In April 2022, we released an article describing proposed policies from the federal government that could impact prescription drug pricing. On August 16, 2022, President Biden signed the Inflation Reduction Act (IRA) into law. The IRA affects several components of the U.S. healthcare system with major implications for the Medicare Advantage and Medicare Part D programs.

Key provisions of the law relevant to the Medicare market include, but are not limited to:

- Part B/D Inflation rebate penalties

- $35 insulin copay caps

- Part D benefit redesign

- Government negotiation of drug prices

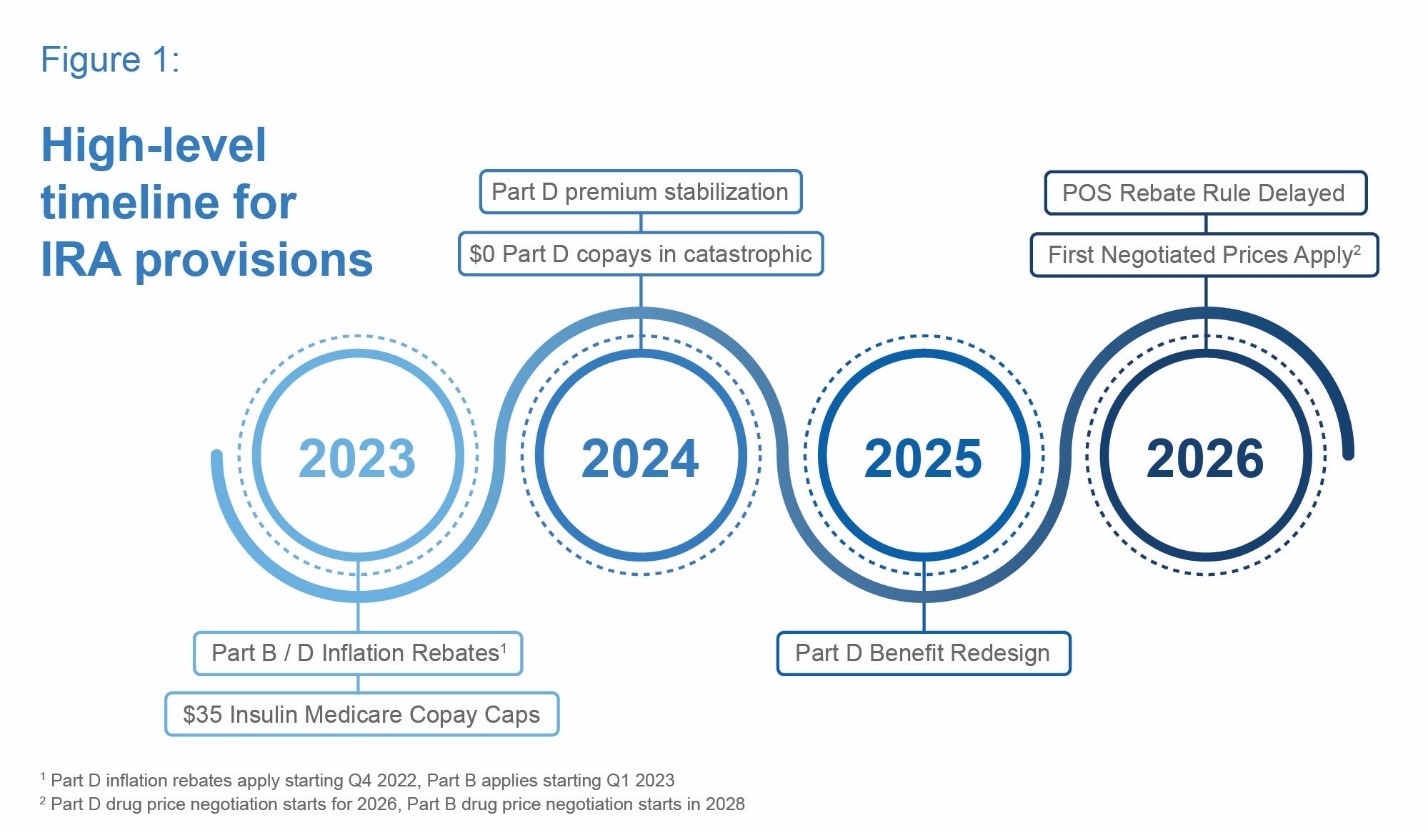

Each of these topics would represent sweeping changes on their own, and together, the IRA represents arguably the largest change to prescription drug financing in the United States since the Medicare Modernization Act of 2003, which started the Part D program. Figure 1 provides a high-level timeline of key IRA provisions.

