The incidence of bone fractures is steadily increasing in the U.S. due to the rapidly aging population and the corresponding increase in the prevalence of associated conditions, such as osteoporosis. Although autologous bone grafts and bone allografts have proven to be effective during surgical procedures employed in the treatment of localized bone damage, limited availability and certain clinical drawbacks, such as increased operative time and blood loss, have created a budding market opportunity for both biological and synthetic substitutes.

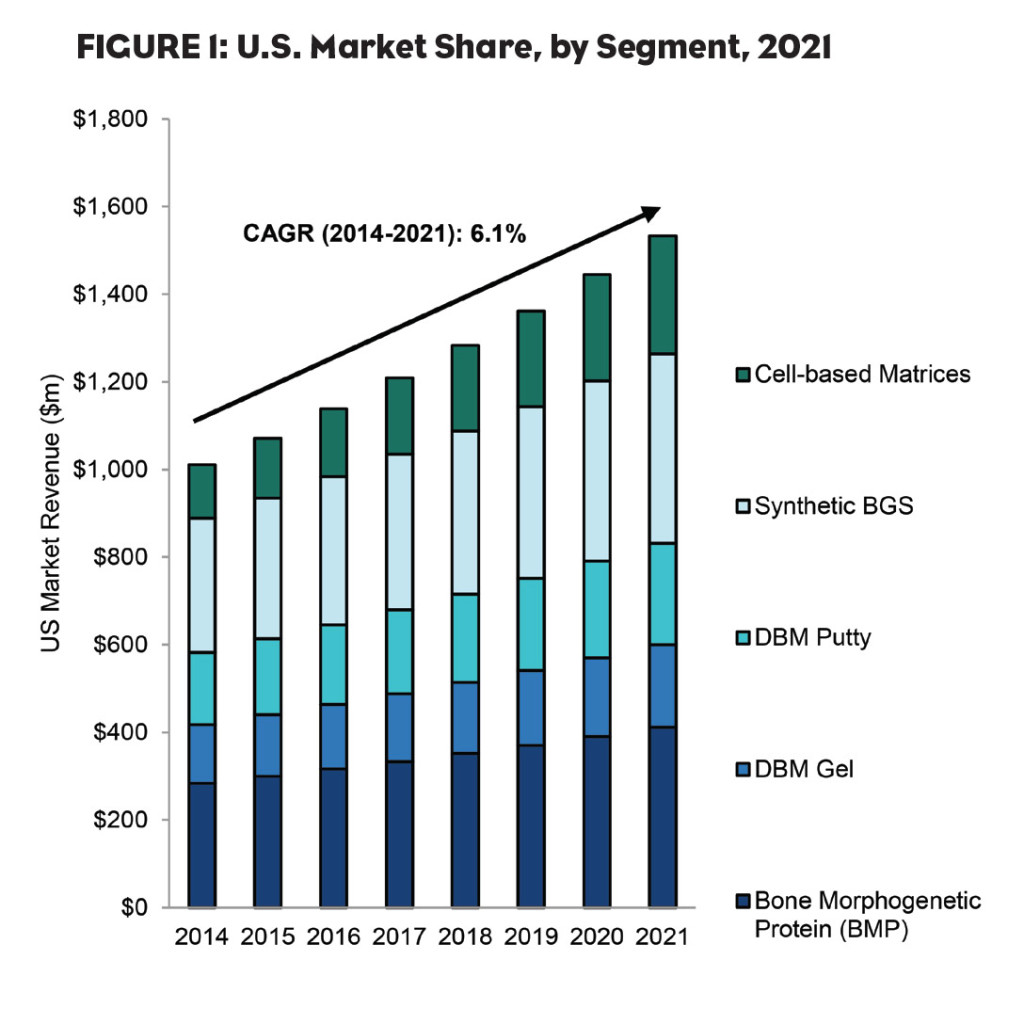

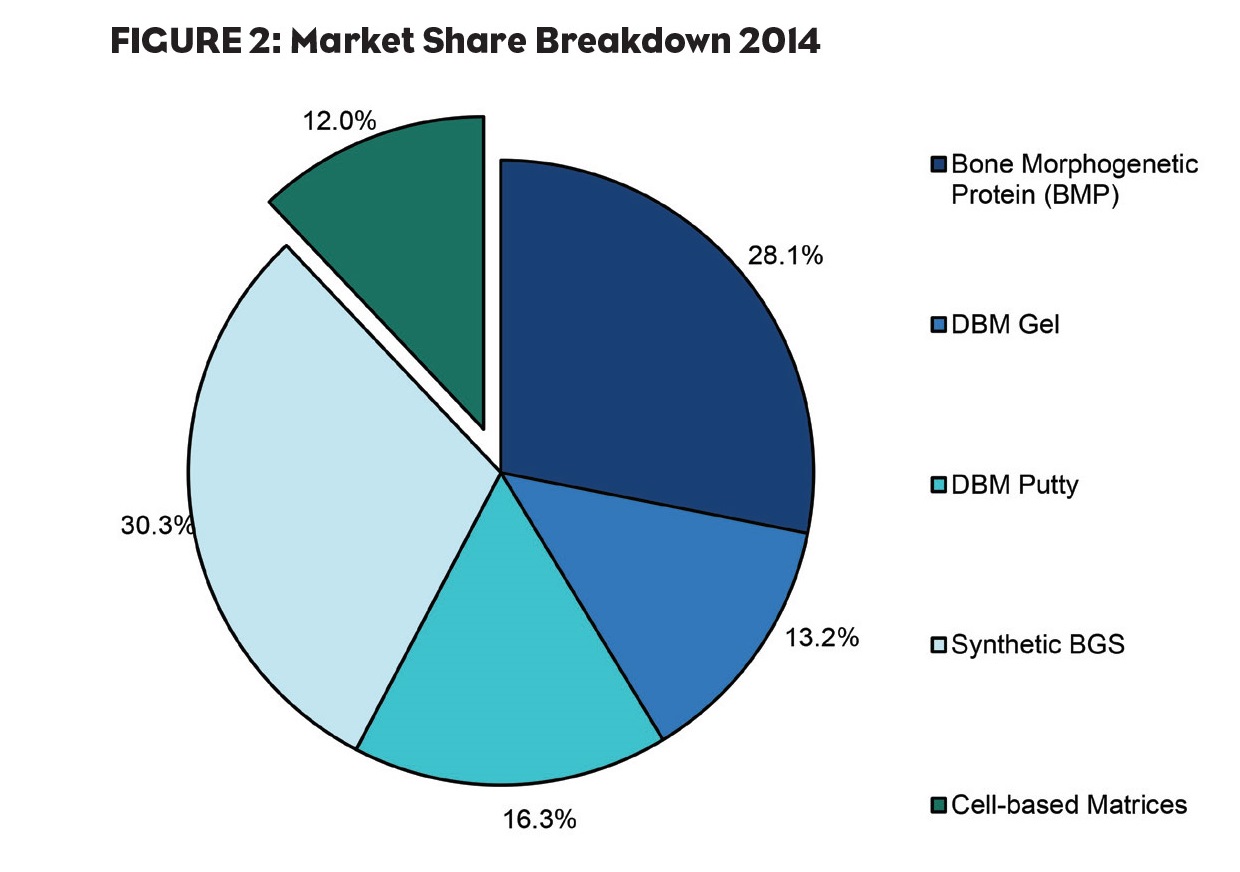

The market for bone graft substitutes (BGS) in the U.S., including bone morphogenetic proteins (BMPs), demineralized bone matrices (DBMs), synthetic bone graft substitutes, and cell-based matrices was estimated to be approximately $1.0 billion in 2014, as shown in Figure 1. Expanding procedure volumes in spinal and orthopedic surgeries drive this increase in market size through 2021. The increasing procedure volume also results in a shortage in the availability of musculoskeletal donor tissue used in conventional allografting procedures, further driving a need for substitute therapies.

