Back in the early ’80s, the concept of urgent care, a medical practice location that provided essential diagnostics and clinician visits as opposed to emergency rooms exploded. Growth included mini-malls, large healthcare medical group facilities, and individual clinician practices.

These practices were largely profitable, and insurance companies endorsed members to use these services as opposed to the more costly visit to the emergency rooms at hospitals. Beginning in 2005, with the advances of mobile and internet technologies, many startups began to develop telemedicine services so that patients could reach a healthcare provider without having to go to an office. Since then, telemedicine applications and services have grown, however, widespread adoption was limited.

And then came the COVID-19 global pandemic. The panic and overcrowding of hospitals, the highly contagious virus affecting healthcare professionals, and unrelated illnesses led to a >1000% increase of telemed application downloads and memberships.

Is This a Paradigm Shift?

Let’s explore post Corona healthcare. We have learned as a society that Work from Home (WFH) is a reality now for many. Healthcare is no exception. Medical professionals suffer from long hours, administrative overhead, and insurance reimbursement and the appeal to lower the costs is a key driver of adoption.

In addition, the number of patients per practice can lead to basic customer service complaints, long wait times to see the clinician despite an appointment, a constant shuffle between nurses and doctors, and patients who want to establish an on-going dialog with a single clinician.

In addition, the number of patients per practice can lead to basic customer service complaints, long wait times to see the clinician despite an appointment, a constant shuffle between nurses and doctors, and patients who want to establish an on-going dialog with a single clinician.

