The media environment is changing and life sciences marketers are certainly taking notice. Emerging technologies are fast becoming new avenues for marketers with year-over-year increases seen in audio impressions (61%), streaming impressions (18%), and online video impressions (5%).

This is according to a new report from Veeva Crossix, which has aggregated media measurement and health data from hundreds of health brand campaigns. The analysis covers key learnings across more than 53 billion digital impressions and 115 billion linear TV impressions per year, representing more than $6 billion in media spend in 2021.

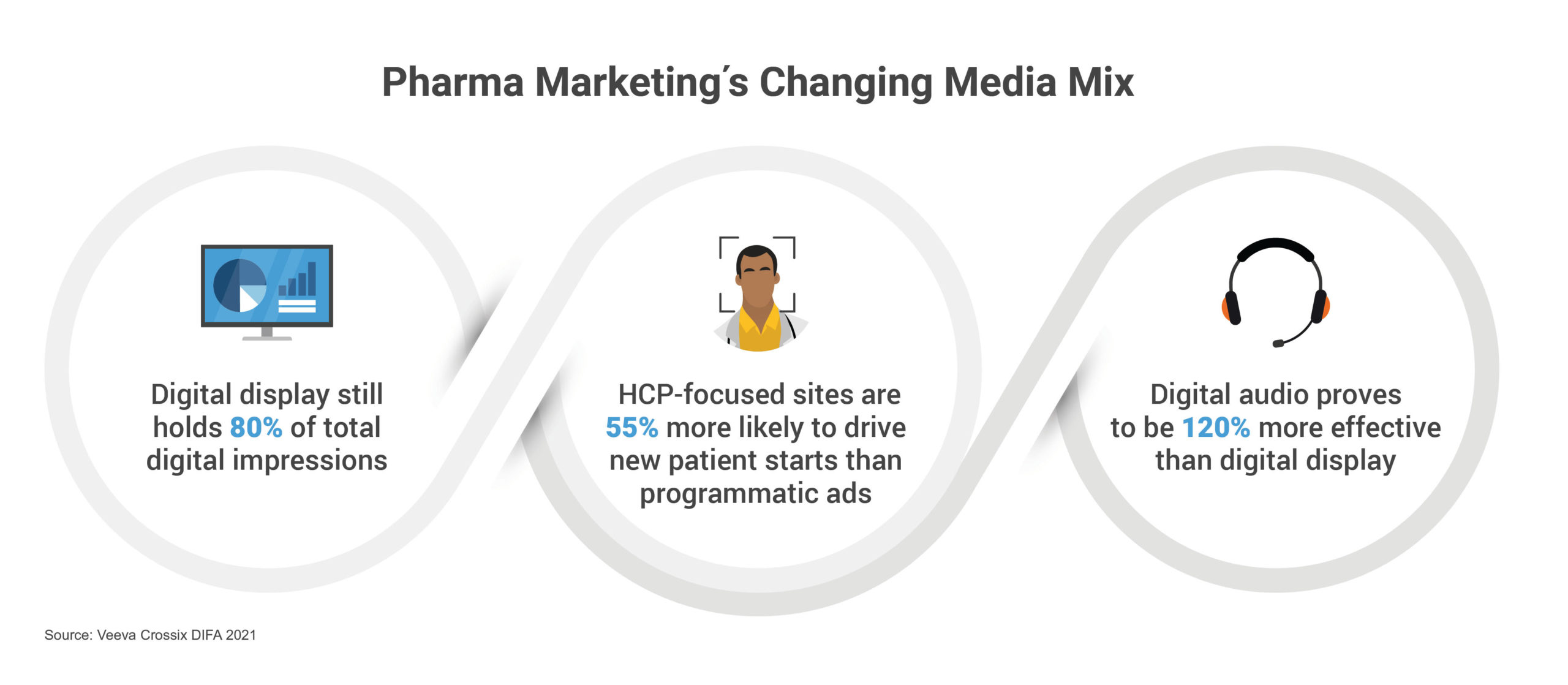

While online video, streaming, and audio advertising have all seen growth, digital display still represented the vast majority (80%) of digital impressions in 2021. Online video (9%), streaming (8%), and audio (1%) only make up a smaller chunk of overall impressions, but their growth is still impressive according to Sarah Caldwell, General Manager of Veeva Crossix Analytics.

“With COVID-19 and the shift to work-from-home, people’s media behaviors have quickly changed,” Caldwell explains. “We are seeing a surge in the use of audio channels—even beyond life sciences. It’s a channel that hasn’t historically been leveraged by the industry. So, while ‘tried-and-true’ digital display ads still make up the majority of marketers’ digital media tactics to get messaging in front of their audience, the rise in audio reveals how they are quickly adapting and experimenting with new channels to determine their effectiveness in expanding reach and impact.”

