The journey for a successful pharmaceutical product launch involves several key steps requiring intensive planning and huge costs. The two major elements of this journey are regulatory approval, in light of the efficacy and safety evidence, and a strong market access strategy to communicate value to stakeholders, including payers, patients, and physicians. Both regulatory and payer approval involve critical steps that determine the success of the pharmaceutical product and the overall costs of the development process.

According to a recently published study in The Journal of the American Medical Association (JAMA) on decisions made by the U.S. Food and Drug Administration (FDA) for market authorization applications between 2000 and 2012,1 half of the submissions were rejected at the time of first submission. Key reasons for rejection included uncertainties of dose selection, clinically relevant endpoints, and efficacy as compared to the standard of care.

A PAREXEL analysis of rejections by the UK National Institute of Health and Care Excellence (NICE) health technology assessment (HTA) unveiled the following reasons for rejection: Non-robust economics, uncertain clinical benefits, inappropriate trial design, comparators or patient population, increased drug cost, and safety concerns.2 Further, a report published by McKinsey & Company notes that Germany’s Institute for Quality and Efficiency in Healthcare (IQWiG) classified 70% of reports assessed since 2004 as “benefit not proven.”3 Of 382 appraisals conducted by NICE between 2000 and 2016, only 61% were recommended.4

With this research in mind, it’s apparent that regulatory submissions for marketing authorization of pharmaceutical products and subsequent market access should no longer be viewed independent of each other. Commercial success of a pharmaceutical product is strongly linked to evidence generated for marketing authorization. In the absence of cohesive planning across clinical development and market access, the success of a product cannot be assured.

Though the clinical development phase is critical and the primary determinant to create value of a pharmaceutical product through key efficacy and safety outcomes, commercialization activities must address the value communication for a product. If the value has not been established, it cannot be communicated.

