Even though an orchestra conductor waving his baton to direct the brass, woodwind, and string sections is not playing an instrument, he is instrumental in guiding the musicians to perfectly synchronized, integrated performance. Modern contract sales organizations (CSOs) in the life sciences industry have a similar role. It used to be that CSOs were called upon only to provide sales rep head count, but today they help orchestrate complex commercial strategies and ensure that patients, payers, and providers receive targeted messages as products move from the clinical to the commercial space. It’s a challenging role that came about in response to dramatic changes in the industry, but it’s the reason contract organizations are now commonly viewed as strategic partners.

The life sciences industry, according to an industry report, is in an era in which targeting specific populations and improving patient outcomes is critical for specialty products and in which reaching more customers in rapidly developing markets is paramount for growth. This new era requires more nimble and convenient collaborations between pharmaceutical companies and physicians, payers, patients, and caregivers that take place through a multitude of channels.1

CSOs should be able to create those collaborations through integrated multichannel engagement that optimizes the mix of communications across three main types of channels:

- Live! — Live channels involve real-time interactions between a rep and a prescribing healthcare provider (HCP) or payer, regardless of the channel or number of participants. These may involve face-to-face or digital interactions to build personal relationships. These are usually prioritized to target the most valuable customers.

- Personalized — By their nature, personalized channels rely on individual identification and consent from the healthcare provider. Examples include opt-in and personalized emails, social channels, and one-to-many virtual meetings. Though response time is rapid, it is rarely in real-time.

- Non-personal — No personally identifiable information is involved in these channels, including websites, social media, direct mail, bulk email and mobile applications. These interactions are traditionally leveraged for a wider berth of lower-value or hard-to-reach customers.2

Synchronizing Activities

In any type of integrated multichannel engagement, the role of the CSO is not necessarily to create the strategy; that task is still the responsibility of the life sciences company. Nor is the role to execute on every engagement channel, which may fall to various vendors. Instead, like the orchestra conductor, the CSO synchronizes and drives those activities to ensure successful completion. In this capacity, the CSO is a strategic partner, helping the company drive its strategy toward its goals.

Gartner Research introduced a similar concept—“rep as concierge”—a number of years ago before CSOs were an intimate part of the commercial team for life sciences companies.3

