The market access landscape for pharmaceutical products has shifted as payers struggle to control the growing cost of healthcare. Recent product launches, coupled with growing medical and pharmaceutical costs, have placed strains across the healthcare ecosystem. In an effort to mitigate these forces, insurers have turned to tighter formulary controls and passed on greater cost-sharing to patients. These actions result in myriad downstream effects that many manufacturers do not currently account for in brand planning: Lost market volume, smaller targeted patient populations, increased payer utilization management, inflation in patient cost-sharing, declining patient value, and higher total costs of access driven by growing rebates and co-pay offset costs.

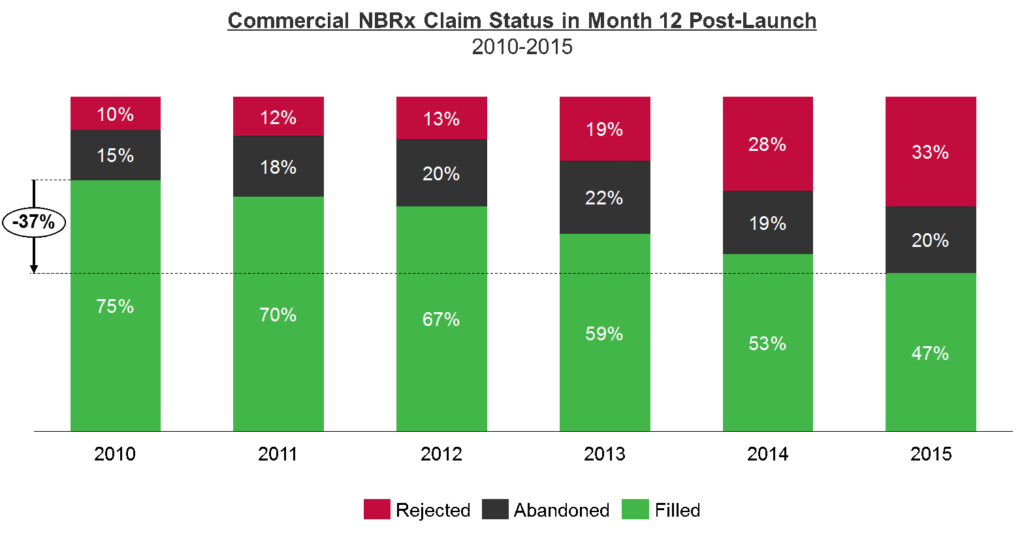

In a study of launch products from 2010 to 2015, a steady decline in fill efficiency was observed. As insurers become more restrictive, fewer new-to-brand patients are able to make it on the prescribed therapy and those that did were subjected to higher cost-sharing. Products launched in 2010 saw 75% of commercially insured patients attempting to fill be successful in month 12 post launch. However, by 2015 fewer than half of commercially insured patients were able to successfully navigate onto the prescribed therapy in month 12 post launch. The decline in fill efficiency is directly linked to an increase in payer restrictions.

Exhibit 1: Commercial NBRx Claim Status in Month 12 Post-Launch (2010-2015)

Manufacturers find themselves struggling to explain how changes in demand are influencing performance while margin erodes with each passing year. Properly diagnosing these challenges requires the utilization of longitudinal patient data that tracks access changes over time, breaks down a market into its constituent components, and explains how these forces interact with one another. Through understanding these market forces, and modeling scenarios, manufacturers can begin to unlock how to improve performance and protect margin.

The Importance of “True Demand”

Many brands miss forecasts but few determine if the reason for the miss is poor fill efficiency. One important emerging concept is the development of “True Demand.” True Demand is the total of all attempted prescriptions—not just those that are successfully filled at the pharmacy. The value of understanding how much demand is realized can help inform the total levels of effort that will be required to meet financial goals and give insights into the volume and cost of lost opportunities. For example, if a brand target is to generate 100,000 prescriptions, examination of True Demand will inform assumptions on the total number of patients that need to attempt to fill the brand in order to realize that level of realized demand.

Making More Accurate Forecasts

Next-generation forecast models must incorporate dynamic planning elements that allow for modeling various market, demand, access, patient, and margin scenarios. The practice is especially critical for new launches as historical analogs become increasingly outdated and unable to explain the impact of a complex environment on demand forecasts. However, this level of detail is just as useful for established brands. Whether they are anticipating the effect of a new entrant in the market or investigating the impact of payer access changes, brands need the detailed and flexible level of sophistication provided by dynamic modeling to make accurate forecasts.

Key Market Access Questions

Many manufacturers struggle to find ways to incorporate the changing market fundamentals into scenario planning and forecasting. Incorporating more nuanced elements can help answer many key business questions such as:

- How will market access strategies impact market sizing?

- What is the size of the dynamic market that is made up of new to therapy, switching, and stable patients and how will demand vary amongst these patient segments?

- What level of True Demand must be generated to meet brand goals?

- What is the impact of step edits, prior authorizations, and line of therapy requirements on realizing demand?

- How does changing the timing and cost of payer access influence top and bottom line sales?

- How does patient cost-sharing impact abandonment, persistence, and adherence?

- What is the role of co-pay offset programs in driving brand revenue?

- How does investment in distribution networks, adherence programs, and other patient services impact realized demand?

- What assumptions need more detailed study and development before organizational alignment can occur?

- What are the best case, worst case, and most likely scenarios of brand performance?

- What Key Performance Indicators (KPIs) need to be developed and tracked over time to determine if strategic goals are being met?

The speed by which the pharmaceutical market is evolving is accelerating. The emergence of new challenges requires updated best practices in order to unlock how complex market forces combine to influence demand and margin. Dynamic modeling allows for sales, marketing, market access, and finance groups to work together and align on assumptions thereby realizing the full power of a launch. Brands are thus enabled to build a platform that identifies gaps in strategy, develops KPIs, and builds a more robust, yet flexible, model for short- and long-term business planning.