When comparing the challenges presented in emerging markets with more mature markets, the obvious starting point is healthcare expenditure. Having less to spend means a difference in priorities for governments—the focus in emerging markets continues to be more on building capacity in both physical infrastructure and human capital. Developed markets with infrastructure in place prioritize efficient utilization and high-service quality.

Follow the Money First

If healthcare expenditure is the starting point, then any framework for understanding access must begin with affordability. One way to assess affordability is to map the relationship between individual resources (e.g., GDP per capita or household income) and the level of healthcare funding support from government (e.g., percent of out-of-pocket spend where lower is better). Generally, in developed markets, higher income and higher government support go together, with the reverse seen in emerging markets. However, there are exceptions.

Governments take different paths to funding healthcare, especially medicines, based on policy decisions relating to how much of the population will be under coverage and which products will be reimbursed. Mature markets tend to provide comprehensive product coverage for the patients funded by government, whereas emerging markets generally focus on basic medicines and services as they expand toward universal coverage of their populations.

In many markets, private health insurance and other sources of funding are expanding to fill some of the gaps in public coverage, especially in middle-income countries where rising middleclass demand and expectations are moving faster than governments can provide.

A More Holistic Market Access Model in Emerging Markets

Affordability for both governments and patients is one significant barrier to access in emerging markets but not always the most immediate barrier, especially outside of major urban areas. The maturity of the local healthcare system also constitutes a major factor in restricting access in two ways:

- Availabilityof product depends on supply chain elements such as logistics, warehousing, and cold chain. This issue gained prominence in 2021 when the mRNA vaccines required very cold temperature storage that was simply unavailable in many emerging markets. Provincial hospitals and clinics may not have sufficient budgets to purchase needed medicines. Access can also be impacted by the absence of adequate healthcare facilities, especially for specialty care such as oncology, and even trained healthcare professionals in a particular location.

- Awarenessof the impact of a disease as well as the benefits and risks of treatment can also present barriers to access. Lack of awareness extends to prevention and diagnosis, which can delay seeking treatment. In some cases, patients and their families may simply not know about a particular disease. Treatment decisions also may be impacted by cultural beliefs, financial concerns, or general reluctance to go to healthcare facilities. Finally, local healthcare professionals themselves may lack awareness about the disease and provide the wrong treatment or the required specialist referral.

Availability and awareness are reflections of the overall maturity of a country’s healthcare system. The level of system maturity impacts the capacity of that country to anticipate and manage the diagnosis and treatment of a particular disease as well as the overall health of its population. Taken together, affordability, availability, and awareness present numerous barriers that significantly reduce the number of potentially eligible patients receiving treatment.

