Healthcare marketing is tricky. In addition to the many unique regulatory hurdles in health and pharma marketing, finding the right balance between scale and precision makes it challenging to reach the audiences who are most likely to need a particular health-related treatment or service. Pure demographic and geo-targeting can be too broad, with lots of waste and inefficiency. Content targeting almost always lacks significant scale to move the market, and targeting based on purchase history is limited to a small audience of people who are the most difficult to convert—current users of the product or competitive products.

Many healthcare marketers are turning to a different approach—one that provides qualified reach at scale to both healthcare practitioners and consumers, anchored on key point-of-care locations, and refined through aggregated healthcare data. All without divulging personal health information.

Anchor on Location

Whether the goal is to drive physician recommendation of an OTC brand or increase patient requests for brand-name prescription medicines or devices, concentrating mobile impressions in select locations helps provide efficiency. By qualifying audiences based on characteristics such as prescribing volume, market and insurance data, and physician concentration by specialty, it’s possible to identify and target the most valuable locations for a brand to drive their business.

But it’s not enough to simply geo-fence a list of doctor offices; that will spread impressions too thin and water down the impact of a mobile ad campaign. Rather, by ranking the point-of-care locations that have the best potential to influence sales lift, we’ve seen brand marketers yield an average lift of 4.3% for prescription brands. We’ve also seen lift of nearly 12% in driving foot-traffic to promoted hospitals as compared to others at the same POC locations.

Connect in Context

With these “hotspots” in sight, smart marketers are further targeting these campaigns based on audience personas that are based on location histories at relevant healthcare locations and de-identified consumer data.

For example, by looking at all the signals gathered from interactions with a geo-located mobile campaign aimed at diabetic patients, we can identity nuances in how these different consumers behave—both how they engage digitally and how they manage their health.

A persona analysis might identify a group of high income “work hard/play hard” diabetics who exercise regularly but also regularly eat frozen dinners and sweets. Other signals may indicate a group of targets who appear to be doing what they need to do to keep their condition under control, or those who seem to be in denial of their condition altogether. Clearly, understanding these behaviors and how they play out in the real world—at the pharmacy, at the supermarket, or even at the gym—is key to crafting messages that resonate and drive action. This rich combination of observed data and enhanced data informs new places to target, which in turn provide new context in which to engage audiences, which in turn drives messaging.

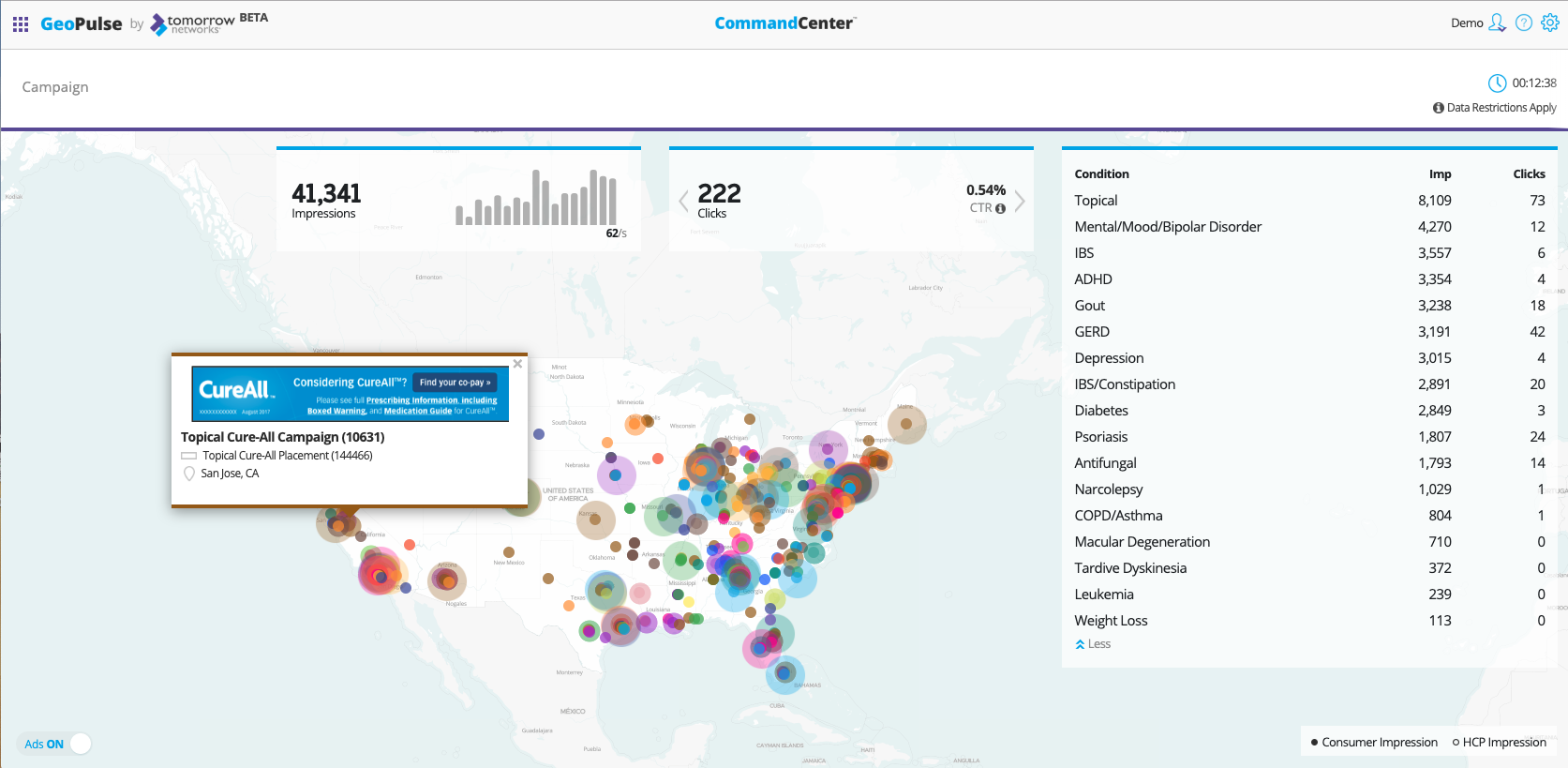

Pharma marketers can also gain access to a powerful campaign reporting dashboard called CommandCenter, created by Tomorrow Networks. This illustrates how the campaign is performing in near-real-time in the specific geographic locations where campaign assets are being served on mobile devices that correspond to the target audiences’ demographics, sociographics, condition prevalence, healthcare coverage, writing behaviors, consumer purchasing patterns, and more. This insight into campaign performance allows for mid-stream insights and data-driven recommendations to optimize performance.

For example, the data might reveal a high-performing location, suggesting an opportunity to expand the campaign in that area and scale it back in a low-performing area. The data might show that one ad is immediately getting a lot of engagements, prompting the marketer to invest more in that ad and pull back on others. They can also identify regions that are most responsive and increase other outreach efforts there, such as rep visits and email communications.

The result—hyper-local, hyper-targeted campaigns that offer the scale of television with the precision of point-of-care advertising in a compelling, privacy-safe way that drives results. After all, that’s the real target, isn’t it?