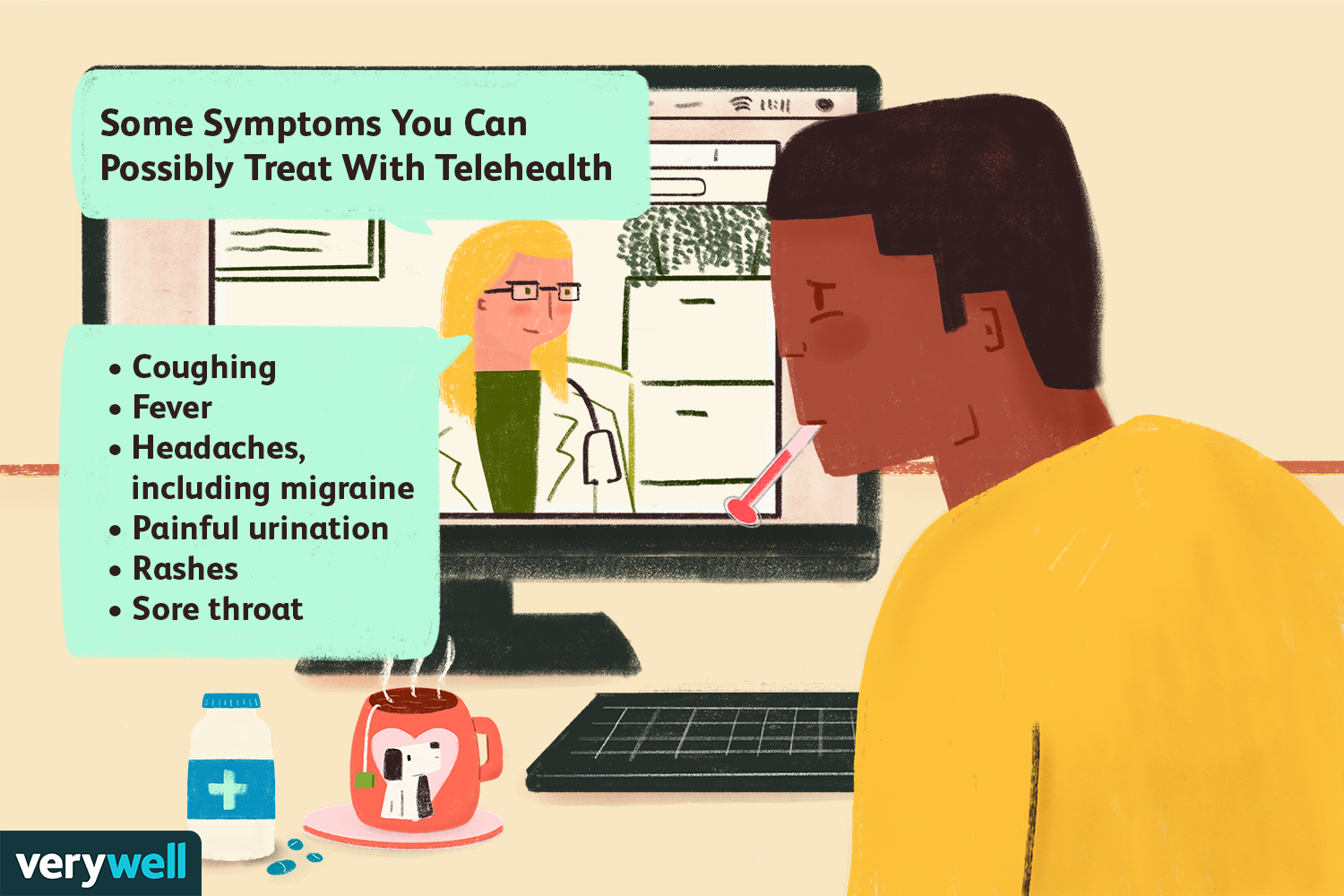

Telemedicine can alleviate some of these items, while adding additional services and enhancing the healthcare provider relationship with patients and their families.

With hospitals portrayed as triage centers in a war zone during COVID, and the shelter-in-place orders from most countries/governments, the ability to speak about non-emergency medical conditions was hampered and many people’s disease progression continued unabated. Media outlets reported the uptick in telemed activities, but many of the leading platforms were unprepared for the surge and demand. In addition, many practitioners who had family or internal medicine practices were recruited into fighting COVID on the front line and thus “inventory” or availability to schedule a call became a challenge.

As many medical professionals tested positive, the telemed recruiting effort intensified using the logic that “since they are quarantined anyway” the clinician could see patients and offer advice.

Financial incentives to the physicians were also increased during the first month of the pandemic, stressing the supply/demand economics and a way to ensure that these competing platforms could adopt with agility. A comparison to Uber Surge pricing was put forward as well.

Post pandemic, we can project that the swift adoption by the public to telehealth will be sustained. The ability to avoid ER rooms and urgent care centers where you can possibly be exposed to some airborne contagious virus will weigh heavily on the minds as the post-traumatic stress of surviving the pandemic lingers.

The Growing Potential of Telemed

There is a significant upside to the advancement of telemed. Patient/doctor relationships can be more solidified with remote monitoring services. In a perfect business model, not only can someone speak to a doctor on demand, but they can also get a remote monitoring service. This new service allows for patients to provide medical adherence, biometrics from smartphones/watches, and other information to help generate a medical profile with unprecedented visibility, all while safeguarding privacy and security. For a monthly subscription, doctors can establish thresholds with patients and monitor for compliance.

Let’s use an example: A patient with diabetes can sign up for remote services, and the doctor can set the A1C threshold for an alert. Should the levels exceed the set point, notification to both the patient and the physician is issued. Much like security services for the house, the remote monitoring service can call the patient, a family member, or emergency services to ensure the patient is responding. We have all seen the “Help I have fallen and can’t get up” commercials, this takes that concept and expands to a more full-service offering.

Another post-COVID-19 expectation is the need for smaller office space for practices. While specialist practices will always have a need for patients, waiting rooms etc., the future promises to take advantage of social distancing with the potential for automated queuing for patients to come to the office and might even lead to a smaller real estate footprint since fewer in-office visits will be offset by telemed.

Let’s look at the business side now: A recent article in Inc. identified a number of companies with a significant investment during the COVID-19 crisis. For example, companies that announced new funding investments since the pandemic started include Seattle-based 98Point6 ($43 million), New York City-based TytoCare ($50 million), Los Angeles-based SteadyMD ($6 million), Singapore-based Doctor Anywhere ($27 million), and New York- and Tel Aviv-based K Health ($48 million).

The Inverse of Telemed

Even more disruptive, will be how these telemed applications will also change how healthcare professionals interact with pharmaceutical companies. Pharma reps try to get a slice of an HCP’s time while they are in the office, to educate about new drugs, offer samples so the HCP can see the efficacy, etc. Going forward, the very relationship between these companies and providers will morph. HCPs who want to learn more about a particular drug will be able to have a live video session with the same speed as a patient talking with their doctor. The ability to deliver mechanism of action, prescribing information, and more can be integrated into the “providers corner” of the telemed application, and provide the convenience to the provider with “rep on demand.”