Overview of Key Provisions by Year

Overview of Key Provisions by Year

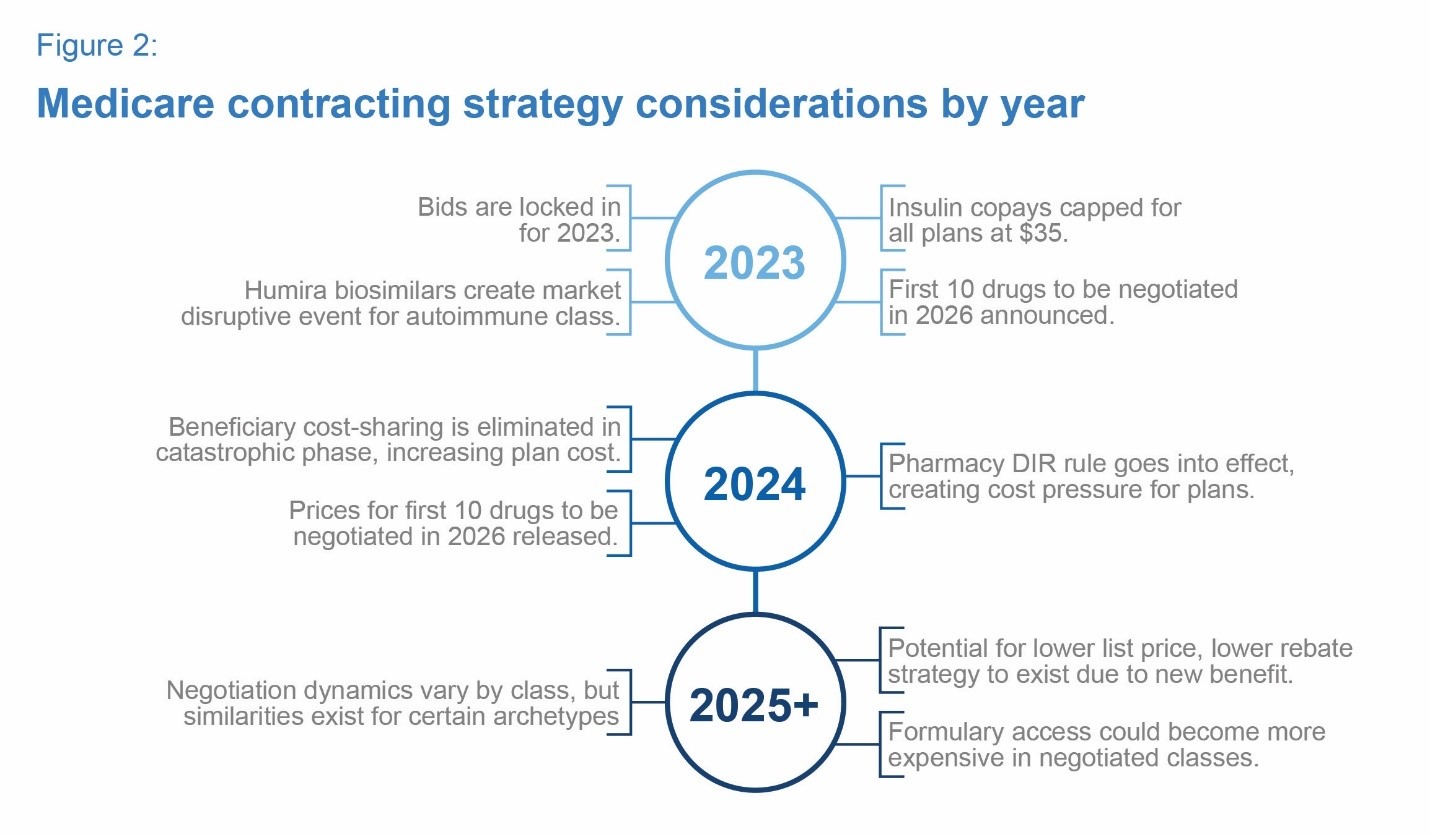

With major IRA provisions going into effect over the next few years, it is critical for drug manufacturers to understand and prepare for the implications to their business. In the sections below, we lay out key items to watch and preparation strategies for the next three years and beyond. Figure 2 summarizes some high-level considerations for each of the next few years. We discuss in greater detail below.

2023

2023

The facts:

- Medicare Part D bids for plan year 2023 were submitted before the IRA was signed.

- Cost sharing for all covered insulins for all beneficiaries will be limited to $35 per month or lower. This is similar to, but farther reaching than, the Senior Savings Model program.

- Medicare Part D beneficiaries will have access to vaccines with $0 cost sharing.

- Drug manufacturers are subject to Medicare Part D and Part B inflation rebates.

What to watch:

- The big biosimilar launch: The much-anticipated Humira biosimilars are expected to launch in 2023, which could reset market dynamics. In addition, the IRA may encourage more uptake of lower cost biosimilars due to a revised Part D benefit and the price negotiation of legacy brand products.

- Patient behavior on insulin: Part D plans will have limited opportunity to adjust strategy for 2023, given bids are locked in. Behavioral response (patient adherence/persistence) to a lower out-of-pocket cost for insulin is unknown.

- The first round of negotiated drugs announced: In late 2023, the first drugs selected for government negotiation will be announced.

How drug manufacturers should prepare for 2024:

- Have a strategy for request-for-proposal (RFP) season: RFPs for plan year 2024 will come out in late 2022 and run into early 2023. Drug manufacturers should prepare formulary access and contracting strategies that consider the implications of the IRA through 2025 and beyond.

