Several years ago I wrote The History of Bio-Pharma Industry M&As, Lessons Learned and Trends to Watch. In it I shared my collection of the genealogy of some of the largest pharmaceutical and biotechnology companies thinking that it would be informative to many, especially to those who have not lived through the industry dynamics of the last 40 plus years. I heard appreciation for this work and have been hearing requests for an update.

The first article pointed out that, contrary to what many people believe, the biopharma industry is not oligopolistic with only a few very large players in the game. The industry is extremely fragmented with many participants of all shapes, sizes, focus areas, strategic styles, and cultures. This fragmentation and the dynamic environment that surrounds it, including many startups, represent fertile ground for continual consolidation through mergers and acquisitions.

Mergers and acquisitions are sought out for many reasons; sometimes for truly long-term strategic purposes, but other times simply to fill short and medium-term pipeline gaps, to cover for forecasted growth dips, or simply to bridge resource utilization breaks in sales forces.

Different Ways to Becoming Powerhouses

The prevailing wisdom had been that some companies were destined to remain powerhouses in particular therapeutic areas for decades to come and that such a strength could never be dislodged, at least not quickly or easily. Turns out, that powerhouse status can change relatively fast. Some 30 years ago, Merck was a cardiovascular powerhouse; Lilly was a neuroscience one; and Wyeth was very strong in women’s health. As recent as 15 years ago, Merck or BMS were not thought of as specialty companies—in spite of their robust specialty portfolios (subject for another article). In another corner of the pharma landscape, 15 years ago Roche in the U.S. was associated, almost exclusively, with primary care products and certainly not with oncology.

Today, these three large companies are very well known and celebrated for their specialty and oncology research and commercial success—even more so than their traditional general medicines legacies. How did they get here? They took very different paths, some deliberate, some almost accidental.

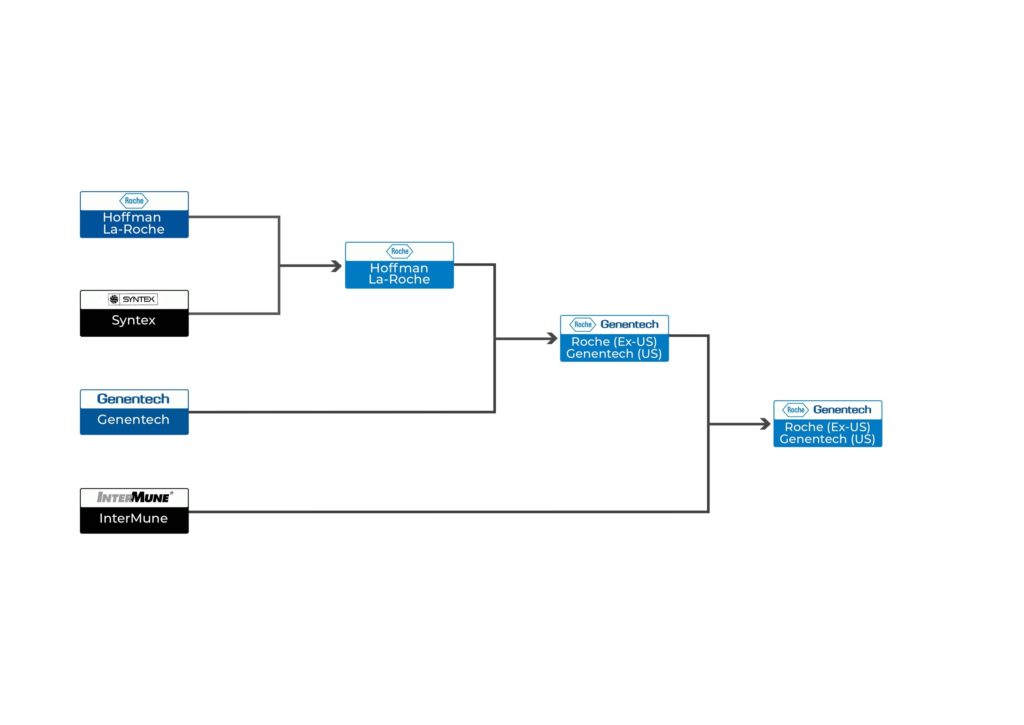

In the case of Roche, before 2009 it already owned 50% of Genentech but in a silent leave-it-alone sort of partnership. Genentech, of course, came to be the most important company in oncology, but Roche itself was not seen as an oncology company and was limited to only selling Genentech’s products outside the U.S. When, in 2009, Roche decided to buy the 50% of Genentech it did not already own, it instantly became a global oncology powerhouse (in the U.S. the company operates under the Genentech name and image).

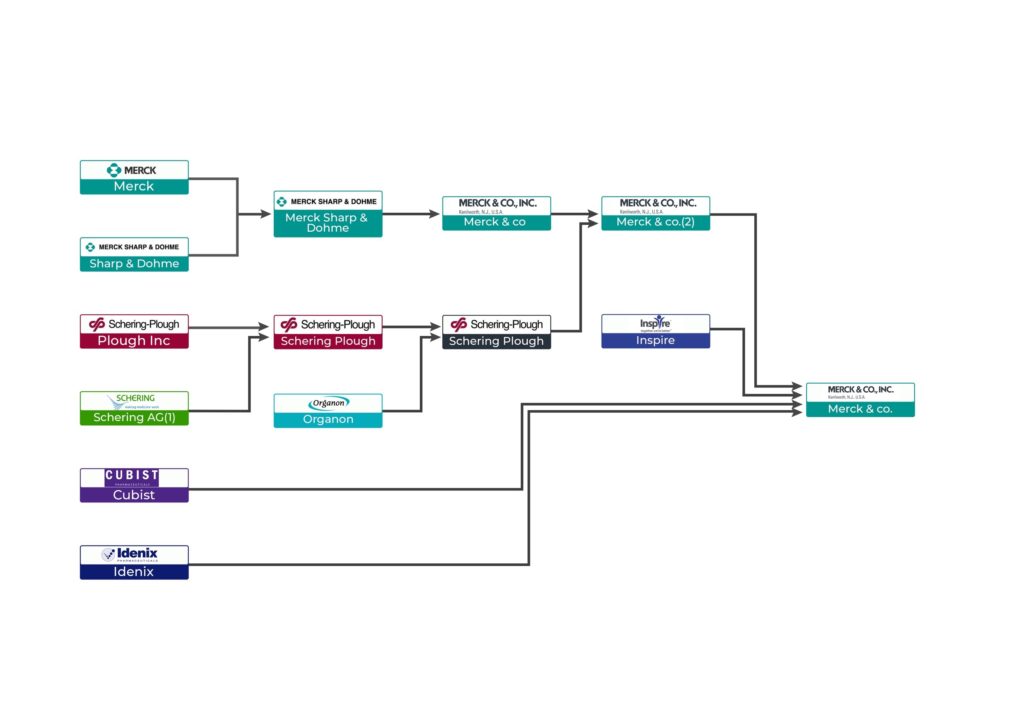

Merck took an entirely different road. Although it had some presence in oncology through its supportive oncology product for chemotherapy-induced nausea and vomiting (Emend), it didn’t really have a serious presence in the field. Come pembrolizumab, the product that came along in an asset basket when Merck effectively acquired Schering-Plough. In the early-development portfolio there was this molecule that had come earlier to Schering-Plough via its own purchase of Organon years before. It’s been reported that pembrolizumab was not a priority for Schering-Plough when it bought Organon and was not a priority for Merck when it bought Schering-Plough. In fact, it has been reported that Merck tried to out-license the product in 2010. But dynamics and strategies can change quickly for those paying attention. Along the way, Bristol-Myers published positive results with its checkpoint inhibitor Yervoy, prompting Merck to dust off pembrolizumab and then developing it in an almost stealth mode to the huge success that it (now known as Keytruda) has become. Merck, all of a sudden became a powerhouse in oncology along BMS and Roche/Genentech.

