Payers are right up there with patients and physicians as being among the preeminent healthcare influencers and decision-makers. For the last 10 years, payer feedback has informed product development earlier and earlier in the innovation process. Understanding what they anticipate, think, feel, and value greatly impacts how treatments are perceived, made available, covered, and prioritized.

However, before any discussion of payers and their influence can begin, we must clearly articulate their roles, titles, and responsibilities.

Payers are a larger, more diverse group than many realize. In the most exclusive sense, a payer refers specifically to the Pharmacy Directors and Medical Directors who serve on P&T committees within large national and regional health plans.

In the broadest sense, payers can also include:

- Pharmaceutical Benefit Management (PBM) executives who support health plans and manage their formularies

- Pharmacy Directors and Medical Directors from large hospitals and integrated delivery networks who serve as executive payers

- Self-funded employers, Employee Benefit Consultants, executives, and buying influencers from post-acute care facilities, cancer centers, nursing homes, home health agencies, community clinics, and other organizations

Often the treatment context and buying process dictate the people and titles most relevant in any given healthcare buying (or “paying”) decision.

What’s on their Mind?

At the end of 2022, Sermo sought to better understand the challenges and opportunities U.S. payers anticipate for 2023. In our research, we used the most common payer definition—Pharmacy Directors and Medical Directors from large national and regional health plans.

The hybrid study leveraged n=5 qualitative interviews to develop a quantitative survey separately fielded to n=30 payers who sit on their plan’s P&T committee. Those 30 payers collectively represented over 200M covered lives across public and private lines of business.

Here’s what they had to say.

Top 3 Payer Challenges

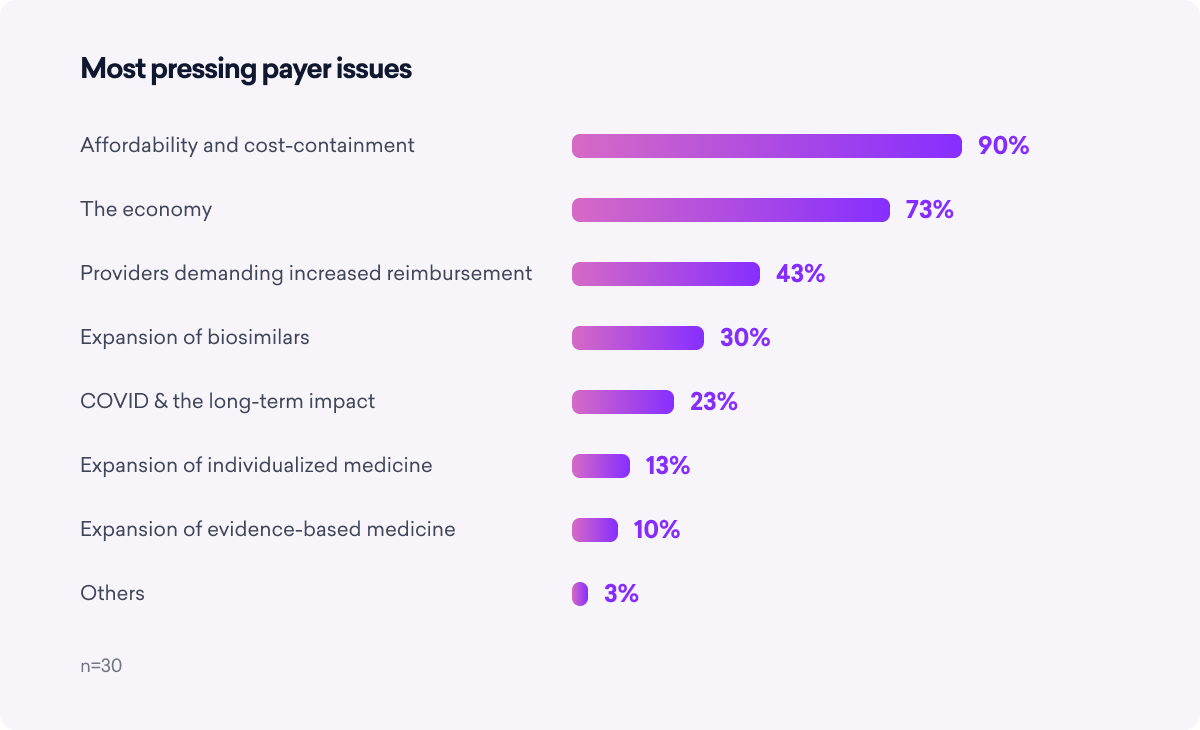

Payers identify affordability and the economy as the top two challenges they face today. And by “the economy,” they really mean jobs and unemployment.

