Getting data to help us better interact with our customers is something we all strive to do. Historically, the pharmaceutical industry has used the abundant data it collects on doctor prescribing, patient claims, outlet sales, rep calls, marketing promotional spend, managed care formulary—and the list goes on to address business problems centered on brand performance and resourcing. Targeting, segmentation, forecasting, and ROI are just a few operations benefitting from this analysis. Though useful, this approach is company-centric, rather than customer-centric, prioritizing the understanding of response to industry activity, rather than first gaining an understanding of customers themselves.

Enter predictive analytics. Like other types of analysis, predictive models correlate customer characteristics, environmental variables, and past behavior with a future outcome of interest. Unlike other analyses, the emphasis is on understanding and predicting customer behaviors. The difference is more than just a matter of perspective. Traditional analysis is an effort to understand and evaluate our own behavior (say, the effectiveness of pharmaceutical marketing) with the goal of learning how we should change what we do to be more effective in reaching our goals, while predictive analytics is an effort to understand the customer’s behavior independent of company action. Ultimately, the approaches are complementary in that understanding customer behavior along with their response to our interventions together can maximize outcomes.

This is not a new concept. Other industries are far ahead of pharma in their use of predictive analytics. For decades, communication, financial, and consumer goods companies have used the detailed information available from tens of millions of customers to develop predictive models to understand and anticipate behavior—resulting in more personalized interactions to drive improved loyalty and/or sales. For example, Amazon famously recommends additional products based upon a customer’s past purchase history and that of other customers with similar buying patterns. Netflix does the same with movies and TV shows. Your favorite retailer or grocery store prints targeted coupons personalized to your interests.

The following cases demonstrate opportunities within the pharmaceutical industry to use predictive analytics in its outreach efforts to optimize its interactions and improve benefits for both company and customer.

Business Case 1: How Long Will My Patient Stay on Therapy?

Patient care programs are developed to help patients remain on therapy. The doctor also plays a key role in deciding whether or not a patient should terminate or switch treatment. If the sales and marketing team knew when the patient and doctor were going to decide to stop therapy, then a timely intervention might make a difference. For example, the sales rep could arrive with a discussion on efficacy or the patient care program could deliver assistance with side effect management. But how do we know when the patient is going to stop therapy? This understanding of the patient, as well as patient behavior, is a prerequisite to delivering a relevant intervention. Otherwise, it would be necessary to continuously bombard doctors and patients with compliance messages, usually at times when the treatment decision is not at issue.