These two examples show how very different acquisition strategies can play out over time. In one case, a deliberate acquisition of a strategic asset in a specific area. In the other, even though there was a company acquisition, it was not at all for the asset or even the therapeutic area that turned out to be the eventual crown jewel.

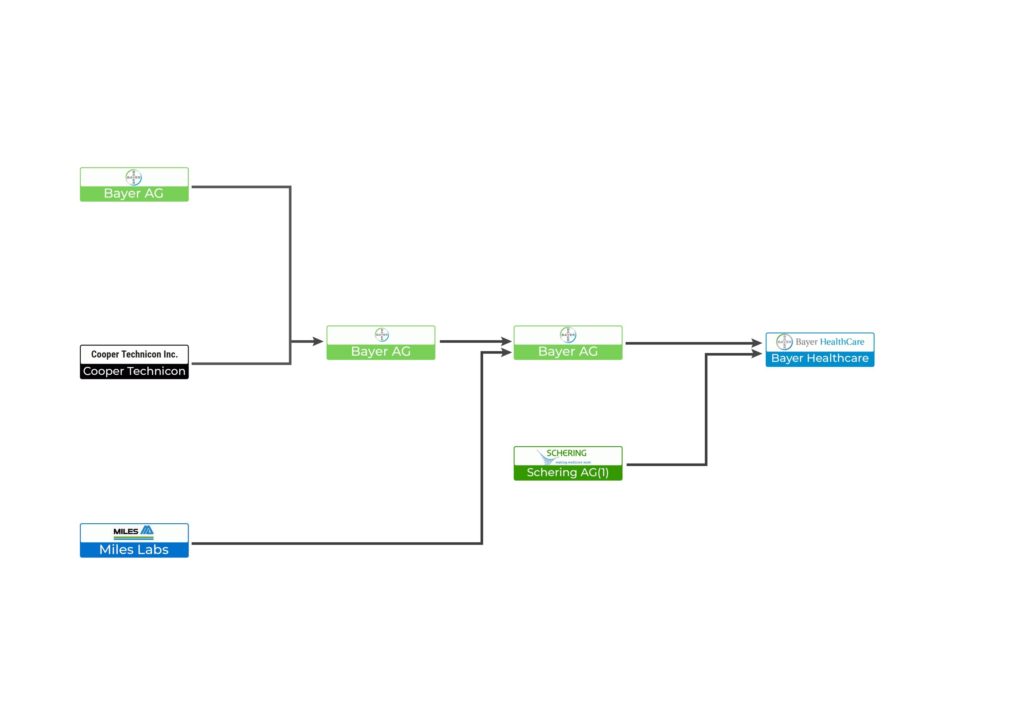

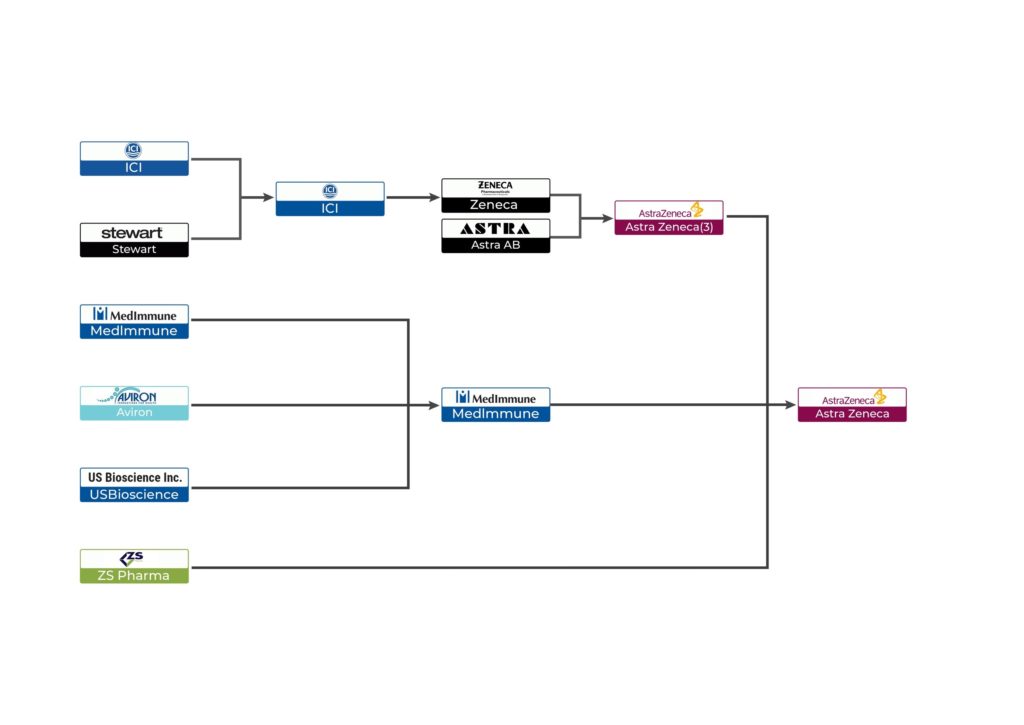

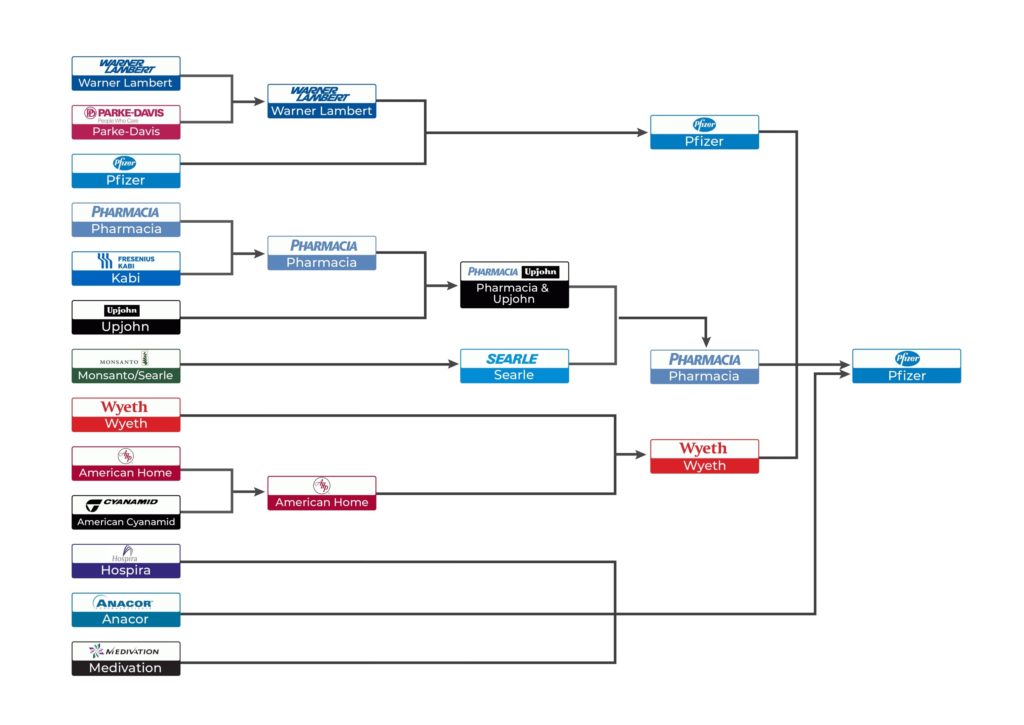

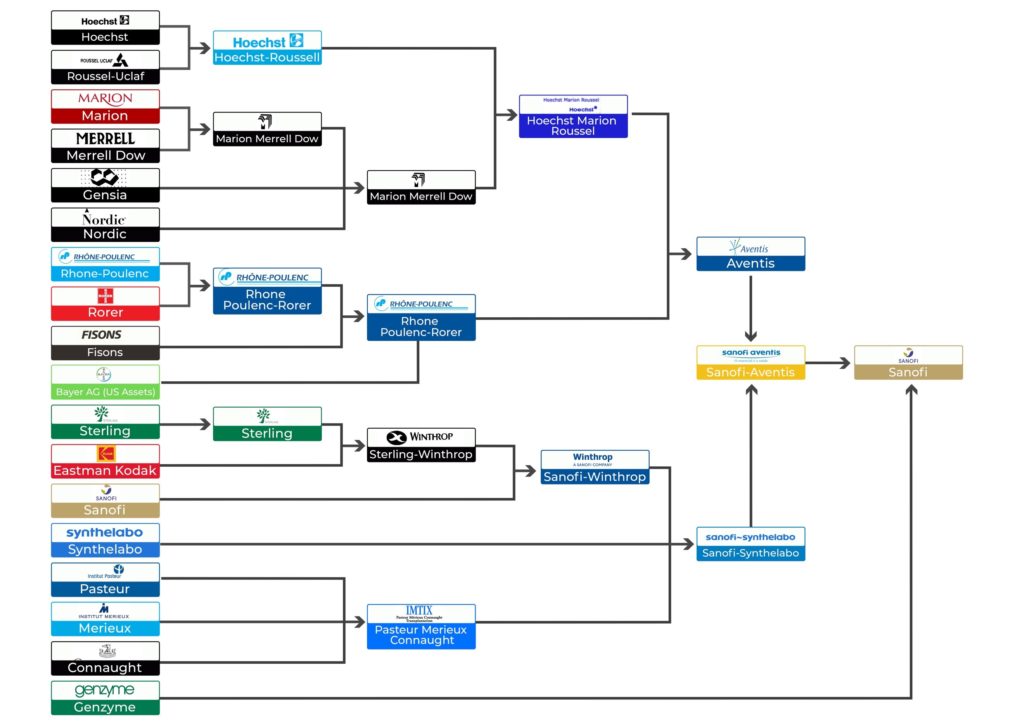

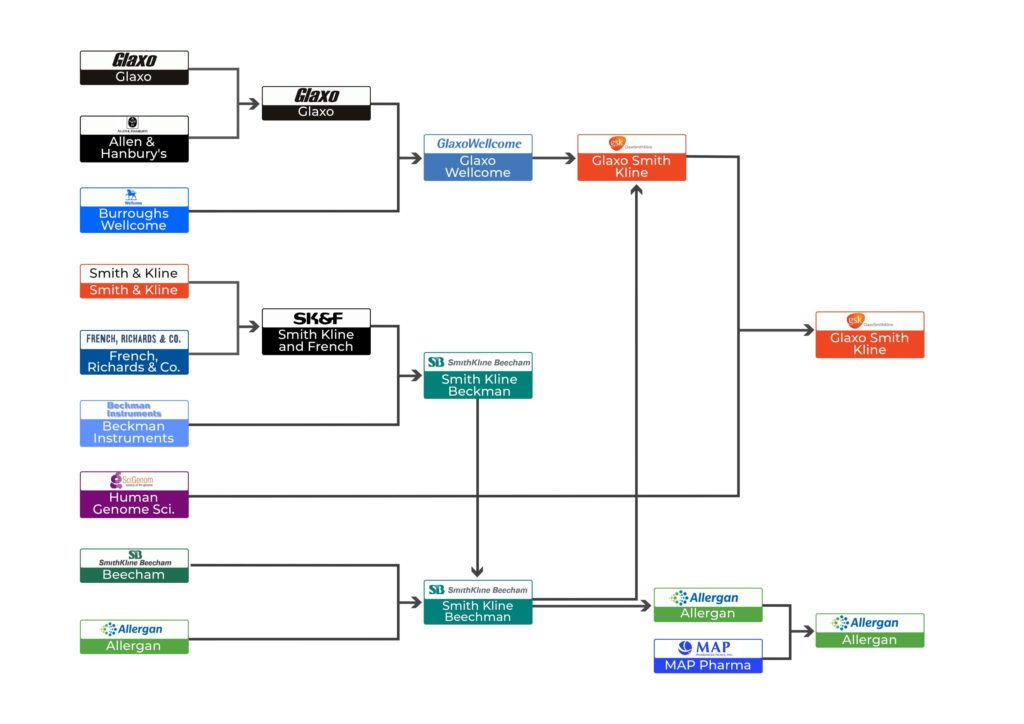

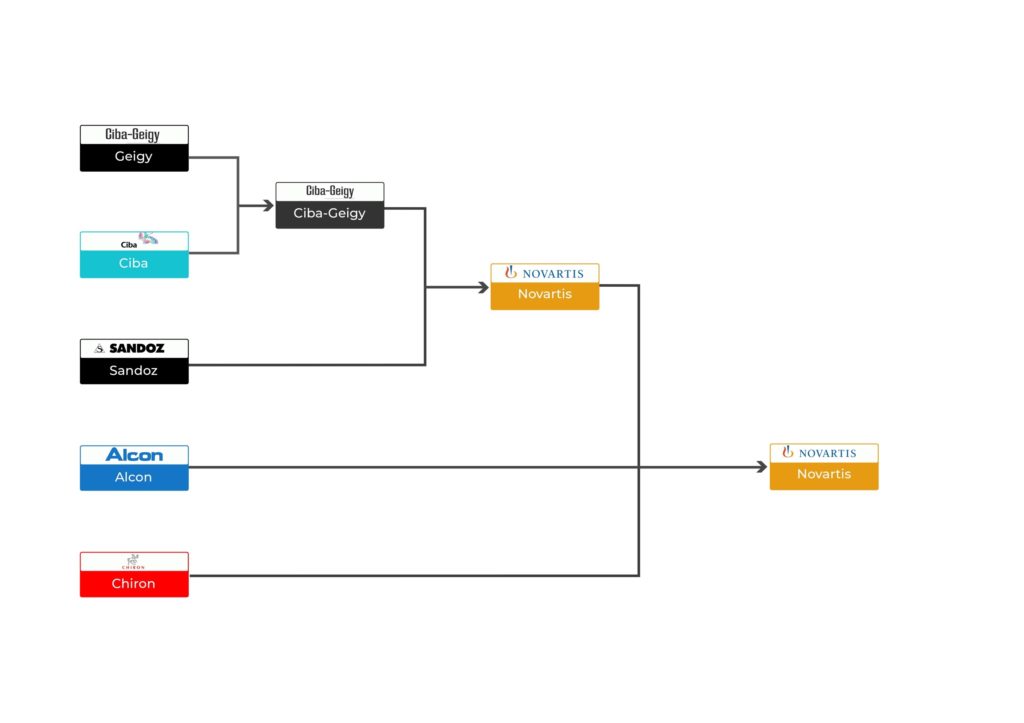

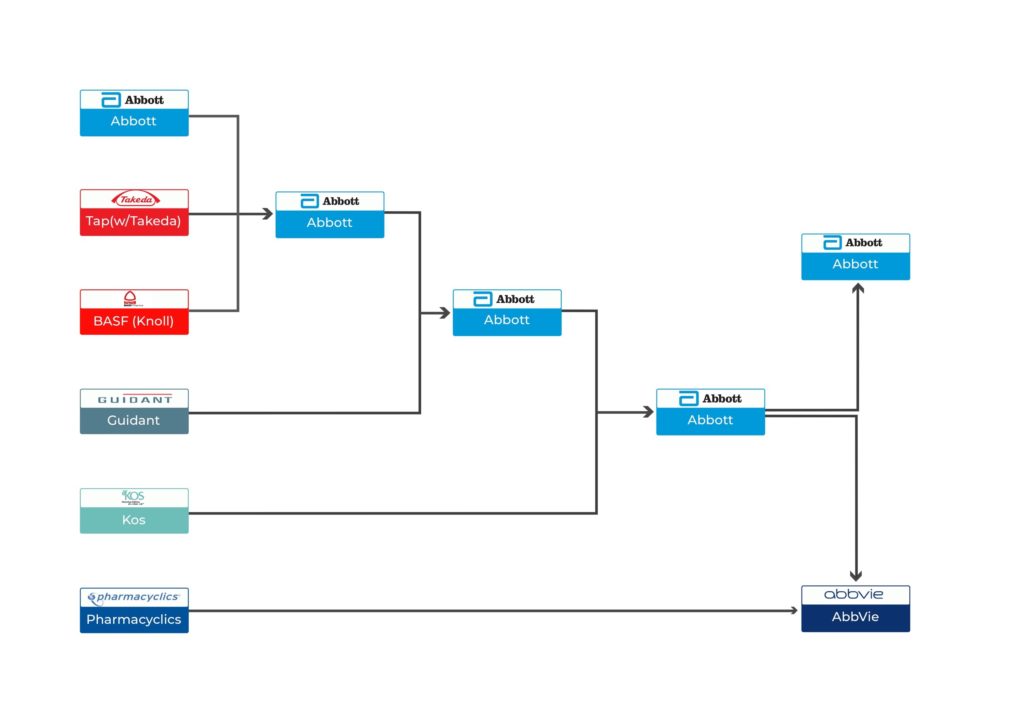

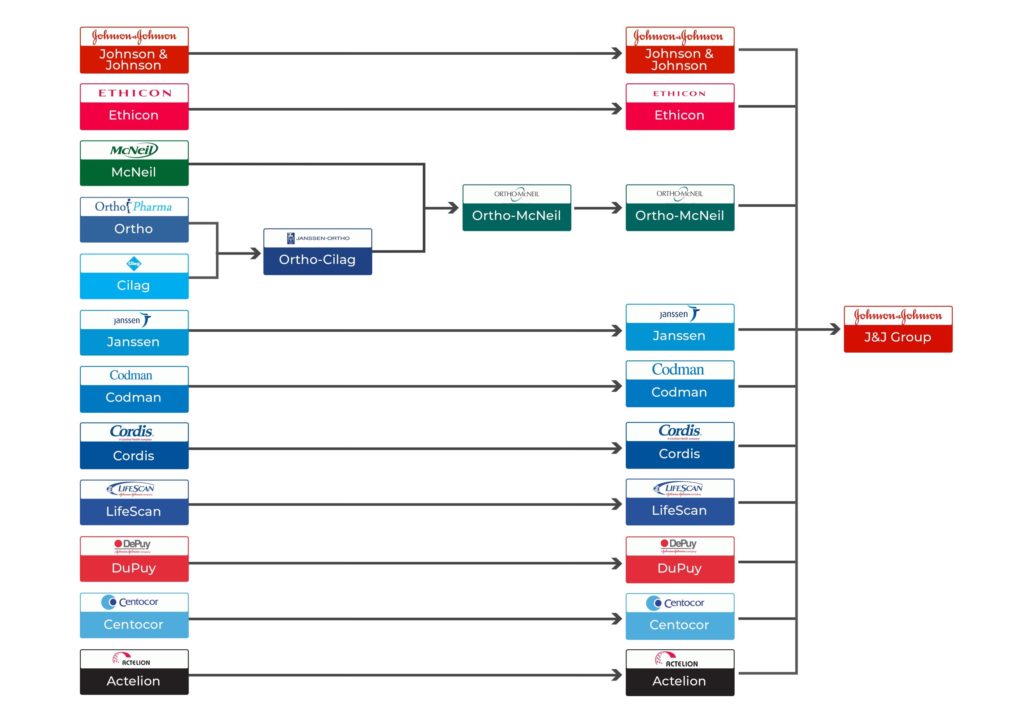

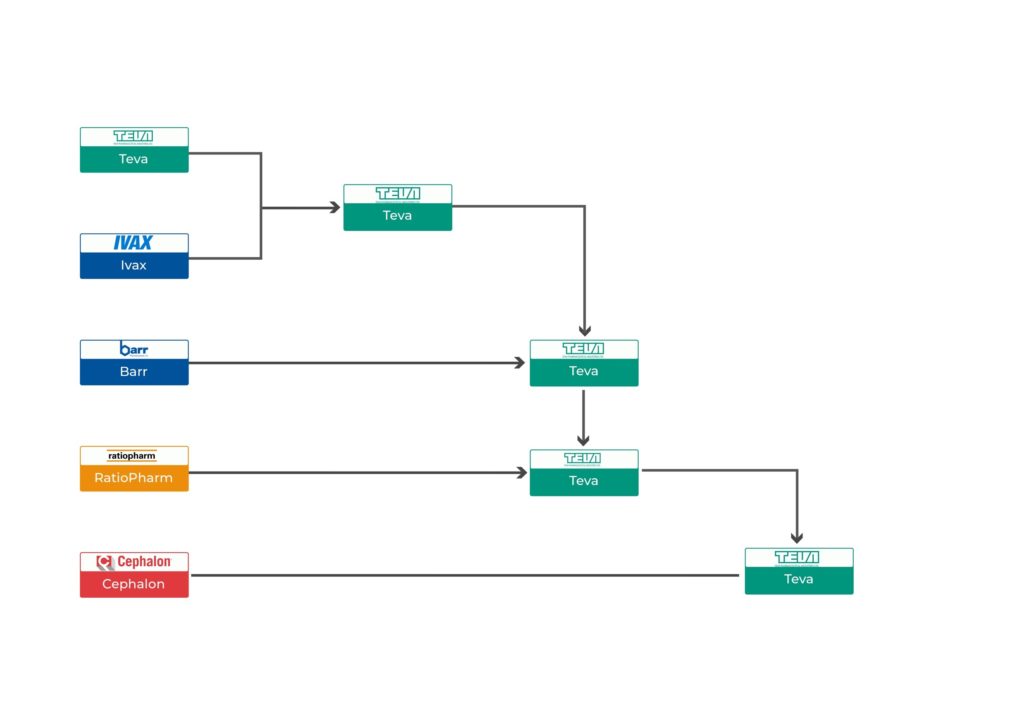

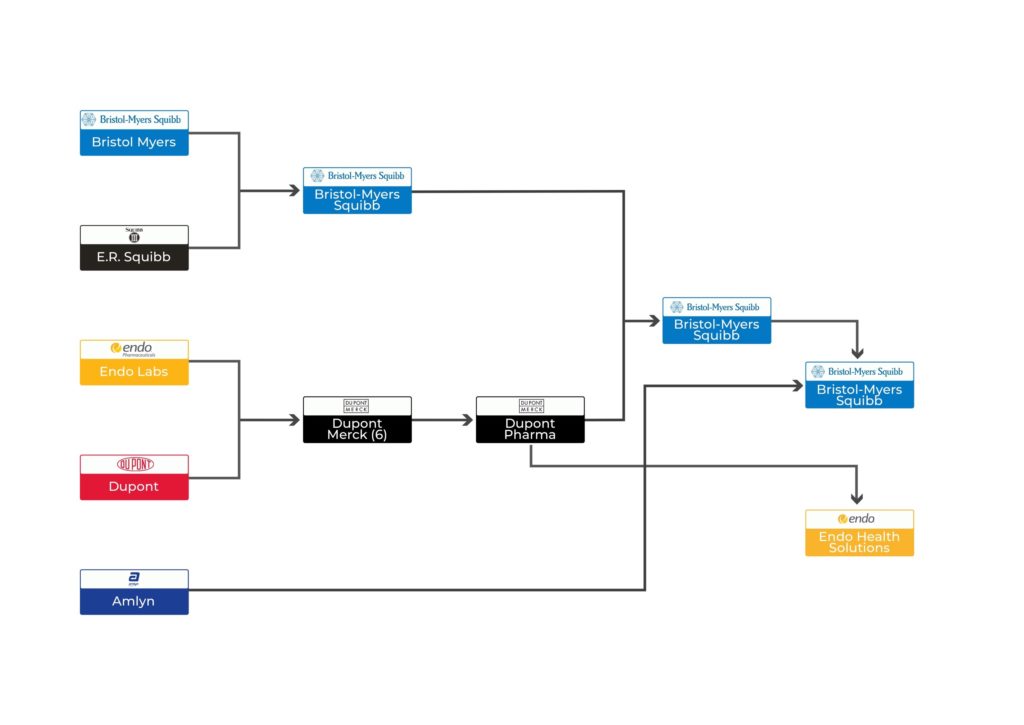

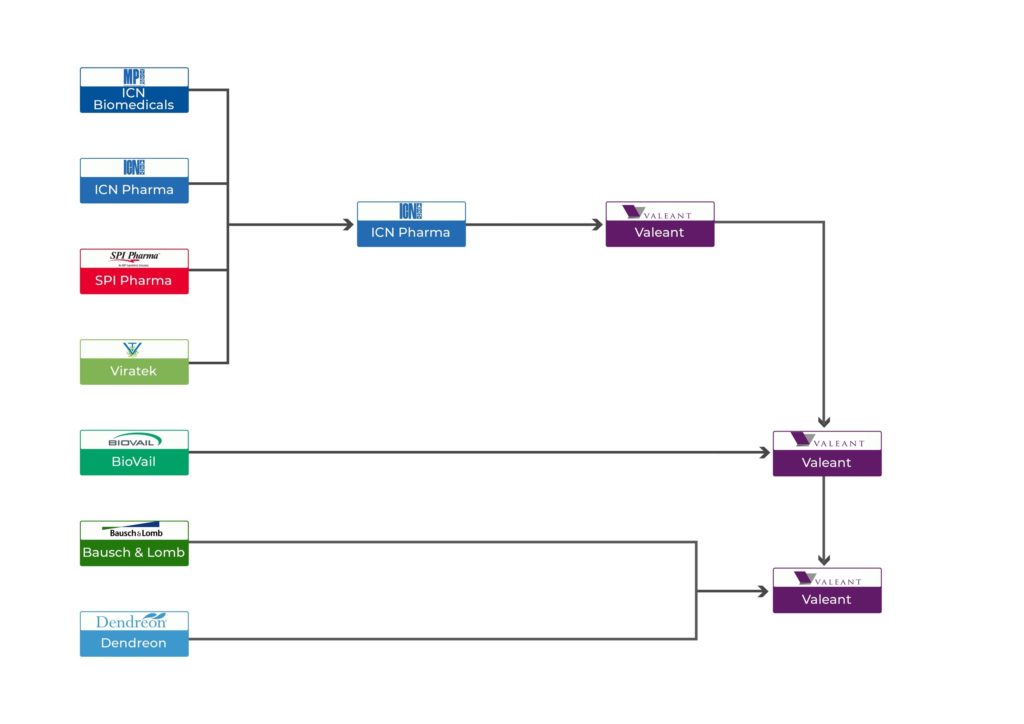

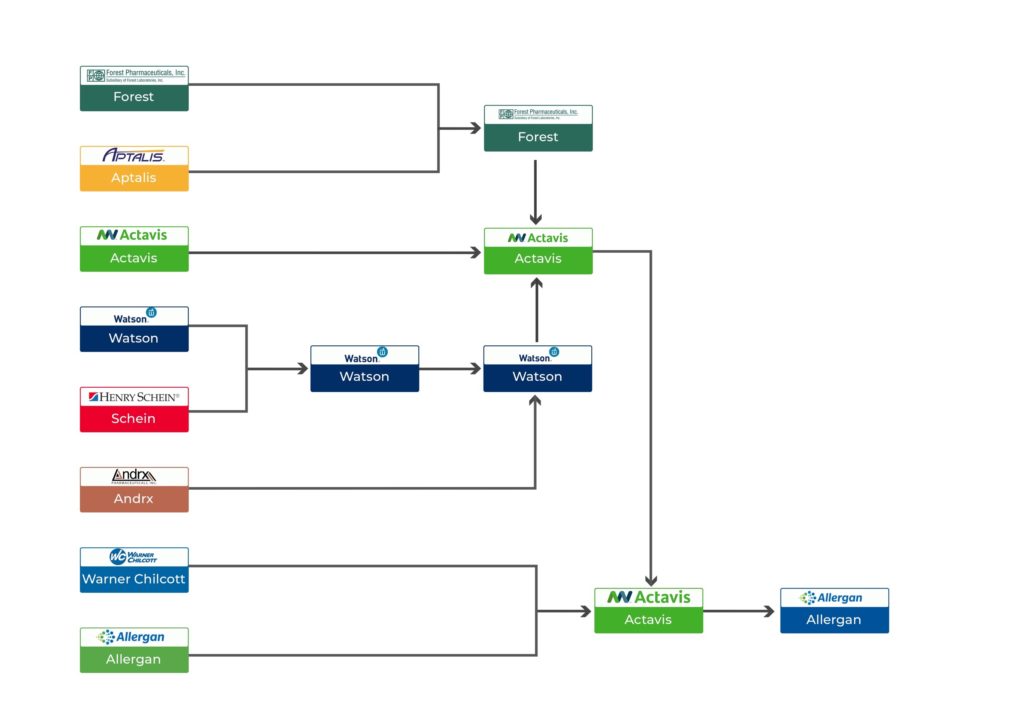

