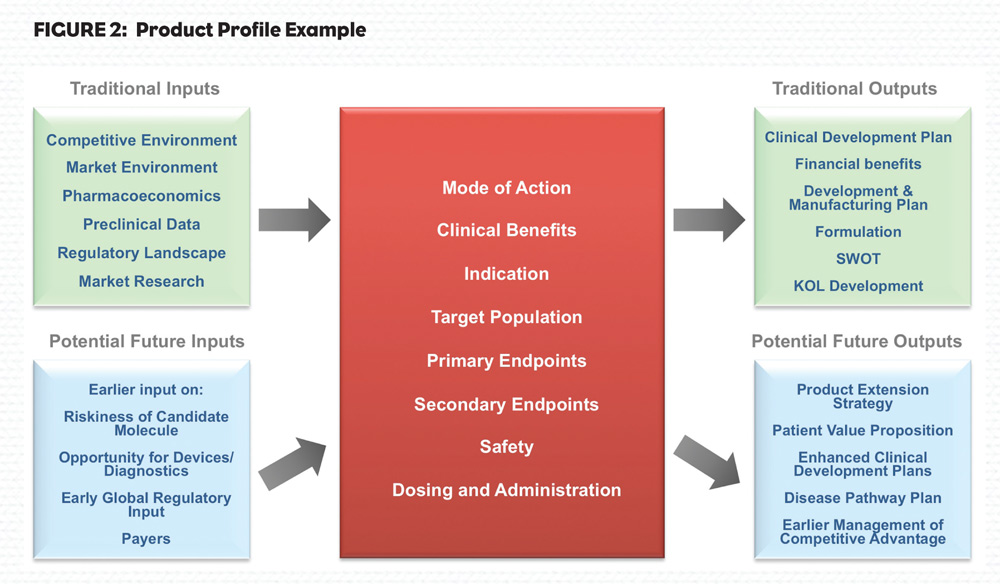

Another challenge is that R&D and commercial operations are not well integrated and aligned with each other. It can be challenging to engage commercial input with assets that are still several years from launch, especially as commercial teams are often prioritized on working with assets in mid- to late-stage development. Early commercial knowledge is captured and translated first by zeroing in on a disease area and later forming a product profile (PP). The requirement for these documents to contain more info to guide investment decisions is ever more important today.

Pharmaceutical companies want to make the right investment decisions at the earliest opportunity and are now challenging whether the key criteria outlined below, are enough, including:

Commercial potential: Derived from calculation based upon the potential number of patients, the ability to access those patients, the strength of the potential differentiation of the new brand and hence the share attainable, and further, the price that the payers are willing and able to pay.

Cost of development: In terms of resources and capital consumption as well as elapsed time.

Risk from a range of taxonomies:

- Technical risk: Wherein the quality of the asset and its potential for efficacy in its early evaluation is assessed relative to the disease models and biomarkers available as well as the clarity of “Mode of Action” and the potential for that to be communicated to the market.

- Developmental risk: The ability to develop the medicine and scale up, and in large part the tolerability of the asset in patients.

- Commercial risk: Competitors, sub-optimal pricing, co-pay versus full reimbursement and other factors that impact the share (volume) and price assumptions that underpin commercial potential.

Early commercialization is recognized as critical. Therefore companies need improved data and analysis capability. That need is increased by the trend toward the employment of new approaches in drug development, for instance accelerated proof of concept. Such an innovation requires improved knowledge of the asset and its potential on which to base that acceleration.

The commercial criteria applied varies across the development cycle with qualitative factors such as availability and credibility of robust animal models being more important in the Target Selection and Pre-clinical stages. When an asset is being evaluated for Phase 3 investment, more so in the decision to launch, data should be highly quantitative and the evaluation based upon a number of key criteria about which the uncertainty has been effectively managed and risk mitigated.