Since most U.S. employees rely on employer-sponsored private insurance to cover the bulk of their medical costs, as one payer put it, “If there are mass layoffs and significant unemployment, there are fewer commercially covered lives.” This impacts who pays and who pays how much for 2023 medical costs.

Third on the list relates to increased provider reimbursement rate demands. Financially, the pandemic was a boon for most health plans—COVID-19 costs were offset by deferred elective care and reduced patient visits—but a drain on providers. They saw patient visits dry up and telemedicine meant less reimbursement compared to in-person. To compensate for the losses, providers are demanding more money than plans want to pay.

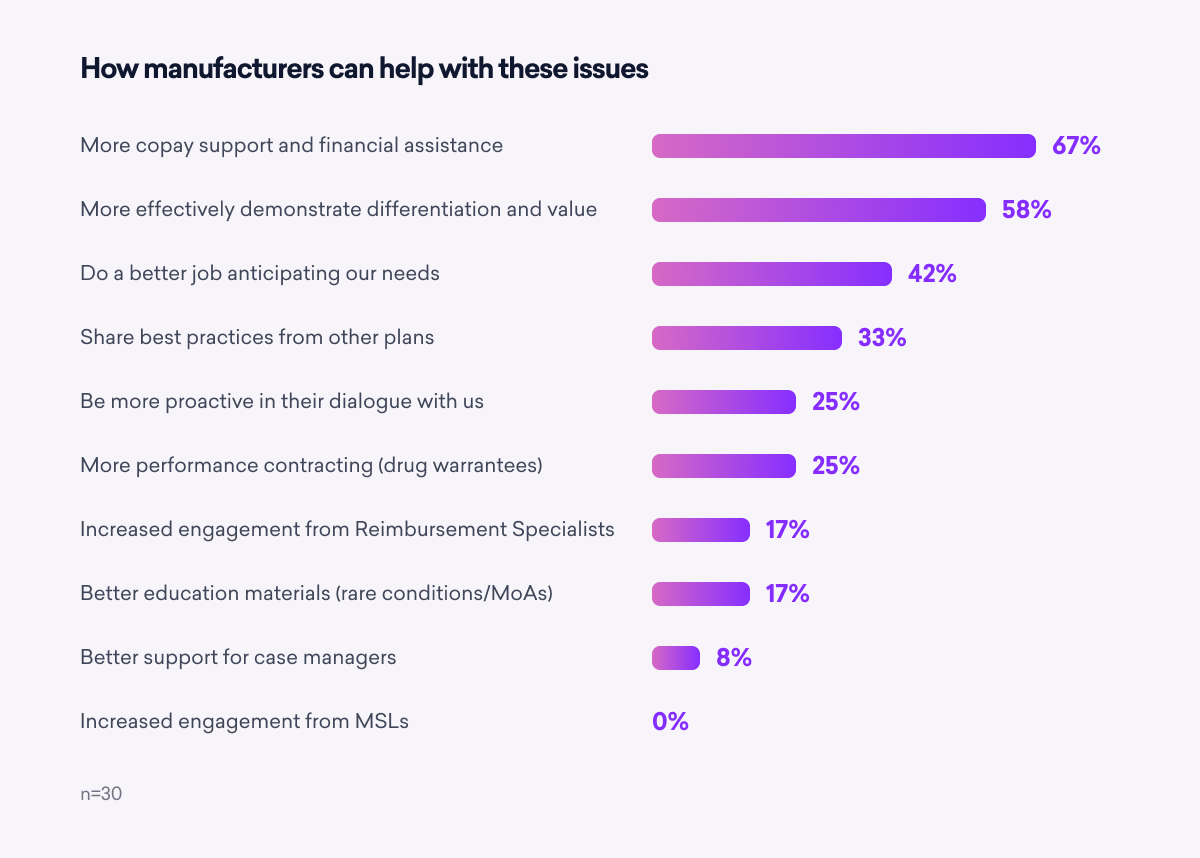

To help offset these challenges, payers want manufacturers to provide more copay and financial assistance, demonstrate differentiation/value more clearly, anticipate their needs more effectively, and share best practices across plans.