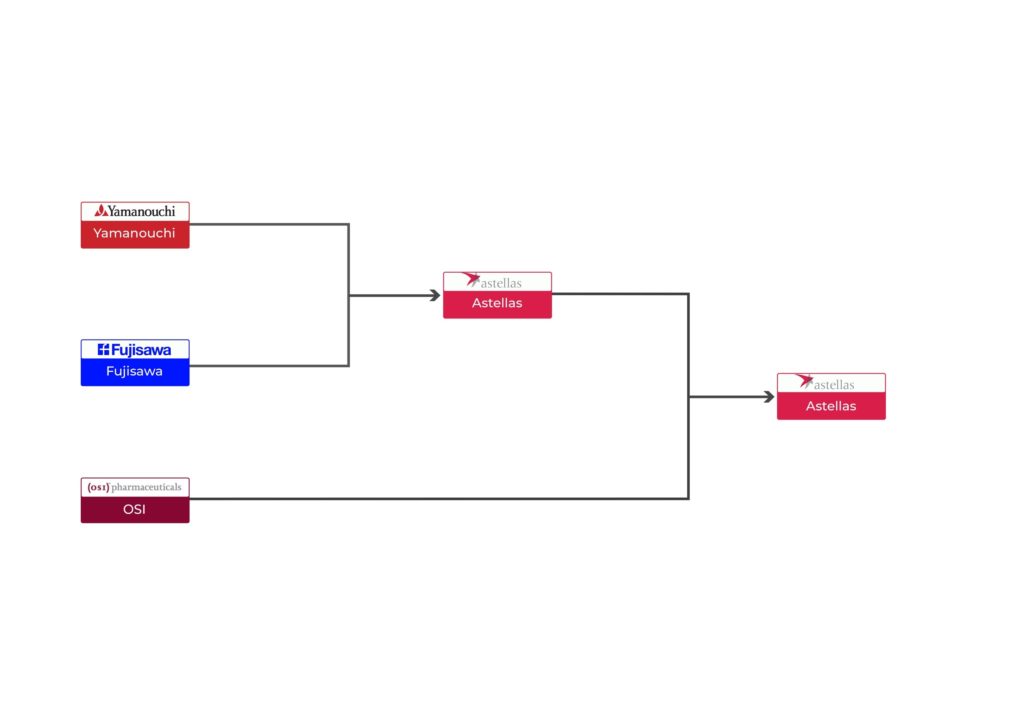

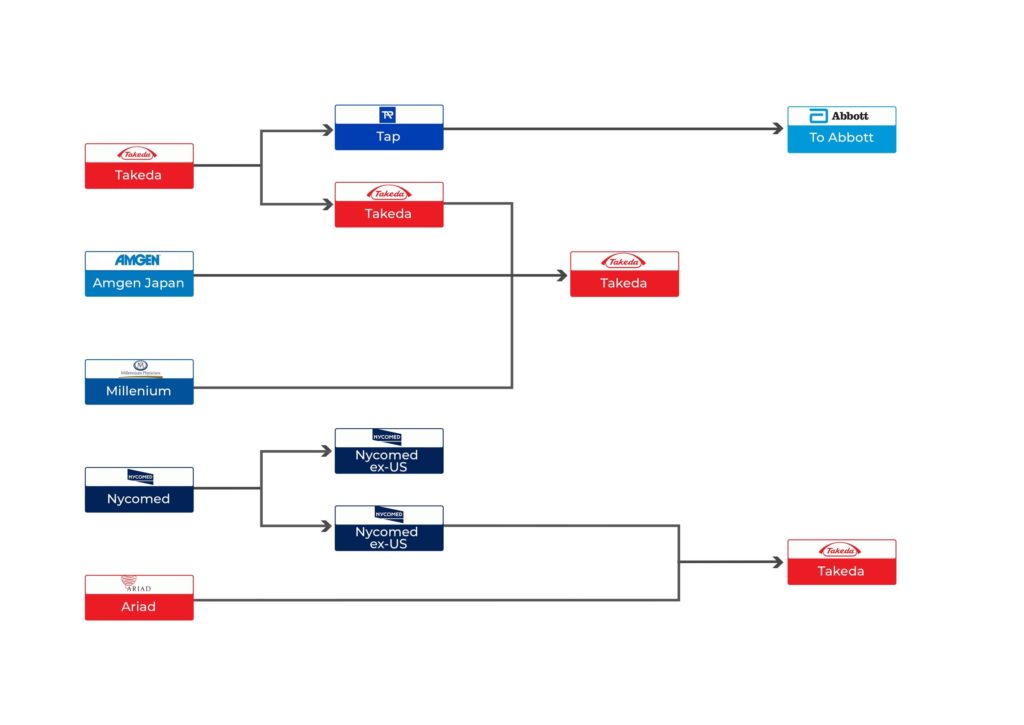

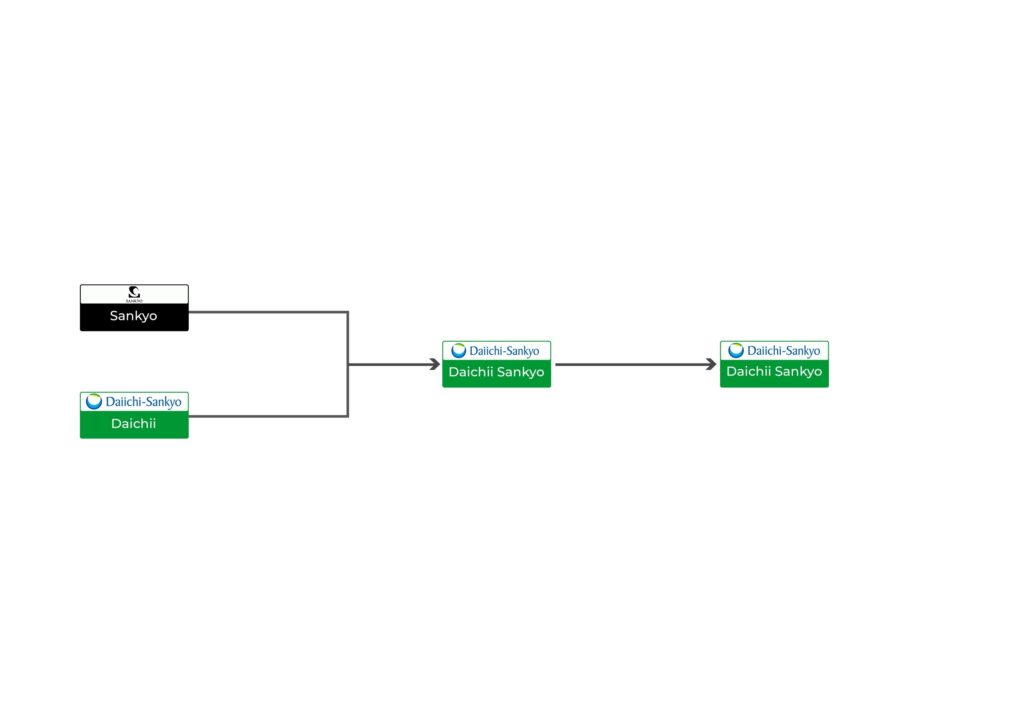

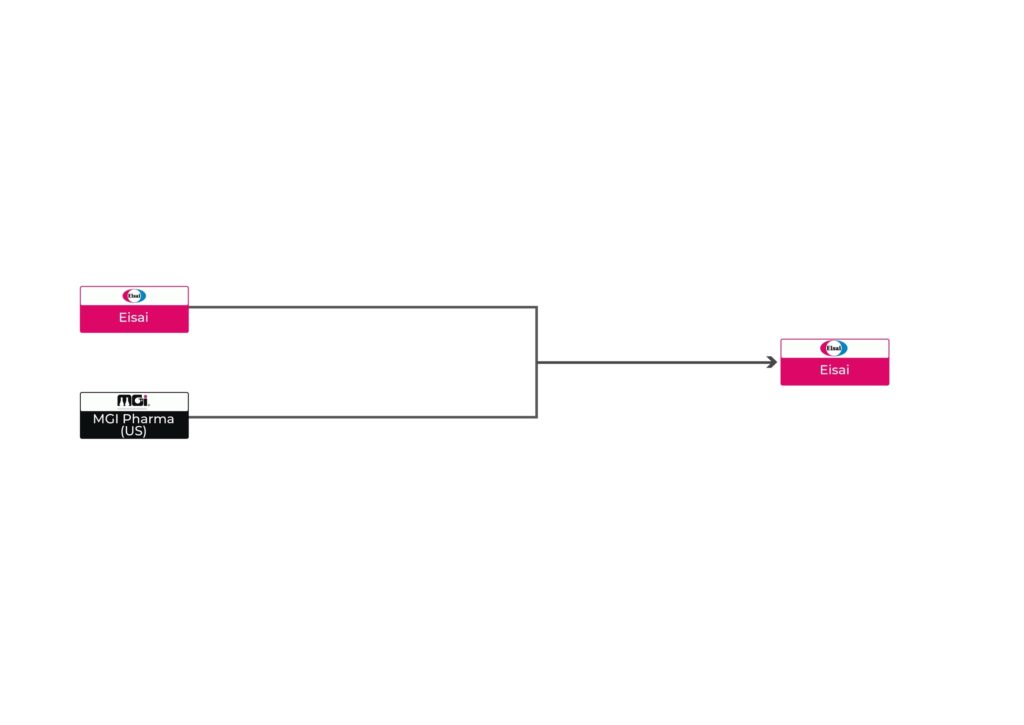

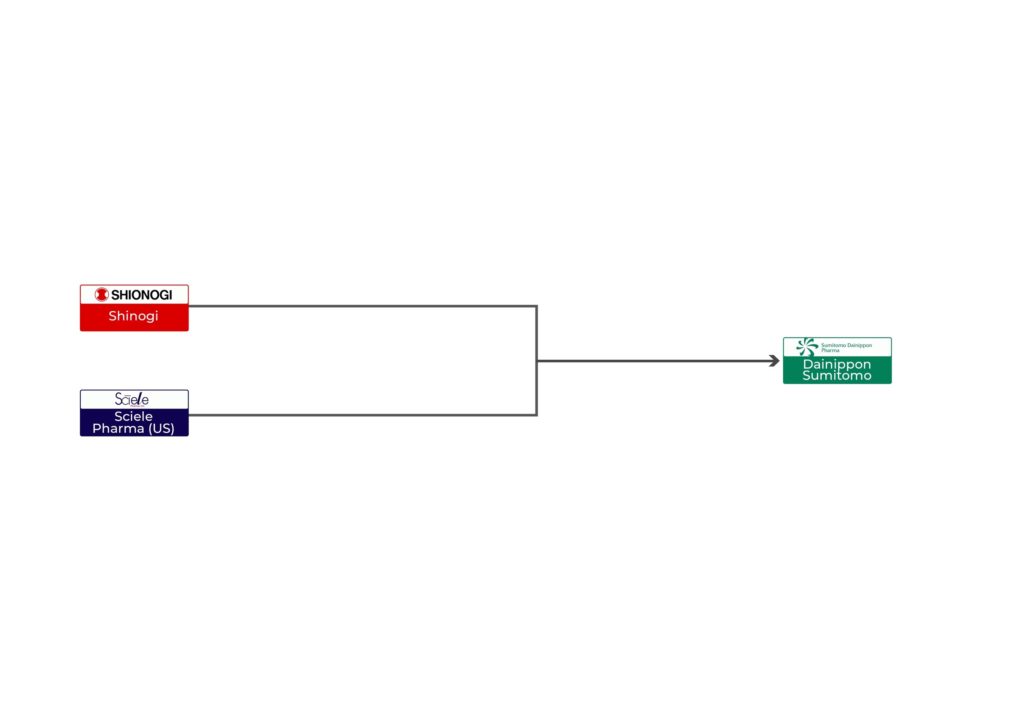

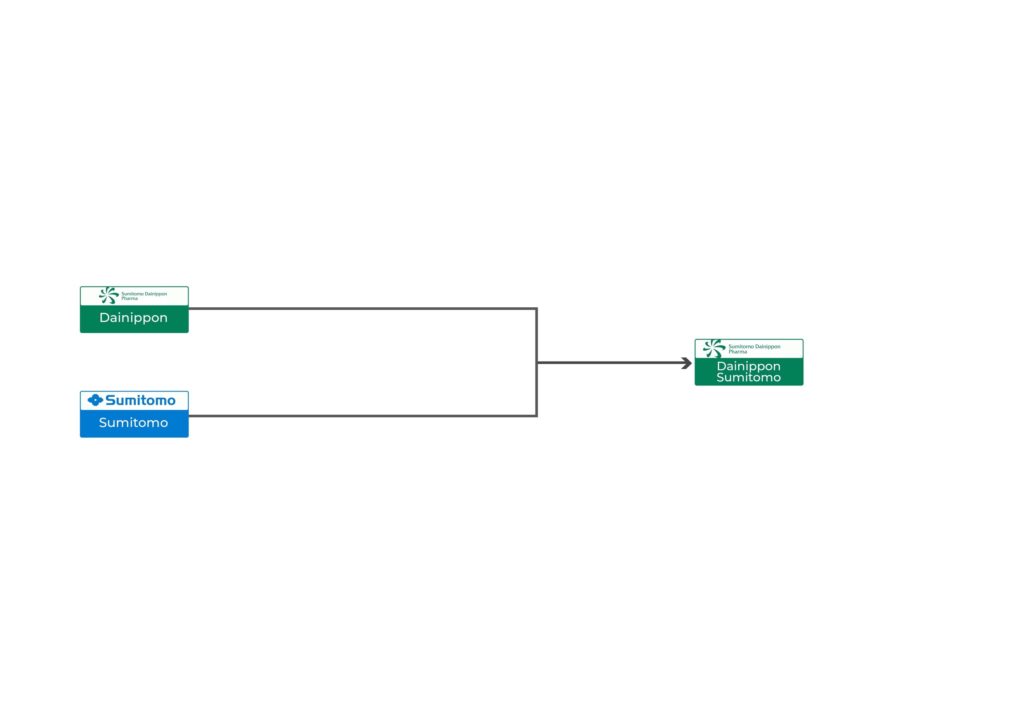

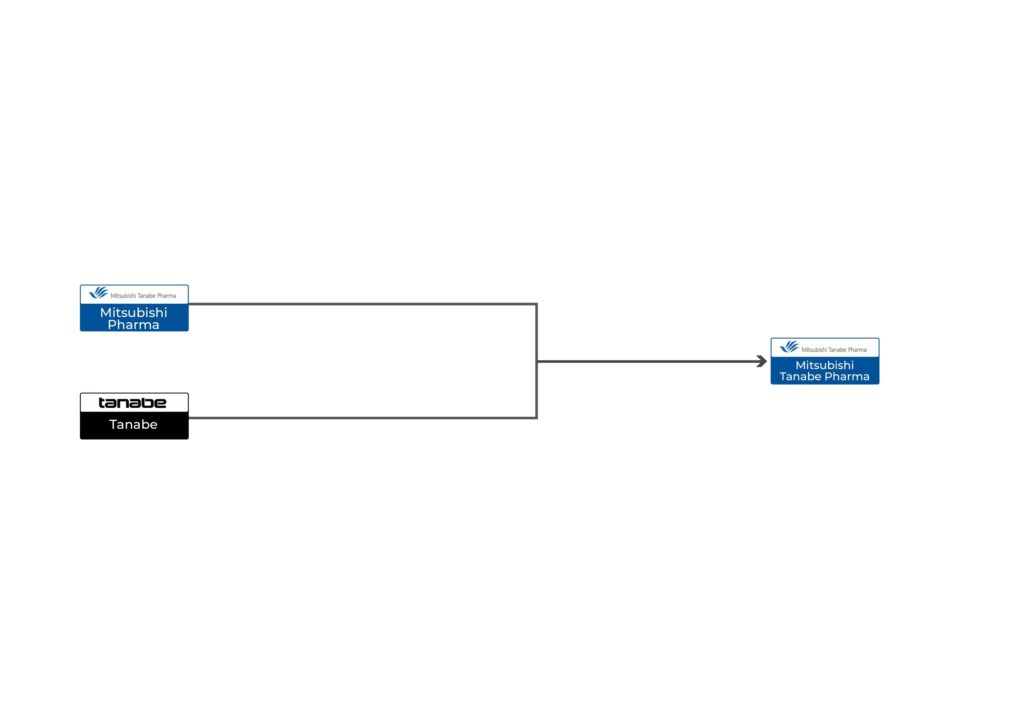

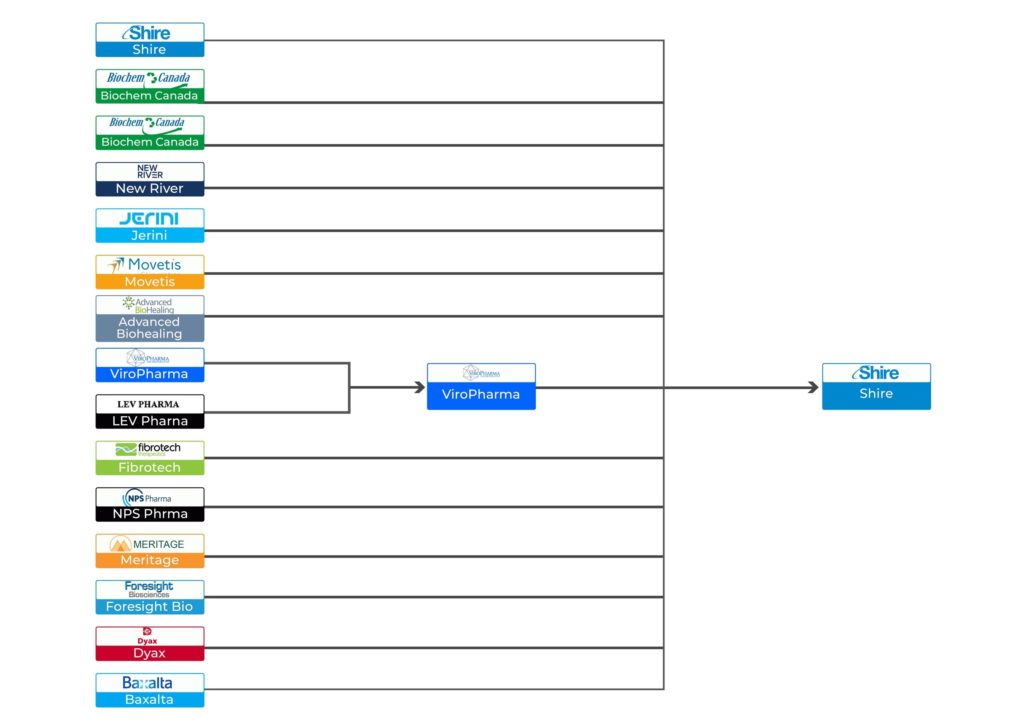

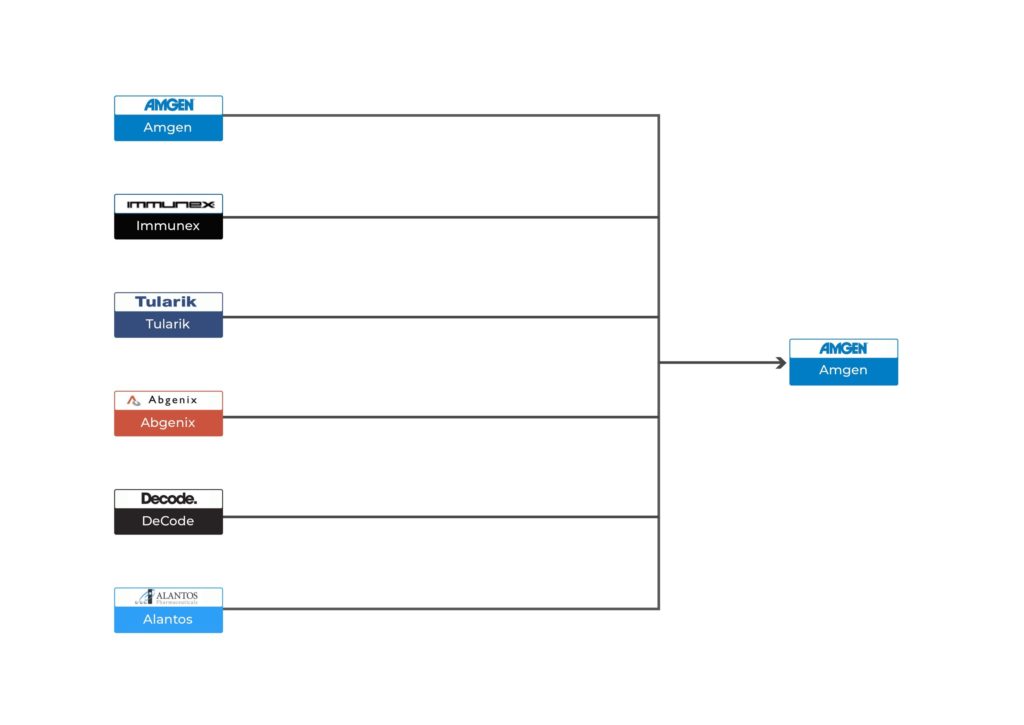

There are multiple different types of mergers and acquisitions and many different paths to success. The accompanying graphics at the end of the article attempt to summarize and provide a retrospective look at how some of the major industry consolidation has come about. I’ll leave to others to analyze the merits and strategies of each of the many combinations portrayed; my intention is to only capture the historical moves and patterns. The charts don’t include every single acquisition, especially