When I was on the client side of the business, I had a front-row seat to two different mergers (Boots/Knoll & Searle-Monsanto/Pharmacia). I also spent four years in business development, helping acquire products and companies. So I have a bit of history as both prey and predator in the world of mergers and acquisitions.

Since the early 1970s, M&A has been a way of life in the advertising world, illustrated by the fact that by the late 1980s, eight of the 10 most recognized agencies were no longer independent. The pace of growth has varied since then, but mergers and acquisitions remain a significant factor in the marketplace and an important part of agency business strategy, particularly for the global holding companies.

In healthcare, M&A activity has been brisk over the past few years and steadily increasing. At least five acquisitions occurred this July alone, with Publicis Health purchasing Payer Sciences for an undisclosed sum; Huntsworth buying Giant Creative Strategy for $72.2 to $97.2 million; UDG Healthcare acquiring Create NYC and SmartAnalyst for up to $82.4 million collectively; and Precision Medical Group buying ETHOS for an unspecified amount.

M&A activity takes a variety of forms in healthcare, including:

- Large holding companies buying specialty or boutique agencies—e.g., Omnicom Health acquiring Snow Companies in Feb. 2018. The main holding companies in healthcare are WPP, Omnicom, Publicis, IPG, Havas, and Syneos, with 95 agencies among them.

- Non-healthcare companies merging with healthcare networks and forming new networks—e.g., Syneos was born from the 2017 merger of INC Research and inVentiv Health.

- Smaller healthcare networks buying specialty agencies—e.g., UDG acquiring Cambridge BioMarketing and MicroMass Communications in 2017. Besides UDG and Huntsworth, other smaller networks active in healthcare M&A include Intouch, W2O, and Precision Value and Health.

- Smaller agencies buying other agencies and becoming networks—e.g., W2O acquiring Pure, Marketeching, and Sentient in 2016, leading W2O to rebrand as a network with five subsidiary companies.

- Smaller agencies acquiring other smaller agencies—e.g., HCB acquiring Topin Associates in 2015.

- Holding companies consolidating agencies—e.g., GSW absorbing Palio after the creation of Syneos.

- Private equity companies acquiring healthcare agencies—e.g., Stagwell acquiring SCOUT in 2017.

Why Acquire?

On the surface, M&A activity makes sense. The desire to increase revenue and sell clients more stuff—with fewer hassles—are powerful drivers. Acquiring companies are often looking for competencies they lack, the theory being that by adding a competency rather than developing it organically, agencies can quickly make their service offerings more complete and complementary. In its 24th Annual Market Study 2018, AdMedia Partners reports that, not surprisingly, the prime targets for acquisition have been analytics, social/mobile marketing, and design/user experience firms, with digital agencies not far behind. Data management companies are also increasingly attractive.

It’s worth noting that consultancies such as Accenture, Deloitte, PwC, IBM, and McKinsey are investing heavily in agency acquisitions, focusing on digital, data, analytics, marketing, and creative shops. Leveraging scale, speed, and well-established relationships, the companies have made strong inroads into marketing services (Accenture Interactive was named “global experience agency of record” for Maserati in 2017). Although the big consultancies haven’t aggressively moved on healthcare networks and agencies yet, many believe they will as they expand their life sciences practices.

What Could Possibly Go Wrong?

Ideally, the goal of M&A is synergy: 1+1=3. Most will settle for 1+1=2. But often the result is 1+1=1.5. Why? Because a merger in the knowledge business is about much more than a product. It’s about people, culture, philosophy, understanding, and vision. And no two companies are alike.

The people running the business of the acquirer presumably lack many of the skills of the people from the company being acquired. With neither party having strong expertise in what the other does, it’s naïve to expect things to run smoothly. Strong management skills are needed on both sides, yet in many agencies, few receive formal management training and no one receives M&A training.