- Understand patients’ new cost experience: In 2024, Medicare beneficiaries on high-cost therapies will no longer pay cost sharing in the catastrophic phase. Drug manufacturers should educate patients and prescribers on the new out-of-pocket cap on cost sharing, as it may influence prescribing patterns and patient adherence/persistence.

2024

The facts:

- All Part D beneficiaries will pay $0 out of pocket for prescriptions in the catastrophic phase.

- Eligibility for the Part D low-income subsidy program will be expanded.

- Part D plans will face cost pressure due to changes in the Pharmacy Direct and Indirect Remuneration (DIR) rule.

- Premium stabilization provision takes effect, limiting impact of rising plan costs on beneficiary premiums.

What to watch:

- Plans positioning for the future: Plans will submit bids for 2025 under the redesigned Part D benefit. Pricing, formulary, and benefit strategies may look different than the current environment. Plan strategies will emerge when premiums become available in October 2024 for the 2025 open enrollment cycle.

- Patient behavior on specialty drugs: No out-of-pocket costs above the catastrophic phase may drive a behavioral response (patient adherence/persistence) for beneficiaries taking high-cost drugs.

- Maximum Fair Prices published: The first round of negotiated Maximum Fair Prices will be published in August 2024, scheduled to take effect in 2026. This will provide the market a first look at negotiated price levels.

How drug manufacturers should prepare for 2025:

- Know your payer customer: With the Part D benefit redesign in 2025, drug manufacturers should seek to understand how patients taking their therapies (or competitors’ similar therapies) either increase or reduce payer costs.

