In about five years, we can expect a 10-fold increase in total data creation, the amount of data subject to data analysis to grow by a factor of 50, and nearly 20% of data globally to be critical to our daily lives, all according to a 2017 whitepaper from IDC called Data 2025. And yet companies today are already struggling to manage the barrage of data currently available. So, how can life sciences companies deal with this continuously growing supply of data?

“The short answer is to start by building a tailored digital-health solution on a flexible, cloud-based platform,” offers Matt Norton, Director of Strategy and Client Solutions, S3 Connected Health. “This enables the capture of the most valuable data and helps avoid the creation of data silos at either a country, regional, or company level—something that severely limits the use of gathered data.”

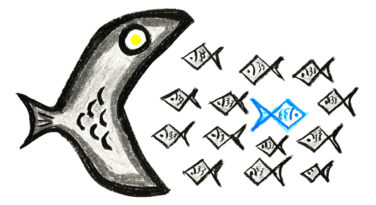

But just collecting data is not enough, especially if companies want to make use of artificial intelligence (AI) or other advances in data analytics to ensure they can turn hordes of information into viable insights.

“For data to be useful, it has to be organized in a standard way,” explains Paul Shawah, Sr. VP of Commercial Strategy at Veeva. “A next-generation, packaged commercial data warehouse can give the industry the right commercial data foundation for AI and analytics. With an industry-specific data model and standard integrations, companies can unify their most important data sources, tap into the right data, and drive intelligence across the organization.”

However, that doesn’t mean all companies should rush to the cloud or find ways to implement AI. According to Philip Beaver, PhD, a Professor at the Daniels College of Business, University of Denver and the Chief Data Officer of DocBuddy, Inc., sometimes IT professionals are all-too-eager to chase the latest buzzwords when in his belief that is the worse way to approach data management.

“Too often we deploy intricate enterprise resource planning (ERP) systems with embedded data management because some vendor convinced us our survival depends on it,” Dr. Beaver says. “It’s good to know what management solutions are available, but that’s not what guides us. Instead, our IT systems should be driven by two fundamental questions: ‘What decisions do we need to make as a business?’ and ‘How can we use our data to help inform these decisions?’”

The Benefits of More Data

And as companies begin to ask themselves what data is of most use to them, they need to understand the types of data now at their fingertips as well as the potential of advancements in analytics to better make use of that data.

“Consumer behavior, location, demographics, purchases, drug Rx, medical claims, EMR, lab, specialty pharmacy, rebate claims, copay cards, and other sources are all now fair game to be connected and integrated, enabling robust targeting, predictive analytics, and the ability to identify reach and impact of various tactics in the marketplace,” says Ashwin Athri, Senior Vice President, Precision Xtract. “However, most importantly, we can now identify the true cost to acquire a ‘customer’ and the impact of those expenses on the Net, by understanding how much has been spent on payer rebates, copay buy downs/vouchers, campaign spend, and channel discounts at the patient and HCP levels.”

Clinical trials is another area that will benefit from recent advances in data analytics, according to Rich Christie MD, PhD, Chief Development Officer at AiCure.

“The ability to directly observe dosing behavior, combined with rapidly advancing refinement of digital biomarkers in specific disease populations, will open up a new world of designing and managing clinical development in real time,” Dr. Christie explains. “This allows for more rapid and confident decision-making, as well as truly novel methods, to interrogate performance of molecules in clinical development.”

And we can expect audience segmentation as we know it to change.

“Many pharma marketers are still segmenting by treatment decile, which ignores the demographic, behavioral, geographic, competitive treatment profiles, and psychographic data associated with the individual providers who are making those treatment decisions,” says Sam Johnson, Senior Director, Advanced Analytics Lab, Intouch Analytics. “But clustering, as the ‘new segmentation,’ creates richer, more detailed profiles of the targets within groups whose similarities cannot be denied while emphasizing the differences between those groups, offering much more valuable and actionable group (and ultimately individual) profiles that lead to more successful programs.”

Data analytics will also be critical in shaping the future of value-based contracts as the industry shifts to a value-based reimbursement structure.

“Clinical data informs market research, underpins contract negotiation, and drives performance terms, while transactional data reinforces the financial viability of deal structures and serves as the basis for financial projections,” says Robert Blank, Managing Consultant, EVERSANA. “In aggregate, these datasets can be used to build, maintain, and advance holistic models which can assess the impact of different contracting scenarios and trace back to original assumptions when evaluating results.”

Avoiding Analysis Paralysis

With all of this new data—and its vast potential—it can be easy for marketers to get overwhelmed, so they must remain focused.

“Each campaign’s objectives along with the brand’s lifecycle must be considered when selecting key performance indicators (KPIs),” says Vishal Patel, VP Strategy & Operations, Outcome Health. “Marketers need to understand where in the sales funnel the campaign is being deployed to in order to understand what metrics to pay attention to. Measuring CPM at the top of the funnel (TV) is quite different when comparing it to the bottom of the funnel (point of care). With access to more data, marketers must marry campaign objectives, brand lifecycle, and the sales funnel location when deciding what success looks like.”

But the ultimate measure of success always comes back to the patient.

“Enormous value is created when you can connect different types of data, in a privacy-safe way, to complete the picture of the patient as an individual,” says Sue Witte, Senior Director, Analytics Services, Crossix Solutions. “But marketers must also have the right tools and teams in place to not only understand but act on this data in real time to make more informed decisions. Noise from superfluous data can lead to analysis paralysis—it becomes too easy to fall back on the status quo and miss out on the potential to improve marketing through data analytics. And, as more effective marketing can improve health outcomes, that is a big (data) opportunity to miss.”