To help offset these challenges, payers want manufacturers to provide more copay and financial assistance, demonstrate differentiation/value more clearly, anticipate their needs more effectively, and share best practices across plans.

Unfortunately, payers do not perceive the “typical” manufacturer as performing particularly well on any of these characteristics. The good news: this underperformance suggests opportunities for crafty manufacturers to stand out by over-delivering on payer requests.

Key takeaway: Payers prefer manufacturers that clearly demonstrate clinical differentiation and value in their treatments, including appropriate subpopulation data. Payers look for openness to value contracting and manufacturers who support them proactively.

Key takeaway: Payers prefer manufacturers that clearly demonstrate clinical differentiation and value in their treatments, including appropriate subpopulation data. Payers look for openness to value contracting and manufacturers who support them proactively.

What Sources Do Payers REALLY Trust?

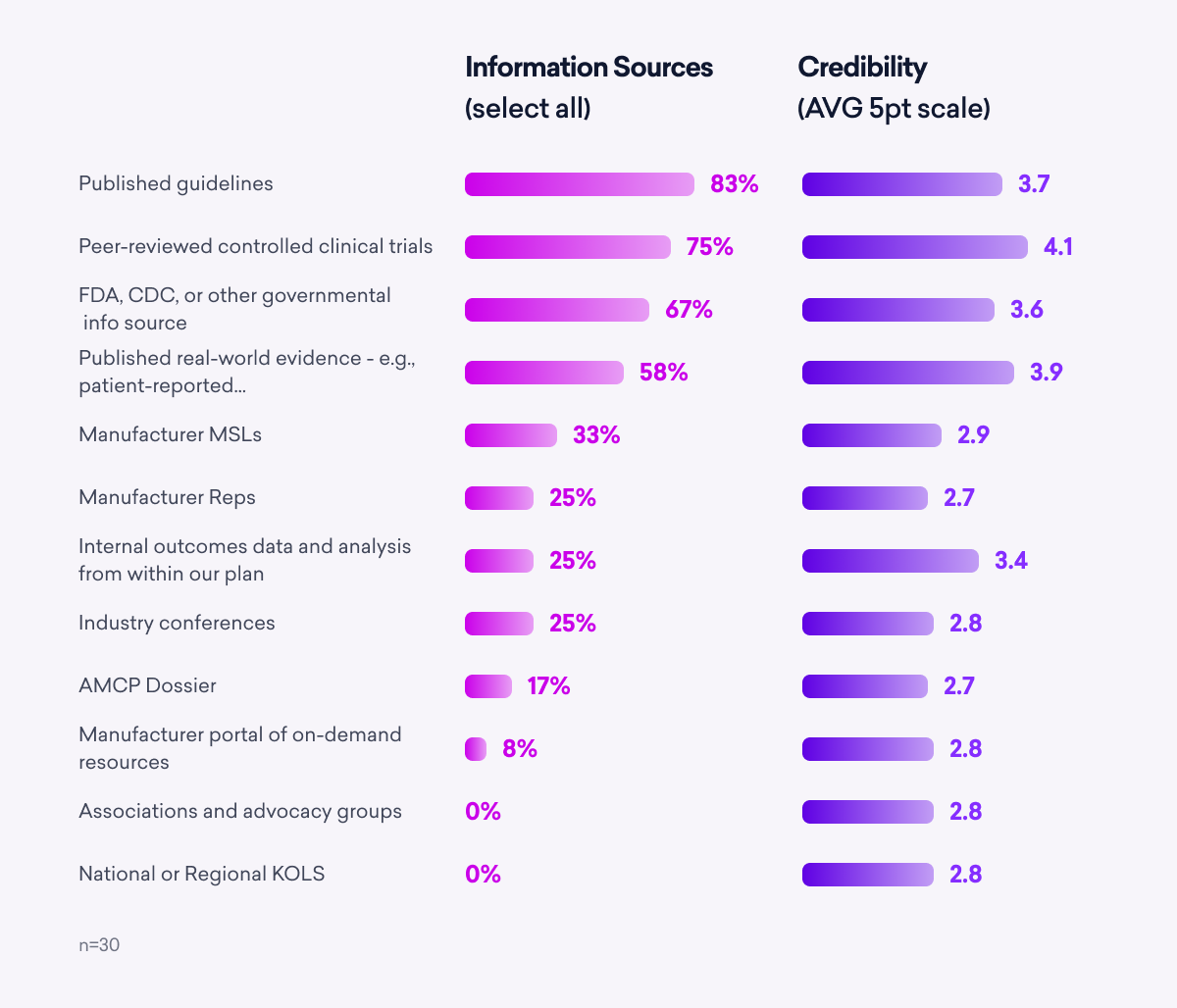

When searching for content to inform decisions around which products are made available to patients, payers are a lot like physicians. They prefer guidelines, clinical trials, government data, and real-world evidence.

Manufacturer reps and Medical Science Liaisons (MSLs) do not score nearly as high as these sources, suggesting another opportunity for savvy manufacturers to differentiate.

As for information channels, although most payer interactions with manufacturers are virtual, live meetings are not out of vogue just yet. Payers expressed a desire for more in-person meetings and feel that industry conferences remain beneficial.

As for information channels, although most payer interactions with manufacturers are virtual, live meetings are not out of vogue just yet. Payers expressed a desire for more in-person meetings and feel that industry conferences remain beneficial.

“In-person meetings are the gold standard. There is nothing like personal interaction, but it should be kept to 30 minutes or less,” says one pharmacy director. Another added: “I prefer in-person, especially for new products, new results, new indications. They are available and on the spot to answer my questions in real time.”

But even in an ideal world, more than half of payer interactions with manufacturers will continue to be virtual—the manufacturers and product developers who find the right mix between virtual and in-person stand to benefit the most.

Key takeaway: Across the survey, payers desired more effective communication with manufacturers. Idea-sharing, timely and relevant data, and transparency underscore the importance of understanding their trusted information sources and specific channel preferences.