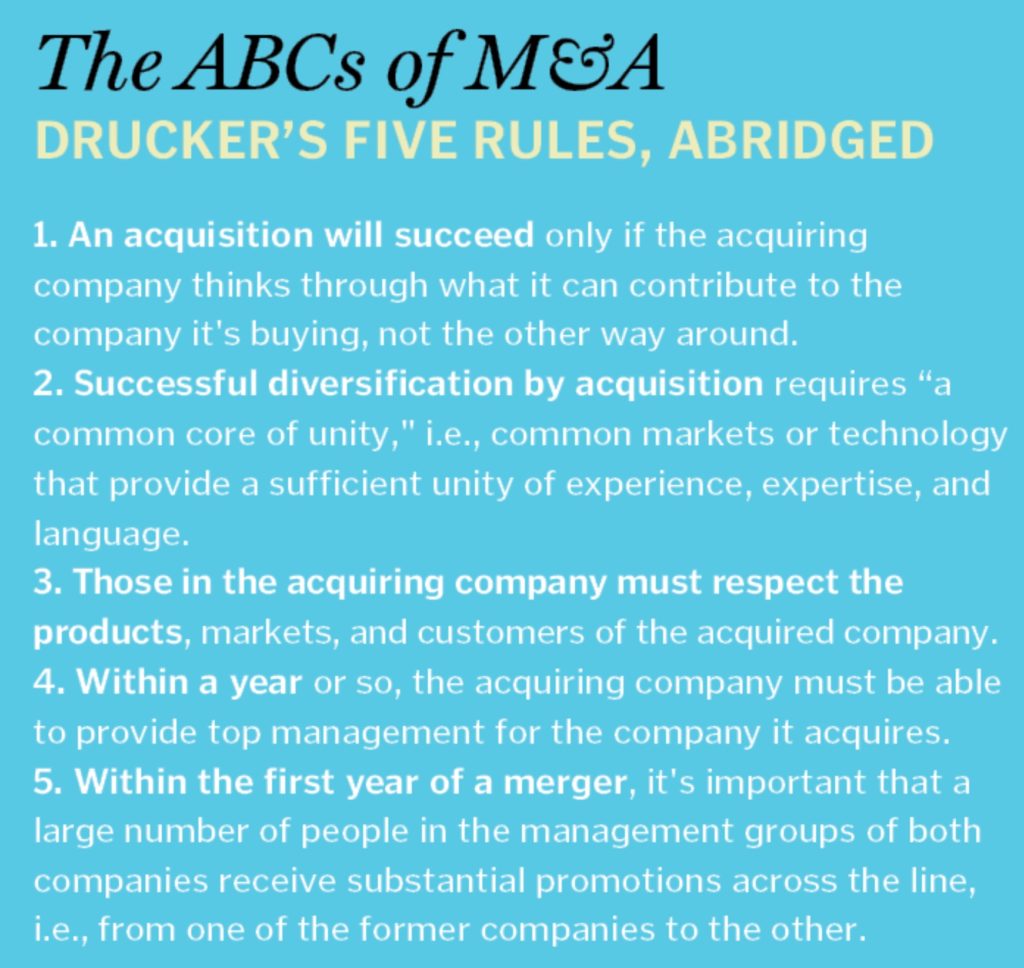

Many companies ignore Drucker’s’ Five Rules of M&A (see box below), the first of which is “an acquisition will succeed only if the acquiring company thinks through what it can contribute to the company it is buying, not the other way around.”

In reality, the driver behind most M&A activity is financial—the easiest way to increase top-line revenue is to acquire another agency. But that means cost efficiencies must be wrung out, which often means things like eliminating duplicative services and staff. It can also mean the expense of making new hires—a lot of poaching goes on during mergers and acquisitions.

In reality, the driver behind most M&A activity is financial—the easiest way to increase top-line revenue is to acquire another agency. But that means cost efficiencies must be wrung out, which often means things like eliminating duplicative services and staff. It can also mean the expense of making new hires—a lot of poaching goes on during mergers and acquisitions.

There’s also the issue of integration after M&A activity. I won’t insult any healthcare colleagues for getting it wrong, but my point is illustrated by this account from an article about the agency of the future by Kristina Bennin and Namit Kapoor:

“For an important recent presentation to a major global consumer-products manufacturing client, one of the global marketing companies assembled a multidisciplinary team of all-stars from across its agency network. It was a clear effort to both dazzle the client with the assembled talent and demonstrate that it could marshal an integrated best-in-class, cross-agency team on the client’s behalf.

The move backfired, however, when the client noticed that members of the cross-agency team were introducing themselves to one another before the meeting, and in some cases couldn’t distinguish between the client executives and their sister-agency counterparts. The next day, the client engagement was formally terminated.”

An extreme example, perhaps, but I would wager that inter-agency coordination and cooperation are among the top concerns of most holding company CEOs.

Why Independents are Still Around

Bigger can be better. One-stop shopping has its appeal. And sometimes there’s no substitute for size, scale, and a wide geographic footprint. Yet many clients, particularly in pharma, continue to use a mix of independent and network agencies. What do they know?

The agency I work for, AbelsonTaylor, has remained independent despite several lucrative offers from holding companies. We believe that our single-minded focus on helping our clients build and grow their brands and businesses is a distinct advantage that would be compromised if we were not independent.

Freed from the pressures of having to meet shareholder demands, achieve a sales target, or sell something on behalf of a sister agency, independent agencies can focus on what they do best—deliver insightful strategy, patient and physician engagement, and great creative. They use their size to their advantage, particularly in terms of client relationships. Clients know that the people who pitched their business are the ones they’ll work with, that the team is always available, and that concerns or requests will get immediate attention. Some independents, including our agency, will even co-locate to clients’ offices to solve problems in real time, shoulder to shoulder.

It’s important to note that independent does not mean isolated or siloed. We frequently partner with other agencies (many of whom are part of a holding company) to deliver on client needs. As AOR, we also often coordinate the activities of these agencies.

Maintaining Culture

And, of course, let’s not forget culture: Very few, if any, agencies are able to maintain their culture when absorbed into a large holding company that could number more than 100,000 people. From an employee perspective, independent agencies are far better able than networks to establish and maintain a culture that’s supportive and responsive to staff members’ needs, both professional and personal.

In summary, mergers and acquisitions will continue, but independent agencies will also remain an important part of the picture—and new ones are being founded every day, often by unhappy staff of merged or acquired companies. Consultancies, private equity firms, and other nontraditional players (Google? Facebook? Amazon?) will sniff around with ever-increasing interest, setting the stage for what could be a seismic shift in how healthcare advertising, PR, and marketing communications agencies present themselves and do business in future.

Whatever happens, embrace the change that’s good, reject what isn’t, and re-read Leo Burnett’s famous “When to take my name off the door” speech. It was true in 1967 and remains true today.