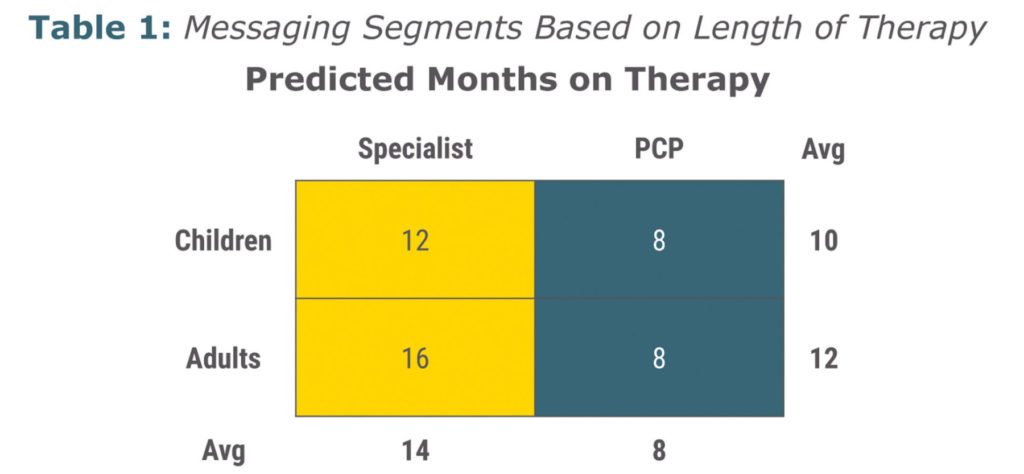

The solution is to estimate approximately when a patient will go off therapy and intervene at that time. As a starting point, how long the average patient stays on therapy is known from market research studies and anonymous patient claims data. This estimate can be further revised by segmenting patients according to their characteristics. For example, it may be for a particular brand that pediatric patients stay on therapy two months shorter than adults, and patients who are cared for by a specialist stay on therapy six months longer than those who see a primary care doctor. The prediction for when patients are expected to go off therapy is now significantly refined. Table 1 illustrates the opportunity to treat doctors and patients differently for greater relevancy to customers and return on promotion. The patient population can be segmented further by as many variables as are relevant.

This rudimentary approach is already predictive analytics—estimating and differentiating patient behavior based upon known characteristics. However, adding more predictors makes the grid quickly become unwieldy. Fortunately, there is a solution. Statistical modeling—a standard tool for predictive analytics—can handle multiple predictors, maintain simplicity, and increase prediction accuracy.

This rudimentary approach is already predictive analytics—estimating and differentiating patient behavior based upon known characteristics. However, adding more predictors makes the grid quickly become unwieldy. Fortunately, there is a solution. Statistical modeling—a standard tool for predictive analytics—can handle multiple predictors, maintain simplicity, and increase prediction accuracy.

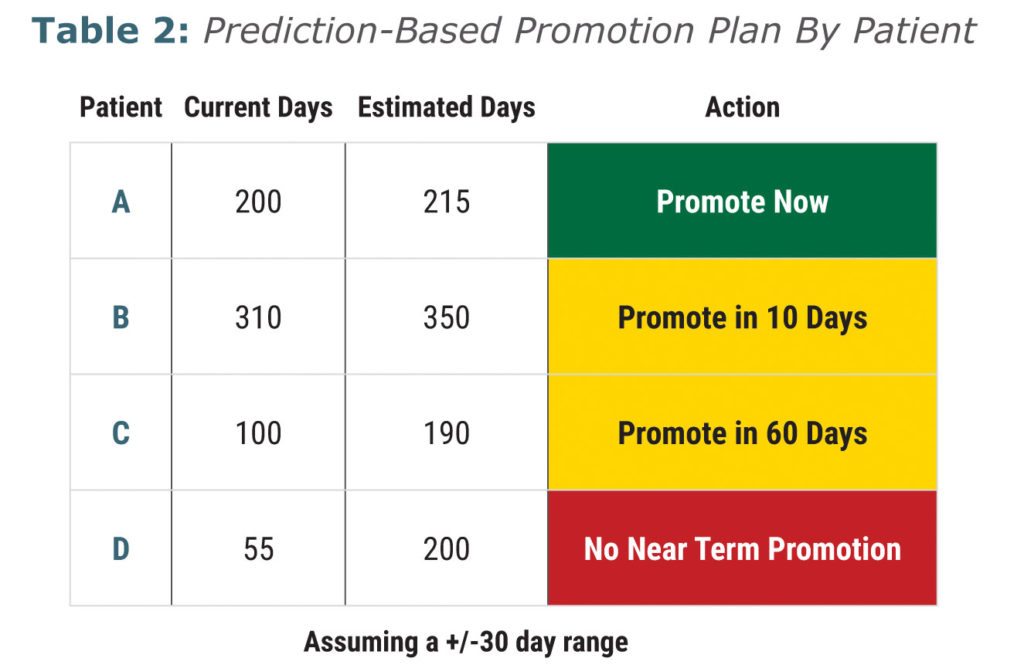

For example, this statistical predictive model, Month of Therapy = f (doctor specialty, patient age, dosage, plan coverage, patient, gender, etc.) is based upon the predictors available. An estimate is made for length of therapy as each patient is scored with the model. A comparison of predicted length of therapy with the current actual gives an indication of whether or not the intervention is appropriate right now.