In early commercialization efforts, especially with the move towards personalized medicines, companies must assess:

- Riskiness of a candidate molecule moving forward.

- Likelihood of achieving a target product profile.

- Pharmacoeconomic data: How does cost compare to other drugs on the market or future drugs that may make it to market?

- Payers: Due to a shift toward personalized medicines requiring a defined value proposition that meets payers’ needs.

- Global healthcare regulations and potential for change.

- New developments such as changes in policy that alter value proposition and could have an impact on data and analysis.

- Areas of unmet medical need.

- Quality of life improvement (for instance, auto injectors over visits to physician).

Market validation needs to be thorough to ensure positive forecasts for return on investment. With increased healthcare pressures, ensuring the benefit to the risk-reward ratio is critical and, given the current economic environment, it is also important to consider whether the benefit to cost ratio will hold.

More importantly, companies might want to understand where others have tried and failed such that their experimental data provides lessons to others. Detailed data and analysis such as this is critical for companies since it allows planning of their portfolio, especially if it means saving time and cost by killing programs via stricter go/no-go decision making points. See Figure 2 for one example of what a company must consider when forming a product profile.

It appears that decision-makers think of the early commercialization space as spanning “discovery” through “Phase 2.” When addressing this space, key components can be categorized into three areas:

- Portfolio management

- In-licensing opportunities

- Lifecycle management

Ask the Right Questions

The following is a guide to what decision-makers should be asking as they consider the possibilities of their potential new product in each of these key areas.

1. Portfolio Management Decisions

- What are our competitors are doing?

- What are Key Opinion Leaders saying?

- How will a change in the valuation of asset X, affect the rest of the portfolio valuation?

- What disease areas hold value?

- What label claims will others try to make?

- What is the market size?

- Will NICE endorse asset X with a specified profile?

- How are doctors making choices?

- What do physicians claim they will do in the future?

2. In-Licensing Opportunities

- Is it a new mode of action?

- What information is there that can help others understand this? Does the company possess the in-house knowledge and experience to develop this asset?

- What available competitor products may decrease asset value?

- What clinical endpoints are needed to satisfy the FDA?

- What are the clinical protocols being used? Can the design be replicated? Can the required patient population be recruited?

- How is the FDA currently approving drugs? What have they not approved?

- When closer to the potential product’s launch, ask questions about what to expect in terms of product perception, particularly by physicians?

- For example: Would considering co-morbidities make any impact?

- Will there be a monopoly on label claims for this particular asset?

3. Lifecycle Management

- What has the FDA declined recently?

- What is the current stance of the FDA? What have they not approved?

- Can you approach regulators in order to understand what is required for approval?

- What are patients demanding?

- How are patient requirements changing? What can be learned from their use of social media?

- What else can be done to achieve greater asset value?

- Is there potential for coupling with devices/diagnostics?

- How is the standpoint of governments in different countries around health changing?

- What markets could be explored?

- What are the entry hurdles in emerging markets? What other markets (other than U.S. or emerging markets) should be explored?

Conclusion

The challenge is in being able to identify potential winners so their development can be prioritized and the resources can be made available to expedite launch. The opportunities to build extra value into the brand should be identified and planned for early to ensure that the full potential of a brand is realized. New indications, formulations and presentations should be identified and evaluated as part of the overall development strategy for the new brand. Problems of delivery and potential challenges of compliance and adherence should be identified as early as possible. The aim must be to take valuable, differentiated medicines into their chosen markets as effectively as possible.

“Picking the winners” early has been of significant importance to R&D executives and is not a new concept. The worst case scenario for R&D management is late attrition, for it is costly and can be debilitating for an organization. AstraZeneca reeled under the impact of a series of late-stage failures in the recent past. However, with costs of development escalating and customers exhibiting an increasing trend towards effectiveness and value for money in the new brands they accept into the market, the pressure is on to identify even earlier those new molecules that have the potential to become reimbursable medicines, not just new drugs!