- Know your new expected liability: In 2025, the new manufacturer discount program will change drug manufacturer liability. This new program warrants a second look, considering the inclusion (and phase-in) for the low-income population, expected patient behavior changes, and the new, uncapped liability associated with claims above the maximum out-of-pocket.

2025

The facts:

- Part D benefit redesign takes effect, stakeholder liability and cost change materially.

- Maximum patient Part D out-of-pocket set at $2,000.

- Cost sharing “smoothing” becomes available.

What to watch:

- Plan product offerings and benefit strategies: Part D plan product offerings and benefit strategies may change materially as the Part D benefit converges to three phases with different stakeholder liabilities. These changes could affect the profitability of different plan types and members, along with the impact of population health management.

- Formulary strategy changes: Due to disruptive changes in 2025 and government negotiation in future years, plans may start to adopt formulary strategies that offset cost pressures. New dynamics could incent greater use of low list price, low rebate products.

- Changes to risk adjustment: With changes in plan sponsor liability, Medicare risk score models will need to be updated to ensure plan compensation aligns with risk. Changes to the risk score model have the potential to materially affect payer strategies.

How drug manufacturers should prepare for the years to come:

Beyond 2025, here are four areas that companies should watch closely as the changes occurring in 2025 could have further implications.

1. New incentives based on which products are selected for negotiation

The selection of certain products could change incentives in the market:

- Clinical considerations: Some top-spend drugs operate in categories where clinically superior agents have recently launched. If the HHS Secretary selects products for negotiation with less clinical benefit than newer products, this could create financial incentives that are not aligned with evidence-based clinical care.

- List vs. net price: The drug ranking is based on gross spend. For some of the top-spend drugs, rebates negotiated by payers may exceed the minimum discounts outlined in the IRA. If government-negotiated discounts are not materially higher than rebates currently negotiated by payers, this could be comparable to passing through rebates at the point of sale, which could increase plan and government costs. In this scenario, plan costs could be lower with non-negotiated products, creating an incentive to favor non-negotiated products with high rebates.