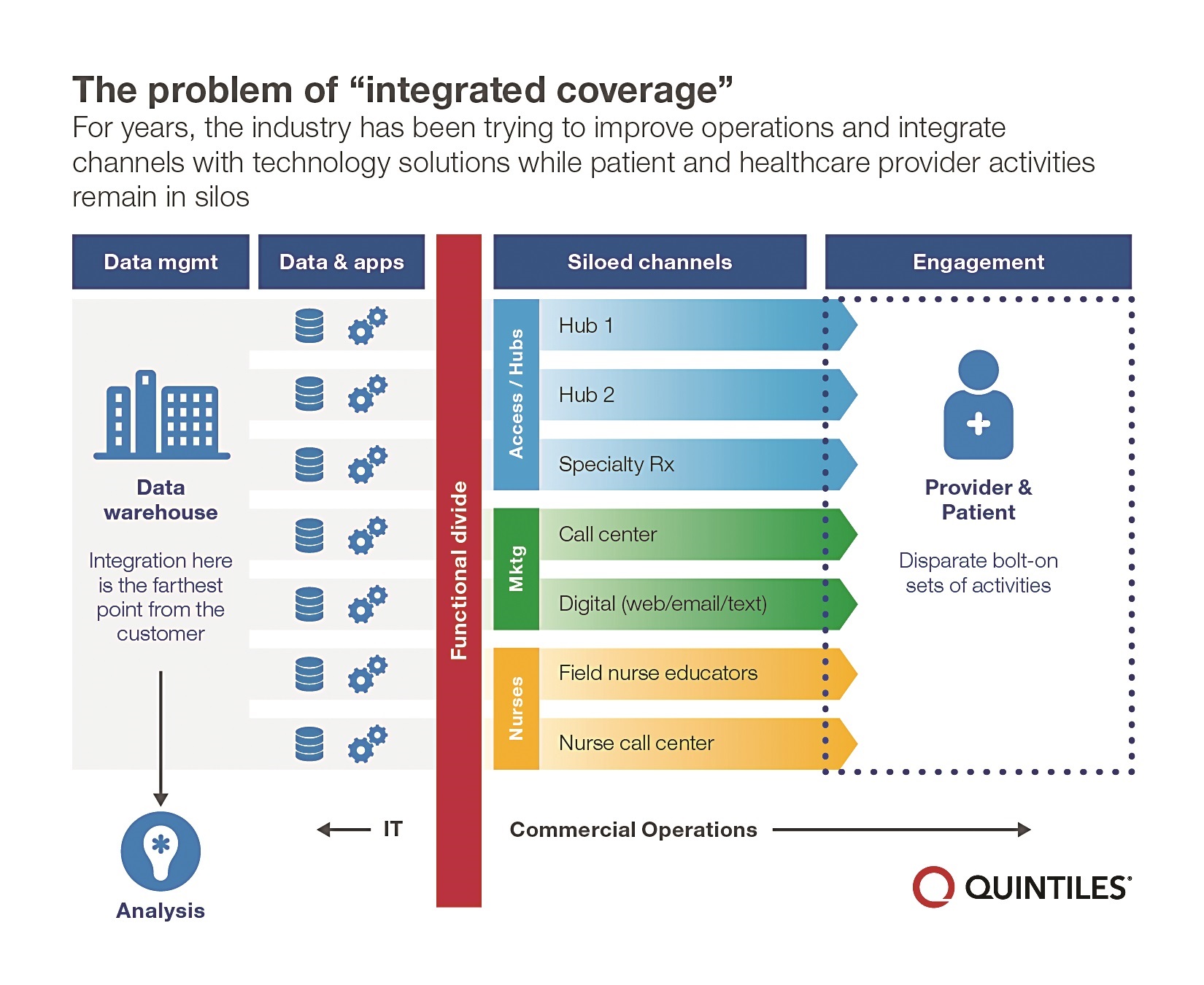

Back then, the expectation was that reps should start focusing more on assessing the needs of their customers and become the broker for relevant information sources. Today, strategic contract partners are adopting this role to ensure that every customer interaction is more about “what do you need, and how can I get you that information?” than “I have a static presentation to show you.” But herein lies the rub—with this opportunity also comes unique challenges because success requires integrating data silos and synchronizing many marketing channels—from operations through supporting applications and channel-specific data—as illustrated in Figure 1.

The starting point for achieving effective engagement is recognizing that the overarching goal is not simply achieving a transaction through a given channel or merely writing a prescription (another form of a transaction), but developing a relationship. A CSO partner should evaluate each individual HCP and determine how to develop a relationship with them over time and move them down the buying path for the long term. And that means understanding each HCP’s specific nuances, how they operate, the barriers they face, and their administrative roadblocks. Understanding how physicians prefer to receive communications—for example, via field reps, email, tele-detailing, eDetailing, video detailing, direct mail, or digital media—allows sales and marketing resources to be precisely targeted for optimal, efficient returns.

Rules of Engagement

Different doctors prefer different approaches, making it important to understand when, how, and how often to approach individual physicians and their affinity for particular channels. By giving the customer the power to decide how they will choose to engage with the industry, we automatically improve the interaction. In fact, a recent Cegedim/Quantia study showed that 76% of physicians have a preference for online communication channels.4 And, according to a Quintiles survey of primary and specialty care physicians in Europe, nearly two-thirds (63%) say that eDetailing is the future of promotional contact, yet they also say they want to spend about half of their time on eDetailing interactions and half of their time in face-to-face meetings.5

While digital, live channels are growing in popularity, a sizable group of HCPs prefer other types of personal and non-personal channels. Conversely, a large group of “no-see” doctors globally are only accessible via non-personal channels like email. For example, one study found that the number of no-see doctors continues to rise—up from 27% in 2013 to 42% just one year later.4

Many recent studies, however, continue to show that HCPs, particularly specialists, find great value in rep visits. For instance, in the same study referenced above, more than 40% of physicians see value in partnering with pharmaceutical companies for self- and staff education. Ultimately, all communications are likely to be highly personalized and digitally integrated. The trick is to aggregate all channels to ensure the right approach is taken with every engagement. Like the sections of an orchestra, each element must be playing in sync for there to be harmony.

Modern CSO partners need to be able to leverage call-center customer service staff, nurse educators and medical science liaisons, as well as reps, as illustrated in Figure 2, to engage with HCPs. New specialty products with complicated self- or office-administered injections make nurse educators, for example, very valuable to office staffs, and that, in turn, opens the door for productive sales rep visits.

Medical science liaisons are proving increasingly crucial to developing ongoing, trusted relationships with leading doctors who then serve as thought leaders across therapeutic areas. CSOs today have to be able to strategically integrate all of these “live” engagement channels along with digital channels so HCPs benefit from an attentive relationship that builds logically over time rather than just inundating them with more, more, and more rep visits, more phone calls, more direct marketing.

In the new era of specialization and precisely targeted promotional channels that address the preferences of many different types of HCPs, pharmaceutical companies need partners that are skilled at orchestrating the wide array of channels and stakeholders. Such partners can help pharmaceutical companies achieve integrated, synchronized performance that keeps HCPs informed, boosts sales and brings lifesaving medicines to patients who need them.

Resources:

1. “Life in the New Normal – The Customer Engagement Revolution Key Findings: Survey of 200 Pharmaceutical Sales and Marketing Executives,” Accenture, 2013.

2. “A Smarter Path to Integrated Multichannel Engagement,” by Gretchen Maciver, September 28 2015.

3. “Changes in Biopharma Market Require New Approaches and Technologies as Sales Rep Morphs from Influencer to Concierge,” by Dale Hagemeyer, September 24, 2009, Gartner Research.

4. “The Evolving CSO Landscape,” by Nick Basta, January 2015, Pharmaceutical Commerce.

5. “Pharma Sales in the Digital Era,” by Liz Murray, October 2015, Pharma Marketing Europe.

6. “A New Era for Pharmaceutical—New Commercial Models: What’s Working and What’s Not,” PriceWaterhouseCoopers, 2015.