In addition to developing treatments to help improve health outcomes, pharmaceutical companies also have a business responsibility to their shareholders to increase revenue, but a new study from HealthPrize Technologies reveals they may be missing out on an opportunity that could raise revenue by as much as 29%, depending on their product portfolio. The key to this increased revenue: Improving adherence.

For the most part, pharma companies have relied on raising drug prices in order to increase revenue. In fact, a April 2017 report from Credit Suisse found that U.S. drug price rises were responsible for 100% of earnings-per-share (EPS) growth in 2016.

“As long as anyone has been in the pharma industry, including everyone who presently inhabits their C suite—they have always made their numbers by raising prices,” says Tom Kottler, CEO and Co-founder, HealthPrize. “And in a world without the pricing pressures they have now it was an accepted business practice. But if you take that approach away, then the industry is in a world of trouble.”

In a January 2019 report from HealthPrize and CEEK Enterprises, “The Pharmaceutical Triple Aim,” the authors point out that in addition to raising drug prices pharma companies can increase revenue in three other ways: 1) Bring a new product to market or get a new indication on an existing drug. 2) Get doctors to write more prescriptions. 3) Get patients to take more of their medications. Of the three, the authors of the report believe the third option is the least explored by pharma companies and offers the biggest opportunity to help both the company and the patient.

“In today’s world, the only untapped opportunity that’s truly available to pharma as a source of additional high-margin, low-risk revenue is going after non-adherence at the enterprise level—and nobody does it,” Kottler adds. “Adherence decisions are left to the brand at a strictly tactical level. But for pharma, adherence programs come with no clinical, no technical, and no regulatory risk. They can also generate the highest-margin revenue pharma can generate because all the work’s already done. The drug’s been brought to market and you’ve spent the money, the time, effort, and energy getting the doctor to write the script. All you’re doing now is developing programs at scale that can motivate patients to stay on therapy. And it’s the only thing they can do that will achieve the pharmaceutical Triple Aim, which is higher margin revenue, better patient outcomes, and lower cost to the healthcare system.”

How to Measure Adherence’s Impact on Revenue

Previously, back in 2016, HealthPrize conducted a study with Capgemini Consulting that found pharmaceutical companies lose $637 billion every year due to nonadherence. But as pharma companies continue to ignore the issue of adherence—with reports that 30% of prescriptions are never filled an additional 30% to 80% of patients with chronic conditions who do fill their first prescriptions stop taking their medications within the first year—HealthPrize wanted to show the industry how much increasing adherence could benefit their companies.