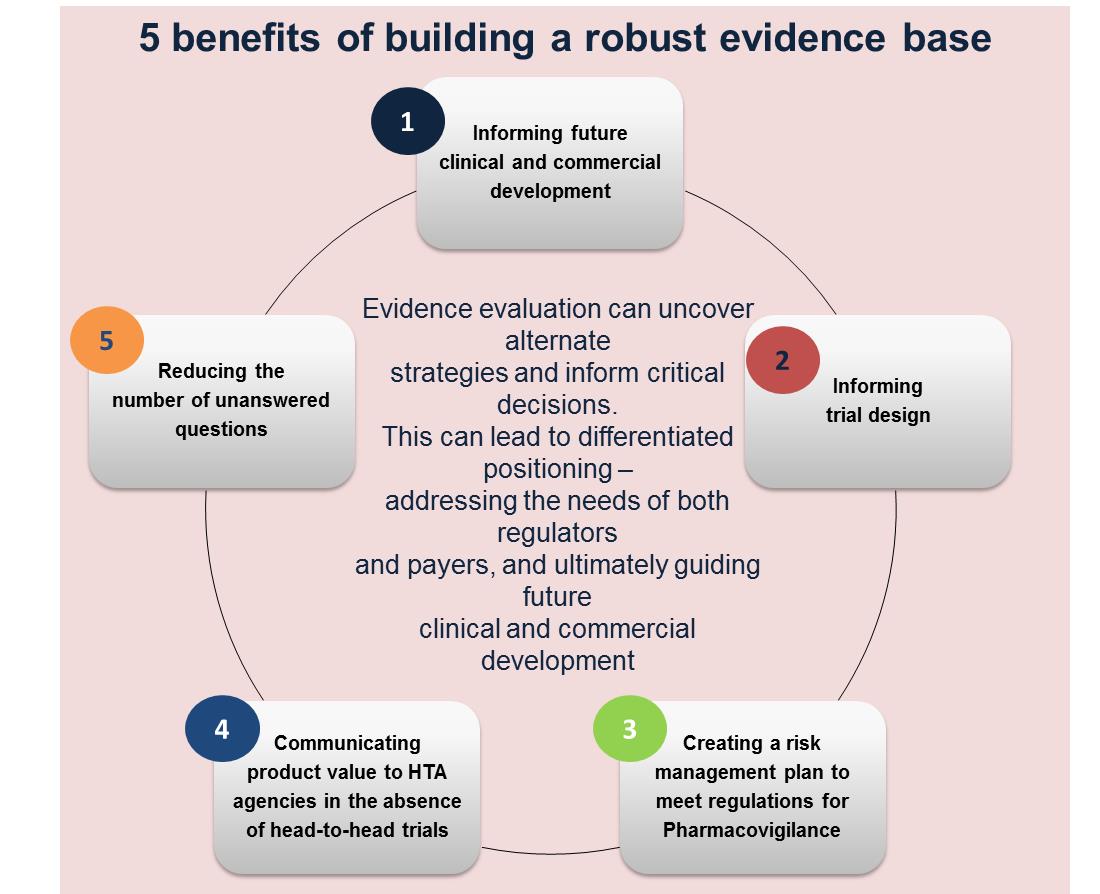

Thus, the challenge lies in addressing the clinical and commercialization needs together to avoid delays and denials by regulators and payers. The strong link between these two stakeholders is the evidence submitted to each one of them for value creation and communication. In fact, evidence generation should start well in advance of the clinical trial to help prevent future failures. It is critical that evidence generation activities shadow the entire clinical development pathway of the pharmaceutical product, while simultaneously addressing the evidence needs of stakeholders across all phases.

To address clinical development and commercialization success concurrently, it is helpful to first understand the needs of the stakeholders involved. This requires clinical development planning and market access strategy included together in an evidence plan that addresses the following objectives:

- Evidence needs (Clinical and commercialization phase)

- Evidence gaps (Clinical and commercialization phases)

- Approaches to fill evidence gaps

- Evidence generation activities per phase

The key step change is designing payer value-informed clinical trials, which would involve not only changes to the approach to evidence generation, but integration of the teams responsible for clinical development and market access strategy. The market access teams will need to inform the evidence planning process far in advance of the reimbursement submissions.

