The tried-and-true method for evaluating physicians of importance for a brand has been to look at their historical prescribing volumes to identify those who write the most prescriptions for a brand or in a market. The highest volume prescription writers are almost always included as part of sales representatives’ targets. Additional refinements to the target list can also be made using prescribing information, such as identifying brand loyalists and “spreaders”—physicians who write a few prescriptions each for multiple drugs in a market.

Today, manufacturers can leverage anonymized patient-level data (APLD) to further refine their prescriber evaluation methods. Using APLD, brand teams can assess referral patterns to understand local influence dynamics, better understand physicians’ focus and specialization, and segment physicians based on the types of patients each physician treats most frequently. These types of insights can lead to more compelling messages and better promotional resource allocation decisions.

INFLUENTIAL PHYSICIANS

Most brand teams today are actively engaged with national Key Opinion Leaders (KOLs) to understand how these experts view the underlying disease state and the available treatment options. The industry, as a whole, understands the importance of national KOLs and the influence they can have on other doctors. However, many brand teams have not attempted to identify and engage with the local opinion leaders who are influential within specific geographic areas. While local opinion leaders do not have the name recognition of their nationally known counterparts, they may often exert as much, or even more, influence on the prescribing choices of their local community physicians.

A local opinion leader is typically a specialist in the chosen therapeutic area who devotes a significant portion of his or her professional time to treating patients— as opposed to doing research, teaching, or publishing. Local opinion leaders are often well known and respected among local primary care providers and other specialists for their comprehensive disease-state knowledge and patient-care expertise. They influence the treatment protocols and brand choices of other practitioners in the community and are most likely to receive referrals of hard-to-treat patients from other community practitioners, including other specialists.

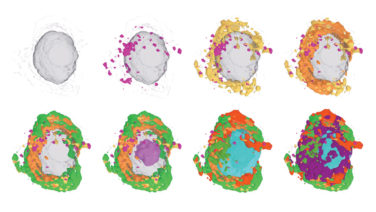

Since there are typically many more local opinion leaders in the U.S. than National KOLs, the primary research-based methods that are well suited for identifying National KOLs can be prohibitively expensive. Instead, local opinion leaders can be identified by analyzing referral networks. Physician referral maps, created by studying medical claims data that indicate referring and rendering physicians and by monitoring patient movement from one physician to another, can identify which physicians are seen first and which physicians receive the most referrals. Figure 1, an example of a local referral network, demonstrates how a referral map looks. In this example, Physician H and Physician I receive a good deal of referrals from a wide range of doctors—including both primary care physicians and other specialists. Based on this data, Physician H and Physician I would be identified as local opinion leaders.

This insight can be used to inform targeting and messaging tactics as well as to identify which physicians warrant additional focus and increased interaction. These experts could be evaluated as potential speakers for locally administered speaker and peer-to-peer programs. And, when it’s time to invite community prescribers to such programs, the referral network can be used to determine which local prescribers should be invited to each speaker’s event. A community-based physician is more likely to participate in a program if the local expert is part of their referral network and is someone to whom they refer a significant number of their patients.

PHYSICIAN BEHAVIORS

For brands that aren’t typically dispensed at retail pharmacies, marketers have to use other metrics besides prescriptions to identify target physicians. But even for typical retail brands, further refinement can be done by studying other physician behaviors, such as diagnoses treated, drugs administered, and procedures performed.

Physicians of the same specialty—even those in the same practice—can treat different types of patients and conditions and/or use different treatments. Within some specialties, physicians focus on different conditions or diseases. It’s not uncommon for an oncologist, for example, to specialize in a certain tumor type. For some conditions, like those where therapies are dispensed at retail pharmacies, it’s possible to identify which doctors are most likely treating the tumor type of interest. For other tumor types, the use of patient-level data that identifies diagnosis and drugs used is the only way to determine which physicians represent greater potential for the brand.

For some specialties, such as cardiology, evaluating only prescribing behavior wouldn’t provide enough information to determine which physicians to target. Most cardiologists use the same types of medications, such as anti-hypertensives, lipid-lowering agents, and anti-platelets. If brand teams look only at prescribing volumes, many physicians would look very similar. By evaluating additional treatments, such as procedures performed, real differences can be seen.

Some cardiologists, known as interventional cardiologists, perform a much higher volume of angioplasties and other procedures. While “Interventional Cardiology” is an American Medical Association (AMA)-recognized specialty, many physicians who don’t identify themselves with the specialty behave, in fact, as interventionalists. Brand teams with products that are used during or after these procedures will be particularly interested in identifying these physicians. Prescription data, used alone, won’t identify these providers, since they are responsible for only a small volume of prescriptions. However, these physicians are highly valuable as initiators of therapy.

PHYSICIANS’ PRACTICES

Nothing affects physicians’ behavior more than the patients that they treat. The conditions the patients suffer from, their managed care coverage, and other characteristics influence physician behavior. Today, healthcare and non-healthcare attributes are used to better understand patient and physician behavior. Factors included are patients’ age, gender, ethnicity, income, past therapies, and prior procedures or events. For instance, a brand team that has a product that is not covered by most managed care plans—such as lifestyle or cosmetic products—may want to study the average income and/or wealth of physicians’ patients. By considering these patient factors in conjunction with physician prescribing, more targeted messages and programs can be created.

For retail brands, evaluating physician prescribing is just the first step in identifying targets. To maximize brand performance and identify growth opportunities, marketers should examine other physician behaviors and which patients they treat to refine target lists, messages, and programs. By using patient-level data, brand teams can identify the physicians who fit the target profile or who treat the patients of most value.

FIGURE 1: A LOCAL PHYSICIAN-TO-PHYSICIAN REFERRAL NETWORK

Patient movement from one physician to another is shown with an arrow. The thickness of the arrow indicates the volume of referrals, with a greater thickness representing a higher volume.

download figures at www.pm360online.com/resourcecentral