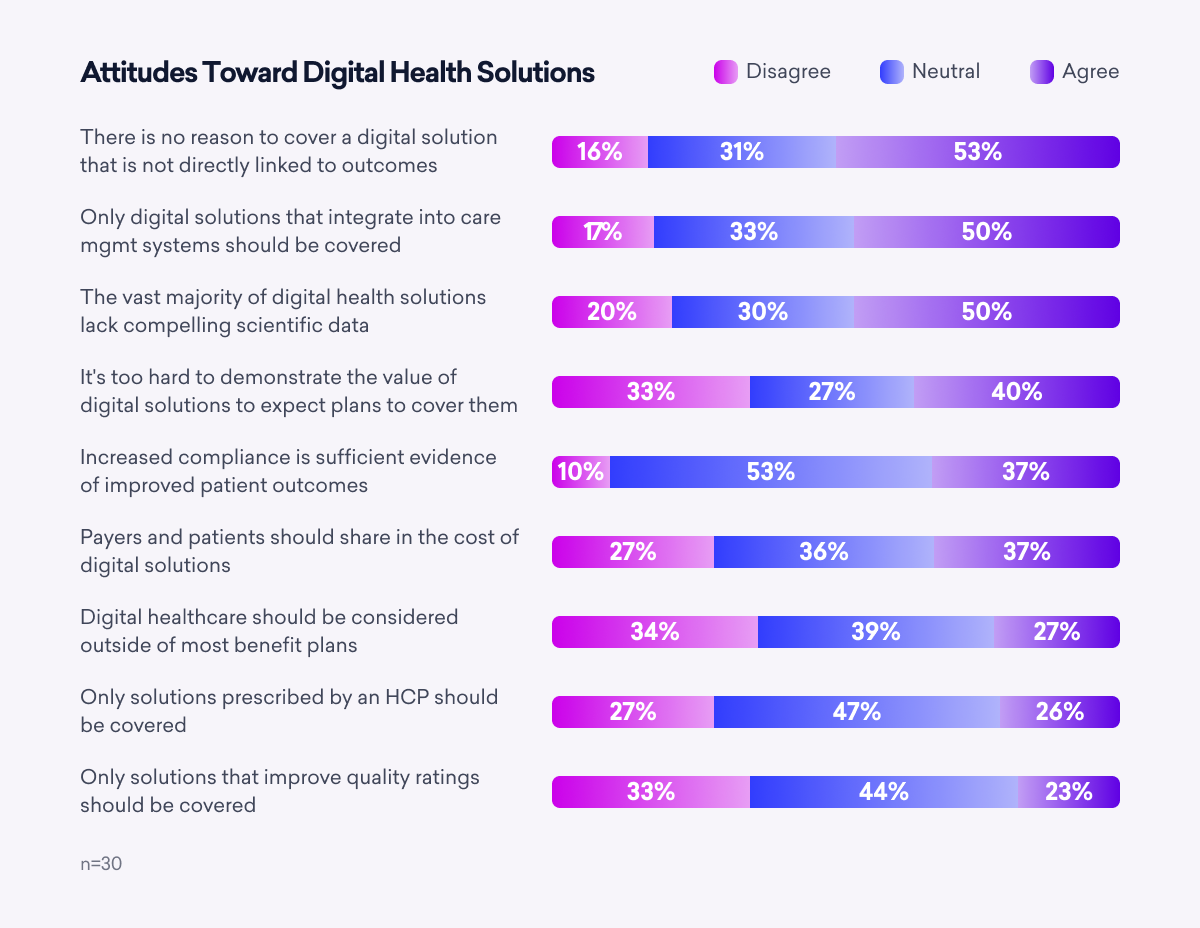

Digital Health Remains an Area of Uncertainty

Digital health solutions had been growing in relevance for more than a decade before their proliferation during the pandemic. However, despite their convenience, popularity, and promise, payers believe digital solutions lack compelling data and remain widely unconvinced they should cover them.

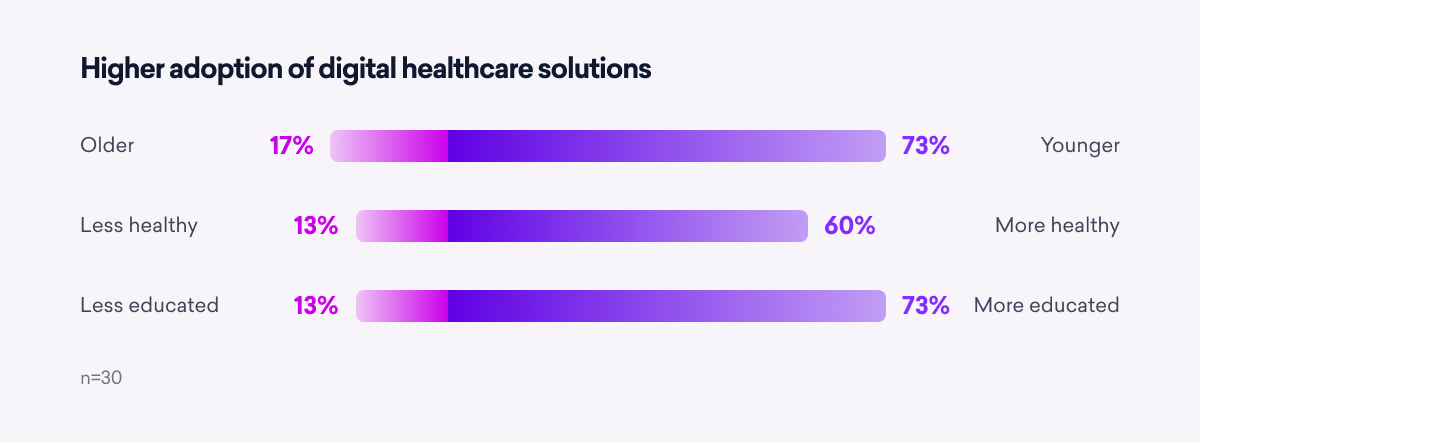

Furthermore, they think these solutions are more likely to be adopted by the youngest, healthiest, and most educated patients, adding to their reluctance to finance.