The accuracy of this estimate will depend upon the variability of the underlying data. A range estimate is made that looks like this: Patient A: 268 days +/-30 days.

The 30-day range means that beginning around day 238 (=268-30) the interventions should begin. Other patients will have different estimated attrition ranges and different timings of promotion. (See Table 2).

This enhanced understanding of customer behavior results in more effective promotion (higher response rates and ROI) and greater customer satisfaction (due to greater promotional relevance).

This enhanced understanding of customer behavior results in more effective promotion (higher response rates and ROI) and greater customer satisfaction (due to greater promotional relevance).

(Note: This application is dependent upon having patient data that can be linked to known doctors and/or patients, so at some level the patient is not fully anonymous. The most common situation is for rare diseases where doctors typically have only a few patients. These products tend to be high priced and highly profitable and can justify highly tailored programs as described here.)

Business Case 2: What is the Best Way to Achieve Enhanced Targeting and Tiering at Launch?

The best way is achieved by identifying early adopters. Based upon past adoption behavior, either in the same therapeutic area or an analogous area, it is possible to predict when a doctor will first try a new product. It is well known that some doctors like to try new products and others will wait a year or more. Using readily available doctor-level Rx data from previous launches, predictive analytics can estimate the post-launch month a particular doctor will first try your new drug, within a range. Predicting adoption timing is one example in which pharma has made some use of predictive modeling, but the full benefit of these predictions is rarely realized because all doctors are still targeted at launch.

Business Case 3: When Will My Message Wear Out and Need Refreshing?

The iPad passively collects information on the content a rep shares with a doctor on a particular sales call. The effectiveness of this content can be actively recorded by the rep based upon the rep’s perception (a personal inference) or by correlating content used with subsequent sales (a statistical measurement). Over time, the effectiveness of specific content can be tracked, using either or both methods of calculation. After experience with dozens of pieces of content across brands, it will be possible to predict—within a range—when a message will begin to wear out, signaling the need for a new message or renewed training. Most companies have this data at their disposal, and though it can drive valuable predictive insights, they do not use it for this (or any other) purpose. This includes using information at the doctor level to predict which message will be the most impactful one to deliver next.

Business Case 4: Developing and Using Leading Indicators.

In the world of economics, leading indicators are developed and used to predict recessions, interest rate movements, stock trends, and other market phenomenon for both policy and profit making. But how about pharmaceutical marketing? Doctors do not just prescribe a drug; patients do not just start filling prescriptions. Many things happen before these events to precipitate these actions. Claims data is particularly important in this area. It is possible to understand the probabilistic “triggers” that cause a new Rx to be written and a patient to be switched. Predictive analytics can sort out what is important, and what is noise, in identifying “leading indicators” of prescribing behavior.

Being able to predict physician and patient behavior provides pharmaceutical commercial operations with an understanding of customers in and of themselves, independent of influence. This understanding helps sales and marketing be more effective in creating meaningful and effective interventions, including the possibility of timing them more appropriately. While prediction will not be perfect, such modeling can eliminate some uncertainty of promotional response and return. More importantly, predictive analytics can help companies enhance their sales and marketing relevance and, so, increase customer satisfaction.

Such improvements are becoming increasingly more critical due to the changing dynamics in the delivery of healthcare and the medicines we use. Gone is dependence on the blockbuster, mass-market drug for corporate success. Newer therapies are more targeted to reach smaller and more needy patient populations. As personalized medicine develops, this situation will be more pronounced. Fortunately, there has been a parallel evolution of analytics and its applications across industries. The purpose and value of advanced analytics of all types, including predictive modeling, is to more precisely target an audience and understand/predict its behavior. Predictive analytics is catching on in pharma just when patient focus has become a medical priority and enhancing customer interaction has become a commercial imperative. This is no coincidence and a welcome development.