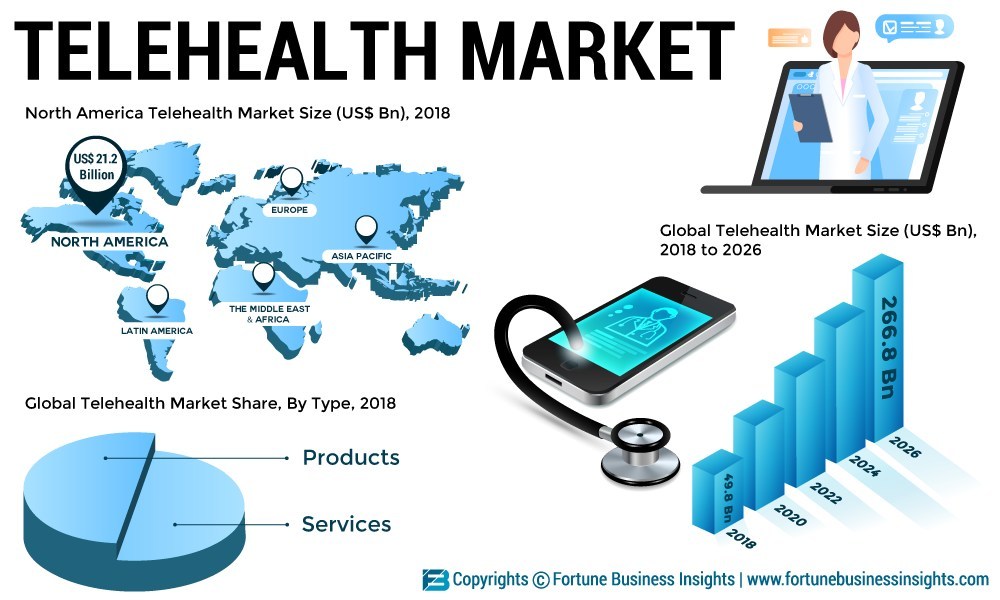

The COVID-19 pandemic was the catalyst for widespread adoption of telemedicine. Almost overnight, many services experienced orders of magnitude growth in consumer registrations, recruiting of healthcare professionals, and increased awareness. The convenience of telemed and the avoidance of in-office visits will continue with sustainable growth for the next two to five years. Scaling to meet the demand, and the ability to integrate traditional health services and payer and insurance providers has led to some constraints. Some regulatory hurdles, such as the ability for Medicaid to use telemed services have been lifted, and even the Veterans Administration is looking to telehealth as a way to provide long-term care and reduce the need for on-site visits.

Naturally, nothing is going to replace a patient to clinical examination, nor can a telemed service run a battery of tests, but there are various “home” kits under development. That includes COVID detection and contact tracing applications, which we anticipate many telemed providers will begin to specialize. Already, applications such as Ginger.io offer mental wellness and therapy, or services like Dermatology.com allow for specialists to communicate directly. It is this convenience and the ability to maintain long-term health management tracking that makes telemedicine so appealing.

In the appendix below, some of the leading providers are listed, and as with any nascent service, there will be a consolidation and shakeout as more well-established players gain market share. Insurance companies, pharmaceutical and biotech companies, electronic health record providers, and even governments will be interested participants. Ultimately, many businesses will drive adoption, attracted by the lower costs, more efficient data collection and analysis, and the lucrative subscription service model that consumers will flock to. Some additional links are also included, providing perspective on the business of telemedicine as an investment, and more.

Leading Telemed applications and consumer ratings:

Leading Telemed applications and consumer ratings:

| Application | Rating |

| MD Live | 4.7 |

| Lemonaid | 4.9 |

| LiveHealth Online | 4.8 |

| ExpressCare Virtual | 4.8 |

| PlushCare | 4.9 |

| Doctor on Demand | 4.9 |

| Amwell | 4.7 |

Additional links and information:

https://www.healthline.com/health/best-telemedicine-companies#1