Over the past several months we’ve reviewed four of the five imperatives for coupon and co-pay program success: Optimal offer development, channel selection, field execution and outcomes measurement. This month we tackle the final imperative, budgeting and finance.

As I began to outline key ideas regarding the money side of co-pay programs, one of my initial thoughts was that this article could easily have been the first of the series rather than the last. Why? Because for many products, when it comes to sheer volume of dollars spent, co-pay assistance is one of the top three or four items, along with sales force, samples, DTC advertising and managed care contracting costs. Indeed, depending on the product and therapeutic class, the “co-pay assistance” budget line is typically in the millions of dollars per year. Because of its budget impact, every marketer should understand the financial aspects of co-pay assistance. Let’s take a quick look at how to approach this real-life issue.

Keeping First Things First

As Stephen Covey reminded us, “The main thing is to keep the main thing the main thing.” And in the world of co-pay program financial management, the main thing is direct patient benefit. It’s simple, really. You as a manufacturer are contributing $10, $20, $50—maybe thousands of dollars—per script to help reduce patients’ out-of-pocket costs. That level of assistance can very quickly add up to hundreds of thousands, if not millions of dollars in patient support outlays.

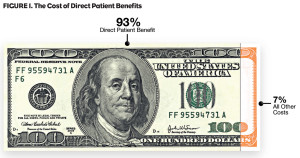

In fact, as shown in Figure 1, the cost of direct patient benefits dwarfs all other co-pay program costs combined. For this reason, you’re way ahead of the game if you focus your cost-management efforts on the direct patient benefit.

Minimizing Spend While Maximizing Effectiveness

Minimizing Spend While Maximizing Effectiveness

So how do you walk the “efficiency tight-rope” in your co-pay program? While every program is unique, some offer development principles we can generally rely on including:

- Reducing out-of-pocket cost is important to patients. Repeated experience shows that the biggest driver of program success is the relationship between a patient’s pre-offer out-of-pocket cost and their post-offer out-of-pocket cost. But that doesn’t mean that every product must have a $0 out-of-pocket for every patient.

- The structure of the offer is important, too. “Pay-no-more-than $XX” offers are typically more effective than “$XX off” offers. But, again, the offer needn’t be “PNMT $0.”

In the past, estimating the most financially efficient offer and structure was based, in large part, on guesses, hunches and “what worked last time.” But in this era of Big Data, new forecasting and modeling tools are coming to the forefront. Brand teams can now employ interactive digital simulations that provide instantaneous budget analysis:

- Enables “what if” calculations with immediate visual representation of the budget impact of the changes.

- Provides a side-by-side financial assessment, allowing easy comparison between scenarios.

- Compares your most cost-effective offers and provides mini “business cases” for each.

Once you’ve settled on an initial offer and structure, remember that this is not a “set it and forget it” business—constant vigilance is required. Your offer can be adjusted over time in order to fine tune financial efficiencies and maximize ROI.

And don’t forget that patient-benefit cost should be evaluated not only on the “front end,” which is the offer itself, but also on the “back end”—the business rules. It’s important to pay close attention to the financial implications of program length and expiration date, who can use the card (commercial, cash-pay, etc.), number of uses, age limitations, days supplied, cap on benefit and required minimum patient out-of-pocket expense, etc.

Getting the Financial Team on Your Side

In addition to managing budget, you’ve got to also manage people. Get senior finance leadership in on the plan early. Many CFOs and other leaders are not familiar with how co-pay programs work or how quickly they can create a disparity between gross sales and net sales. An open and productive meeting, or series of meetings, can help you build a finance department advocate that will be part of your team. Topics for meetings/discussions can include:

- Remind them that 93% of the total spend goes to direct patient benefit—and helping patients is good business!

- Describe the research showing that reducing drug co-pays increases adherence, improves clinical outcomes, and can even reduce total healthcare spending. For more on this topic, see the white paper Benefits of Co-pay Reduction at http://bit.do/co-pay.

- Discuss the type of costs and how they can be accounted for in brand cost calculations.

- Separate the accounting for patient benefit from the accounting for transaction/program management fees.

- Investigate the idea that, like payer rebates, patient benefit dollars should not be part of “promotional spend,” but should instead be considered as part of “cost of goods sold.”

The good news on co-pay budgeting and finance? Unlike Rx data, co-pay data is real and exact. If you see a historic co-pay claim, you can count on the fact that a script was filled and an offer was used. No projections or “gotchas.” What’s more, the ROI is unquestionable. Well-designed co-pay programs have been shown to save Rxs at the pharmacy counter, reduce abandonment rates, increase refill rates, overcome managed care obstacles, and drive adherence—all with a positive ROI. Invest in the patient and the benefits show up in your TRx/NRx curve.

In the end, every brand team should view their co-pay program as a resource that produces a much deeper level of longitudinal outcomes measurement than programs of the past. Because of these data, a well-designed program can be as effective as any other promotional avenue at a fraction of the cost. A team focused on financial and outcomes measurement now has many more—and more creative—options than before.