Key Steps to Evidence Planning for Regulatory and Commercialization Success

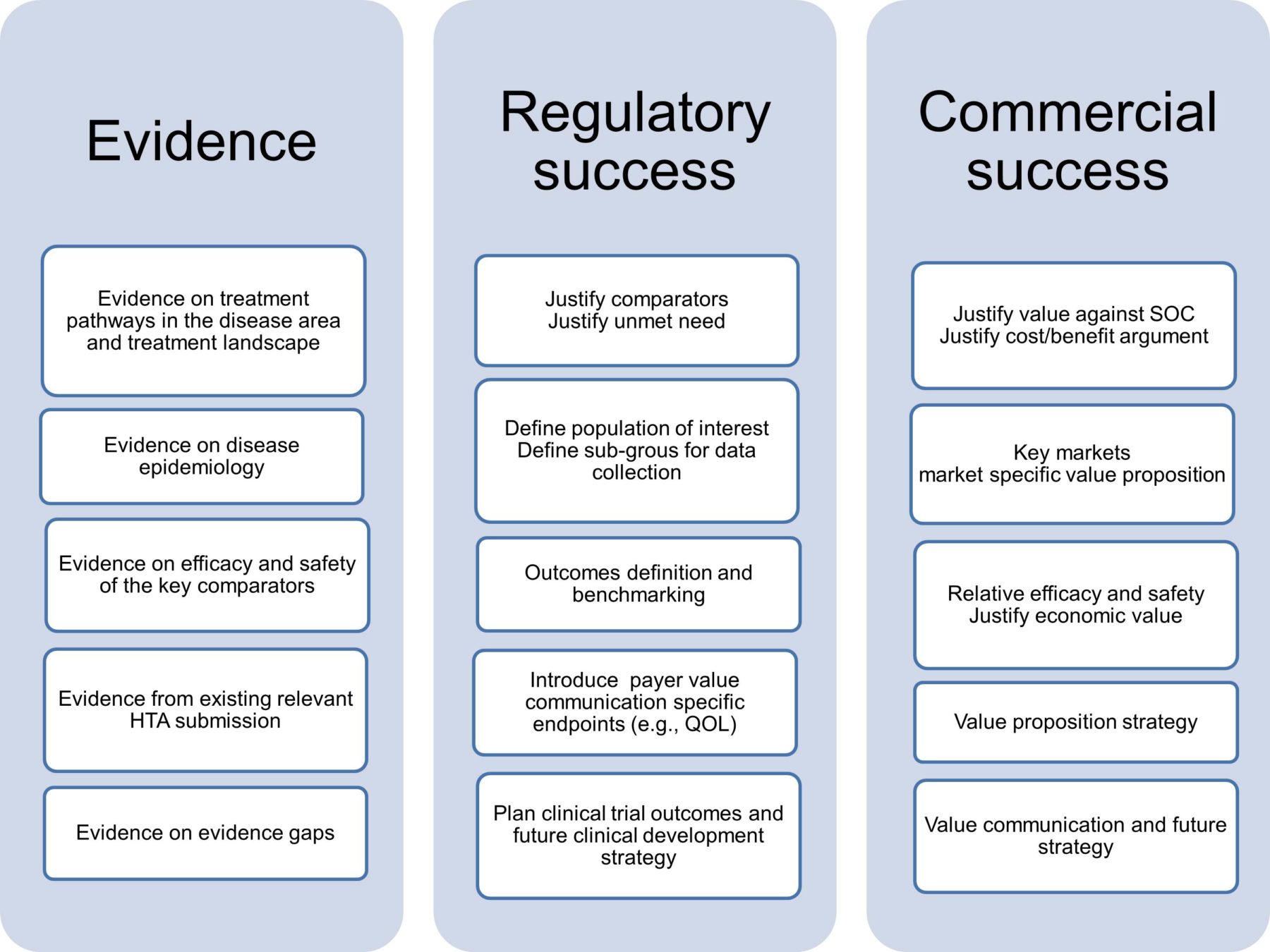

Once the objectives of an evidence plan are identified, the next step is understanding how to approach these objectives. This may include addressing the micro and macro objectives of the clinical development strategy and market access approach. The aim is to actively build market access strategy while still in clinical development.