Although synthetic substitutes have accounted for the largest portion of the BGS market thus far, cell-based matrices are expected to seize 5.6% of the BGS market through GlobalData’s forecast period (Figure 2). These products incorporate adult mesenchymal stem cells (MSCs) and osteoprogenitor cells into an allograft bone matrix containing DBM and cancellous bone, resulting in a biocompatible matrix that fully harnesses the healing triad of osteoconductivity, osteoinductivity and osteogenesis. This will result in an overall improvement in patient outcomes as there is a lower chance of complications such as donor site infection or pain.

Moreover, unlike conventional allografts, adult MSCs can be transferred between unmatched human leukocyte antigen (HLA) individuals without provoking immunorejection, making cell-based matrices a more universal treatment option. However, growth in this market is heavily dependent on the publication of more robust clinical data from independent studies demonstrating improved safety and efficacy over existing products.

Aside from clinical considerations, the regulation of cell-based matrices by the FDA has raised eyebrows in the medical community. Currently companies claim that these products meet FDA criteria under Title 21 CFR Parts 1270 and 1271 and are therefore marketed as minimally manipulated tissue. This allows companies developing these products to bypass premarket review. However, there remains a question as to whether these matrices can be classified as such if there is any cell culture expansion conducted during manufacturing.

Today’s BGS Landscape

As a new segment in BGS, few cell-based matrix products are yet available on the U.S. market. In total, eight products have been brought to market since 2009: AlloStem (AlloSource), Osteocel Plus (NuVasive), Trinity Evolution and Trinity ELITE (Orthofix), Cellentra VCBM (Zimmer Biomet), map3 Cellular Allogeneic Bone Graft (RTI Surgical), ViviGen Cellular Bone Matrix (DePuy Synthes) and BIO4 Viable Bone Matrix (Stryker and Osiris Therapeutics).

Though interest and enthusiasm for cell-based matrices’ use is high, particularly as these products harness the healing triad, physicians have largely been wary of employing them in practice due to the lack of clinical efficacy data. As such, it is paramount that companies expanding into this market conduct clinical studies in order to generate traction for their products.

Currently, several long-term clinical trials are underway covering the use of specific products in a range of spinal and orthopedic procedures, such as the use of the Cellentra VCBM in anterior cervical discectomy. Additionally, studies on NuVasive’s Osteocel Plus in five spinal indications and Orthofix’s Trinity Evolution in foot and ankle fusion and anterior cervical discectomy and fusion have been completed and are awaiting published results.

The initial three products offered in 2009 (Osteocel Plus, Trinity Evolution and AlloStem) continue to lead the cell-based matrix market, granting NuVasive, Orthofix and AlloSource status as key players. However, recent trends indicate that BGS leaders are looking to expand and enhance their product portfolios by partnering with small companies developing innovative cell-based matrix technologies. In 2014, two of the top three global BGS players entered into deals to market the cell-based matrix products of up-and-coming companies: DePuy Synthes generated an exclusive agreement with LifeNet Health to market and promote the ViviGen Cellular Bone Matrix, while Stryker entered into an exclusive partnership with Osiris to commercialize and develop the BIO4 Viable Bone Matrix.

Competition Shapes the Future

Stem cell therapies represent a fast-growing, high-margin opportunity in today’s orthopedics market. Particularly, cell-based matrices present an opportunity for forward-thinking orthopedics and orthobiologics companies to create a comprehensive BGS product portfolio because, in the present U.S. market, few companies offer the entire spectrum of BGS. Rather, manufacturers tend to focus on one or two types of bone grafts and substitutes, mainly the synthetic bone substitutes that present easier market access. As competition in the market increases, companies offering a one-stop shop for physicians’ orthobiologic needs will benefit greatly.

Market leadership takes into account not only the range of product offerings, but also the availability of human clinical data to demonstrate long-term product efficacy. The current lack of clinical data for cell-based matrices is the main barrier to product adoption, holding this segment back from overtaking the BGS market. Though cell-based matrices have only been on the market for six years, the future of this market lies in proven clinical outcomes.