An Increase in Targeting Effectiveness

These new digital tactics are also providing marketers with more precise targeting opportunities that are improving the quality of the audience they reach. From 2020 to 2021, targeting improved by 22% for digital display, 25% for online video, and 4% for audio. Furthermore, the conversion-to-brand rates for streaming and audio have been impressive compared to digital display with streaming experiencing a 10% higher rate and audio a 120% higher rate.

“Audio advertising will become a key player in the ongoing media mix, especially since customers who started adding audio into their media plans are seeing benefits and our data shows that it’s positively influencing prescriber and patient behavior,” Caldwell says. “Marketers can test and learn what works quickly, and with the ability to layer in health-based targeting, investments and impact will continue to grow. With rich ads in audio and video format, marketers’ campaigns are also more likely to stand out and cut through the digital clutter, connecting with their audiences in a meaningful, personal way. Ultimately, I see it following a similar growth pattern as digital video—which has quickly become a standard part of marketers’ media strategy.”

The Opportunities in Audio Advertising

The Opportunities in Audio Advertising

In terms of what audio opportunities marketers are most interested in, Crossix measured 50% more campaigns that included digital audio tactics compared to the year before with more investments in streaming audio channels and an increase in audio inventory purchased programmatically. While several therapeutic categories saw growth in audio impressions, the highest increase was in Preventative Medicine (+103%) and Women’s Health (+77%).

“Audio ads can be run across any ad-supported audio platform, including Pandora, iHeartRadio, Spotify, and others,” Caldwell explains. “In these environments, audiences are often given the option to listen to an ad and then opt out if they prefer to have an ad-free experience afterward. This is an effective way for marketers to capture their audience’s attention while respecting each person’s channel experience. Banners or streaming video can also be placed within the audio environment alongside the narrated ad. This lets marketers convey their key message in a more engaging way while balancing it with the required safety information.”

Advertising in Streaming vs. Traditional TV

As streaming or connected TV (CTV) is becoming a more popular choice for consumers over the more traditional linear TV, many marketers are left wondering if they should also make a change and put more marketing dollars toward streaming. For now, linear TV investment is 8x higher than streaming, but investment in streaming grew 34% YoY.

“Linear will always play a foundational role in the media mix given its reach and breadth, even as digital channels surge. Yet, the gap between linear and streaming investment will continue to shrink as streaming gains a higher share of ad investment moving forward,” Caldwell says. “Each provides distinct benefits depending on marketers’ brand and campaign strategy, enabling them to target and reach the most relevant audiences. For example, the gap might narrow faster in categories where a large part of the patient population primarily consumes online digital media. I’m interested to see how this dynamic will shift across different therapeutic areas and diverse product portfolios.”

The report did examine two therapeutic areas to see how targeting effectiveness differed when advertising via linear versus streaming. For oncology brands, streaming increased targeting effectiveness 49% compared to linear TV buys. Meanwhile for diabetes campaigns, streaming increased targeting effectiveness by only 5%. This is an indication that patients with more common diseases can be reached with similar effectiveness using mass media.

“The advantage of streaming TV is that marketers can be more targeted with the same ads that were traditionally for a mass audience through linear TV,” Caldwell says. “Marketers can be more precise in optimizing their media strategy to effectively communicate with key audiences—especially useful when tapping into smaller, more niche prescriber and patient populations such as in rare disease or oncology. Yet streaming TV is highly fragmented, spanning a variety of platforms and devices. This keeps traditional TV as a better option for reaching larger audiences.”

Are Programmatic Platforms or Endemic Environments More Effective?

Overall, marketers are finding their digital advertising campaigns to be more efficient thanks to the use of more data. Even though, on average, impressions delivered to HCPs per campaign remained flat, marketers reached 10% more priority list HCPs compared to the year before. For the most part, marketers turned to programmatic platforms as a cost-effective way to reach larger HCP lists. It is a method that proved fruitful as 85% of new patient starts influenced by digital HCP campaigns in 2021 were driven by target HCPs.

However, endemic environments can also play an important role in influencing HCP behavior—sometimes even more so than programmatic. In 2021, Crossix found that general endemic environments delivered a 39% higher rate of new brand starts for digital HCP campaigns compared to programmatic buys and niche endemic environments offered 55% higher rates.

“At the end of the day, it’s about meeting your audience where they are,” Caldwell explains. “Every brand’s marketing strategy should be tailored to the unique market position that product is in—taking into account its time in market, competitive pressures, etc. Marketers and their agencies need to have a deep understanding of where the brand’s target audiences are and how media behaviors are changing so they can drive the right mix of campaign tactics.”