MS patients typically stick with their initial treatment—they are even more willing to discontinue treatment than start with something new. But new, more convenient therapies may start to reshape the marketplace.

Multiple sclerosis (MS), an autoimmune disorder of the central nervous system, is the most common cause of neurologic disability in young adults today. According to the National Multiple Sclerosis Society, the disease affects approximately 400,000 people in the United States, with an estimated 200 new diagnoses per week. There are several clinical forms of MS; however, 85% of patients are initially diagnosed with relapsing-remitting MS (RRMS) with symptoms and signs that typically evolve over the course of several days or weeks and then generally improve spontaneously or in response to corticosteroids. Recovery from relapses is often incomplete, leading to stepwise worsening. The general aims of MS treatment are multifaceted and include reducing the frequency of relapses, preventing disability directly attributable to relapse, managing neurologic symptoms and slowing the progression of the disorder.

Key Insights to Treatment Patterns

IMS has conducted comprehensive research of MS market activity by using patient longitudinal metrics to determine how many MS patients are initiating therapy, staying on therapy, lapsing therapy and reinitiating therapy over time. In a specialty market like this where drugs are dispensed through multiple channels, it’s especially important to consult data from a variety of sources. Longitudinal patient metrics can provide visibility into patient behavior, such as how often patients switch to a different therapy, how often they stop and restart therapy, and how adherent and compliant they are over a given period of time.

IMS research indicates that, even with lapses, over 90% of MS patients are still on their initial treatment after three years. Patients seldom switch therapies. In fact, in the past, patients have been more likely to discontinue treatment if their symptoms were not controlled rather than switch to a new therapy. However, these patterns could be changing with new products and formulations becoming available. Nonetheless, this is a key challenge that brand teams need to be aware of when introducing new products into this market. It is likely influenced by multiple factors including limited treatment options, the relapsing and remitting nature of the disease, side effects caused by the MS drugs, specific warnings and contraindications with other agents, patient resistance to the inconvenience and discomfort of injections, and physician familiarity and experience with the drugs.

It is also significant to note that on average, 36 months after a patient starts therapy, less than 10% remain persistent on treatment without lapses in therapy. The patient behavior described here is similar across all of the leading MS brands, including: Copaxone, Avonex, Rebif, Betaseron and Tysabri.

Gilenya—A Promise Unfulfilled

In September of 2010, the launch of Gilenya, the first oral medication for RRMS, was a welcome event for MS sufferers and their doctors. For the first time, patients were offered relief from injectables in the form of this once-daily pill. Previously, all MS treatments were injected either intravenously, subcutaneously or intra-muscularly, with dosing frequency ranging from daily to every three months, depending on the product.

It’s not a surprise that Gilenya enjoyed great success in its first year on the market. By November 2011, it was producing an impressive growth curve in terms of new to brand prescriptions (NBRx), new therapy starts (NTS) and total prescriptions (TRx). For a brief period, Gilenya’s market share of NTS patients even exceeded those of market veterans Avonex and Betaseron.

Based on IMS data, Gilenya’s growth dropped off significantly after a patient taking the drug died in November of 2011 and the FDA issued an alert indicating that it would review the drug’s safety.

In January 2012, as the FDA’s review was just getting started, the product quickly experienced a 10% drop in NBRx market share that would continue in the following months. By June 2012, while the FDA review was still underway, NBRxs for Gilenya had declined even further. The product has since leveled off.

Even after the FDA announced in December of 2012 that it could not conclude whether the patient’s death was caused by Gilenya—and that it continued to believe that the drug provided an important benefit when used as directed—the drug has not regained the momentum it had after launch and its growth has remained relatively flat.

The Post-Gilenya Market

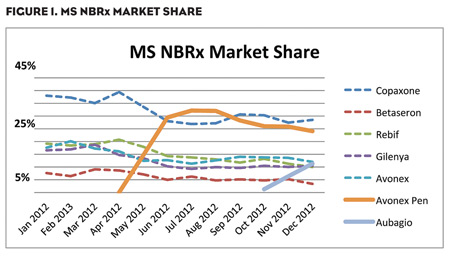

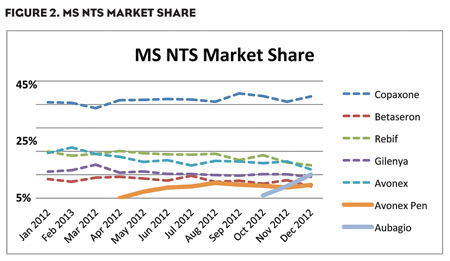

Although enthusiasm for Gilenya has tapered off, the MS marketplace is still evolving and waiting to embrace therapeutic alternatives that provide patients with greater convenience and less anxiety while still meeting or exceeding the efficacy of traditional medicines. New products, such as Aubagio, and new formulations of tried-and-true products, such as the Avonex Pen, are starting to impact the market, as NBRx and NTS metrics show (Figures 1 and 2).

Aubagio, the second oral MS medication, was launched in September 2012 and by December of that same year, had already secured a 10% market share for both NTS and NBRx—similar to the initial growth trajectory of Gilenya. The Avonex Pen, a single-use prefilled autoinjector with a needle half the length of the standard needle for the Avonex Prefilled Syringe, was approved in February 2012 and has already captured significant market share of approximately 24% NBRx. This NBRx growth appears to be coming from Avonex, as expected, as well as from other market products.

Another new single-use autoinjector, Merck Serono’s Rebif Rebidose, received FDA approval in January 2013. Rebif Rebidose was designed to provide improved ease-of-use and offer patients an alternative delivery option to current therapies. In addition, there are quite a few new MS products, formulations and indications in Phase I to Phase III development across the industry. Manufacturers such as Biogen, Genzyme, Teva, Novartis, EMD Serono and others continue to strive to fill the unmet needs of the MS patient.

Oral MS Therapies: A Story Still Being Written

The jury is still out on the impact that new oral MS products will have on the evolving MS market, but what is clear is that having visibility into patient reaction to these new therapies is key. While the story is still being written, it is one that needs to be closely monitored in the coming years.