As more digital health platforms and apps become available, sentiment will likely evolve and expand; but only if product developers engage payer stakeholders earlier in the development process. Very few manufacturers are doing this today. Future widespread coverage will depend on digital health solutions that specifically help the patients who need them the most.

As more digital health platforms and apps become available, sentiment will likely evolve and expand; but only if product developers engage payer stakeholders earlier in the development process. Very few manufacturers are doing this today. Future widespread coverage will depend on digital health solutions that specifically help the patients who need them the most.

Key Takeaway: There is significant uncertainty as to how digital health should be approached. Payers favor coverage only for solutions that deliver improved outcomes and integrate directly into their internal care management systems.

Key Takeaway: There is significant uncertainty as to how digital health should be approached. Payers favor coverage only for solutions that deliver improved outcomes and integrate directly into their internal care management systems.

The Inflation Reduction Act and Healthcare Payments Moving Forward

The Inflation Reduction Act (IRA) was signed into law in 2022 and included many implications for the healthcare industry, such as:

- The federal government will actively negotiate prices in disease areas of greatest spend

- Drug companies will pay rebates if drug prices rise faster than inflation

- Out-of-pocket spending for Medicare Part D patients will be capped at $2,000 annually

- The out-of-pocket cost of insulin will be capped at $35 per month for people with Medicare