those companies that never commercialized a product, but it offers a useful glimpse at the types of strategic choices that seem to be preferred by certain companies or groups; some prefer sequential acquisitions of smaller players; some turn to sequential acquisitions of similarly sized companies; some love mega-mergers.

A Few Observations

As one would expect, in the earlier days of this trend, the tendency was to consolidate nationally before going abroad. For example, British companies such as Glaxo, Welcome, and Smith and Kline converged first; the same can be said for French, American, Japanese and, to some extent, Swiss companies within their respective home countries. Presumably, this was seen as low-hanging fruit permitting easier cultural integration, operational efficiencies, and more. Their moves were also facilitated by local laws, sentiments, and political appetite. As these intra-national combination opportunities became exhausted, and as companies became more globally minded, they started looking for M&A opportunities elsewhere and, as a result, we have seen a lot more multi-national and global activity. And this is continuing as of this writing. Takeda from Japan is in the process of acquiring and integrating Shire from Ireland, for example.

Johnson & Johnson has maintained a unique style all along, in which the strategy includes acquisitions but, unlike the rest of the industry, it has preferred to keep each company relatively independent and separate under the overall J&J group, which tends to operate largely as a holding company.

Some of the larger companies have acquired smaller biotechnology plays: Pfizer bought Medivation; Sanofi bought Genzyme; Amgen bought Onyx; AbbVie bought Pharmacyclics; AstraZeneca bought ZS Pharma. As of this writing, BMS is in the process of acquiring Celgene, which itself had just acquired Juno Therapeutics barely a year before. An interesting dynamic is the contrast between companies that become fully absorbed and integrated into their new parents versus those that are kept in a quasi-independent state—at least initially. In a future article, we may explore some of the factors that go into this integration vs. federation strategy and reasons why, even with the best intentions of keeping entities separate, they become integrated sooner or later.

Five Trends to Watch

1. The re-organization and break up of mega-companies to allow the most innovative and dynamic parts of their businesses to thrive and not get bogged down or diluted by the rest of the product