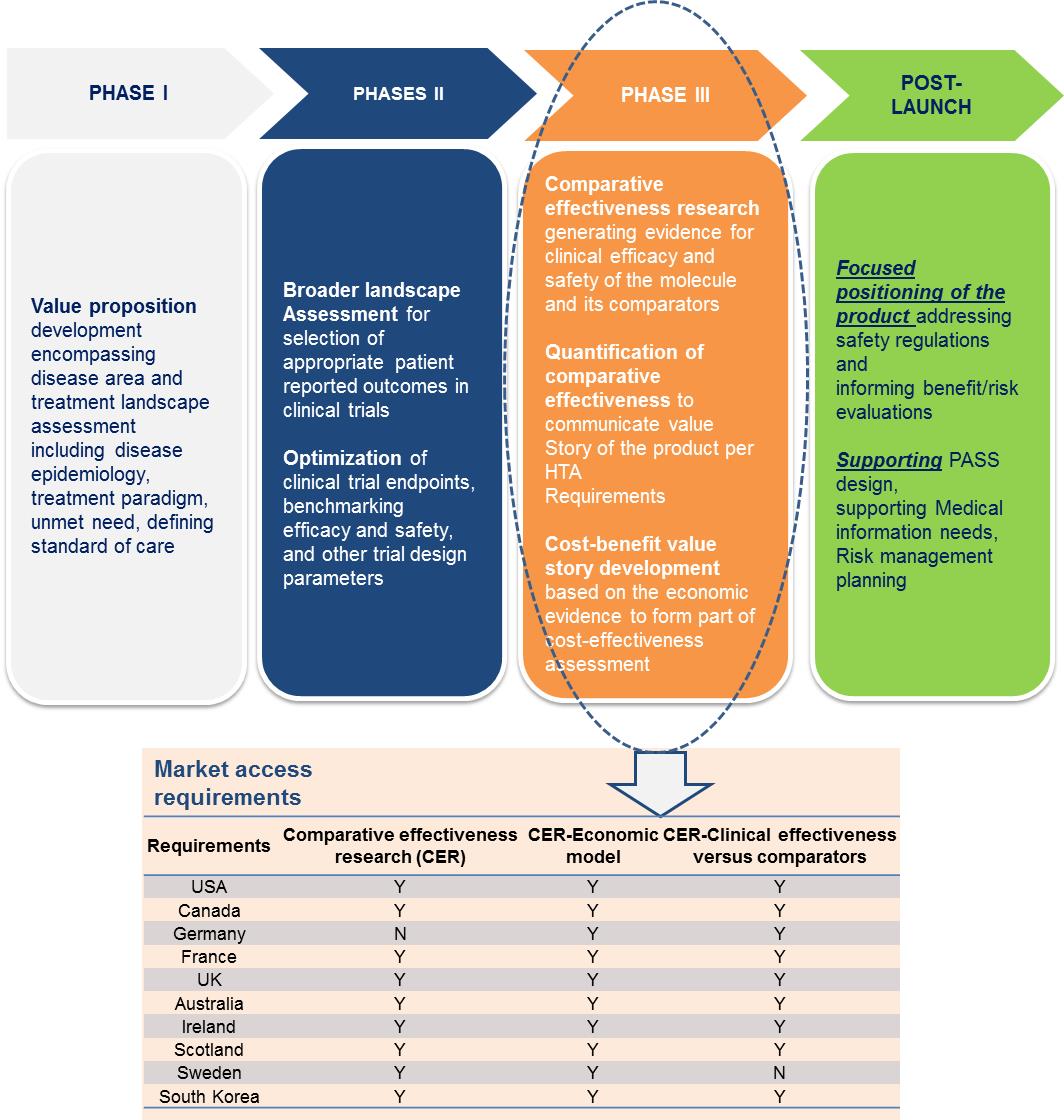

Evidence planning should play a crucial role by addressing key clinical questions around selection of best suited study design, efficacy measures, sample size, selection of patient population or specific sub-population, and other methodological and clinical parameters. In parallel to the clinical trial being conducted, sourcing cost-effectiveness evidence will further strengthen the value proposition for payers. Addressing these objectives in tandem may lead to a higher probability of success compared to a sequential approach as it would save time in revisiting primary research which is costly. Thus, it could be stated that the two principles for achieving these objectives are:

- Integrating clinical trial and reimbursement evidence planning

- Strengthening clinical trials with payer value

Integrate clinical trial and reimbursement evidence planning

In clinical development, each clinical phase has specific objectives and addresses set clinical questions. Conversely, the commercialization strategy needs to address the payer value proposition, considering any unmet needs with reference to specific populations and geographies at entry and value maintenance on maturity. These objectives could be addressed by an integrated evidence plan. Best practices for an integrated evidence plan are as follows:

- Phase-dependent integration: Ensure the value proposition for market access stakeholders is created and evaluated in the planned clinical trials.

- Proactive Evidence planning: Evidence generation requires both primary and secondary research.

- Primary research: Primary research to address gaps and mandatory regulatory requirements.

- Secondary research: Secondary evidence forms the basis for well-designed clinical trials and authenticates decisions pertinent to the design and planning of clinical studies, which may include the following: Choice of comparators, dose/frequency, outcomes, recruitment rates, estimate difference to detect, follow-up duration, adverse events and withdrawal.

- Value communication strategies: Value communication strategies per development phase and post-launch phases.

- Active evidence plans: To include integrated evidence solutions for a molecule in multiple indications or different molecules in a common indication.

Strengthening your clinical trials with payer value

Clinical trials that are informed by payer value will portray the product value story based on the clinical efficacy and safety evidence collected at each phase. Optimizing the trial design to translate into regulatory approvals and, in parallel, creating value for payers will save time and costs for stakeholders. The figure below summarizes the vital evidence platforms needed at each phase of the clinical trial.

- Market access knowledge to design payer value-informed clinical trials: Market access expertise is required to access phase-specific market needs and validate the design, outcomes, comparators, and geographies relevant to clinical development based on future commercialization requirements.

- Benchmark outcomes for clinical and commercialization success: Integrated evidence planning should be able to create the cost/benefit argument based on the right kind of clinical, safety, and quality of life (QoL) outcomes with a planned approach to address criticism for payers during clinical trial design planning.

- Forums to encourage dialogue between regulators and payers: Creating guidance on integrated evidence with collaboration between regulators and payers involving participation from the industry, regulators, and payers.

To summarize, a successful regulatory and reimbursement pathway starts with robust evidence planning that addresses clinical and commercialization objectives. An integrated approach to objectives in the evidence plan should address phase-dependent evidence collection and clinical and market access needs. It should also include a balance of primary and secondary research with clearly defined evidence gaps and a well-defined product value communication strategy. To build payer value and strengthen clinical trials, integrate market access skills into clinical development planning, benchmark clinical and payer focus outcomes strategically, and interact with payers and regulators on collaborative forums. Regulatory and payer value-informed evidence planning serves as the vital process step which, once integrated into clinical and commercialization strategies, saves significant time and cost.

References:

1. Sacks LV, Shamsuddin HH, Yasinskaya YI, Bouri K, Lanthier ML, Sherman RE. “Scientific and regulatory reasons for delay and denial of FDA approval of initial applications for new drugs,” 2000-2012. JAMA. 2014;311(4):378-384.

2. “Exploring the Variability Between Disease Type and the Proportion of Submissions with ICERS Lower Than the Threshold That Are Rejected by HTA Agencies” – PAREXEL, 2014.

3. “Value-driven drug development—unlocking the value of your pipeline,” McKinsey, 2011.