- Patients will no longer have to share in covering the cost of adult vaccines

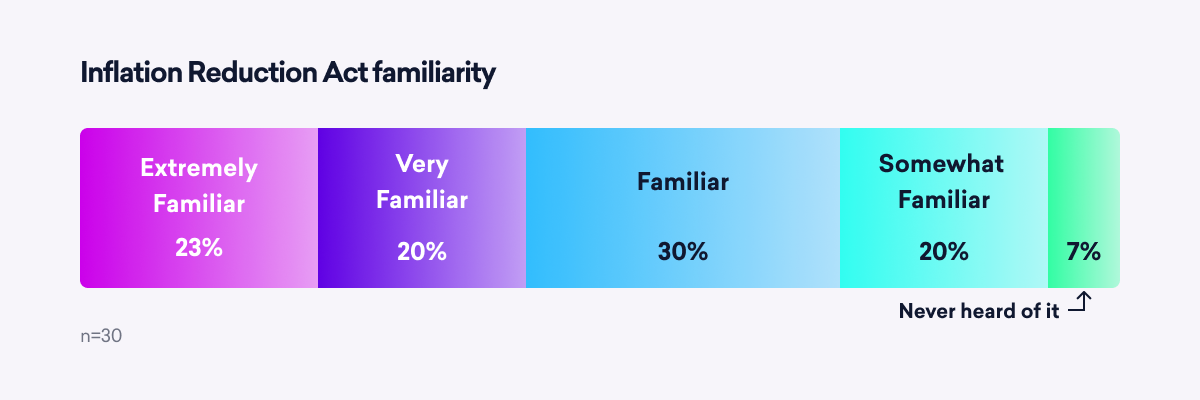

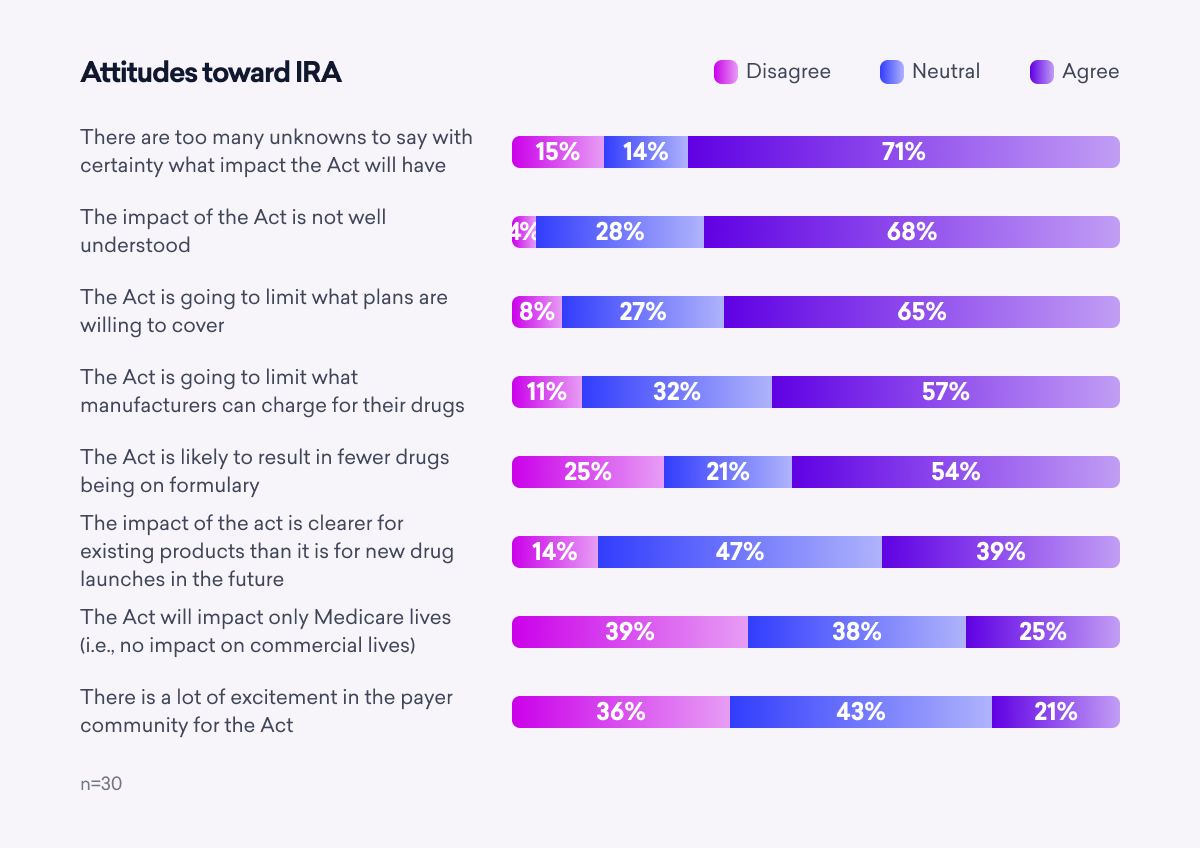

The content of the IRA is critically important to payers, but they are only moderately familiar with the details of the comprehensive act. And they report very little excitement about it.

Beyond the basic themes of limiting select drug prices and restricting what plans are willing to cover, many unknowns remain that make the full extent of the IRA’s impact poorly understood. One payer summarizes it: “This is a big unknown—one of the biggest unknowns we have. A ton of time is being spent running through possible scenarios as to how this plays out. Truth is, we just don’t know.”

Beyond the basic themes of limiting select drug prices and restricting what plans are willing to cover, many unknowns remain that make the full extent of the IRA’s impact poorly understood. One payer summarizes it: “This is a big unknown—one of the biggest unknowns we have. A ton of time is being spent running through possible scenarios as to how this plays out. Truth is, we just don’t know.”

Key Takeaway: Payers do not anticipate the impact of the IRA being limited to Medicare. A large majority of those surveyed believe that commercial markets will also be impacted. According to one pharmacy director, “It’s obviously geared toward Medicare lives but it’s going to have an impact on commercially insured lives as well.”

Your 2023 Payer Roadmap

Your 2023 Payer Roadmap

Bridging the gap between payer expectations and manufacturer deliverables will lead to better business relationships and collaboration. Keep these key findings in mind when planning your strategy:

- Affordability is the single most-pressing issue for payers, especially as we head into a potential recession—manufacturers that demonstrate differentiation and value effectively, are open to value contracting, and proactively support payers will win payers’ business and trust.

- Many payers desire digital health solutions to be integrated into their care management systems and linked to improved outcomes—the focus should be on proving outcomes and alignment with the FDA.

- Comparing what sources payers utilize most with which channels offer the most value shows an interesting spread—published guidelines, clinical trials, RWE, and government agency (FDA/CDC) data are the best ways to meet payers’ content needs.