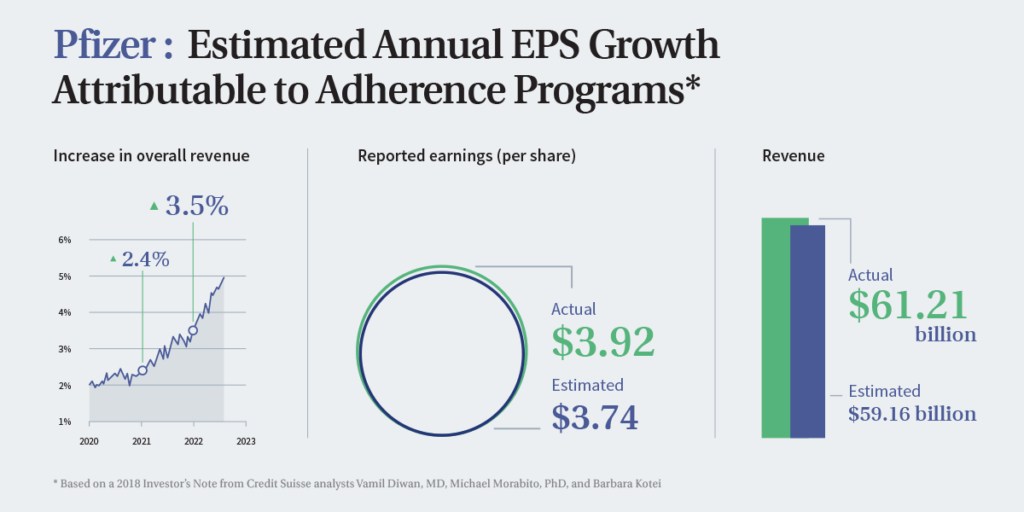

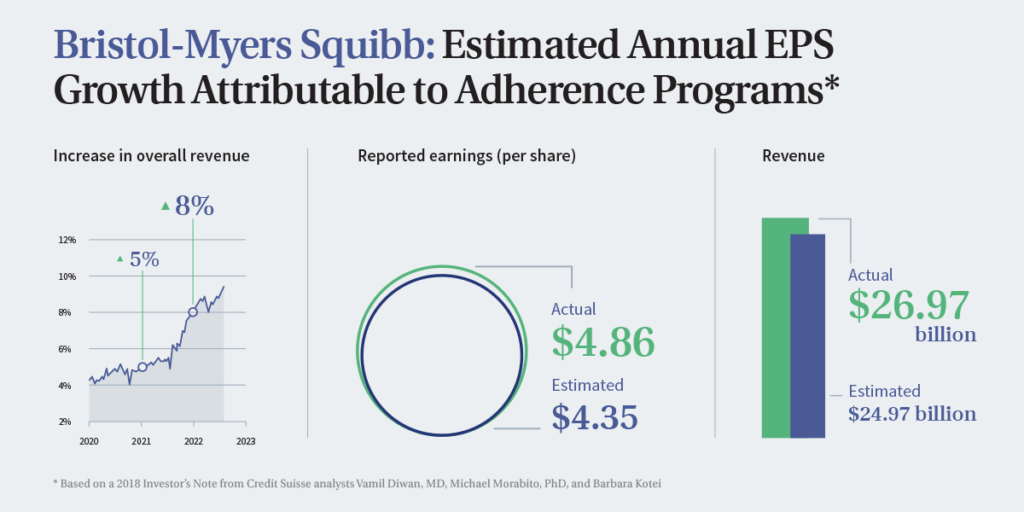

The study began with a challenge to Credit Suisse. Kottler asked the financial services company to call their investor relations contacts within the several large cap pharma companies they cover to see how seriously they were taking the non-adherence issue. When Credit Suisse found none of them viewed adherence as a priority, the company decided to dig into the numbers. In March 2018, they released the report, “What If Patients Actually Took Their Drugs? Assessing an Underappreciated Opportunity.”