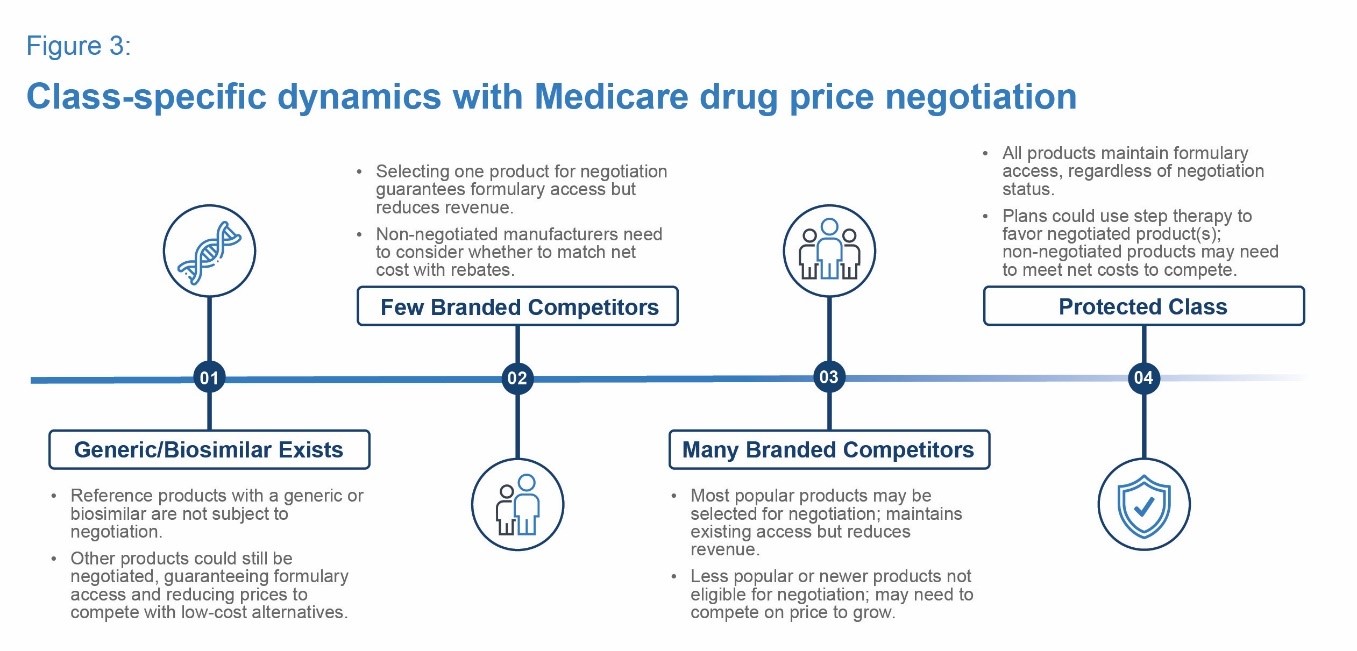

2. Therapeutic areas may have archetype characteristics to consider

Plan bids will reflect negotiated prices for the first time in 2025 (for the 2026 plan year), affecting formulary and coverage strategies. Although the dynamics within each therapeutic area may vary, certain archetypes could influence competitive dynamics. Figure 3 summarizes some potential archetypes, with commentary on how the dynamics could affect classes that fit the mold.

Two examples of the “Few Branded Competitors” archetype are the Rapid-Acting Insulin and the Oral Anti-Coagulants classes. In each class, formulary management is highly active and one to two preferred products are typically selected. In this type of class, selecting one product could materially disrupt competitive dynamics. For the product selected for negotiation, it can either reinforce or create broad Medicare access. For the products not selected, drug manufacturers have a choice to compete with a publicly known net cost target by offering rebates to the payer. Both market leaders and laggers have opportunities to execute strategic growth or defend patient access in this archetype.

Two examples of the “Few Branded Competitors” archetype are the Rapid-Acting Insulin and the Oral Anti-Coagulants classes. In each class, formulary management is highly active and one to two preferred products are typically selected. In this type of class, selecting one product could materially disrupt competitive dynamics. For the product selected for negotiation, it can either reinforce or create broad Medicare access. For the products not selected, drug manufacturers have a choice to compete with a publicly known net cost target by offering rebates to the payer. Both market leaders and laggers have opportunities to execute strategic growth or defend patient access in this archetype.

3. Considerations for Medicare Part B drugs

Additional considerations specific to Part B drugs include:

- Introducing inflation penalties for Part B drugs makes it more difficult to calibrate Average Sales Price (ASP) to enable incentives for provider use and preserve drug manufacturer gross-to-net margin.

- Although products with biosimilars are insulated from government negotiation, biosimilar competition is already putting downward pressure on ASP.

- With ASP-based reimbursement lagging two quarters behind and using four quarters of smoothed rebates and discounts, drug manufacturers need to consider how to position for biosimilar impacts in the near-term and for 2028 and beyond.

4. Enterprise view of portfolio is critical

Competitive and pricing dynamics will vary based on the nuances associated with each therapeutic area. Although a granular approach is important, it is also critical for drug manufacturers to maintain an enterprise view of the impact of the IRA on their portfolio. Negotiation is isolated to specific drugs or classes, making a full 360-degree view necessary to understand broader implications. In addition, drug manufacturers should consider the potential for negotiation and inflation rebates in setting launch prices for a new product, as well as downstream impacts across the entire portfolio.

Conclusion

The IRA will undoubtedly have major impacts on the Medicare market. As provisions start to take effect, drug manufacturers should take the time now to understand what the next few years will look like and carefully plan for the market landscape under the IRA.