line—which may have different valuation drivers. Pfizer and Novartis have started on this path and there are rumors surrounding GSK.

2. Along these same lines, we may see the formation of multiple small companies under an overall umbrella. Presumably this would allow for a degree of independence, speed, and innovation. One can call this the “J&J model.” We see an example of this with the “Vant Companies”: Roivant, Myovant, Axovant, Dermavant, and Urovant. Also, it would not be surprising for larger companies to break off smaller pieces and then combine those with smaller pieces of other companies to form new dynamic small to mid-size entities.

3. The continuing sequential swallowing of smaller and new players by larger ones, along the lines of Celgene buying Juno in early 2018 and then BMS buying Celgene in 2019.

4. Unlikely but perhaps one or two megamergers of very large companies in the next five years.

5. An unusual set of transactions with biotechnology and pharmaceutical companies buying “adjacent” businesses in the digital health, diagnostics, devices, and services spaces.

Notes on certain transactions from the above graphics:

- Asset split between Schering and Schering AG.

- Technically the acquisition was Schering-Plough buying Merck & Co., reportedly to avoid triggering a change of control clause in the agreement between Schering-Plough and Johnson & Johnson for Remicade. Essentially Merck & Co. became Merck Sharp & Dohme; Schering became Merck & Co., and with the paper acquisitions, Merck & Co. lives on.

- Includes AstraMerck in the U.S., the venture between Merck and Astra to establish a new U.S. entity.

- Allergan acquired by SKB in 1980, later spun-off in 1989.