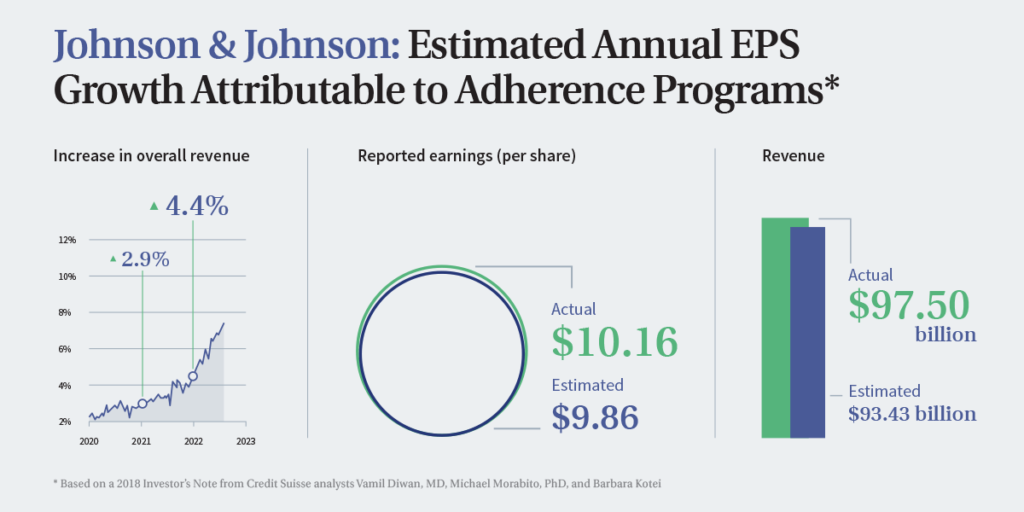

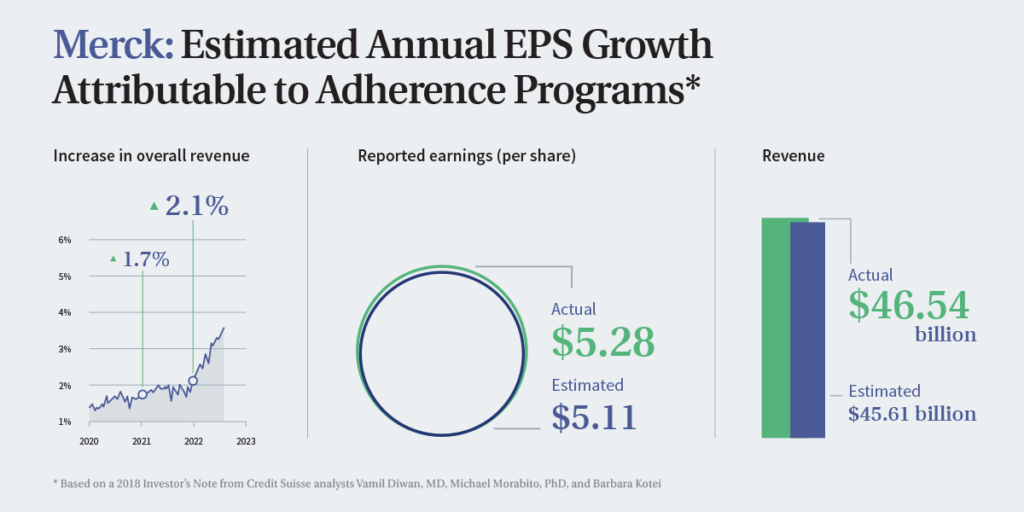

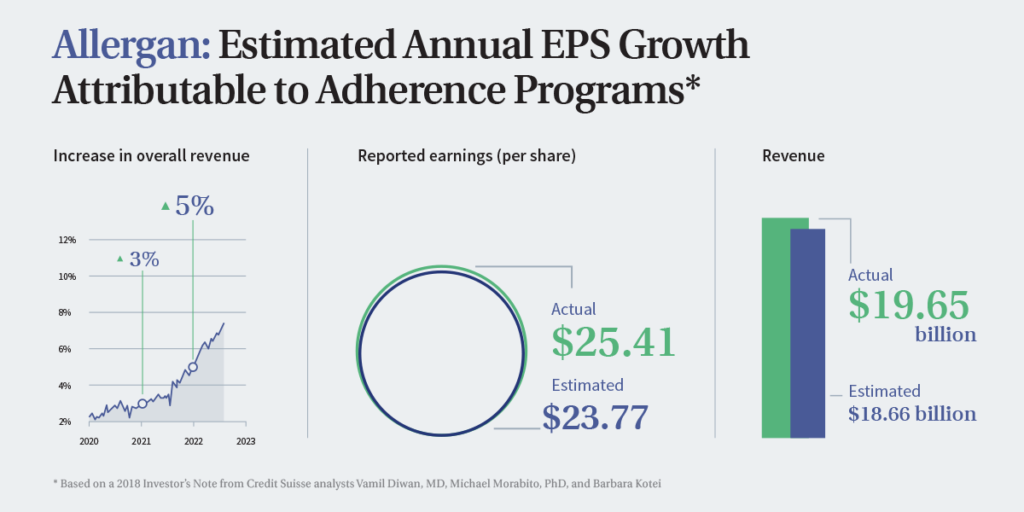

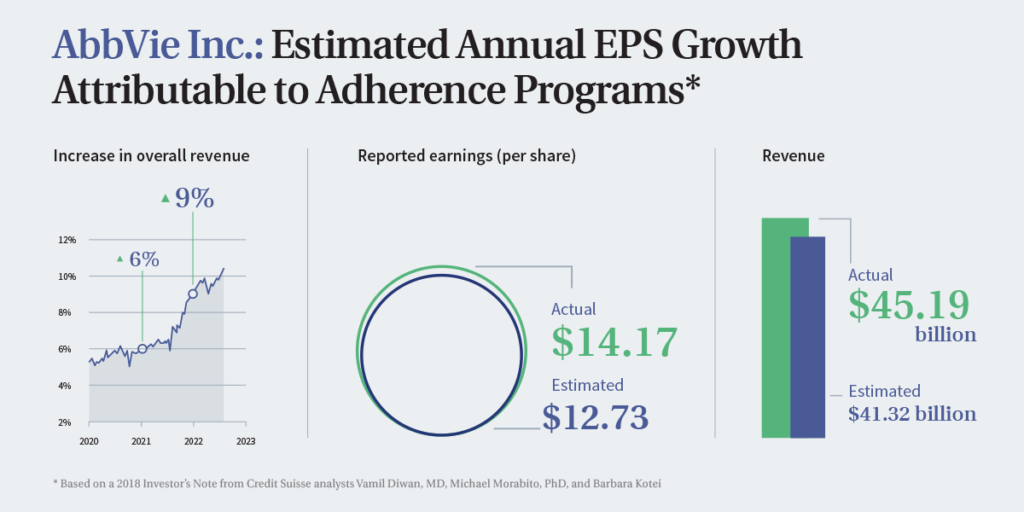

They conducted a study to see how implementing adherence programs would impact revenue for seven pharma companies: Merck, Pfizer, Bristol-Myers Squibb, Johnson & Johnson, Lilly, Allergan, and AbbVie. For the study, they focused the analysis on medications that patients take at home for chronic conditions. They put the products that companies had for these conditions into three categories:

- Drugs for life-threatening conditions

- Drugs for generally symptomatic conditions

- Drugs for generally asymptomatic conditions

Then they made a few assumptions. First, they assumed patients with life-threatening conditions would be the most adherent, followed by patients with symptomatic but non-life-threatening conditions, and finally the patients with generally asymptomatic conditions. Based on this assumption, they then decided on a modest percentage increase in sales that drugs in all three categories would experience between 2020 and 2026. Since they assumed patients with asymptomatic conditions have the lowest adherence, they figured adherence programs would result in the largest increase in sales for this class of treatments. The exact breakdown they assigned was:

Finally, they assumed that pharma companies would spend approximately 20% of their revenue gain on their efforts to increase adherence. However, they also assumed that pharma companies would not invest on new adherence programs for older products that they already are no longer promoting, so those products were excluded from the study. In terms of cost of goods sold (COGS), they assumed that the added sales would come at each company’s current gross margin. Using those figures, they then were able to calculate the level of revenue and EPS growth each company would experience between 2020 and 2026 based on their current forecasts for those companies.

Finally, they assumed that pharma companies would spend approximately 20% of their revenue gain on their efforts to increase adherence. However, they also assumed that pharma companies would not invest on new adherence programs for older products that they already are no longer promoting, so those products were excluded from the study. In terms of cost of goods sold (COGS), they assumed that the added sales would come at each company’s current gross margin. Using those figures, they then were able to calculate the level of revenue and EPS growth each company would experience between 2020 and 2026 based on their current forecasts for those companies.

How Much Can Adherence Increase Revenue

Based on the study, implementing adherence programs would increase revenue and EPS for all seven of the pharma companies they examined for every year between 2020 and 2026. Of the companies they studied, Lilly saw the highest degree of yearly growth in 2026 with 29.5%.

“I think the numbers that Credit Suisse have in their model are very conservative,” Kottler says. “In fact, I think they’re extremely conservative. And that’s the point. Even at relatively low levels, adherence can be an absolutely huge benefit for these companies that they’re just not focused on.”