Taking Action for Access in Emerging Markets

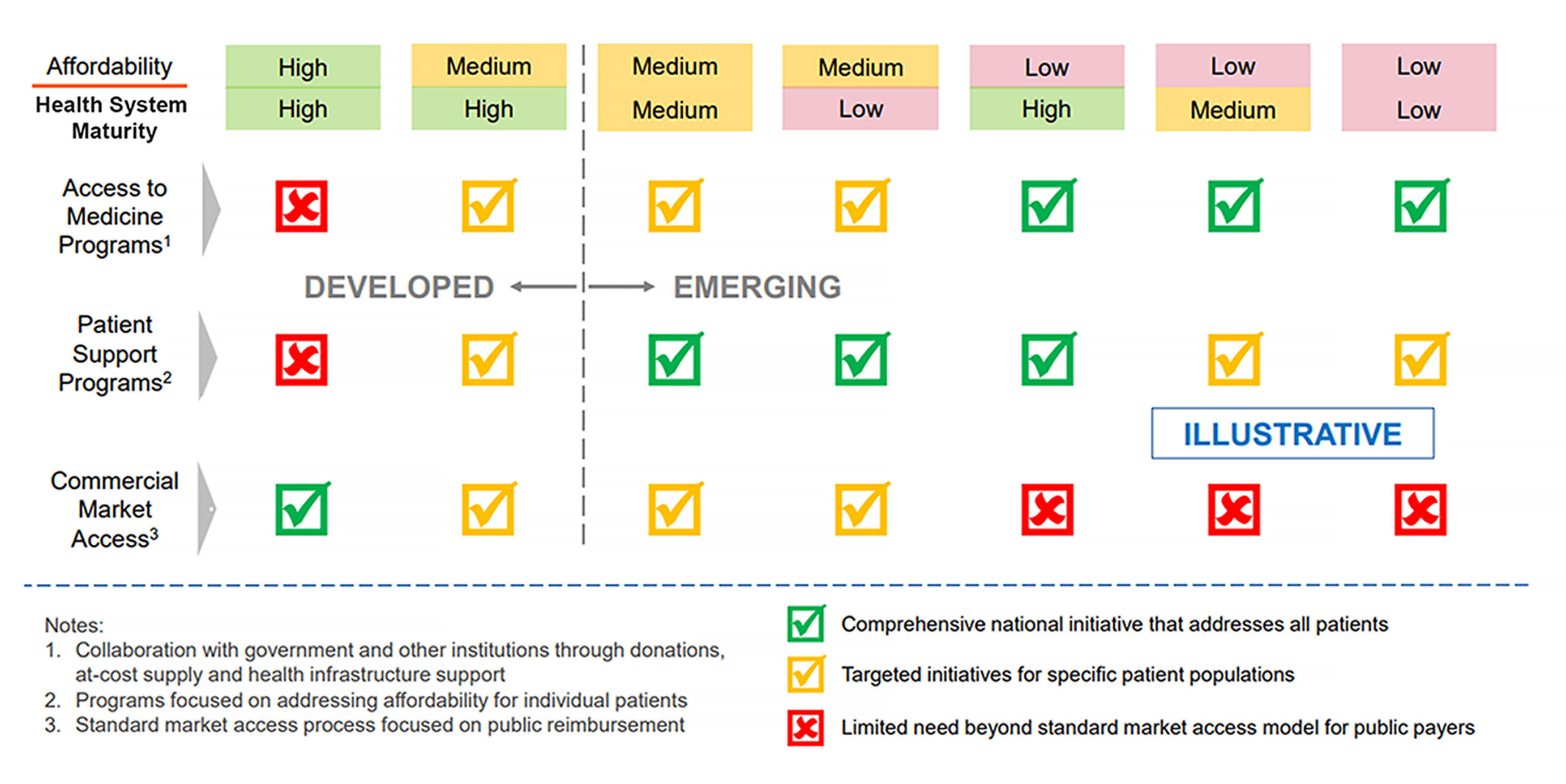

Successful strategies for market access in emerging markets therefore requires addressing challenges in both affordability and system maturity. The first step is understanding these two elements at a country level and defining market archetypes that will enable the development of access models that can start quickly and be scaled within and across markets. The archetypes can be based on defining country situations in each element to reflect the full range of markets, especially recognizing that emerging markets themselves encompass a broad diversity of conditions.

Once defined, a company can deploy an appropriate access model for each archetype. In most developed markets, the usual approach would be applying for national reimbursement in anticipation of a full commercial launch. In emerging markets, the pathway to access is not so straightforward and may call for different models depending on the archetype, or even a combination of approaches for different populations within markets (see below).

Broadly, markets within medium-level archetypes (generally, middle-income countries) are best addressed with approaches that focus on the affordability for individual patients who may have the ability to pay for at least some of their treatment. For some patients, the route can include private health insurance, either through individual policies or as part of health benefits provided by employers. Beyond insurance, many patients get access under patient support programs offered by pharma companies to eligible patients based on assessment of their ability to pay for treatment.

Broadly, markets within medium-level archetypes (generally, middle-income countries) are best addressed with approaches that focus on the affordability for individual patients who may have the ability to pay for at least some of their treatment. For some patients, the route can include private health insurance, either through individual policies or as part of health benefits provided by employers. Beyond insurance, many patients get access under patient support programs offered by pharma companies to eligible patients based on assessment of their ability to pay for treatment.

In the lower-level archetypes—where the system maturity barriers of availability and awareness are more acute—access approaches generally focus on patient populations more than on individuals. These models usually involve companies working with governments (both local and those from rich donor countries) and multilateral agencies, such as the World Health Organization (WHO) and non-profit institutions.

These collaborations typically would not involve commercial sales but may encompass subsidized or donated supply of product to governments or non-governmental organizations (NGOs). Markets with lower-level archetypes have also seen a variety of innovative approaches to financing healthcare, ranging from microinsurance and microlending to impact bonds. Pharma companies are increasingly collaborating with financing players to enable access. Finally, some partnerships also focus on supporting health system infrastructure, such as diagnostic screening or supply chain logistics to ensure that patients can get access to treatment.

Looking Ahead

The biopharmaceutical industry is currently experiencing a revolution in technological innovation that is bringing truly breakthrough therapies to patients. But given that more than 80% of the world’s population lives in emerging markets,1 the industry must view these breakthroughs in terms of the expansion of global access and equity as well as the clinical impact on patient outcomes.

The next wave of innovation must also address access challenges in distribution, healthcare delivery, financing, and human capital. These will require advances in both technology and business model thinking if we are to realize the true potential of this revolution in medicine.

Reference:

1. https://corporatefinanceinstitute.com/resources/economics/emerging-market-economy.