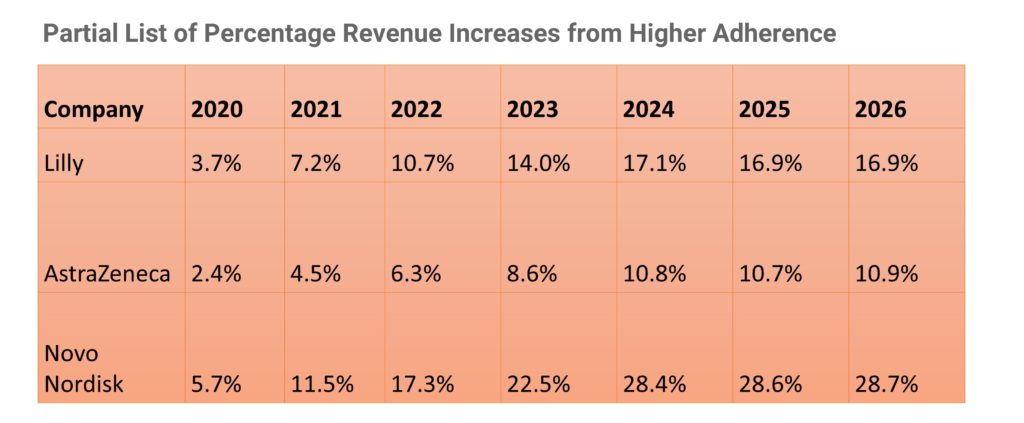

That is one reason why HealthPrize decided to expand on these findings by partnering with CEEK Enterprises and using a similar methodology to Credit Suisse to examine an additional 14 pharma companies: Amgen, Astellas, AstraZeneca, Bayer, Biogen, Celgene, Gilead, GSK, Novartis, Novo Nordisk, Roche, Sanofi, Shire, and Takeda.

Once again, all companies experienced at least some kind of growth in terms of revenue and EPS, though for some it much larger than others. For instance, Novo Nordisk would experience the largest increases in both revenue (a high of 28.7% in 2026) and EPS (a high of 45.3% in 2026). Additionally, AstraZeneca, Biogen, Celgene, GSK, Novartis, and Sanofi all saw increases of 10% or greater in revenue at some point between 2024 and 2026. Meanwhile, Astellas, AstraZeneca, Celgene, and Sanofi saw the biggest increases in EPS with all of them experiencing 15% growth or more sometime between 2022 and 2026.

Once again, all companies experienced at least some kind of growth in terms of revenue and EPS, though for some it much larger than others. For instance, Novo Nordisk would experience the largest increases in both revenue (a high of 28.7% in 2026) and EPS (a high of 45.3% in 2026). Additionally, AstraZeneca, Biogen, Celgene, GSK, Novartis, and Sanofi all saw increases of 10% or greater in revenue at some point between 2024 and 2026. Meanwhile, Astellas, AstraZeneca, Celgene, and Sanofi saw the biggest increases in EPS with all of them experiencing 15% growth or more sometime between 2022 and 2026.

Here is a closer look at the revenue growth that six of the companies studied would experience:

Based on the results, and the way the study was conducted, companies with a substantial portfolio of drugs for chronic conditions saw the biggest growth, especially those with treatments for asymptomatic conditions such as cardiometabolic diseases, heart failure, hypertension, and diabetes. That is the main reason why Novo Nordisk saw the most potential growth as it has a large portfolio of diabetes drugs, which are also known to have low adherence rates. But even a company with few treatments for chronic conditions like Celgene, which only has four drugs in the space, experienced significant growth.

Based on the results, and the way the study was conducted, companies with a substantial portfolio of drugs for chronic conditions saw the biggest growth, especially those with treatments for asymptomatic conditions such as cardiometabolic diseases, heart failure, hypertension, and diabetes. That is the main reason why Novo Nordisk saw the most potential growth as it has a large portfolio of diabetes drugs, which are also known to have low adherence rates. But even a company with few treatments for chronic conditions like Celgene, which only has four drugs in the space, experienced significant growth.

What Can Pharma Do to Increase Adherence

While there are several different methods and strategies out there for boosting adherence, Kottler would like to see pharma companies become more focused on addressing the issue at an enterprise-level instead of just at an individual brand-level. He even suggests companies implement a Chief Adherence Officer.

“As far as I know, there is nobody in any pharma company C-suite with direct access to either the board or the CEO who is responsible, at the enterprise level, for recouping the lost revenue from adherence or demonstrating the benefits of adherence in helping improve outcomes and negotiate better deals with payers,” Kottler explains. “And in the absence of an adherence executive, you’re going to get what we have now, which is some brands are pretty good at adherence, while some aren’t. In fact, some are awful. And very few of them actually understand the economic consequences to their brand and their company, not to mention the patients they are intended to serve.”